Banking

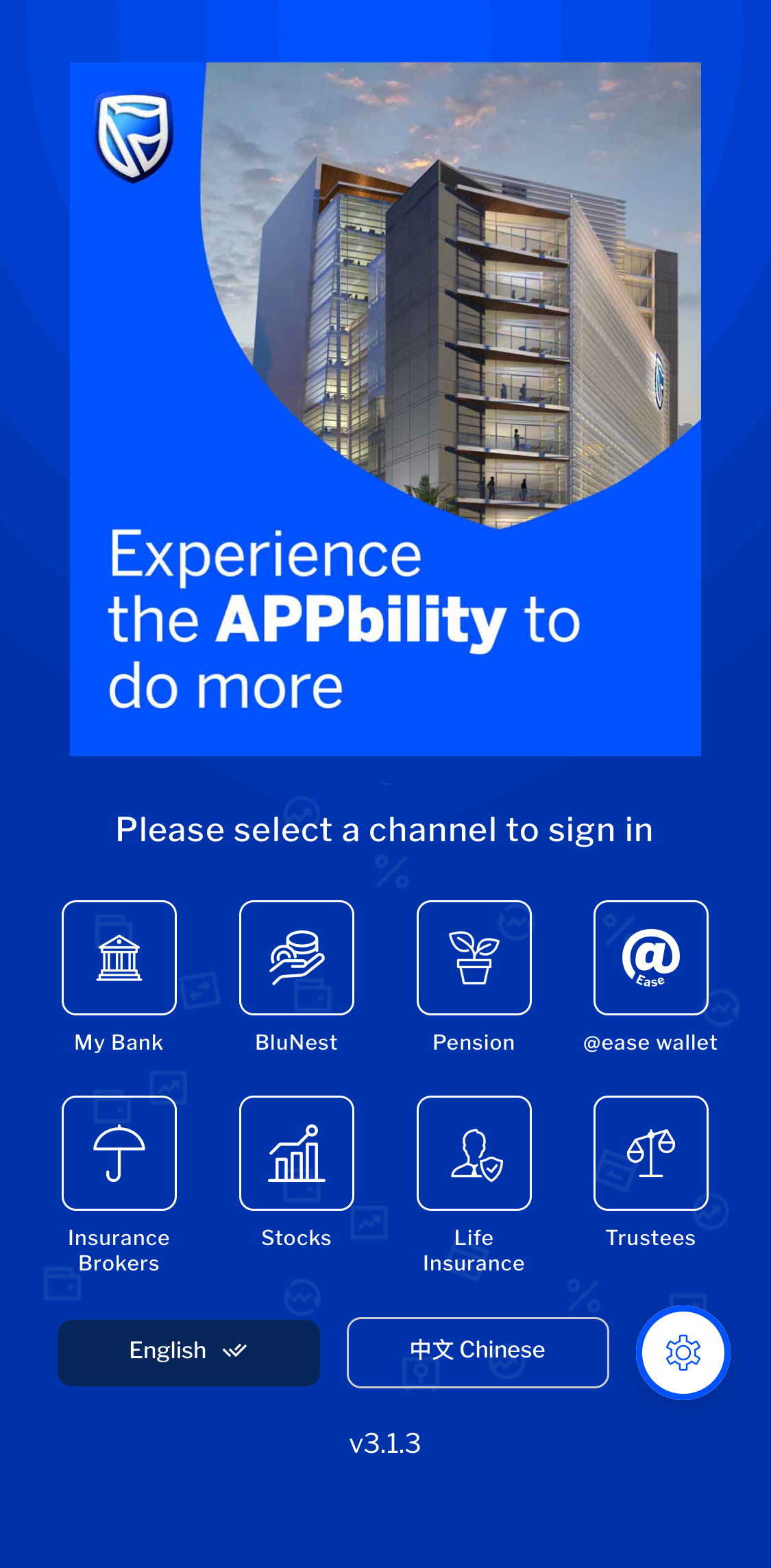

In-Depth Review of Stanbic IBTC Mobile App 3.0

Securing the Future of Finance: Unpacking the Robust Security Architecture of Stanbic IBTC Mobile App 3.0

In an era where digital interactions drive everyday banking, the security of financial transactions has become paramount. Stanbic IBTC Bank’s Mobile App 3.0 establishes a new standard for secure digital banking through a meticulously designed, multi-layered security architecture. Each customer interaction is guarded by a suite of advanced security measures, ensuring both protection and peace of mind for users navigating the digital landscape.

Comprehensive Multi-Layered Security Framework

The Stanbic IBTC Mobile App 3.0 employs a comprehensive approach to security, integrating advanced encryption, biometric and multi-factor authentication, secure coding standards, and behavioural risk profiling. This layered defence strategy is designed to counteract evolving cyber threats, meaning every login, transaction, and exchange of information remains protected. Such a holistic framework empowers customers to confidently manage their finances, knowing that robust safeguards are in place at every step.

A Shared Commitment to Security

Stanbic IBTC’s dedication to security extends beyond technological solutions; it embodies a culture of shared responsibility. As highlighted by Abumere Igboa, Chief Information Security Officer at Stanbic IBTC Holdings PLC: “Stanbic IBTC prioritises the safety of its customers and continually ensures the security of its digital platforms with innovative technology to detect, monitor and protect against online threats during financial transactions. Staying safe and secure online is a shared responsibility that begins with you and me. We must jointly support and remain committed to a safer Cyber space. Should you notice any suspicious activity when using any of our digital and online platforms, don’t delay – act promptly and reach out to our 24/7 customer support centre.” This philosophy fosters an environment where cutting-edge security tools are complemented by customer empowerment, creating a vigilant and resilient banking ecosystem.

Biometric and Multi-Factor Authentication

At the heart of the app’s security is its robust biometric and multi-factor authentication (MFA) system. This foundation ensures secure and seamless digital access by requiring multiple independent identity verification methods, moving beyond the limitations of traditional passwords. The result is a significant reduction in the risk of account takeovers, strengthening overall account security. The biometric authentication feature enables customers to utilise fingerprint or facial recognition on compatible devices, combining convenience with stringent protection. By making unauthorised access exceedingly difficult, the app upholds the premium security standards expected by its users.

Encryption and Data Security

Encryption is integral to every interaction within the app, safeguarding sensitive data both in transit and at rest. This protection prevents unauthorised interception or tampering, ensuring that critical information—such as transaction details and personal identifiers—remains inaccessible to unauthorised parties. Together, these measures create a comprehensive “defence-in-depth” security strategy.

Customer Empowerment and Self-Service Safeguards

The app further empowers users with self-service security features, allowing them to instantly immobilise their accounts upon detecting suspicious activity. Additionally, a USSD fallback option (9091*911#) is available for blocking accounts, enabling immediate action in cases such as device loss. This ensures that customers retain control and can act swiftly to protect their financial assets.

Redefining Premium Banking Security

Stanbic IBTC Mobile App 3.0 stands as a model for layered, intuitive, and resilient banking security. By embedding sophisticated features into a unified platform, the bank reinforces its commitment to safeguarding customer funds and cultivating lasting trust in an increasingly digital world. To experience these enhanced security measures first-hand, download the app from the Google Play Store or Apple App Store today, and embrace a future where financial security is at the forefront.

Banking

Senate Seeks Stronger CBN Oversight in Fintech Regulation

By Adedapo Adesanya

The Senate has called for a strengthened regulatory framework that positions the Central Bank of Nigeria (CBN) at the centre of oversight of the country’s fast-growing fintech sector.

The recommendation was made by Chairman of the Senate Committee on Banking, Insurance, and Other Financial Institutions, Mr Adetokunbo Abiru, during a one-day public hearing at the National Assembly complex on Wednesday.

The event focused on the proposed amendment to the Banks and Other Financial Institutions Act (BOFIA) 2020 (SB. 959) and included an investigative session into fraudulent investment platforms, notably the recent Crypto Bullion Exchange (CBEX) incident.

Mr Abiru, who is a former Group Managing Director of Polaris Bank and Executive Director at First Bank Nigeria, emphasised that fintechs, including mobile money operators, digital lenders, payment platforms, and settlement companies, have become systemically important to Nigeria’s financial ecosystem.

While their growth has expanded financial inclusion, existing laws, he said, do not fully address the scale, data sensitivity, and systemic impact of these technology-driven institutions.

“The question has arisen as to whether a new standalone regulatory agency would be preferable for supervising fintechs,” Mr Abiru said.

“However, creating a separate agency would duplicate functions, fragment oversight, and increase bureaucratic costs. It is far more effective to strengthen the BOFIA framework, modernise CBN supervisory powers, and mandate coordination with key agencies such as the Securities and Exchange Commission, Nigerian Communications Commission, Corporate Affairs Commission, Federal Competition and Consumer Protection Commission, and the Office of the National Security Adviser,” he added.

The lawmaker proposed that the amendment should explicitly empower the CBN to designate qualifying fintechs as Systemically Important Institutions, establish a national registry for transparency and beneficial ownership disclosure, and strengthen risk-based supervision tailored to technology-driven financial services.

Beyond fintech regulation, the Senate intensified scrutiny on Ponzi schemes and fraudulent investment platforms.

Mr Abiru described the rising prevalence of such schemes as a threat to financial stability and public trust, citing the CBEX debacle, which reportedly caused severe financial losses to individuals across Nigeria, including professionals, traders, students, and retirees.

Banking

Zenith Bank Deepens Engagement Around Women’s Empowerment, Others

By Modupe Gbadeyanka

Monday, March 9, 2026, has been fixed by Zenith Bank Plc for its annual International Women’s Day seminar in Lagos.

The event is part of activities lined up to commemorate the 2026 International Women’s Day, themed Give to Gain.

The theme prepared for Zenith Bank’s programme is Take it, You Own it, and was designed to deepen meaningful engagement around women’s empowerment, leadership, and sustainable impact.

The workshop will include segments focused on leadership insight, professional empowerment, wellbeing, and collaboration, offering attendees opportunities to engage deeply with thought leadership and practical strategies for advancing equity.

With a carefully curated programme spanning keynote addresses, panel conversations, Q and A sessions, and creative interludes, Zenith Bank’s 2026 International Women’s Day Seminar promises to be a catalyst for meaningful action.

“International Women’s Day is a reminder that progress requires intentionality.

Give to Gain speaks to the responsibility institutions have to create real opportunities, while our theme, Take It, You Own It, challenges women to step forward boldly and lead.

“At Zenith Bank, we are deliberate about building environments where women are supported to grow, thrive, and shape outcomes, not only within our institution but across the communities and industries we serve,” the chief executive of Zenith Bank, Ms Adaora Umeoji, stated.

Over the years, the lender’s International Women’s Day initiatives have brought together women leaders, professionals, entrepreneurs, and emerging talents for dynamic dialogue, inspiration, and shared learning around gender equity, professional growth, and inclusive opportunity.

More than a commemorative gathering, the 2026 seminar is designed as a convergence of influence, insight, and inspiration, bringing together accomplished women and progressive leaders across business, governance, creative industries, technology, and social impact.

Banking

Ecobank Accelerates Growth for Women Entrepreneurs With Enhanced ‘Ellevate’ Programme

By Modupe Gbadeyanka

As part of activities commemorating International Women’s Day 2026, Ecobank Nigeria has improved its multi-award-winning gender financing initiative, Ellevate by Ecobank.

Originally launched to improve access to finance for women-owned, women-led, and women-focused small and medium-sized enterprises (SMEs) within its commercial banking segment, the enhanced Ellevate programme now adopts a broader, more inclusive structure.

The new framework extends across all business segments, positioning Ellevate as a comprehensive ecosystem designed to address the structural financing and growth barriers faced by women entrepreneurs.

The upgraded programme reinforces the bank’s long-term commitment to advancing women-led enterprises in Nigeria and across Ecobank’s pan-African footprint.

Under the expanded structure, beneficiaries will enjoy improved access to credit on competitive terms, including more flexible collateral considerations aimed at easing traditional financing constraints. Beyond lending, the programme integrates digital payment, collections, and cash management solutions to enhance operational efficiency and support scalability.

A core pillar of the enhancement is structured market access. Through the bank’s MyTradeHub online matchmaking platform and e-commerce enablement capabilities, women entrepreneurs will be better positioned to connect with customers and trade partners across Africa, facilitating cross-border expansion and participation in regional value chains.

The initiative also incorporates robust non-financial support mechanisms, including targeted training programmes, leadership development sessions, and knowledge-sharing platforms to strengthen managerial capacity and long-term sustainability.

This is complemented by access to customised wealth management advisory services, integrated insurance solutions, and a loyalty framework offering commercial incentives through select retail and lifestyle partnerships.

“Since its launch in Nigeria in July 2021, Ellevate has delivered meaningful impact for SMEs and women-led businesses.

“This next phase deepens our value proposition and reinforces our resolve to remain the preferred financial partner for women entrepreneurs,” the Managing Director of Ecobank Nigeria, Mr Bolaji Lawal, said.

“African businesswomen deserve world-class banking solutions that drive turnover, profitability, and sustainable growth. Our approach goes beyond financial inclusion to building an enabling ecosystem that enhances competitiveness and long-term resilience,” he added.

He further highlighted that Ecobank Nigeria consistently hosts flagship platforms such as Adire Lagos, Oja Oge, +234Art Fair, the Lagos Pop-Up Museum, SME Bazaar, and the Design & Build Exhibition, which provide prominent opportunities for showcasing and elevating women-owned businesses.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn