Economy

An In-depth Look into Best CFD Trading Platforms in South Africa by Traders Union

Recent years have witnessed a significant surge in the popularity of Contract for Difference (CFD) trading in South Africa. In light of this evolving market dynamic, Traders Union experts conducted a meticulous examination of the top CFD trading platforms catering to the South African market. Their insightful findings aim to assist novice and experienced traders in navigating through various platforms, each boasting unique offerings and services.

The experts considered numerous best CFD trading platforms in South Africa to ensure an unbiased assessment, eventually identifying a select few that demonstrated outstanding performance across all assessment criteria. A multifaceted approach, including comprehensive evaluations of regulatory compliance, asset variety, trading features, and overall user experience, underpinned the TU expert analysis.

The forthcoming sections present a detailed summary of their findings. Read and learn about the top platforms to trade CFDs in South Africa for novice and experienced traders.

Pioneering CFD Trading Platforms in South Africa

The Traders Union team, having scrutinized the market, has delineated several trading platforms. Learn about their features and tools.

RoboForex

Regulated by IFSC, RoboForex provides traders with an extensive array of 9 asset types for CFD trading, including Forex, stocks, indices, ETFs, commodities, metals, energies, and cryptocurrencies. With a low minimum deposit of $10, the platform offers multiple account types, catering to different trading styles and risk appetites. Their platform is easy to navigate, allowing traders to maximize their trading efficiency.

XM Group

XM Group stands out with its impressive regulatory portfolio, which includes ASIC and CySEC. They offer various CFDs on asset classes such as Forex, stocks, commodities, indices, and cryptocurrencies. Traders can enjoy competitive spreads, rapid execution of orders, and dedicated support for MT4 and MT5 trading platforms.

Tickmill MT4

Tickmill offers an assortment of CFDs, including Forex, stock indices, bonds, and commodities, on its MT4 platform. The platform, regulated by the FCA, CySEC, and FSA, requires a minimum deposit of $100. Key features include low spreads, high-speed order execution, and no requotes, contributing to a seamless trading experience.

IC Markets cTrader

IC Markets facilitates trading in Forex, indices, commodities, bonds, futures, and cryptocurrencies CFDs on its sophisticated cTrader platform. It boasts high-speed order execution, level II pricing, and detachable charts. Furthermore, it is regulated by ASIC, a globally recognized financial regulator.

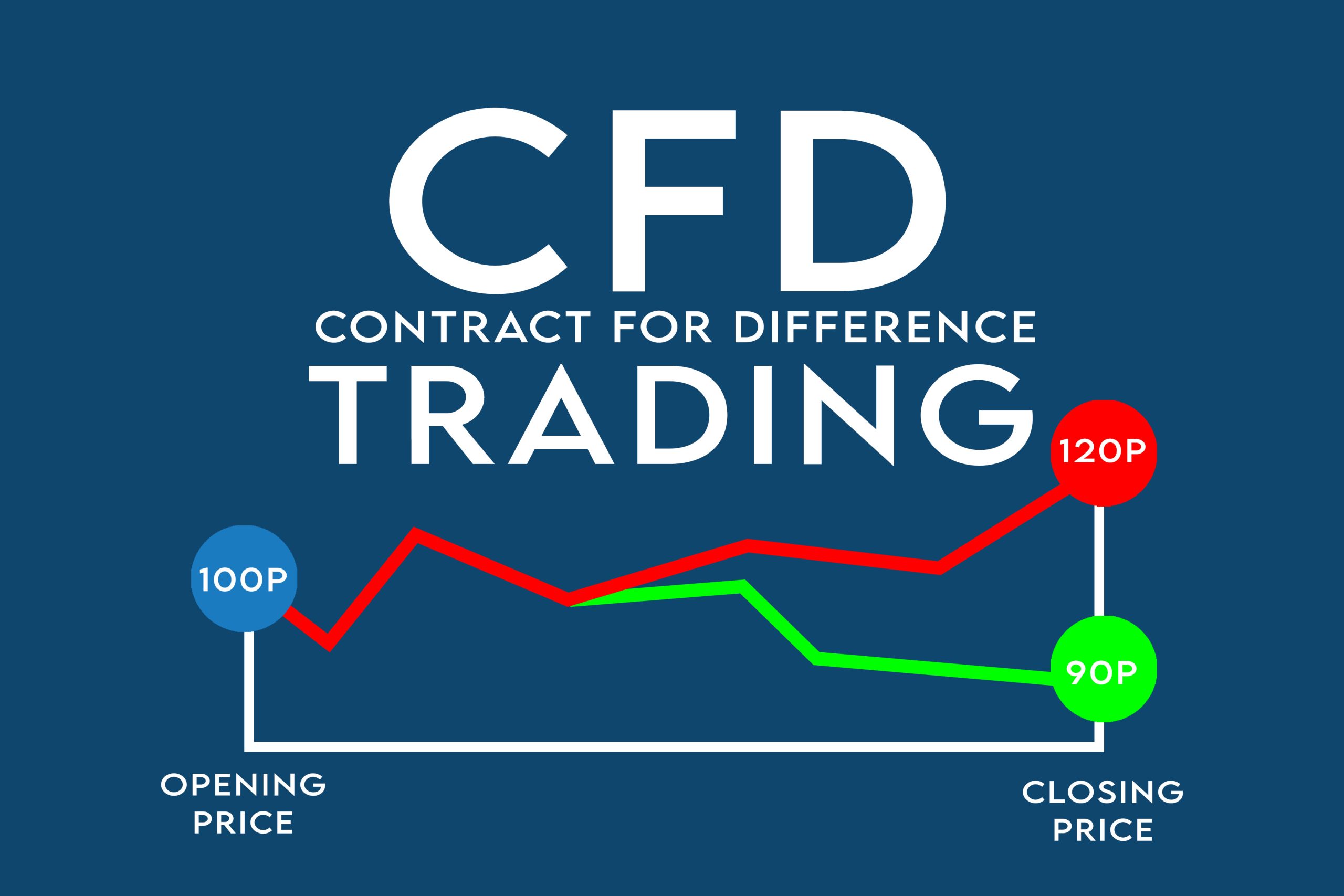

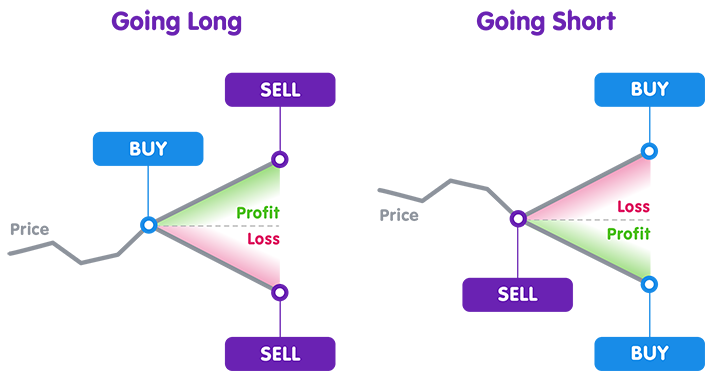

Understanding CFDs

CFDs are complex financial instruments that enable traders to speculate on the price movements of various global financial markets. In CFD trading, traders do not directly own the underlying asset. Rather, they enter into a contract with the broker to exchange the difference in the price of an asset from the time the contract is opened to when it is closed. TU team discussed key steps in CFD trading:

- Checking the regulatory status of the platform.

- See the available markets.

- Verify the availability of direct share CFDs from the broker.

- Check the features and tools of the platform.

- Check commissions and fees, including spread and withdrawal costs.

- Confirm the minimum deposit amount.

- Learn about available software.

- Check the customer support service availability via email, phone or live chat.

- Sign up to start trading CFDs.

Evaluating the Legality of CFD Trading in South Africa

CFD trading is legal in South Africa and is regulated by various entities. The Financial Sector Conduct Authority (FSCA) is South Africa’s main financial regulator, ensuring fairness and integrity in the financial markets. The Australian Securities and Investments Commission (ASIC) and Cyprus Securities and Exchange Commission (CySEC) are well-recognized global regulators that oversee Forex and CFD brokers. The UK’s Financial Conduct Authority (FCA) and Germany’s Federal Financial Supervisory Authority (BaFin) are further assurances of regulatory oversight, providing robust investor protection.

Assessing Tax Implications for CFD Traders in South Africa

Traders engaging in CFD trading are subject to South African tax laws. Income from CFD trading falls under gross income as per the Income Tax Act and must be reported to the South African Revenue Service (SARS). Capital Gains Tax (CGT) also applies to the profits earned from CFD trading. Traders Unions’ experts explain that traders must consider these tax implications when calculating their potential returns.

Identifying Ideal CFD Platforms for Beginners in South Africa

For novice traders, platforms that offer copy trading or PAMM accounts present an excellent starting point. Some of these platforms include XM Group and RoboForex. These features allow beginners to learn from experienced traders, gaining insights into successful trading strategies.

Conclusion

For a more exhaustive understanding of the CFD trading landscape in South Africa, readers are advised to visit the TU website. This rich repository hosts a plethora of detailed reviews, guides, and invaluable resources to equip traders with the knowledge they need for successful trading.

Economy

SUNU Plans N9.3bn Rights Issue for Recapitalisation

By Adedapo Adesanya

SUNU Assurances Nigeria Plc has taken steps to raise N9.3 billion through a rights issue by offering 2,075,285,714 ordinary shares of 50 Kobo each at the price of N4.50.

The new shares would be allotted to shareholders in the ratio of five new ordinary shares for every 14 ordinary shares held as of February 12, 2026.

Proceeds from the exercise would be used by the company to meet the new minimum capital requirements of the National Insurance Commission (NAICOM).

The non-life insurer is preparing to raise fresh equity capital from the capital market to meet the N15 billion minimum capital requirement introduced under the Nigerian Insurance Industry Reform Act (NIIRA) 2025, with a July 2026 compliance deadline.

According to the company’s chairman, Mr Kyari Abba Bukar, the capital plan is a proactive move to strengthen solvency, expand underwriting capacity and maintain competitive positioning in a tightening regulatory environment.

“This is a growth initiative. We are positioning early to meet the new benchmark and enhance our capacity to underwrite larger and more complex risks,” he said.

On his part, the chief executive, Mr Samuel Ogbodu, underscored the company’s dividend track record, noting that SUNU has paid dividends consistently over the past three to four years.

“We have maintained steady growth in premium income, profitability and governance standards over the last decade. Our shareholders have been rewarded, and we project continuity in value delivery,” Mr Ogbodu said.

The SUNU Group, as the majority shareholder with approximately 83 per cent equity interest, has decided to reduce its stake to comply with the free float requirements of the Nigerian Exchange (NGX) Limited. The exchange’s rule book said listed firms must float 20 per cent for the general investing public.

This strategic review of the company’s ownership structure aligns with the group’s long-term growth objectives and its commitment to supporting market development.

He said that while the parent company possesses the financial capacity to fully recapitalise the business, the board has determined that existing shareholders and new Nigerian investors shall be afforded the opportunity to participate in the next phase of the company’s growth.

This decision underscores SUNU’s commitment to broadening Nigerian participation in the ownership structure of the Company, Mr Ogbodu added.

Economy

NASD OTC Market Cap Declines to N2.53trn After 0.28% Dip

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange further lost 0.28 per cent on Wednesday, March 11, cutting down the market capitalisation by N7.21 billion to N2.533 trillion from the preceding session’s N2.540 trillion.

In the same vein, the NASD Unlisted Security Index (NSI) was down during the session by 12.06 points to finish at 4,233.91 points compared with the 4,245.97 points it ended on Tuesday.

The midweek session experienced a decline in the volume of securities by 91.3 per cent to 1.3 million units from 14.9 million units, as the value of securities decreased by 75.9 per cent to N31.9 million from the N132.7 million recorded on Tuesday, and the number of deals fell 37.9 per cent to 36 deals from the preceding session’s 58 deals.

The session ended with Central Securities Clearing System (CSCS) Plc as the most traded stock by value on a year-to-date basis with 38.1 million units valued at N2.4 billion. Okitipupa Plc followed with 6.3 million units traded at N1.1 billion, and FrieslandCampina Wamco Nigeria Plc recorded the sale of 5.8 million units worth N529.9 million.

Resourcery Plc remained as the most traded stock by volume on a year-to-date basis with 1.05 billion units sold for N408.7 million, trailed by Geo-Fluids Plc with 130.6 million units exchanged for N503.8 million, and CSCS Plc with 38.1 million units worth N2.4 billion.

The alternative stock market closed the day with three price decliners and three price gainers led by IPWA Plc, which added 41 Kobo to sell at N4.56 per unit versus the previous day’s N4.15 per unit, MRS Oil Plc appreciated by 10 Kobo to N210.10 per share from N210.00 per share, and Lighthouse Financial Services Plc increased its value by 5 Kobo to 55 Kobo per unit from 50 Kobo per unit.

Conversely, FrieslandCampina Wamco Nigeria Plc lost N3.92 to quote at N132.78 per share versus N136.70 per share, UBN Property Plc dropped 20 Kobo to settle at N2.38 per unit from N2.18 per unit, and First Trust Mortgage Bank Plc declined by 1 Kobo to N1.90 per share from N1.91 per share.

Economy

Naira Rebounds 1.8% to N1,376/$ at Official Market

By Adedapo Adesanya

For the first time in a while, the value of the Nigerian Naira improved against its United States counterpart, the Dollar, in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Wednesday, March 11.

At the midweek session, it gained N25.21 or 1.8 per cent on the greenback in the official market to trade at N1,376.19/$1 compared with the previous day’s value of N1,401.40/$1.

It was also a positive outcome for the Naira in the spot market, as it appreciated against the Pound Sterling yesterday by N40.26 to close at N1,845.47/£1 versus Tuesday’s value of N1,885.73/£1, but closed flat against the Euro at N1,631.51/€1.

At the GTBank FX desk, the Nigerian currency appreciated against the Dollar yesterday by N9 to settle at N1,407/$1, in contrast to the N1,416/$1 it was exchanged a day earlier, and in the black market, it maintained stability at N1,420/$1.

The FX market pressure eased from a two-month low, as foreign reserves topped the $50 billion mark for the first time since January 2009, buoyed by a positive oil price threshold and forex inflows that could strengthen the current account balance and improve FX liquidity.

Inflows into the FX market have strengthened in recent weeks, but likewise, the US Dollar has strengthened in the international market due to the recent crisis facing the global markets involving the United States, Israel, and Iran.

As for the digital currency market, it was mixed on Wednesday amid renewed Middle East tensions, as on-chain data show persistent selling pressure and weak demand as investors grapple with conflict-driven stagflation fears and fading prospects for near-term Federal Reserve rate cuts ahead of next week’s meeting.

Solana (SOL) slumped 0.9 per cent to $85.11, Ripple (XRP) declined by 0.6 per cent to $1.38, Bitcoin (BTC) dropped 0.4 per cent to sell for $69,433.43, and Cardano (ADA) depreciated 0.2 per cent to $0.2591.

But TRON (TRX) added 1.0 per cent to sell at $0.2900, Binance Coin (BNB) gained 0.8 per cent to close at $644.54, Ethereum (ETH) appreciated by 0.5 per cent to $2,027.98, and Dogecoin (DOGE) grew by 0.2 per cent to $0.0919, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn