Banking

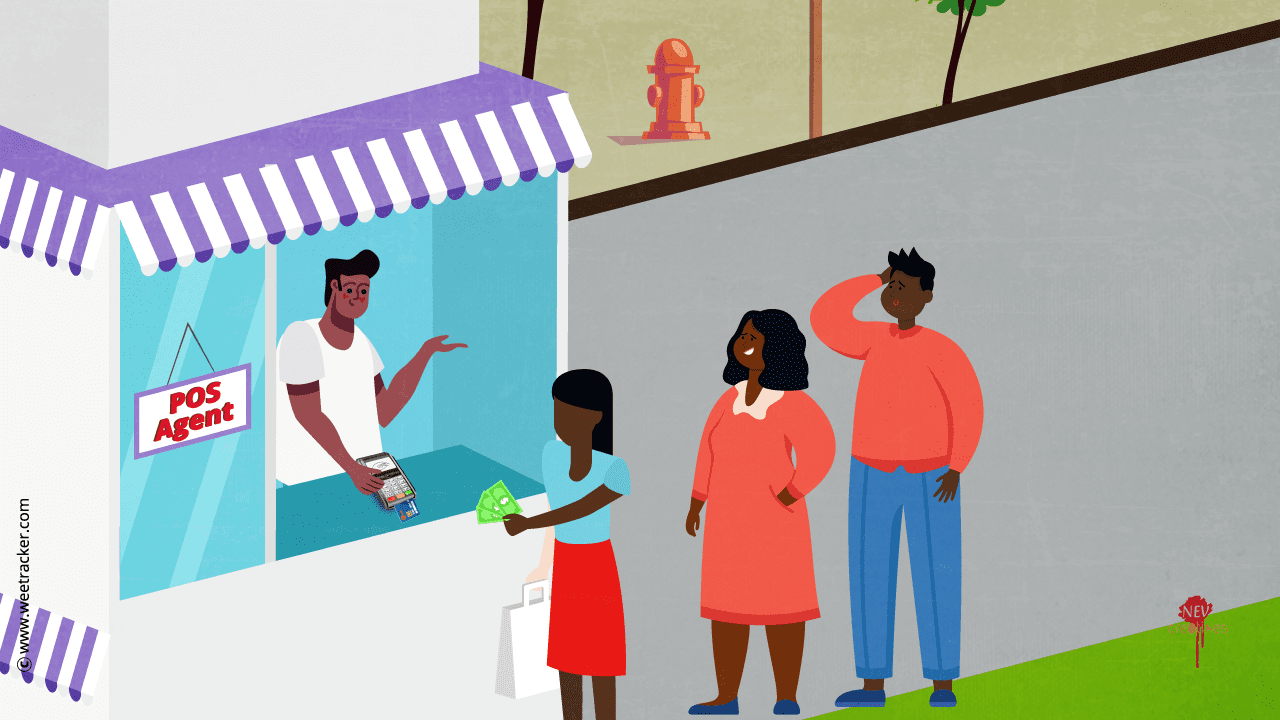

CBN Limits PoS Agents’ Daily Transactions to N1.2m, Customers to N100,000

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has introduced new operational guidelines for agent banking across the country, limiting daily cumulative transactions per agent to N1.2 million and individual transactions at N100,000 per customer.

The revised framework, released on Monday, also mandates all financial institutions to submit monthly reports on the activities of their Point-of-Sale agents to enhance oversight and service quality.

The circular (PSP/DIR/CON/CWO/001/049), signed by the Director of the Payments System Management Department, Mr Musa Jimoh, aims to strengthen financial stability, promote inclusion, and protect consumers.

The circular, addressed to all deposit money banks, other financial institutions, and payment service providers, takes immediate effect, while provisions on agent location and exclusivity will become effective from April 1, 2026.

“The Central Bank of Nigeria, in furtherance of its mandate for the stability of the financial system and pursuant to its role in deepening the financial system, hereby issues the Guidelines for the Operations of Agent Banking in Nigeria.

“The guidelines aim to establish minimum standards for operating agent banking in Nigeria, enhancing agent banking to provide financial services and promoting financial inclusion, encouraging responsible market conduct and improving service quality in Agent Banking operations.

“This circular takes effect from the date of release, while the implementation of agent location and agent exclusivity shall be with effect from April 1, 2026.

“All stakeholders are required to ensure strict compliance with the Guidelines and all other regulations, as the CBN continues to monitor developments and issue guidance as may be appropriate.”

The apex bank also directed that all agent banking transactions must be conducted through a dedicated account or wallet maintained by the principal financial institution to ensure transparency and better oversight.

The CBN warned that using non-designated accounts for agent operations would constitute a regulatory violation and attract sanctions with agents found guilty of misconduct, fraud, or related offences will be held personally liable and may be placed on industry watchlists or have their agreements terminated.

Principals, which are financial institutions, are now required to publish and regularly update the list of all their agents on their official websites and display them within their branches.

Super agents must have at least 50 agents distributed across the six geopolitical zones to ensure wider coverage and access to financial services in underserved areas.

The guidelines also stipulate that no agent can relocate, transfer, or close its banking premises without prior written approval from its principal or super agent.

The CBN also noted that a relocation notice must be displayed prominently at the business premises for at least 30 days to notify customers.

All agent transactions must now be conducted in real time using a secure, interoperable payment infrastructure while financial institutions are mandated to deploy technologies that enable instant settlements and immediate reversals in the event of system failure.

Transaction receipts must include the agent’s name and geographical coordinates, while audit trails and settlement records are to be preserved for at least five years to support regulatory oversight.

Although the new framework pegs the daily cumulative cash-out limit at N1.2 million per agent, the apex bank reserves the right to review the limit in line with the CBN Guide to Charges for Banks and Other Financial Institutions.

“POS agents are restricted to a maximum of N1.2 million per day. Individual customers are limited to N100,000 in daily transactions.

“These limits are intended to curb misuse, enhance financial integrity, and protect consumers within the agent banking framework,” it stated.

Additionally, all devices deployed for agent banking must be geo-fenced or tagged to operate strictly within the registered location to prevent unauthorised mobile use.

Financial institutions are required to submit monthly returns to the CBN, detailing transaction volumes and values, incidents of fraud, the number of active agents, customer complaints, and training conducted, among other indicators.

“The monthly reports must include comprehensive data on the nature, value, and volume of transactions conducted by agents. Submissions are to be made no later than the 10th day of the following month,” it added.

The apex bank warned that it reserves the right to demand additional information, carry out inspections, or exercise direct supervisory powers over any agent or financial institution at any time.

Institutions that violate the guidelines risk administrative sanctions, suspension from onboarding new agents, blacklisting, removal of management officials, or licence revocation.

“The CBN may, in the event of a breach, invoke any or all sanctions against any defaulting participant in the agent banking system,” the circular read.

Banking

Senate Seeks Stronger CBN Oversight in Fintech Regulation

By Adedapo Adesanya

The Senate has called for a strengthened regulatory framework that positions the Central Bank of Nigeria (CBN) at the centre of oversight of the country’s fast-growing fintech sector.

The recommendation was made by Chairman of the Senate Committee on Banking, Insurance, and Other Financial Institutions, Mr Adetokunbo Abiru, during a one-day public hearing at the National Assembly complex on Wednesday.

The event focused on the proposed amendment to the Banks and Other Financial Institutions Act (BOFIA) 2020 (SB. 959) and included an investigative session into fraudulent investment platforms, notably the recent Crypto Bullion Exchange (CBEX) incident.

Mr Abiru, who is a former Group Managing Director of Polaris Bank and Executive Director at First Bank Nigeria, emphasised that fintechs, including mobile money operators, digital lenders, payment platforms, and settlement companies, have become systemically important to Nigeria’s financial ecosystem.

While their growth has expanded financial inclusion, existing laws, he said, do not fully address the scale, data sensitivity, and systemic impact of these technology-driven institutions.

“The question has arisen as to whether a new standalone regulatory agency would be preferable for supervising fintechs,” Mr Abiru said.

“However, creating a separate agency would duplicate functions, fragment oversight, and increase bureaucratic costs. It is far more effective to strengthen the BOFIA framework, modernise CBN supervisory powers, and mandate coordination with key agencies such as the Securities and Exchange Commission, Nigerian Communications Commission, Corporate Affairs Commission, Federal Competition and Consumer Protection Commission, and the Office of the National Security Adviser,” he added.

The lawmaker proposed that the amendment should explicitly empower the CBN to designate qualifying fintechs as Systemically Important Institutions, establish a national registry for transparency and beneficial ownership disclosure, and strengthen risk-based supervision tailored to technology-driven financial services.

Beyond fintech regulation, the Senate intensified scrutiny on Ponzi schemes and fraudulent investment platforms.

Mr Abiru described the rising prevalence of such schemes as a threat to financial stability and public trust, citing the CBEX debacle, which reportedly caused severe financial losses to individuals across Nigeria, including professionals, traders, students, and retirees.

Banking

Zenith Bank Deepens Engagement Around Women’s Empowerment, Others

By Modupe Gbadeyanka

Monday, March 9, 2026, has been fixed by Zenith Bank Plc for its annual International Women’s Day seminar in Lagos.

The event is part of activities lined up to commemorate the 2026 International Women’s Day, themed Give to Gain.

The theme prepared for Zenith Bank’s programme is Take it, You Own it, and was designed to deepen meaningful engagement around women’s empowerment, leadership, and sustainable impact.

The workshop will include segments focused on leadership insight, professional empowerment, wellbeing, and collaboration, offering attendees opportunities to engage deeply with thought leadership and practical strategies for advancing equity.

With a carefully curated programme spanning keynote addresses, panel conversations, Q and A sessions, and creative interludes, Zenith Bank’s 2026 International Women’s Day Seminar promises to be a catalyst for meaningful action.

“International Women’s Day is a reminder that progress requires intentionality.

Give to Gain speaks to the responsibility institutions have to create real opportunities, while our theme, Take It, You Own It, challenges women to step forward boldly and lead.

“At Zenith Bank, we are deliberate about building environments where women are supported to grow, thrive, and shape outcomes, not only within our institution but across the communities and industries we serve,” the chief executive of Zenith Bank, Ms Adaora Umeoji, stated.

Over the years, the lender’s International Women’s Day initiatives have brought together women leaders, professionals, entrepreneurs, and emerging talents for dynamic dialogue, inspiration, and shared learning around gender equity, professional growth, and inclusive opportunity.

More than a commemorative gathering, the 2026 seminar is designed as a convergence of influence, insight, and inspiration, bringing together accomplished women and progressive leaders across business, governance, creative industries, technology, and social impact.

Banking

Ecobank Accelerates Growth for Women Entrepreneurs With Enhanced ‘Ellevate’ Programme

By Modupe Gbadeyanka

As part of activities commemorating International Women’s Day 2026, Ecobank Nigeria has improved its multi-award-winning gender financing initiative, Ellevate by Ecobank.

Originally launched to improve access to finance for women-owned, women-led, and women-focused small and medium-sized enterprises (SMEs) within its commercial banking segment, the enhanced Ellevate programme now adopts a broader, more inclusive structure.

The new framework extends across all business segments, positioning Ellevate as a comprehensive ecosystem designed to address the structural financing and growth barriers faced by women entrepreneurs.

The upgraded programme reinforces the bank’s long-term commitment to advancing women-led enterprises in Nigeria and across Ecobank’s pan-African footprint.

Under the expanded structure, beneficiaries will enjoy improved access to credit on competitive terms, including more flexible collateral considerations aimed at easing traditional financing constraints. Beyond lending, the programme integrates digital payment, collections, and cash management solutions to enhance operational efficiency and support scalability.

A core pillar of the enhancement is structured market access. Through the bank’s MyTradeHub online matchmaking platform and e-commerce enablement capabilities, women entrepreneurs will be better positioned to connect with customers and trade partners across Africa, facilitating cross-border expansion and participation in regional value chains.

The initiative also incorporates robust non-financial support mechanisms, including targeted training programmes, leadership development sessions, and knowledge-sharing platforms to strengthen managerial capacity and long-term sustainability.

This is complemented by access to customised wealth management advisory services, integrated insurance solutions, and a loyalty framework offering commercial incentives through select retail and lifestyle partnerships.

“Since its launch in Nigeria in July 2021, Ellevate has delivered meaningful impact for SMEs and women-led businesses.

“This next phase deepens our value proposition and reinforces our resolve to remain the preferred financial partner for women entrepreneurs,” the Managing Director of Ecobank Nigeria, Mr Bolaji Lawal, said.

“African businesswomen deserve world-class banking solutions that drive turnover, profitability, and sustainable growth. Our approach goes beyond financial inclusion to building an enabling ecosystem that enhances competitiveness and long-term resilience,” he added.

He further highlighted that Ecobank Nigeria consistently hosts flagship platforms such as Adire Lagos, Oja Oge, +234Art Fair, the Lagos Pop-Up Museum, SME Bazaar, and the Design & Build Exhibition, which provide prominent opportunities for showcasing and elevating women-owned businesses.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn