Economy

API Architecture: The Invisible Engine Powering Modern Banking

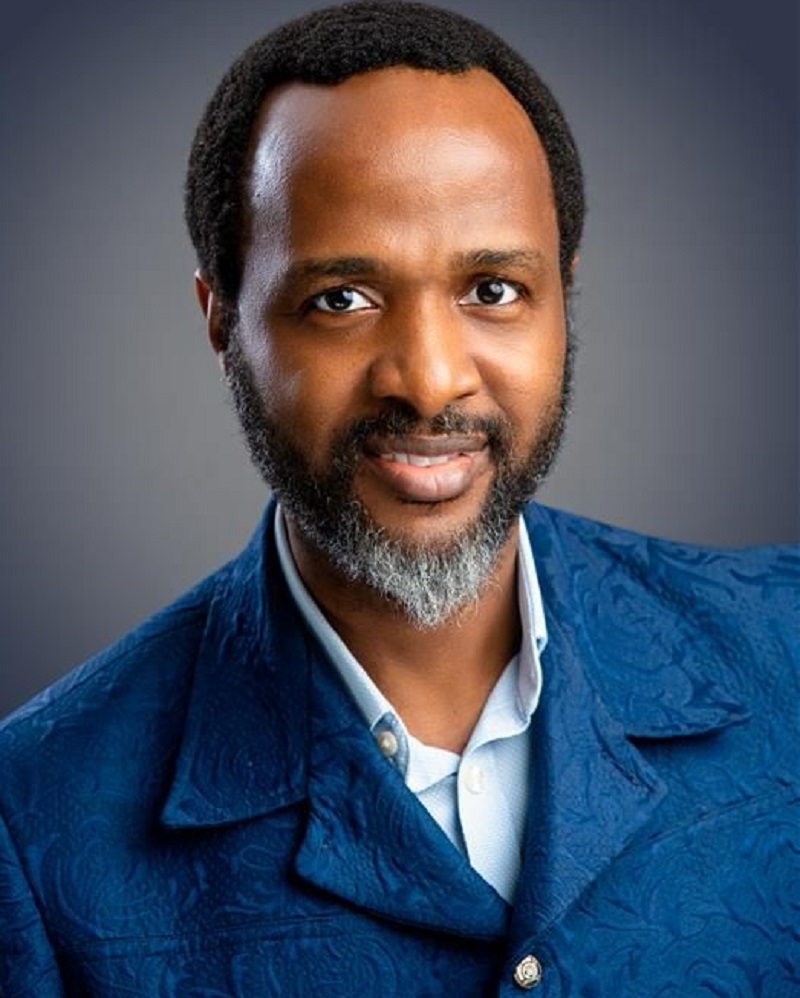

By Echezona Agubata

Banking has evolved far beyond the days of paper ledgers and long queues. Today, it’s a dynamic force driving Nigeria’s economy, responding to customers in real time, and powering digital innovation. The unsung hero behind this transformation is the Application Programming Interface (API)—a tool that lets bank systems communicate seamlessly with each other and external partners.

In Nigeria’s fast-growing digital finance landscape, APIs are the invisible engine enabling banks to offer instant balance checks, process payments at retail checkouts, or verify identities for loan approvals. The secret to their success? A robust API architecture, the structured framework that makes banking secure, scalable, and innovative.

Picture API architecture as a bridge connecting islands of financial services. It allows banks to share data securely. In Nigeria, where digital banking is literarily booming, APIs let banks like Coronation Merchant Bank expand services without rebuilding infrastructure. This flexibility fuels innovation, enabling tailored solutions for everyone from small businesses to large corporations.

The Central Bank of Nigeria (CBN) along with Industry players ensure this ecosystem is secure and trustworthy. Its regulations mandate standards like OAuth 2.0 for authentication, tokenization to protect data, and encrypted channels to safeguard transactions. Real-time monitoring and customer consent protocols further build trust, ensuring data is shared only with permission. These rules aren’t just technical or ethical—they’re the backbone of Nigeria’s open banking system, fostering collaboration and innovation.

How do APIs work? Imagine a well-orchestrated machine. The API acts as

● A Gateway: the gatekeeper to a product. It authenticates requests and ensures only authorized people are granted access to the product. It also helps limit the number of requests that can be made for the product at any given time. For instance, when a bank’s mobile app requests a customer’s transaction history, the transaction history API (as a gateway) verifies access (both customer and mobile app) before treating the transaction history request.

- A Guide: the protocol or security who ensures that even authenticated users are only allowed to access products and data that they are authorized to have

- A Funnell: the pipe that ensures that authenticated users access products and data from known locations/sources to known destinations

- An Agent: the agent that ensures that applications regardless of the service offering have access to data/products in the same way as every other application. This gives unified experience across respective platforms that are consuming the service/data offered by the API

Here’s a simplified view of the flow:

Explanation: An app or corporate system sends a request to the API gateway, which authenticates and routes it. The orchestration layer processes it using endpoints, pulling data from the core system via middleware.

The orchestration layer (behind the gateway) breaks services—like catalog, shopping cart, or ordering—into modular endpoints, like building blocks online shops can share securely. The modular endpoints connect these APIs to core systems, translating the requests into formats that can be processed by the core system. Companies also provide developer portals with clear documentation and sandbox environments, simplifying integration for partners.

This architecture can be built for scale. Banks process millions of transactions daily using load balancing to scale out resources, and distribute traffic in a dynamic fashion. This architecture could incorporate the use of in-memory databases and Queueing technologies to cache frequently used data for swifter processing. More so, this introduces rate limiting features which help isolate any problem areas without affecting the entire service as a whole.

Challenges abound. One of such is the existence of legacy systems as many banks and organizations often rely on decades-old mainframes (core systems), thus requiring a middleware solution to bridge old and new systems—a complex but critical step. Another recent challenge is the need to enforce data privacy expectations, this has made encryption and data masking a necessary action. Encryption in itself comes with its own attendant side-effects especially where applied on data without proper service governance. It can slow performance, so banks and organizations use caching and optimized data flows to balance speed and security. Compliance with CBN guidelines and Nigeria’s data privacy laws demands robust

consent management and audit trails. Versioning APIs (e.g., /v1/payments) prevents disruptions when systems evolve.

Real-world examples highlight APIs’ impact. Coronation Merchant Bank built the Dangote ISOP Collection API to streamline payments for Dangote’s distributors. These payments were previously riddled with slow reconciliations and delayed cash flow. The API integrates payments directly into Dangote’s ERP system and thereby automating the process, reducing errors, and strengthening business ties. Another bank used a KYC API to verify customer identities for loan applications, cutting onboarding time while meeting CBN standards. A third example involves a major Nigerian bank’s payment API, which enables instant corporate transfers for retailers, ensuring funds clear in seconds during peak sales.

APIs are also driving open finance. The CBN’s 2023 guidelines expand APIs to cover credit, investment, and insurance data, enabling embedded finance—loans at retail checkouts or savings tools linked to salary accounts. This makes banking invisible yet ever-present, blending into daily life.

The future is exciting. Banks are adopting API-first design, prioritizing APIs as core interfaces for faster innovation. AI-driven APIs are emerging, enabling fraud detection or tailored loan offers. Blockchain-based APIs promise secure cross-border payments. Event-driven architectures, using tools like Kafka, process real-time events like transaction alerts, boosting efficiency.

At Coronation Merchant Bank, our APIs are business enablers. Our custom solutions, like the Dangote integration, solve real-world problems, while our investment banking desk advises on capital raising and partnerships, helping clients stay competitive. APIs lower barriers, drive growth, and deliver seamless experiences for customers.

Nigeria’s financial future isn’t about who holds the most assets—it’s about who builds the strongest connections between data, money, and people. API architecture is the invisible engine powering that future, creating a connected, inclusive banking ecosystem.

Economy

Nigeria’s Inflation Eases Further to 15.1% in January 2026

By Adedapo Adesanya

Nigeria’s headline inflation rate eased further to 15.10 per cent in January 2026, down from 15.15 per cent in December 2025, continuing the moderation that started in the latter months of 2025.

According to the National Bureau of Statistics (NBS), Consumer Price Index (CPI) declined to 127.4 points in January 2026, reflecting a 3.8-point decrease from the preceding month of December 2025, which came in as 131.2 points.

The data, which is the first of the year, beat analysts’ expectations, which had expected an 18 per cent growth. Instead, the January 2026 print showed a decrease of 0.05 per cent compared to the December 2025 Headline inflation rate.

On a year-on-year basis, the inflation rate was 12.51 per cent lower than the rate recorded in January 2025 (27.61 per cent). This shows that the Headline inflation rate (year-on-year basis) decreased in January 2026 compared to the same month in the preceding year.

On a month-on-month basis, the Headline inflation rate in January 2026 was -2.88 per cent, which was 3.42 per cent lower than the rate recorded in December 2025 (0.54 per cent). This means that in the review month, the rate of increase in the average price level was lower than the rate of increase in the average price level in December last year.

The percentage change in the average CPI for the twelve months ending January 2026 over the average for the previous twelve-month period was 21.97 per cent, showing a 4.37 per cent increase compared to 17.59 per cent recorded in January 2025.

Nigeria’s food inflation rate in January 2026 was 8.89 per cent on a year-on-year basis. This was 20.73 percentage points lower compared to the rate recorded in January 2025 (29.63 per cent).

On a month-on-month basis, the Food inflation rate in January 2026 was -6.02 per cent, down by 5.66 per cent compared to December 2025 (-0.36 per cent).

The decline can be attributed to the rate of decrease in the average prices of water yams, eggs, green peas, groundnut oil, soya beans, palm oil, maize (corn) grains, guinea corn, beans, beef meat, melon (egusi) unshelled, cassava tuber, and cow peas (white).

The NBS data showed that the average annual rate of food inflation for the twelve months ending January 2026 over the previous twelve-month average was 20.29 per cent, which was 18.18 percentage points lower compared with the average annual rate of change recorded in January 2025 (38.47 per cent).

Economy

Terrahaptix Secures Additional $22m from Investors, Valuation Hits $100m

By Adedapo Adesanya

Nigerian defence technology startup, Terra Industries, has extended its funding round to $34 million after securing an additional $22 million from investors, making it a $100 million company.

The new capital round was led by venture firm Lux Capital, with injections from the chief executive officer of Lagos-based unicorn Flutterwave, Mr Gbenga Agboola, as well as angel investors such as American actor Jared Leto and Jordan Nel.

The company said in a statement on Monday that the round was completed in under two weeks.

This comes weeks after it raised $11.75 million in January. That funding round was led by 8VC founded by the co-founder of Palantir Technologies Inc., Mr Joe Lonsdale. Other investors included Valor Equity Partners, Lux Capital, SV Angel, Leblon Capital GmbH, Silent Ventures LLC, Nova Global and angel investors, including Mr Meyer Malka — the managing partner of Ribbit Capital.

Some of the investors in the new round included 8VC, Nova Global, Silent Ventures, Belief Capital, Tofino Capital, and Resilience17 Capital, founded by Flutterwave CEO.

Terrahaptix, founded by Mr Nathan Nwachukwu and Mr Maxwell Maduka, will use the new funding to expand Terra’s manufacturing capacity as it expands into cross-border security and counter-terrorism.

The extension also comes amid growing international expansion. Earlier this month, Terra announced a partnership with Saudi industrial giant AIC Steel to launch a manufacturing hub in Saudi Arabia focused on producing infrastructure security systems.

In the coming weeks, the company also plans to unveil a mega factory, an indication of the company’s growth and importance, particularly as the need for security has risen in recent years, as groups such as Islamic State and al-Qaeda are gaining ground in Africa, converging along a swathe of territory that stretches from Mali to Nigeria.

According to Mr Nwachuku, the initial $11.75 million raise created significant momentum for the company, enabling it to close the additional $22 million in just under two weeks.

He added that beyond capital, the investors were selected for their experience building similar hard-tech and defence-focused companies.

Economy

Analysts Predict 18% Inflation Rate for January 2026

By Adedapo Adesanya

Analysts have projected that Nigeria’s headline inflation could rise to about 18 per cent in January, defying the downward trend recorded in 2025.

The forecast comes ahead of the first Consumer Price Index (CPI) data release by the National Bureau of Statistics (NBS) of 2026 due on Monday.

Headline inflation closed December at 15.15 per cent year-on-year, while the annual average eased sharply to 23.33 per cent from 33.18 per cent in 2024.

According to analysts at Cowry Research, the recent CPI normalisation has created a lower base for January comparisons, making a temporary uptick in headline inflation likely in January and possibly February. It projects inflation to trend within the 17.8 per cent to 18.7 per cent range in 2026, driven by election-related spending pressures and fading base effects, even as structural reforms support a medium-term disinflation path.

Similarly, analysts at Quest Merchant Bank said the lower base effect could push January inflation to around 18 per cent to 19 per cent. They, however, expect inflation to resume a broadly disinflationary trajectory over the course of the year, supported by softer energy prices, stable exchange rate conditions and easing food costs.

Last year’s deceleration was driven largely by base effects after the stats office normalised its CPI computation methodology. Unlike previous rebasing exercises that used a single month as the base period, the agency calculated the base using the average of all months in 2024. The rebasing also involved reweighting several categories and expanding the inflation basket to 934 items from 740.

In December alone, the NBS published two separate inflation figures for December after the CPI methodology tweaking caused the headline rate to more than double.

Nigeria’s inflation data are closely monitored by the Central Bank of Nigeria (CBN) as it transitions toward an inflation-targeting monetary policy framework.

The CBN has already factored in the CPI rebasing and related computational issues in its three-year inflation forecast.

The apex bank is targeting a slowdown in inflation to around 13 per cent by next year, despite current price pressures and statistical adjustments.

The Monetary Policy Committee (MPC) will meet next week, and today’s inflation report will form the basis for whether there will be a cut or hold in the interest rates.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn