Auto

Motorists Demand Reversal of New Third-Party Insurance Policy

By Adedapo Adesanya

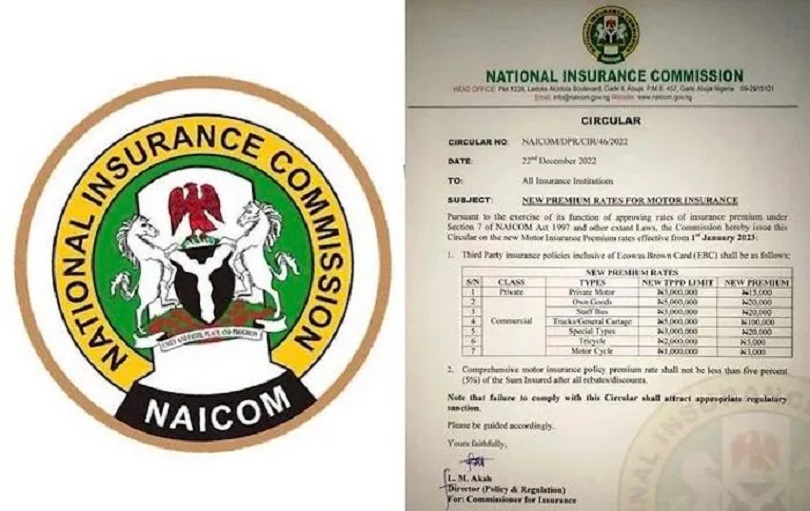

The Insurance Consumers Association of Nigeria (INSCAN), which includes motorists, has called on the National Insurance Commission (NAICOM) to reverse its directive on the increase of third-party motor insurance premium in Nigeria.

NAICOM recently issued a policy directive on the increase of third-party insurance policy in Nigeria by 200 per cent.

INSCAN, in a letter signed by its National Coordinator, Mr Yemi Soladoye, demanded the reversal of the directive, saying it amounted to a deliberate breach of the fundamental Principle of Utmost Good Faith and other decent regulatory principles guiding Insurance practice.

“We hereby write with respect to your Circular No.: NAICOM /DPR/CIR.46/2022 dated Dec. 22, 2022, increasing the third-party motor insurance premium in Nigeria by 200-400 per cent for different categories of motor vehicles.

“And by implication, giving only one week’s notice to the insuring public of Nigeria to comply.

“We demand the reversal of the directive as it amounts to a deliberate breach of the Fundamental Principle of Utmost Good Faith and other decent regulatory principles that guide insurance practice,” it said.

The INSCAN recalled that enough time was given to the public for feedback and adjustments to be made on the recent cases of currency redesign as well as the cash withdrawal limit introduced by the CBN.

It said the almost 20 million Motor Insurance Consumers in Nigeria deserved more than a week’s notice for compliance, describing the duration as a great insult to the collective intelligence of Nigerians.

The association said it had read over 500 public comments by Nigerians on the directive, saying the reputation slowly built for the Nigeria Insurance Industry was being eroded by the series of condemnations.

It said that practitioners, as well as the various arms of the central government of Nigeria, were being unfairly treated.

It quipped, “How much has your commission paid out to victims and customers of Proscribed Insurance Companies over the past 20 years as required under Section 78 of the Insurance Act 2003 to justify an astronomical increase in premium amount?

“Where is the report of an ad hoc committee required to be set up under Sec. 52 of the Insurance Act 2003, stating the imperative of increasing Insurance Premium by a whopping 200 per cent?

“We also know that the referred Sec. 52 of that Insurance Law does not confer arbitrary powers on you because Insurance is a business affected by Public Policy and otherwise it becomes legalised robbery,” it said.

The association said that the predictable outcome of the directive would be a substantial increase in the number of fake Insurance Underwriters in Nigeria.

You are definitely aware of the fact that even at the current N5,000 MTP Premium, many Nigerians still patronise the fake underwriters.

“And this is not because these Nigerians cannot afford the N5,000 but because they don’t see any benefit be it under your genuine or the fake cover,” the association said

It said that the directive would garner more money to the pockets of NAICOM and insurance operators and more hardship to Nigerian insurance consumers.

“To what extent have the interests of the Policyholders of the Insurance Underwriters, whose licences you revoked in the past year, been protected?

“How much have you paid to the various Fire Brigades in Nigeria as Fire Service Maintenance Fund as prescribed under Sec. 65 of the Insurance Act 2003.

“But still, you are quick to increase the Premium burden on the largely dissatisfied Insurance Customers in Nigeria,” it said.

INSCAN lamented the increment without due consideration for the feelings of the consumers, particularly in Nigeria, where the good customers who didn’t make claims are never rewarded.

The association said that failure to reverse the obnoxious directive would put NAICOM on record as the regulator with the highest level of impunity and insensitivity in Nigeria.

It stated that NAICOM’s policy directive was not subjected to civilised trade practices, professionally-accepted insurance principles, transparent customer-oriented regulations and humane attention to the economic situation of most Nigerians.

The association said that consumers were further convinced that the motive behind the directive was self-serving, arrogant and detrimental to their interests.

It said NAICOM was established to protect consumers, demanding a reversal of the policy pending proper consideration of the grey areas of the directive.

Auto

Heirs to Introduce Low-Cost Motor Insurance

By Modupe Gbadeyanka

There are plans by Heirs Insurance to introduce insurance products tailored for vehicle owners, a statement from the underwriting firm has disclosed.

According to the subsidiary of Heirs Holdings, this low-cost motor insurance package known as the Flexi Comprehensive Motor Insurance Plan will provide the benefit of a comprehensive motor insurance plan for a fraction of the cost, addressing the financial realities many Nigerians face.

The underwriting company announced the plan to introduce this package as it launched a new campaign designed to reward its customers.

This initiative themed Unwrapping Smiles will bring hope to individuals, families, and communities this holiday season, and will run from December 10 to December 31, 2024.

It will feature community-focused outreaches, including Christmas gifts and exciting rewards to put smiles on the faces of Nigerians. It will also include the launch of a holiday-watch web film known as The Underwriters for all Nigerians to enjoy.

“At Heirs Insurance Group, we are committed to providing much more than insurance. In a season when many Nigerians seek hope and reasons to smile, we are proud to offer initiatives that inspire and uplift,” the Chief Marketing Officer of Heirs Insurance, Ms Ifesinachi Okpagu, said.

Auto

FG Claims Investments in Presidential CNG Initiative Now $450m

By Adedapo Adesanya

Nigeria’s Presidential Compressed Natural Gas Initiative (PCNGi) claims that investments in championing the CNG value chain have hit $450 million.

This was disclosed by Mr Michael Oluwagbemi, Project Director and Chief Executive Officer (CEO), PCNGi, during the 9th Edition of the Nigeria Energy Forum (NEF2024) Day 2, Virtual Event themed Energising Sustainable Industrialisation.

According to the PCNGi CEO, the amount goes into things like mother stations, daughter stations and refuelling stations as well as conversion centres which are starting to spring up across the nation.

Mr Oluwagbemi, represented by Mr Tosin Coker, the Head of Commercial, PCNGi, said the initiative had successfully converted more than 10,000 vehicles from petrol to CNG.

“By 2027, the initiative will have converted more than one million vehicles using petrol to CNG,” he said.

On incidents of explosion of vehicles using CNG, the CEO assured Nigerians that it had taken precautionary measures with different agencies of government to ensure safety.

Mrs Ibironke Olubamise, National Coordinator of the GEF Small Grants Programme (SGP), managed by UNDP, said the SGP was investing in youth energy innovation for economic growth and environmental sustainability.

Mr Daniel Adeuyi, NEF Group Chairman, said, “The event featured three super sessions on Energising Industrial Revolution, Community Climate Action by GEF-SGP UNDP and Clean Energy Innovations.

“The sessions are to share lessons learnt from real-life projects and build capacity of young entrepreneurs and cross-industry professionals.”

Mr Joseph Osanipin, the Director General of the National Automotive Design and Development Council (NADDC), said that the council had trained more than 4,000 auto technicians on how to convert petrol vehicles to CNG.

He said the council had started campaigns to sensitise Nigerians on the advantages of using CNG to power their vehicles.

“CNG can guarantee a cleaner environment, it is cheaper and affordable,” he said.

Mr Oluwatobi Ajayi, the Chairman and Managing Director of Nord Automobile Ltd., said the company was established to tackle the growing demand for vehicles in Africa and reduce import dependency.

He said that because of the Federal Government’s CNG initiative, the company had incorporated it into their vehicle production to meet up with the government policy.

Mr Armstrong Tankan, the Managing Director and Chief Executive Officer, Ministry of Finance Incorporated (MOFI), said that MOFI was set up in 1959 as the statutory vehicle to hold all the assets owned by the federal government.

“Today, we’ve been able to identify the assets the federal government owns and we are trying to track them.

‘We actually do have assets, not just locally but globally as well and we must establish visibility over what the federal government owns before we can start talking about managing them.

“So, we want to try to minimise the waste, minimise the overlaps and help to improve output,” he said.

Auto

Dangote Becomes Largest Operator of CNG Trucks With $280m Investment

By Aduragbemi Omiyale

Over $280 million has been invested by Dangote Cement Plc in compressed natural gas (CNG) technology and infrastructure to enhance energy efficiency and drive economic growth in Nigeria.

The cement maker turned to CNG in demonstration of its support for President Bola Tinubu’s drive for cheaper and cleaner fuelling alternatives for all Nigerians.

At a recent event, the President emphasised the urgent need for Nigeria to utilise its vast natural gas resources in the transportation sector.

He stated that CNG transportation is an economic necessity for Nigeria, signalling a significant shift in the country’s approach to public transportation and energy use.

This has spurred Dangote Cement to adopt CNG, reflecting its dedication to mitigating climate change and supporting a transition to a low-carbon economy, making it the largest operator of CNG trucks in the country.

The chief executive of Dangote Group, Mr Aliko Dangote, said his company’s investments in CNG are also in line with Nigeria’s Nationally Determined Contribution (NDC) under the Paris Agreement, which aims for net-zero emissions by 2060.

“In this pursuit of transition to clean energy, we are optimistic of a remarkable accomplishment by President Tinubu, as he has taken the lead in the nation’s drive towards energy efficiency. This presupposes private sector intervention to support this noble idea initiated by the President,” he stated.

The businessman noted that the firm’s early adoption of CNG has made it the largest operator of CNG trucks in Nigeria, emphasising that the initiative is a boost to Mr Tinubu’s quest towards enhancing the nation’s energy independence and contributing to a more secure energy future.

“We are now using CNG vehicles, especially with the new policy of the federal government, launched under the Renewed Hope Agenda by President Tinubu. We are committed to a cleaner and greener future,” Mr Dangote said.

On his part, the chief executive of Dangote Cement, Mr Arvind Pathak, said the cement miller aims to acquire 100 per cent CNG trucks as part of a long-term plan to transition its entire fleet to CNG.

He disclosed that the CNG infrastructure investments have positively influenced Nigeria’s transition to cleaner fuels, adding that the CNG station at Obajana, capable of refuelling over 3,000 trucks, exemplifies this commitment, with a second station currently under development in Ibese to support fleet operations further.

“By mid-2026, Dangote Cement aims to operate a fleet predominantly powered by CNG. To facilitate this transformation, we are investing in expanding our CNG fuelling infrastructure, ensuring that our growing fleet has reliable access to CNG as our fuel,” Mr Pathak said.

He added that plans are afoot to aggressively pursue this timeline of deployment, beginning from the first quarter of 2025, saying, “We are keeping our eyes on the ball to ensure that we do not miss our target dates of full compliance.”

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN