Banking

KPMG Ranks Ecobank Among Top Five Customer-centric Nigerian Banks

By Aduragbemi Omiyale

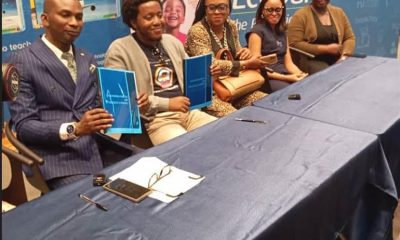

Ecobank Nigeria Limited has been ranked among the top five customer-centric financial institutions operating in the country.

The ranking was done by a leading audit and professional services company in Nigeria, KPMG, in its 2021 survey of Nigerian banks.

Ecobank Nigeria was number five in the study in the Wholesale (Corporate) Banking category of the KPMG Customers’ Experience and Satisfaction Survey.

When compared with the previous year, the lender moved eight places higher, which was a significant improvement.

The top banks in order of rating include Citibank, Standard Chartered Bank, FCMB, Zenith and Ecobank Nigeria.

KPMG explained that Ecobank and other leaders in the segment demonstrated digital banking excellence with higher transaction volumes; adding that they were seen as partners to corporates and also move quickly to address and exceed customer needs.

“Our annual banking survey continues to provide an independent platform for banks and other organizations to acquire this outside-in perspective and understand the voice and priorities of Nigerian customers.

“This year, our results reveal a very competitive landscape in the race for the customer and at the same time, customer feedback that recognizes the effort and innovation of Nigerian banks,” the respected firm stated.

Specifically, it stated that, “In the report, we explore, in more detail, key priorities for corporates such as transaction banking support as well as the payments experience for retail customers.”

The KPMG Nigeria Banking Industry Customer Experience Survey has been held annually for the last 15 years with the 2021 edition themed Changing Customer, Changing Priorities.

The experience survey measures the performance of lenders in the country in terms of their relationship with their account holders and other users of financial services. They are usually rated in three categories – Retail, SME and Wholesale.

The 2020 survey covered 15,056 retail customers, 1,856 SMEs and 332 commercial/corporate organisations. Respondents were selected from customers who have interacted with their banks in the last six months.

Banking

Public Offer: Sterling Holdco Allots 13.812 billion Shares to 18,276 Shareholders

By Aduragbemi Omiyale

Sterling Financial Holdings Company Plc has allotted shares from its public offer of 2025 to investors with valid applications.

The allotment follows the earlier receipt of final approval from the Central Bank of Nigeria (CBN) and the recent clearance by the Securities and Exchange Commission (SEC).

In September 2025, the financial institution offered for sale about 12,581,000,000 ordinary shares of 50 kobo each at N7.00 per share in public offer.

However, the exercise received wide participation from the investing public, with the company getting 18,280 applications for 16,839,524,401 ordinary shares valued at approximately N117.88 billion.

Following a thorough verification process, valid applications were received from 18,276 shareholders for a total of 13,812,239,000 ordinary shares, representing a subscription level of 109.79 per cent and reflecting sustained confidence in Sterling Holdco’s strategic direction, governance, and long-term growth prospects.

The firm approached the capital market for additional funds for the recapitalisation of its two flagship subsidiaries, Sterling Bank and The Alternative Bank.

The capital injection will support the commencement of full operations and contribute to the group’s revenue diversification objectives.

In line with the guidelines set out in the offer prospectus, Sterling Holdco confirmed that all valid applications will be allotted in full. Every investor who complied with the terms of the offer will receive all the shares for which they applied.

A very small number of applications were not processed or were partially rejected due to non-compliance with the offer terms, including duplicate payments and failure to meet the minimum subscription requirement of 1,000 units or its multiples, as stipulated in the offer documents.

The group ensures a seamless post-offer process, with refunds for excess or rejected applications, along with applicable interest, to be remitted via Real Time Gross Settlement or NIBSS Electronic Funds Transfer directly to the bank accounts detailed in the application forms.

Simultaneously, the electronic allotment of shares has be credited to successful shareholders’ accounts with the Central Securities Clearing System (CSCS) on February 17, and for applicants who do not currently have CSCS accounts, their allotted shares will be temporarily held in a registrar-managed pool account pending the submission of their completed account opening documentation to Pace Registrars Limited, after which the shares will be transferred to their personal CSCS accounts.

Banking

CBN Governor Seeks Coordinated Digital Payment Reforms

By Modupe Gbadeyanka

To drive inclusive growth, strengthen financial stability, and deepen global financial integration across developing economies, there must be coordinated reforms in digital cross-border payments.

This was the submission of the Governor of the Central Bank of Nigeria (CBN), Mr Olayemi Cardoso, at the G‑24 Technical Group Meetings in Abuja on Thursday, February 19, 2026.

According to him, high remittance costs, settlement delays, fragmented systems, and heavy compliance burdens still limit the participation of households and Micro, Small and Medium Enterprises (MSMEs) in global trade.

The central banker emphasised that efficient payment systems are essential for economic inclusion, highlighting that global remittance corridors still incur average costs above 6 per cent, with settlement delays of several days, excluding millions from modern economic activity.

Mr Cardoso cautioned that while digital payments present significant opportunities, they also carry risks such as currency substitution, weakened monetary transmission, increased FX volatility, capital-flow pressures, and regulatory fragmentation.

The G-24 TGM 2026, themed Mobilising finance for sustainable, inclusive, and job-rich transformation, convened global financial stakeholders to advance the modernisation of finance in support of emerging and developing economies.

The CBN chief reaffirmed Nigeria’s commitment to working with G-24 members, the IMF, the World Bank Group, and other partners to build a more inclusive, resilient, and development-oriented global financial architecture.

“We have strengthened our AML/CFT frameworks in line with FATF guidelines, requiring strict dual-screening of cross-border transactions to mitigate risks.

“To deepen regional integration, the CBN introduced simplified KYC/AML requirements for low-value cross-border transactions to encourage broader participation in PAPSS, easing processes for Nigerian SMEs and enabling faster intra-African trade payments.

“We have also embraced fintech innovation through our Regulatory Sandbox, allowing payment-focused fintechs to test secure, instant cross-border solutions under close CBN supervision,” he disclosed.

Banking

Unity Bank, Providus Bank Merger Awaits Final Court Approval

By Modupe Gbadeyanka

The merger and business combination between Unity Bank Plc and Providus Bank Limited remains firmly on course, a statement from one of the parties disclosed.

According to Unity Bank, there is no iota of truth in reports in certain sections of the media suggesting that the merger process had stalled, as the transaction remains firmly on track.

It was disclosed that the necessary regulatory steps have been completed, but only a few other steps to finalise the transaction, especially the final court sanction.

There had been speculations that both lenders may not meet the new minimum capital requirement of the Central Bank of Nigeria (CBN) before the March 31, 2026, deadline.

However, it was noted that the combined capital base of Unity Bank and Providus Bank exceeds N200 billion, which is the minimum requirement to retain a national banking licence under the CBN’s recapitalisation framework.

When completed, the Unity-Providus merger is expected to deliver a stronger, more competitive, and customer-centric financial institution — one with the scale, innovation, and reach to redefine the retail and SME banking landscape in Nigeria.

“The merger with Providus Bank significantly enhances our capital base, operational capacity, and strategic positioning.

“We are confident that the combined institution will be better equipped to support economic growth and deliver innovative financial solutions across Nigeria,” the chief executive of Unity Bank, Mr Ebenezer Kolawole, stated.

Recall that a few months ago, shareholders authorised the merger between the two entities at Court-Ordered Meetings. They also adopted the scheme of merger at their respective Extraordinary General Meetings (EGMs) in September 2025,

The central bank also backed the merger, with a pivotal financial accommodation to support the transaction. The merger also received a further boost with a “no objection” nod from the Securities and Exchange Commission (SEC).

The regulatory approvals form part of broader efforts to strengthen the resilience of Nigeria’s banking system, reinforce capital adequacy across the sector, and mitigate potential systemic risks.

The development positions the combined entity among the 21 banks that have satisfied the apex bank’s new capital threshold for national banking operations.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn