Economy

ANALYSIS: The Problem With International Breweries N165bn Rights Issue

By Dipo Olowookere

Not too long ago, the board of International Breweries announced that it plans to raise about N165 billion from its existing shareholders through rights issue.

According to board, proceeds from the exercise would be wholly used to refinance part of the N245 billion debts the brewery giant incurred from five local and foreign lending institutions; Citibank N.A, Zenith Bank, Standard Chartered Bank Nigeria, Stanbic IBTC and Rand Merchant Bank Nigeria.

Analysts at Meristem Research said if this exercise is 100 percent successful, the company’s debt burden should significantly reduce by 66 percent to about N81.90 billion, with the finance costs hovering between N5.5 billion and N6 billion in 2020.

But it noted that while this should be good news to shareholders of the firm, the bitter truth is that International Breweries has been operating at a loss since 2017 and that the N165 billion rights issue may have little impact on the overall performance of the company without a strategy to effectively cut costs.

“We note that the financing decision does not solve the operating problems of the company which is responsible for the poor margins,” the investment firm said in its report seen by Business Post.

It further said, “Costs have been high and hampering profits and if this persists, the company’s performance will not improve. Therefore, we believe that International Breweries’ current operating profile negatively affects its ability to deliver value to shareholders.”

“In addition, the potential dilution in earnings will erode the near-term benefits. We also expect that the company will require additional capital to boost its working capital needs, a measure that will not materialise with this issue.

“Hence, we expect it to raise debt in the near term or equities with the potential for more earnings dilution. We therefore do not expect the benefits of this financing decision to improve margins in the near-term,” the report also stated.

Giving an insight on the brewery giant’s performance, Meristem Research said before it became a subsidiary of AB InBev, the largest beer producer in the world, the brewer operated an average cost to sales of 55.12 percent, second to Nigerian Breweries at 52.88 percent, the cost leader in the industry.

However, since this deal was finalised, the firm has made consecutive losses, which worsened to N16.45 billion in 9M:2019, with cost to sales trending northwards at 60.75 percent in 2018FY, 64.42 percent in Q1:2019, reaching its highest point of 68.00 percent in 9M:2019 due to a spike in production costs- raw material costs and production staff salaries shot up by 27.99 percent and 45.22 percent respectively.

In addition, revenue has continued to decline despite initially rising after the completion of its new plant in Sagamu, Ogun State, which ranks as the second largest in Africa.

The turnover first grew YoY by 32.16 percent and 23.54 percent in Q1:2019 and Q2:2019 respectively, but went down by 5.32 percent to N28.63 billion in Q3:2019 from N30.24 billion in Q3:2018 as increased excise duties and competitive pressures constrained topline growth. Also, the firm’s depreciation charges rose in 9M:2019 by 31.54 percent YoY, contracting the gross margin to 32.00 percent (vs. 38.67 percent in 9M:2018).

It was noted that high operating costs has been another worrisome trend post-merger, a major factor for the thinning operating margin which turned negative in 9M:2019 at -11.25 percent, saying the firm has been expending higher costs on advertising (+36.10 percent in 9M:2019) as well as transportation and distribution expenses (up by 36.53 percent during the same period) in order to stay competitive.

“Apart from the high production and overhead costs pressuring margins, finance costs, which increased by 45.81 percent to N13.14 billion in 9M:2019, has been a drag on the company’s performance.

“Benefits can only accrue to shareholders if the company maintains a lid on costs, which seems to be slipping out of hand,” the report stated.

International Breweries, which controls 20.35 percent of the beer sector in Nigeria as at FY2018, is raising N165 billion by selling 18,266,206,614 units of shares on the basis of 17 new shares for every eight held by shareholders whose names were on the register of the company as at November 6, 2019 at N9.00 each.

Meristem Research, giving its verdict on the exercise based on the above issues it highlighted, declared that, “We do not recommend that shareholders take up their rights.”

Economy

Nigeria Repays $3.4bn COVID-19 Loan to Exit IMF Debtor List

By Adedapo Adesanya

The International Monetary Fund (IMF) has removed Nigeria from its Total IMF Credit Outstanding list after repaying the $3.4 billion pandemic loan.

The global lender provided funding support to some countries after the COVID-19 pandemic in 2020, which crumbled the global economic and made some nations struggling to survive.

Nigeria was among the countries that relied on the IMF for funding support and it has repaid the loan, prompting the lender to remove its name from the debtors’ list.

The journey towards clearing this debt began in earnest in 2023, when the nation’s IMF debt stood at $1.61 billion, reaching $472 million by January 2025.

Commenting on the development, the Senior Special Assistant to the President on Digital Engagement and Strategy, Mr O’tega Ogra, described the clearance as a “strategic reset” for the nation’s financial policy.

He emphasized that this achievement is a reflection of the administration’s focus on fiscal discipline, long-term sustainability, and economic resilience.

“This milestone signals a new chapter for Nigeria, one marked by clarity, capacity, and fiscal responsibility.

“We are no longer defined by aid dependence but by our capacity to stand tall and manage our financial future on our terms,” Mr Ogra stated.

While Nigeria’s exit from the IMF’s debtor list is a symbolic moment of progress, Mr Ogra made it clear that the country would continue to engage with the IMF and other international partners, but now on a more proactive, strategic basis.

“Global partnerships remain essential, but we approach them from a place of strength, not dependency,” he added.

Economy

Nigeria Woos Norway on Debt Restructuring, Tax Transparency, Climate Finance

By Adedapo Adesanya

Nigeria has called for deeper collaboration with Norway in the areas of debt restructuring, tax transparency, and climate finance, as part of its broader strategy to unlock sustainable development opportunities through global partnerships.

According to a statement, this call was made by the Minister of State for Finance, Mrs Doris Uzoka-Anite, during a high-level bilateral meeting with the Norwegian Deputy Minister of International Development, Ms Stine Renate Håheim, held on the sidelines of the recent 2025 United Nations Meetings in New York.

Mrs Uzoka-Anite emphasized that Nigeria is prioritizing partnerships that can accelerate its economic reform agenda and climate resilience goals.

“We are actively seeking partners who understand the urgency of our development needs, especially in areas such as climate finance, debt restructuring, and tax cooperation,” she said.

She spoke on Nigeria’s interest in NORAD’s Energy for Development platform, which supports sustainable energy solutions across developing economies.

The Minister noted that Nigeria is eager to tap into the initiative to fast-track energy access and reduce emissions.

“Our energy transition plan aligns with global climate goals, and we believe collaboration under NORAD’s platform will be instrumental in delivering clean, affordable energy to millions of Nigerians,” she added.

The meeting also spotlighted the need for greater transparency in international tax cooperation frameworks.

“Improving tax transparency is critical to domestic resource mobilization. We welcome Norway’s support in helping us strengthen systems that fight illicit financial flows,” Mrs Uzoka-Anite stressed.

Ms Håheim acknowledged Nigeria’s regional importance and expressed readiness to explore areas of mutual interest, particularly in promoting inclusive growth and green development.

The statement added that the bilateral engagement reflects Nigeria’s diplomatic outreach at the 2025 UN Meetings, reinforcing its drive to forge strategic alliances that enhance governance, unlock financing for development, and boost resilience in the face of current global economic challenges.

Economy

Usoro’s Maritime Law Book to Drive Judicial, Economic Reforms

By Modupe Gbadeyanka

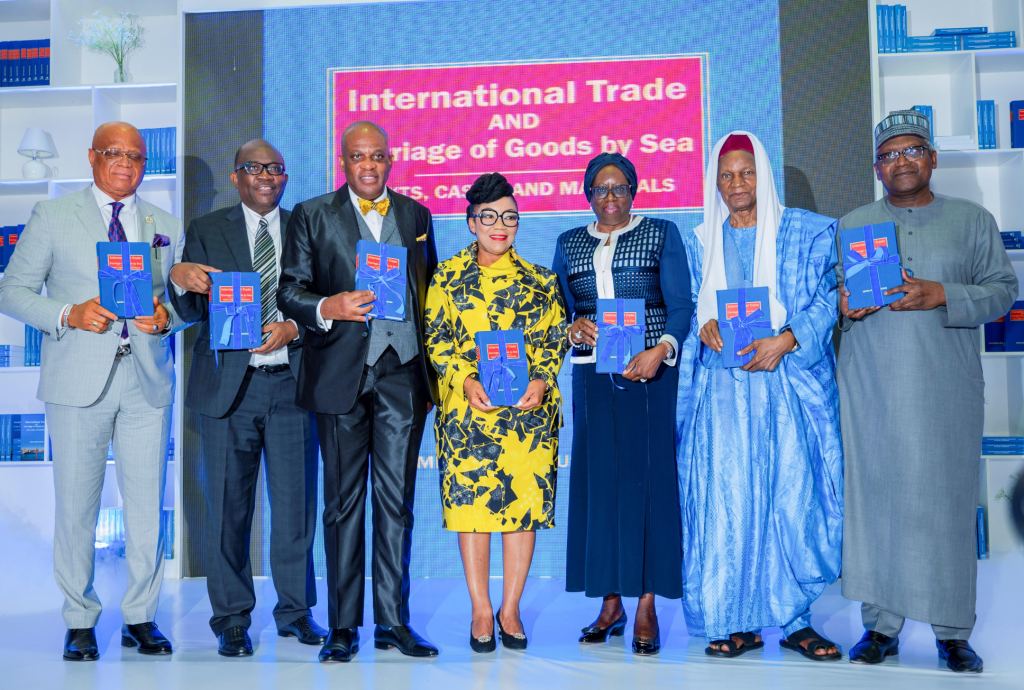

Stakeholders have projected that the maritime law book authored by Mrs Mfon Ekong Usoro will drive judicial and economic reforms in Nigeria.

At the presentation of the book titled International Trade and Carriage of Goods by Sea: Text, Cases, and Materials in Lagos on Tuesday, the piece was described as a timely intervention to strengthen the country’s judicial processes and economic development, particularly in the area of international trade.

The book, which integrates both local and international legal standards, aims to serve as a reference point for legal professionals, regulators, financial institutions and participants in the trade and shipping industries.

The Chief Justice of Nigeria (CJN), Mrs Kudirat Kekere-Ekun, who wrote the forward, said the publication would serve as a foundational text that would enhance the judiciary’s capacity to resolve disputes related to trade and shipping efficiently.

She said the book presents a practical approach to interpreting legal issues around carriage contracts, cargo liabilities and dispute resolution under both local and international frameworks.

“By simplifying complex concepts through case studies, diagrams and statutory references, the book will strengthen the quality of judicial decisions and enhance legal education in this essential sector.

“This text is exactly what our legal system needs. It commands respect for local precedents while drawing on legal judgments from other jurisdictions, guiding our courts to a uniform approach and giving our practitioners the confidence to negotiate, mitigate and arbitrate across borders,” she said.

On his part, the president of the Dangote Group, Mr Aliko Dangote, described the book as essential for businesses operating in global trade.

“This is the kind of resource that improves certainty in commercial transactions and boosts confidence among business operators,” he stated, praising the author’s contribution to trade and legal practice in Nigeria.

The book reviewer, Mr Adedolapo Akinrele (SAN), described the text as a unique, structured resource, citing over 200 cases, extensive chapters and global conventions to illustrate key concepts in maritime and international trade law.

He emphasised its practicality and relevance to both seasoned professionals and new entrants in the legal and commercial sectors.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN