Banking

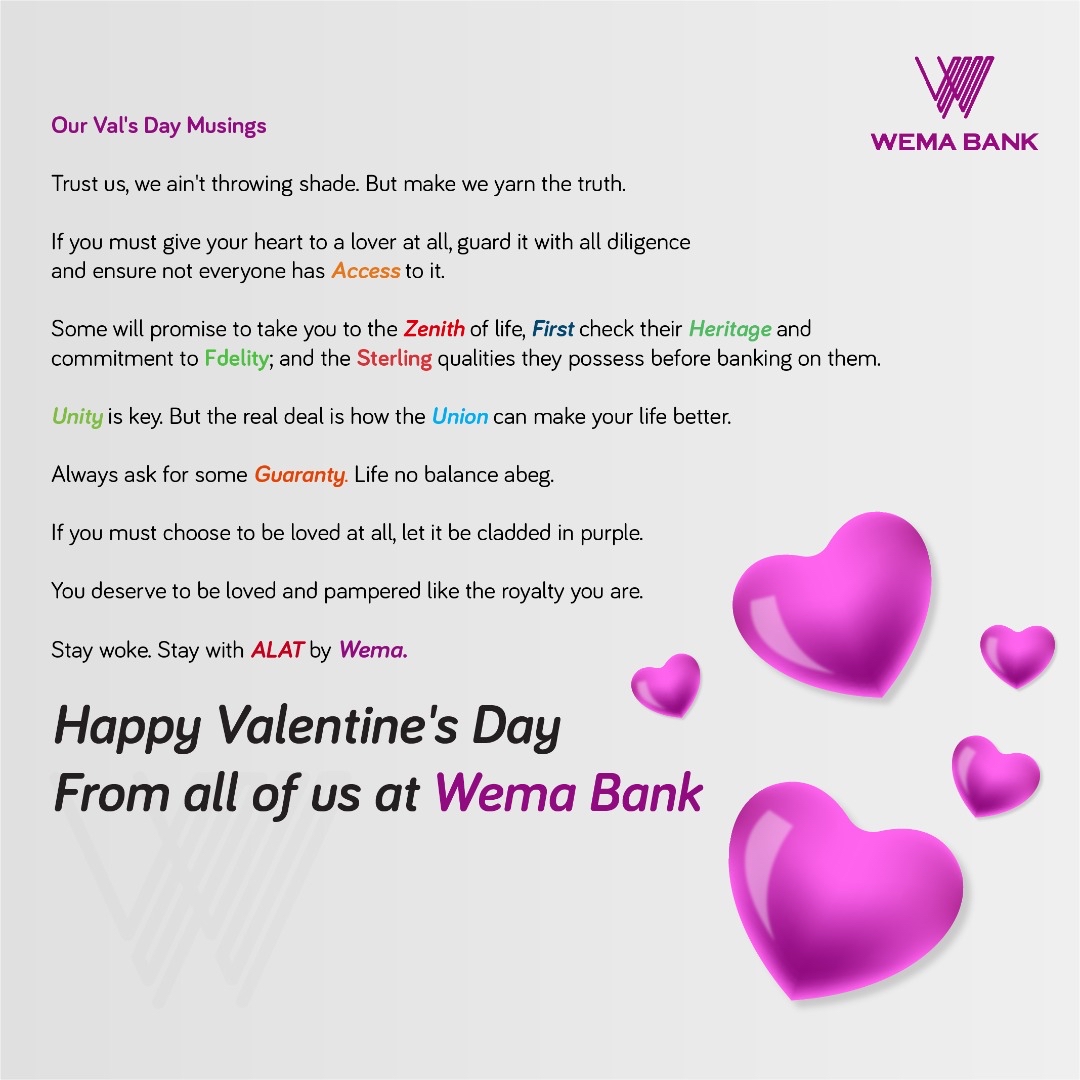

Twitter Agog for Wema Bank Val’s Day Banter

By Modupe Gbadeyanka

Though the 2021 Valentine’s Day may have come and gone, one of the key moments was how Wema Bank made the day memorable.

Leveraging the currency of banter trends, Wema Bank took on some leading financial institutions in the country with its Valentine’s Day campaign.

Titled Our Val’s Day Musings, the creatively humorous banter has sent social media, particularly Twitter, agog, with thousands of commentators retweeting and passing positive comments.

“Trust us, we ain’t throwing shade. But make we yarn the truth,” the message begins.

“If you must give your heart to a lover at all, guard it with all diligence and ensure not everyone has Access to it.

“Some will promise to take you to the Zenith of life, First check their Heritage and commitment to Fidelity; and the Sterling qualities they possess before banking on them.

“Unity is key. But the real deal is how the Union can make your life better.

“Always ask for some Guaranty. Life no balance abeg.

“If you must choose to be loved at all, let it be cladded in purple.

“You deserve to be loved and pampered like the royalty you are.

“Stay woke. Stay with ALAT by Wema. Happy Valentine’s Day from all of us at Wema Bank.”

Commenting on the good-natured banter, a tweep, Jubril A Gawat with the handle@Mr_JAGs noted: “very nice, clean, soft and simple ‘General Market’ banter.

@Ayothefather commented, “I dey go open Wema Bank account tomorrow”, while @Mofiolaoluwasa1 tweeted, “Wema Bank nailed eet. Dragged title from Sterling.”

A FirstBank customer, @iambellotaiwo, jumped in with “@FirstBankngr you can’t shame me, shey you know…You guys need to respond to this real quick.”

A Wema Bank customer, @ray_hadji, reaffirmed his love for the bank with “I’m proud of my bank” and @Ajoke_Onifaari hailed its quality. “This Wema Bank Valentine’s ad is top notch.”

The banter continues to trend on social media with more commentators having their say.

Recall that the digitally-led innovative Wema Bank is currently delighting its customers with a prepaid gift card they can gift to their loved ones in the Valentine’s season.

To promote the tradition of gift-giving that accompanies the holiday, the bank is offering customers a special gift option to share with their loved ones and embarking on a love fiesta of their own: the *945# love campaign.

Members of her online community would win giveaways including goody bags, airtime recharge, purchase discounts and cash prizes.

Banking

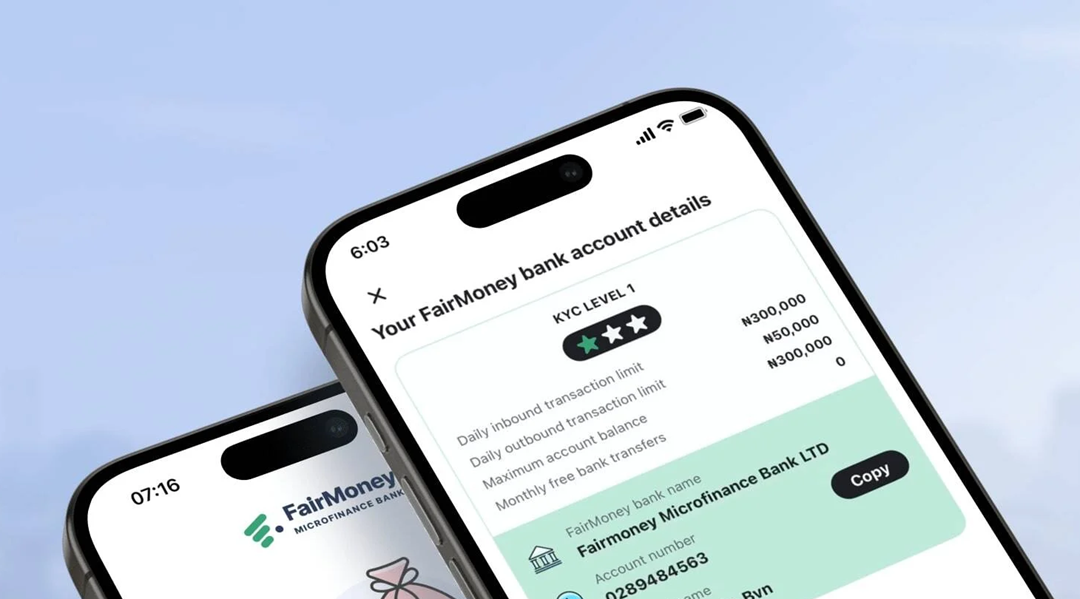

How FairMoney is Powering the Next Generation of Nigerian SMEs

SMEs are widely regarded as the engine of economic growth. According to the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), in 2025, Nigerian SMEs continued to anchor the economy, representing approximately 96% of all businesses. These enterprises contributed over 48% to Nigeria’s GDP and accounted for between 84% of total employment. However, while the vast majority of SMEs play a vital role in national development, only a small minority have access to formal credit or the financial literacy required to scale and meet eligibility requirements.

FairMoney Microfinance Bank (MFB), a leading technology-enabled bank in Nigeria, is supporting national financial inclusion objectives and bridging the gap by providing solutions that directly assist small and medium-sized enterprises (SMEs). It does this not only by providing access to financing but also by offering efficient payment processing options that help SMEs scale up financially.

Access to Capital

Securing a loan through FairMoney MFB offers a streamlined path for Nigerian SMEs to transform potential into performance. By prioritising digital speed and accessibility, the microfinance bank enables eligible business owners in Nigeria to secure up to ₦5,000,000 without physical collateral; however, access remains subject to credit assessment. This rapid disbursement creates a real opportunity for entrepreneurs to act on time-sensitive growth prospects, whether that means restocking inventory ahead of a peak season, fulfilling a sudden large-scale order, or upgrading essential equipment. To improve their eligibility for higher loan amounts, SMEs simply need to increase their engagement with the FairMoney ecosystem; banking and managing finances directly through the app after an initial application using their BVN and business details.

Beyond the Bank Statement

Alternative credit scoring is the engine that allows FairMoney MFB to leverage broader data sets to better inform credit decisions for a wider range of SME customers. FairMoney MFB doesn’t just look at a bank statement; it looks at potential. By utilising Alternative Credit Scoring powered by advanced data analytics and machine learning, FairMoney MFB assesses creditworthiness based on non-traditional data, such as app usage patterns, transaction velocity, and digital footprints – with customer consent and in accordance with Nigerian data protection requirements. This approach opens the door for businesses with limited formal financial histories to access real growth opportunities that were previously out of reach. For the Nigerian SME, this presents the opportunity to scale from small-scale survival to ambitious expansion, securing the funding necessary to innovate and compete based on the real-time strength of their operations.

Smarter Savings

True business growth requires a shift from simple borrowing to disciplined wealth management, and FairMoney MFB empowers SMEs with a suite of specialised products designed to ensure their capital works as hard as they do. Through FairTarget, entrepreneurs can define specific financial milestones, such as purchasing equipment or securing a larger office, and automate their progress toward reaching them. For operational liquidity, FairSave offers a high-interest savings account where funds remain accessible while earning daily interest, while FairLock provides long-term stability by allowing businesses to secure surplus funds at premium interest rates, protecting capital from impulsive spending. Together, these features transform FairMoney MFB from a lender into a comprehensive financial partner to SMEs that fosters both immediate scalability and long-term fiscal health.

POS Systems

FairMoney MFB’s Point of Sale (POS) systems provide Nigerian SMEs with a robust infrastructure to accept online, mobile, and in-person payments seamlessly. By transitioning from a cash-only model to a multi-channel payment system, businesses can significantly reduce operational risks such as theft and accounting errors while expanding their reach to a nationwide customer base. This digital shift unlocks real-life opportunities for growth. A local retailer can move beyond foot traffic to sell to customers across the country via the web, while service providers can offer “Pay with Transfer” or card options that cater to the growing demographic of cashless consumers.

Every digital transaction creates a verifiable financial trail within the FairMoney MFB app, which the bank uses to build a more accurate credit profile for the merchant. This means that simply by making it easier for customers to pay, SMEs could potentially improve their credit profile and gain access to more competitive pricing needed for long-term expansion.

Maintaining detailed financial records has transitioned from a best practice to a regulatory necessity for SMEs. The current landscape, influenced by the Nigeria Revenue Service (NRS), increasingly values verifiable digital records as a means of supporting eligibility assessments for small business tax holidays. Maintaining such records through record keeping can facilitate compliance with requirements for exemptions, such as the 0% Company Income Tax (CIT) rate for businesses with an annual turnover below ₦100 million. Without accurate, time-stamped digital trails, including structured e-invoices and clear transaction histories, SMEs risk not only losing these vital fiscal reliefs but also facing significantly sharper penalties for late filing or non-compliance.

Beyond tax, streamlined records bridge the information gap that often hinders access to credit; by presenting a “financial compass” of real-time cash flow and profitability, business owners can prove their creditworthiness to partners, turning their compliance into a strategic tool for securing the capital needed to scale in an increasingly formalised market. FairMoney MFB continues to serve as a dynamic partner in an SME’s journey toward long-term scalability and financial stability.

Banking

GTBank Offers Customers 2.95% on Quick Airtime Loan Via *737*90# Code

By Modupe Gbadeyanka

Customers of Guaranty Trust Bank (GTBank) Limited in need of quick airtime on their phones for payment later can now do so at an interest rate of 2.95 per cent.

The flagship banking franchise of GTCO Plc, in a statement, said this innovative digital solution gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring they can stay connected when it matters most.

The service known as the Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group.

Leveraging HabariPay’s Squad, the solution reinforces the group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

The Quick Airtime Loan service was created to help customers address missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight and options are limited.

The product offers users instant access to airtime on credit, directly from their bank.

With Quick Airtime Loan, eligible GTBank customers can access from N100 and up to N10,000 by dialling *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15 per cent, but GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95 per cent.

Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

“Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs.

“The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience.

“By leveraging unique strengths across the Group, we can accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels,” the Managing Director of GTBank, Ms Miriam Olusanya, commented.

Banking

UBA Taps $100bn Annual Diaspora Flows With New Platform

By Modupe Gbadeyanka

United Bank for Africa (UBA) Plc has introduced a diaspora platform designed to connect global Africans with investment and wealth opportunities.

This platform, according to the lender’s Head of Diaspora Banking, Mr Anant Rao, would be used to tap into the $100 billion diaspora remittance flows to Africa annually.

Mr Rao stated that the objective is to provide a platform that brings together offerings across the numerous needs of the global African, including banking and payments, investments, securities services, asset management, insurance, pensions, and real estate.

“Diaspora capital is not just a flow of funds — it is a strategic growth partner for Africa.

“Our role is to provide a trusted platform that converts capital into structured investment and shared prosperity across the continent,” he stated at the unveiling of this platform in Lagos recently.

Business Post gathered that this diaspora banking and investment platform will serve Africans living and working across the world and within the continent.

It was launched in collaboration with leading ecosystem partners, including United Capital, Africa Prudential, UBA Pensions, Afriland Properties, Heirs Insurance Group, and Avon Healthcare Limited.

“For decades, Africa’s engagement with its diaspora has focused largely on remittances. Today, we are moving beyond that. This platform represents a transition from simple money transfers to a financial ecosystem where Africans globally can bank, make payments, invest, protect their families, and build long-term wealth seamlessly,” Mr Rao further said.

It was learned that through this coordinated ecosystem, diaspora customers can access financial solutions across multiple sectors through a single trusted platform, enabling them to manage their financial lives and family commitments across borders with ease and transparency.

Also speaking, the Head of Marketing and Corporate Communications for UBA, Ms Alero Ladipo, noted that, “The modern African is a global citizen, mobile, ambitious, and deeply connected to home. Whether living in Africa, Europe, the Americas, or the Middle East, there must be a structured and secure financial connection back home. This platform ensures that Africans everywhere can remain economically connected to the continent with confidence and transparency.”

Partners within the ecosystem highlighted growing demand among diaspora Africans for structured investment opportunities, secure property ownership, insurance protection, and long-term financial planning.

United Capital showcased globally accessible investment products designed to deliver professionally managed and transparent wealth creation opportunities.

Afriland Properties emphasised structured and well-governed real estate investment pathways for diaspora clients.

Heirs Insurance highlighted protection solutions for life and assets, while Avon Healthcare Limited demonstrated healthcare access and insurance solutions for families across borders.

Africa Prudential and UBA Pension reinforced digital investment management and long-term pension savings solutions designed to support diaspora participation in African capital markets.

They all underscored a shared commitment to providing diaspora Africans with credible, transparent, and professionally managed financial pathways.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn