Banking

H1 2017: Wema Bank Optimises Loan Book, Keeps NPL at 4.90%

By Dipo Olowookere

Wema Bank Plc, in its unaudited financial results for the 6 months ended June 30, 2017, said some achievements were recording during the period, including further optimising its loan book by focusing on recoveries and supporting transaction with good and steady cash flows.

This, it said, resulted in a 9.38% decline in the volume of Loans and Advances, while yield on assets improved.

Its Capital Adequacy Ratio (CAR) increased to 12.71% (H1’2017) from 11.06%, as at FY2016, whilst NPL remained below the 5% mark at 4.90% as at H1’2017.

Managing Director/Chief Executive Officer of the lender, Mr Segun Oloketuyi, while commenting on the results, stated that in the first half of the year, the bank operated in an uncertain and challenging domestic economic environment.

“While we recorded notable improvements in the second quarter of the year, especially around foreign currency management, the execution of fiscal policies and the continued tight monetary policy impacted on consumers’ disposable income and invariably on banking sector performance.

“Despite the relatively tough climate, Wema Bank recorded success on a number of financial and non-financial priorities. Specifically, Gross Earnings recorded stable growth, increasing by 25.17% from N24.26 billion (H1’2016) to N30.37 billion (H1’2017).

“This growth resulted from a 25.84% increase in interest income to N25.37 billion and a 21.92% rise in non-interest income where we continue to see impressive growth, led by income from our mobile and digital banking offerings.”

Mr Oloketuyi further stated that, “The impact of the growth in gross earnings was however muted by the higher cost of funds within the sector.”

“Despite this, we still maintained a decent interest margin while recording a 10% growth in Profit before Tax (PBT),” he added.

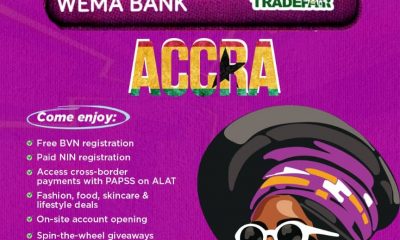

He disclosed that Wema Bank’s growth strategy – Project LEAP – revolves around the Bank’s Retail business and this was further strengthened by the May 2017 launch of ALAT, Nigeria’s first fully digital Bank.

ALAT is the first of its kind with its end-to-end digital offering and customer interaction.

The bank’s target is to onboard an average of 1,000 new customers per day and we are on track to achieve that. The Bank also continues to improve its customer acquisition through the launch of its Agency Banking initiative and the impressive performance of its USSD platform (*945#). Indeed with this 3-pronged strategy, Wema Bank is poised to be Nigeria’s leading Retail Bank.

“We have commenced the second half of the year with cautious optimism, especially around the implementation of the needed economic reforms and execution of the 2017 budget to ensure stimulation of economic growth.

“The expectation is that the country will exit recession in the 2018 financial year, but this will be dependent on a diligent execution of the reform programme,” he added.

Further discussions with Ademola Adebise, the Deputy Managing Director, revealed that for Wema Bank, the emphasis in the next six months is to build and consolidate on the gains within the Digital Banking space, where the Bank presently leads and to improve on customer acquisition and invariably cost of funds.

In sharing the Bank’s growth plan, the Deputy Managing Director revealed that the Bank has opened three branches in the North.

The Bank will expand further with two (2) other branches within the North Central Region and at least one in the East before the end of the year.

“We continue to improve on the brand perception of the Bank, both across physical channels and through social media engagement,” according to Adebise.

The Bank has renovated more than 70% of its branch network to make these service channels more contemporary both in look and feel, and in in the provision of infrastructure. This will continue as the economic climate improves.

On the Bank’s growth plan and capital raise, Tunde Mabawonku, the Chief Finance Officer stated that, “we are also closely watching interest rates in the money market and relevant government policies to determine the timing of the second tranche of our Debt Capital issue, to further boost our ability to grow our franchise. We have continued to engage both local and international fund providers and have improved on our capacity to do business especially within the Trade Finance space.

The Bank is rated by two rating agencies (Fitch & GCR) and our credit rating remains investment grade and a stable outlook.

Banking

Public Offer: Sterling Holdco Allots 13.812 billion Shares to 18,276 Shareholders

By Aduragbemi Omiyale

Sterling Financial Holdings Company Plc has allotted shares from its public offer of 2025 to investors with valid applications.

The allotment follows the earlier receipt of final approval from the Central Bank of Nigeria (CBN) and the recent clearance by the Securities and Exchange Commission (SEC).

In September 2025, the financial institution offered for sale about 12,581,000,000 ordinary shares of 50 kobo each at N7.00 per share in public offer.

However, the exercise received wide participation from the investing public, with the company getting 18,280 applications for 16,839,524,401 ordinary shares valued at approximately N117.88 billion.

Following a thorough verification process, valid applications were received from 18,276 shareholders for a total of 13,812,239,000 ordinary shares, representing a subscription level of 109.79 per cent and reflecting sustained confidence in Sterling Holdco’s strategic direction, governance, and long-term growth prospects.

The firm approached the capital market for additional funds for the recapitalisation of its two flagship subsidiaries, Sterling Bank and The Alternative Bank.

The capital injection will support the commencement of full operations and contribute to the group’s revenue diversification objectives.

In line with the guidelines set out in the offer prospectus, Sterling Holdco confirmed that all valid applications will be allotted in full. Every investor who complied with the terms of the offer will receive all the shares for which they applied.

A very small number of applications were not processed or were partially rejected due to non-compliance with the offer terms, including duplicate payments and failure to meet the minimum subscription requirement of 1,000 units or its multiples, as stipulated in the offer documents.

The group ensures a seamless post-offer process, with refunds for excess or rejected applications, along with applicable interest, to be remitted via Real Time Gross Settlement or NIBSS Electronic Funds Transfer directly to the bank accounts detailed in the application forms.

Simultaneously, the electronic allotment of shares has be credited to successful shareholders’ accounts with the Central Securities Clearing System (CSCS) on February 17, and for applicants who do not currently have CSCS accounts, their allotted shares will be temporarily held in a registrar-managed pool account pending the submission of their completed account opening documentation to Pace Registrars Limited, after which the shares will be transferred to their personal CSCS accounts.

Banking

CBN Governor Seeks Coordinated Digital Payment Reforms

By Modupe Gbadeyanka

To drive inclusive growth, strengthen financial stability, and deepen global financial integration across developing economies, there must be coordinated reforms in digital cross-border payments.

This was the submission of the Governor of the Central Bank of Nigeria (CBN), Mr Olayemi Cardoso, at the G‑24 Technical Group Meetings in Abuja on Thursday, February 19, 2026.

According to him, high remittance costs, settlement delays, fragmented systems, and heavy compliance burdens still limit the participation of households and Micro, Small and Medium Enterprises (MSMEs) in global trade.

The central banker emphasised that efficient payment systems are essential for economic inclusion, highlighting that global remittance corridors still incur average costs above 6 per cent, with settlement delays of several days, excluding millions from modern economic activity.

Mr Cardoso cautioned that while digital payments present significant opportunities, they also carry risks such as currency substitution, weakened monetary transmission, increased FX volatility, capital-flow pressures, and regulatory fragmentation.

The G-24 TGM 2026, themed Mobilising finance for sustainable, inclusive, and job-rich transformation, convened global financial stakeholders to advance the modernisation of finance in support of emerging and developing economies.

The CBN chief reaffirmed Nigeria’s commitment to working with G-24 members, the IMF, the World Bank Group, and other partners to build a more inclusive, resilient, and development-oriented global financial architecture.

“We have strengthened our AML/CFT frameworks in line with FATF guidelines, requiring strict dual-screening of cross-border transactions to mitigate risks.

“To deepen regional integration, the CBN introduced simplified KYC/AML requirements for low-value cross-border transactions to encourage broader participation in PAPSS, easing processes for Nigerian SMEs and enabling faster intra-African trade payments.

“We have also embraced fintech innovation through our Regulatory Sandbox, allowing payment-focused fintechs to test secure, instant cross-border solutions under close CBN supervision,” he disclosed.

Banking

Unity Bank, Providus Bank Merger Awaits Final Court Approval

By Modupe Gbadeyanka

The merger and business combination between Unity Bank Plc and Providus Bank Limited remains firmly on course, a statement from one of the parties disclosed.

According to Unity Bank, there is no iota of truth in reports in certain sections of the media suggesting that the merger process had stalled, as the transaction remains firmly on track.

It was disclosed that the necessary regulatory steps have been completed, but only a few other steps to finalise the transaction, especially the final court sanction.

There had been speculations that both lenders may not meet the new minimum capital requirement of the Central Bank of Nigeria (CBN) before the March 31, 2026, deadline.

However, it was noted that the combined capital base of Unity Bank and Providus Bank exceeds N200 billion, which is the minimum requirement to retain a national banking licence under the CBN’s recapitalisation framework.

When completed, the Unity-Providus merger is expected to deliver a stronger, more competitive, and customer-centric financial institution — one with the scale, innovation, and reach to redefine the retail and SME banking landscape in Nigeria.

“The merger with Providus Bank significantly enhances our capital base, operational capacity, and strategic positioning.

“We are confident that the combined institution will be better equipped to support economic growth and deliver innovative financial solutions across Nigeria,” the chief executive of Unity Bank, Mr Ebenezer Kolawole, stated.

Recall that a few months ago, shareholders authorised the merger between the two entities at Court-Ordered Meetings. They also adopted the scheme of merger at their respective Extraordinary General Meetings (EGMs) in September 2025,

The central bank also backed the merger, with a pivotal financial accommodation to support the transaction. The merger also received a further boost with a “no objection” nod from the Securities and Exchange Commission (SEC).

The regulatory approvals form part of broader efforts to strengthen the resilience of Nigeria’s banking system, reinforce capital adequacy across the sector, and mitigate potential systemic risks.

The development positions the combined entity among the 21 banks that have satisfied the apex bank’s new capital threshold for national banking operations.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn