Economy

An In-depth Look into Best CFD Trading Platforms in South Africa by Traders Union

Recent years have witnessed a significant surge in the popularity of Contract for Difference (CFD) trading in South Africa. In light of this evolving market dynamic, Traders Union experts conducted a meticulous examination of the top CFD trading platforms catering to the South African market. Their insightful findings aim to assist novice and experienced traders in navigating through various platforms, each boasting unique offerings and services.

The experts considered numerous best CFD trading platforms in South Africa to ensure an unbiased assessment, eventually identifying a select few that demonstrated outstanding performance across all assessment criteria. A multifaceted approach, including comprehensive evaluations of regulatory compliance, asset variety, trading features, and overall user experience, underpinned the TU expert analysis.

The forthcoming sections present a detailed summary of their findings. Read and learn about the top platforms to trade CFDs in South Africa for novice and experienced traders.

Pioneering CFD Trading Platforms in South Africa

The Traders Union team, having scrutinized the market, has delineated several trading platforms. Learn about their features and tools.

RoboForex

Regulated by IFSC, RoboForex provides traders with an extensive array of 9 asset types for CFD trading, including Forex, stocks, indices, ETFs, commodities, metals, energies, and cryptocurrencies. With a low minimum deposit of $10, the platform offers multiple account types, catering to different trading styles and risk appetites. Their platform is easy to navigate, allowing traders to maximize their trading efficiency.

XM Group

XM Group stands out with its impressive regulatory portfolio, which includes ASIC and CySEC. They offer various CFDs on asset classes such as Forex, stocks, commodities, indices, and cryptocurrencies. Traders can enjoy competitive spreads, rapid execution of orders, and dedicated support for MT4 and MT5 trading platforms.

Tickmill MT4

Tickmill offers an assortment of CFDs, including Forex, stock indices, bonds, and commodities, on its MT4 platform. The platform, regulated by the FCA, CySEC, and FSA, requires a minimum deposit of $100. Key features include low spreads, high-speed order execution, and no requotes, contributing to a seamless trading experience.

IC Markets cTrader

IC Markets facilitates trading in Forex, indices, commodities, bonds, futures, and cryptocurrencies CFDs on its sophisticated cTrader platform. It boasts high-speed order execution, level II pricing, and detachable charts. Furthermore, it is regulated by ASIC, a globally recognized financial regulator.

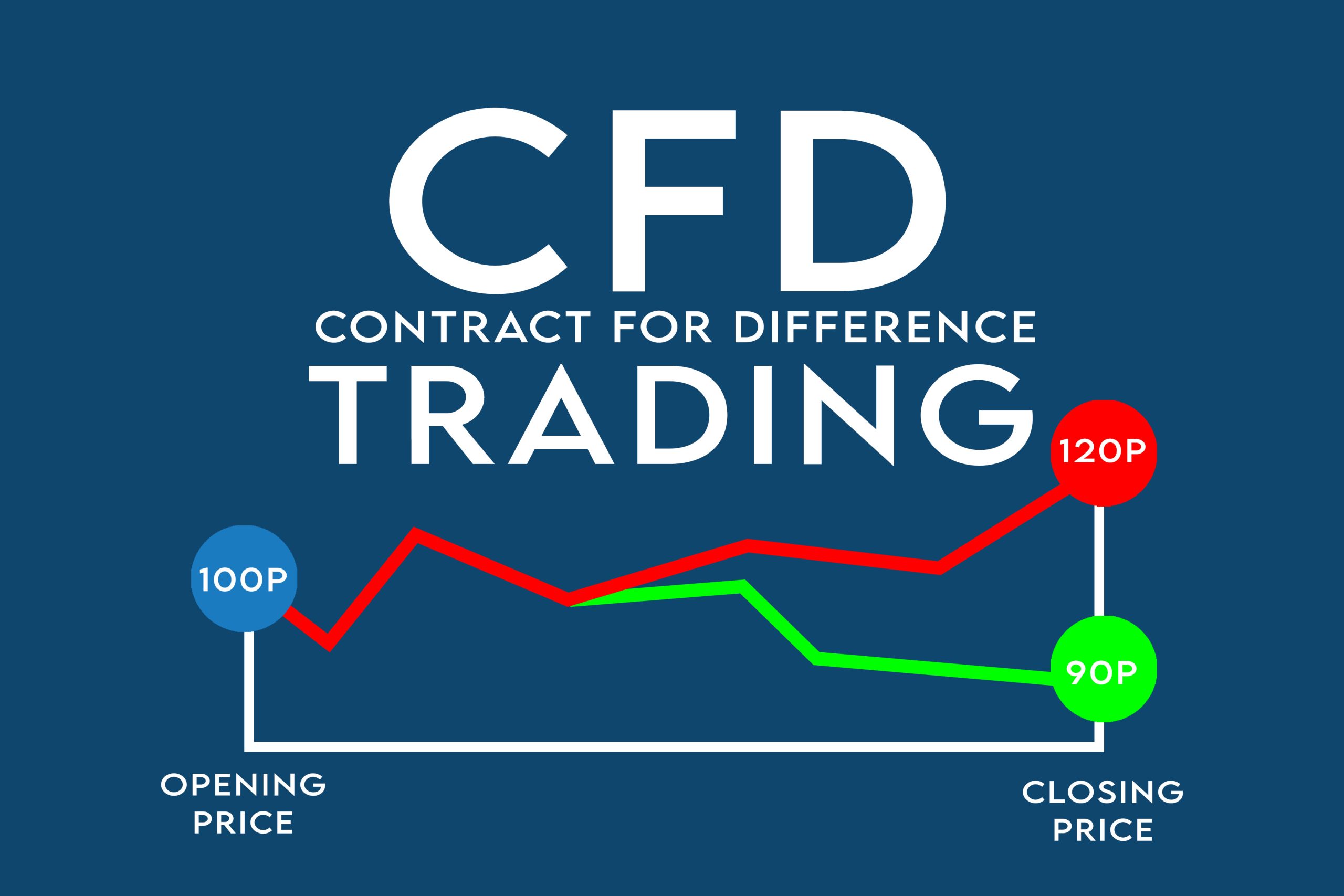

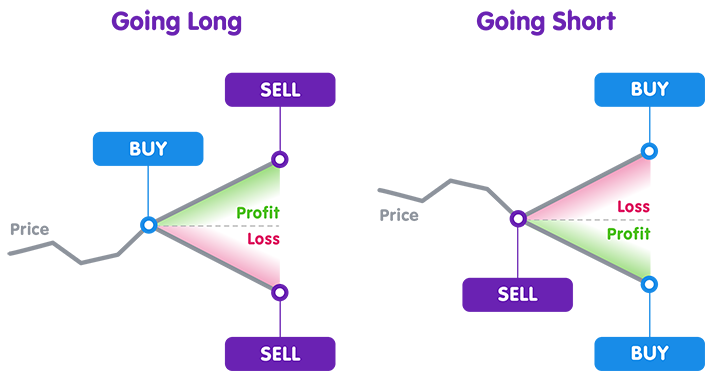

Understanding CFDs

CFDs are complex financial instruments that enable traders to speculate on the price movements of various global financial markets. In CFD trading, traders do not directly own the underlying asset. Rather, they enter into a contract with the broker to exchange the difference in the price of an asset from the time the contract is opened to when it is closed. TU team discussed key steps in CFD trading:

- Checking the regulatory status of the platform.

- See the available markets.

- Verify the availability of direct share CFDs from the broker.

- Check the features and tools of the platform.

- Check commissions and fees, including spread and withdrawal costs.

- Confirm the minimum deposit amount.

- Learn about available software.

- Check the customer support service availability via email, phone or live chat.

- Sign up to start trading CFDs.

Evaluating the Legality of CFD Trading in South Africa

CFD trading is legal in South Africa and is regulated by various entities. The Financial Sector Conduct Authority (FSCA) is South Africa’s main financial regulator, ensuring fairness and integrity in the financial markets. The Australian Securities and Investments Commission (ASIC) and Cyprus Securities and Exchange Commission (CySEC) are well-recognized global regulators that oversee Forex and CFD brokers. The UK’s Financial Conduct Authority (FCA) and Germany’s Federal Financial Supervisory Authority (BaFin) are further assurances of regulatory oversight, providing robust investor protection.

Assessing Tax Implications for CFD Traders in South Africa

Traders engaging in CFD trading are subject to South African tax laws. Income from CFD trading falls under gross income as per the Income Tax Act and must be reported to the South African Revenue Service (SARS). Capital Gains Tax (CGT) also applies to the profits earned from CFD trading. Traders Unions’ experts explain that traders must consider these tax implications when calculating their potential returns.

Identifying Ideal CFD Platforms for Beginners in South Africa

For novice traders, platforms that offer copy trading or PAMM accounts present an excellent starting point. Some of these platforms include XM Group and RoboForex. These features allow beginners to learn from experienced traders, gaining insights into successful trading strategies.

Conclusion

For a more exhaustive understanding of the CFD trading landscape in South Africa, readers are advised to visit the TU website. This rich repository hosts a plethora of detailed reviews, guides, and invaluable resources to equip traders with the knowledge they need for successful trading.

Economy

NASD Exchange in Red for Third Straight Session After 0.15% Fall

By Adedapo Adesanya

For the third straight session, the NASD Over-the-Counter (OTC) Securities Exchange closed bearish, further losing 0.15 per cent on Thursday amid weak demand for unlisted stocks.

During the session, the NASD Unlisted Security Index (NSI) declined by 5.70 points to 3,908.67 points from 3,914.37 points, and the market capitalisation lost N3.41 billion to end N2.338 trillion compared with the N2.342 trillion it ended on Wednesday.

The alternative stock exchange suffered a loss despite having more price gainers than price losers, with five for the former and four for the latter.

Okitipupa Plc lost N10.00 to close at N250.00 per unit versus midweek’s N260.00 per unit, Central Securities Clearing System (CSCS) Plc depreciated by N4.98 to N64.92 per share from N69.90 per share, Industrial and General Insurance (IGI) Plc dropped 4 Kobo to sell at 50 Kobo per unit compared with the previous day’s 54 Kobo per unit, and Acorn Petroleum Plc moderated by 1 Kobo to N1.32 per share from N1.33 per share.

Conversely, 11 Plc gained N13.65 to quote at N276.55 per unit versus the preceding session’s N263.00 per unit, FrieslandCampina Wamco Nigeria Plc appreciated by N6.10 to N84.15 per share from N78.05 per share, Food Concepts Plc expanded by 32 Kobo to N3.60 per unit from N3.28 per unit, Geo-Fluids Plc improved by 30 Kobo to N3.60 per share from N3.30 per share, and First Trust Mortgage Bank Plc increased by 10 Kobo to N1.09 per unit from 99 Kobo per unit.

Yesterday, the volume of transactions surged 2,797.1 per cent to 45.8 million units from 1.6 million units, the value of transactions jumped 315.2 per cent to N208.2 million from N50.1 million, and the number of deals soared 18.2 per cent to 39 deals from 33 deals.

At the close of business, CSCS Plc remained the most active stock by value (year-to-date) with 32.6 million units worth N1.9 billion, followed by Geo-Fluids Plc with 117.4 million units valued at N463.1 million, and Resourcery Plc with 1.05 billion units exchanged for N408.6 million.

Resourcery Plc ended the session as the most traded stock by volume (year-to-date) with 1.05 billion units sold for N408.6 million, trailed by Geo-Fluids Plc with 117.4 million exchanged for N463.1 million, and CSCS Plc with 32.6 million units traded for N1.9 billion.

Economy

Bulls Reaffirm Control of Nigeria’s Stock Exchange With 1.39% Surge

By Dipo Olowookere

Sell-offs in energy stocks could not bring down Nigeria’s stock exchange on Thursday, as the gains recorded by the others sustained the upward momentum.

Yesterday, the Nigerian Exchange (NGX) Limited further appreciated by 1.39 per cent on the back of a strong appetite for domestic equities, which are gaining traction among investors.

The banking index grew by 2.63 per cent, the consumer goods sector appreciated by 054 per cent, the insurance counter improved by 0.50 per cent, and the industrial goods space rose by 0.29 per cent, while the energy industry fell by 0.11 per cent.

When the bourse closed for the day, the All-Share Index (ASI) pointed northwards by 2,645.61 points to settle at 193,073.57 points compared with the previous day’s 190,427.96 points, and the market capitalisation soared by N1.698 trillion to N123.934 trillion from N122.236 trillion.

The trio of Deap Capital, Okomu Oil, and Fortis Global Insurance appreciated by 10.00 per cent each to N6.93, N1,459.70, and 55 Kobo apiece, while the duo of Infinity Trust Insurance and Zichis gained 9.96 per cent each to settle at N14.35, and N15.79, respectively.

On the flip side, the quartet of Tripple G, Multiverse, Secure Electronic Technology, and McNichols lost 10.00 per cent each to quote at N5.40, N25.20, N1.80, and N8.28, respectively, while Meyer declined by 9.80 per cent to N20.70.

Business Post reports that there were 52 appreciating equities and 26 depreciating equities on Thursday, showing a positive market breadth index and strong investor sentiment.

The busiest stock yesterday was Japaul with 80.1 million units valued at N293.3 million, Secure Electronic Technology sold 71.8 million units worth N136.5 million, Mutual Benefits transacted 58.7 million units for N277.6 million, Zenith Bank exchanged 53.2 million units valued at N4.5 billion, and GTCO traded 52.6 million units worth N6.2 billion.

Unlike the preceding session, the activity chart was in red after market participants transacted 898.5 million shares for N38.5 billion in 61,953 deals compared with the 3.7 billion shares worth N61.9 billion traded in 68,693 deals at midweek, implying a decline in the trading volume, value, and number of deals by 75.72 per cent, 37.80 per cent, and 9.81 per cent apiece.

Economy

Naira Fall 0.24% to N1,341/$1 at Official FX Window

By Adedapo Adesanya

The Naira depreciated further against the Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Thursday, February 19, by N3.24 or 0.24 per cent to N1,341.35/$1 from the N1,338.11/$1 it was traded a day earlier.

However, it improved its value against the Pound Sterling in the official market during the session by N11.16 to sell for N1,805.86/£1 compared with the previous day’s N1,817.02/£1, and gained N7.83 against the Euro to close at N1,577.29/€1 versus Wednesday’s closing price of N1,585.12/€1.

At the GTBank forex counter, the Naira lost N2 against the greenback to settle at N1,349/$1 compared with the N1,347/$1 it was exchanged at midweek, and at the black market, the exchange rate remained unchanged at N1,370/$1.

The performance of the domestic currency in the spot market was weak yesterday amid prevailing dynamics of supply and demand, as the Central Bank of Nigeria (CBN) maintains its efforts to stabilise the foreign exchange market. The exchange rate remained within the expected range, lifted by strong forex inflows and central bank dollar sales to Bureaux de Change (BDC) operators.

Meanwhile, the cryptocurrency market remained bearish, as there was continued caution in coins amid shaky interest in the digital assets.

On the policy front, there were tentative signs of progress on the digital asset market structure bill. The White House hosted talks between crypto industry representatives and bankers, which yielded incremental movement, though no compromise has yet emerged.

Ripple (XRP) declined by 1.7 per cent to $1.39, Litecoin (LTC) went down by 1.3 per cent to $52.46, Cardano (ADA) dropped 0.8 per cent to trade at $0.2715, Dogecoin (DOGE) retreated by 0.7 per cent to $0.0978, and Ethereum (ETH) contracted by 0.2 per cent to $1,943.30.

On the flip side, Solana (SOL) appreciated by 0.8 per cent to $82.12, Bitcoin improved its value by 0.7 per cent to $66,854.86, and Binance Coin (BNB) chalked up 0.1 per cent to sell for $605.58, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closed flat at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn