Economy

Crude Oil Nears $95 Per Barrel as Supply Market Tightens

By Adedapo Adesanya

Crude oil moved closer to $95 per barrel on Monday as expectations of a supply deficit stemming from extended output cuts by Saudi Arabia and Russia overshadowed concerns about demand.

Data obtained from the market yesterday showed that Brent crude appreciated by 76 cents to sell at $94.70 a barrel, while the United States West Texas Intermediate crude futures rose by 71 cents to $91.48 per barrel.

On Friday, oil had its third consecutive week of weekly gains, lifted by the growing imbalance between demand and supply and by China’s latest industrial output report, which showed faster-than-expected growth in August.

Saudi Arabia and Russia this month extended a combined 1.3 million barrels per day of supply cuts to the end of the year.

Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, on Monday defended cuts by the Organisation of the Petroleum Exporting Countries and its allies (OPEC+) to oil market supply, saying international energy markets need light-handed regulation to limit volatility.

He also warned of uncertainty about Chinese demand, European growth, and central banks’ action to tackle inflation.

Speaking at the World Petroleum Congress in Calgary, Canada, he said the Chinese situation “is not bad yet.”

One of China’s latest policy moves to jumpstart the economy has also made market participants and analysts more bullish on oil. Last week, it cut the reserve ratio for banks for a second time this year in a move to increase liquidity in the system.

Despite this, the country remains a key risk because of its sluggish post-pandemic economic recovery, though its oil imports have remained robust.

The markets have started setting their eyes on $100 oil, with Citibank on Monday predicting that Brent prices could exceed $100 a barrel this year.

Also, Chevron Chief Executive Mike Wirth said in a Bloomberg News interview he thinks oil will cross $100 per barrel.

Meanwhile, analysts warn that Saudi Arabia and Russia’s output cuts could lead to a 2 million barrels per day deficit in the fourth quarter, and a subsequent drawdown in inventories could leave the market exposed to further price spikes in 2024.

Falling global inventories amid a tightening market with the OPEC+ and Saudi production cuts have supported oil prices in recent weeks.

The markets will also be looking at central banks this week, including an interest rate decision from the US Federal Reserve and the Bank of England.

Economy

Afriland Properties, Geo-Fluids Shrink OTC Securities Exchange by 0.06%

By Adedapo Adesanya

The duo of Afriland Properties Plc and Geo-Fluids Plc crashed the NASD Over-the-Counter (OTC) Securities Exchange by a marginal 0.06 per cent on Wednesday, December 11 due to profit-taking activities.

The OTC securities exchange experienced a downfall at midweek despite UBN Property Plc posting a price appreciation of 17 Kobo to close at N1.96 per share, in contrast to Tuesday’s closing price of N1.79.

Business Post reports that Afriland Properties Plc slid by N1.14 to finish at N15.80 per unit versus the preceding day’s N16.94 per unit, and Geo-Fluids Plc declined by 1 Kobo to trade at N3.92 per share compared with the N3.93 it ended a day earlier.

At the close of transactions, the market capitalisation of the bourse, which measures the total value of securities on the platform, shrank by N650 million to finish at N1.055 trillion compared with the previous day’s N1.056 trillion and the NASD Unlisted Security Index (NSI) went down by 1.86 points to wrap the session at 3,012.50 points compared with 3,014.36 points recorded in the previous session.

The alternative stock market was busy yesterday as the volume of securities traded by investors soared by 146.9 per cent to 5.9 million units from 2.4 million units, as the value of shares transacted by the market participants jumped by 360.9 per cent to N22.5 million from N4.9 million, and the number of deals increased by 50 per cent to 21 deals from 14 deals.

When the bourse closed for the day, Geo-Fluids Plc remained the most active stock by volume (year-to-date) with 1.7 billion units valued at N3.9 billion, followed by Okitipupa Plc with 752.2 million units worth N7.8 billion, and Afriland Properties Plc 297.5 million units sold for N5.3 million.

Also, Aradel Holdings Plc, which is now listed on the Nigerian Exchange (NGX) Limited after its exit from NASD, remained the most active stock by value (year-to-date) with 108.7 million units sold for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.5 million units worth N5.3 billion.

Economy

Naira Weakens to N1,547/$1 at Official Market, N1,670/$1 at Black Market

By Adedapo Adesanya

The euphoria around the recent appreciation of the Naira eased on Wednesday, December 11 after its value shrank against the US Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N5.23 or 0.3 per cent to N1,547.50/$1 from the N1,542.27/$1 it was valued on Tuesday.

It was observed that spectators’ activities may have triggered the weakening of the local currency in the official market at midweek as they tried to fight back and ensure the value of funds in foreign currencies strengthened.

The domestic currency was regaining its footing after the Central Bank of Nigeria (CBN) launched an Electronic Foreign Exchange Matching System (EFEMS) platform to tackle speculation and improve transparency in Nigeria’s FX market.

At midweek, the Nigerian currency depreciated against the Pound Sterling by N3.56 to close at N1,958.68/£1 compared with the preceding day’s N1,955.12/£1 and against the Euro, it slumped by 34 Kobo to trade at N1,612.66/€1, in contrast to the previous session’s N1,613.00/€1.

As for the black market segment, the Naira lost N45 against the American currency during the session to quote at N1,670/$1 compared with the N1,625/$1 it was traded a day earlier.

A look at the cryptocurrency market showed a recovery following profit-taking as the US Consumer Price Index report matched economist forecasts.

The news was enough to convince traders that the Federal Reserve is certain to trim its benchmark fed funds rate another 25 basis points at its meeting next week.

The move also saw Bitcoin (BTC), the most valued coin, return to the $100,000 mark as it added a 2.9 per cent gain and sold for $100,566.12.

The biggest gainer was Cardano (ADA), which jumped by 15.00 per cent to trade at $1.16, as Litecoin (LTC) appreciated by 10.4 per cent to sell for $121.76, and Ethereum (ETH) surged by 7.0 per cent to $3,929.30, while Dogecoin (DOGE) recorded a 6.7 per cent growth to finish at $0.4181.

Further, Binance Coin (BNB) went up by 5.2 per cent to $716.72, Solana (SOL) expanded by 4.6 per cent to $229.77, and Ripple (XRP) increased by 4.2 per cent to $2.43, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closed flat at $1.00 apiece.

Economy

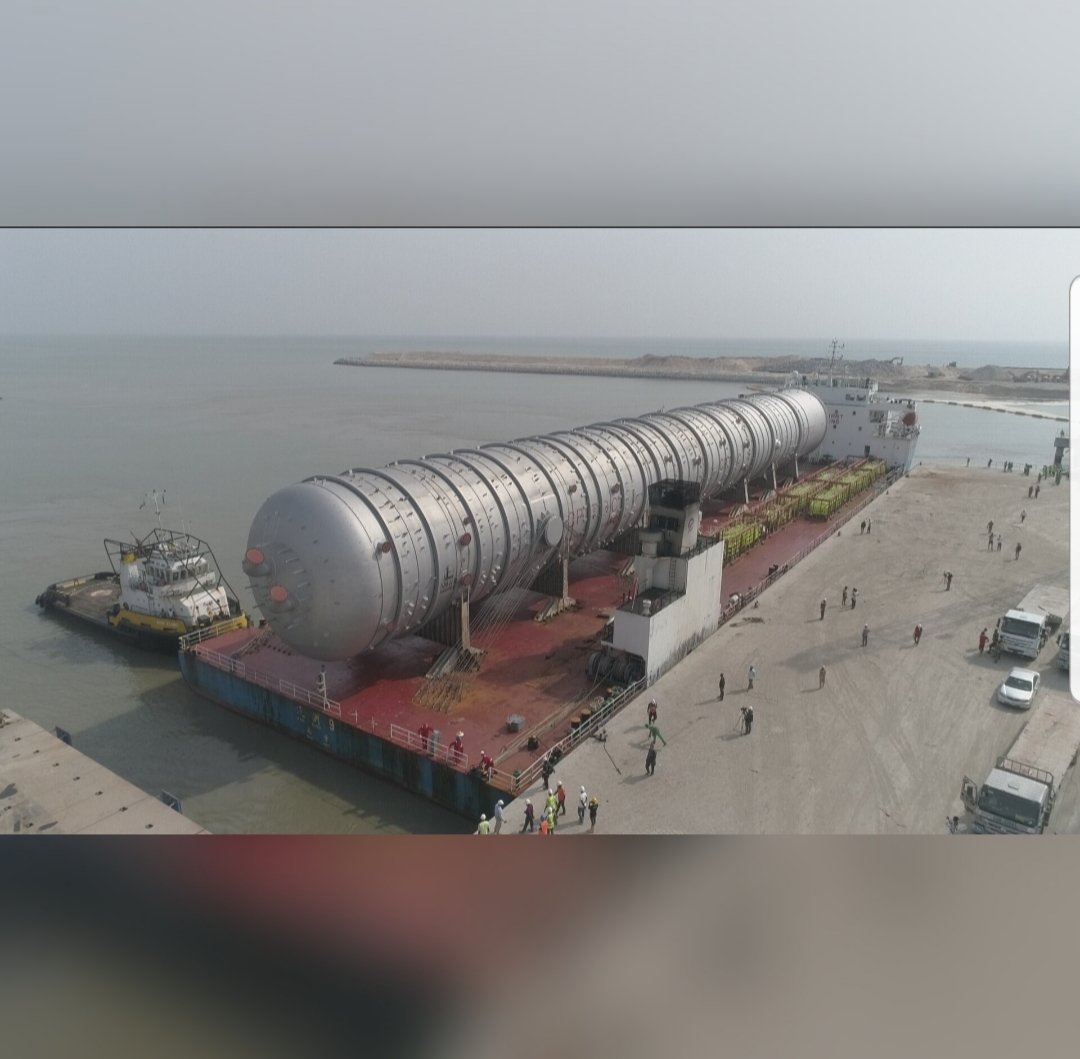

Dangote Refinery Makes First PMS Exports to Cameroon

By Aduragbemi Omiyale

The Dangote Refinery located in the Lekki area of Lagos State has made its first export of premium motor spirit (PMS) just three months after it commenced the production of petrol.

In September 2024, the refinery produced its first petrol and began loading to the Nigerian National Petroleum Company (NNPC) on September 15.

However, due to some issues, the facility has not been able to flood the local market with its product, forcing it to look elsewhere.

In a landmark move for regional energy integration, Dangote Refinery has partnered with Neptune Oil to take its petrol to neighbouring Cameroon.

Neptune Oil is a leading energy company in Cameroon which provides reliable and sustainable energy solutions.

Dangote Refinery said this development showcases its ability to meet domestic needs and position itself as a key player in the regional energy market, adding that it represents a significant step forward in accessing high-quality and locally sourced petroleum products for Cameroon.

“This first export of PMS to Cameroon is a tangible demonstration of our vision for a united and energy-independent Africa.

“With this development, we are laying the foundation for a future where African resources are refined and exchanged within the continent for the benefit of our people,” the owner of Dangote Refinery, Mr Aliko Dangote, said.

His counterpart at Neptune Oil, Mr Antoine Ndzengue, said, “This partnership with Dangote Refinery marks a turning point for Cameroon.

“By becoming the first importer of petroleum products from this world-class refinery, we are bolstering our country’s energy security and supporting local economic development.

“This initial supply, executed without international intermediaries, reflects our commitment to serving our markets independently and efficiently.”

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN