Economy

Economy: Investors Panic as CBN ‘Suspends’ MPC Meeting

By Modupe Gbadeyanka

With just two weeks left to the first meeting of the Monetary Policy Committee (MPC) meeting this year, it is not certain if the meeting will hold.

This is because the committee lacks the quorum to seat and the Senate, which is to screen and confirm nominees to fill the vacant positions, has refused to carry out this duty because of a face-0ff with the executive arm of government.

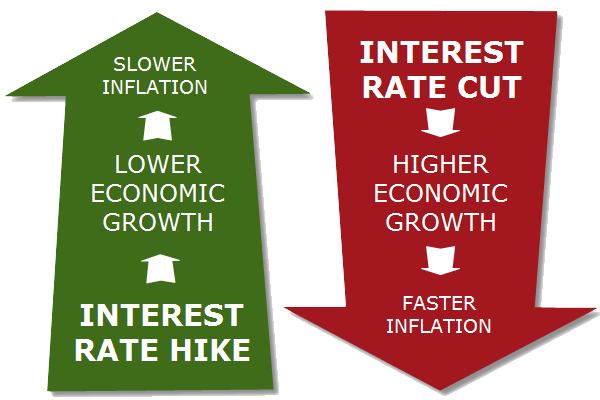

The MPC meeting is organised by the Central Bank of Nigeria (CBN) and it uses it to formulate monetary policies and set interest rates.

The committee comprises the CBN Governor, who acts as the chairman; the four deputy governors of the apex bank; two members of the board of directors of the chief lender; three members appointed by the President; and two members appointed by the Governor.

At the moment, eight positions on the 12-member committee are vacant, making it impossible for the committee to form a quorum.

With the crisis on ground, investors are already getting worried where this could lead the nation’s economy to.

Business Post gathered that investors and observers want the Senate and Presidency to quickly resolve the issue so as not to put the recovering economy into another crisis.

“It is a bad signal to investors. If the meeting fails to hold later this month, be rest assured that it would have a negative effect on the economy because it would surely bring panic amongst us,” an investor, Mr Sunday Akinremi, told Business Post on Monday.

The Senate is expected to resume from its recess on Tuesday, January 16, 2018, while the MPC meeting is scheduled to hold a week after.

According to a report by ThisDay, a Senator, who spoke on the condition of anonymity on Sunday, maintained that the position of the upper legislative chamber remained unchanged until the impasse regarding the nomination and non-confirmation of the acting chairman of the Economic and Financial Crimes Commission Crimes Commission (EFCC), Mr Ibrahim Magu, was resolved.

The lawmaker also said the Senate had resolved to seek legal interpretation of a comment made by Vice-President Yemi Osinbajo that the position of the EFCC chairman does not require the confirmation of the Senate, as it was not specified in the constitution.

As a result of Mr Osinbajo’s remark, the Senate had resolved to suspend the confirmation process for all nominees of the president not specifically mentioned in the 1999 Constitution, but are provided for in the establishment Acts of several agencies of the federal government such as the CBN, FIRS, NCC, and others.

The source explained: “What we are saying is that there is a need to test this in court. Since the vice-president, who is a lawyer, can pronounce that Magu does not need Senate confirmation and that his nomination should not have been sent to us in the first instance, then we queried why that of the MPC members were sent to the Senate.

“After all, the appointment of MPC members is also not contained in the constitution. So why was it sent to us? If we decline confirmation, would the executive not still interpret it the way they have chosen to interpret the issue with Mr Magu?

“Just like the EFCC chairmanship, the members of the MPC are not mentioned in our constitution.”

However, the lawmaker pointed out that the Senate has been confirming nominees of the president specifically mentioned in the constitution such as officials of the Independent National Electoral Commission (INEC).

When contacted, the spokesman of the Senate, Mr Sabi Aliyu Abdullahi, could not be reached for his reaction, as his mobile phones were switched off.

In a recent interview, he had told THISDAY that the resolution of the Senate was still in place until the impasse regarding Mr Magu was resolved.

The President had in October nominated Mrs Aisha Ahmad as deputy governor of the CBN to replace Mrs Sarah Alade, who retired from the Bank last June.

He also nominated Professor Adeola Festus Adenikinju, Dr Aliyu Rafindadi Sanusi, Dr Robert Chikwendu Asogwa and Dr Asheikh Maidugu as members of the MPC to fill the positions of four others whose tenure expired at the end of last year.

Similarly, the president had nominated five non-executive directors for the CBN, who have also not been confirmed by the Senate.

Meanwhile, Mr Suleiman Barau, another deputy governor of the central bank, who is also a member of the committee, retired last month.

The president is yet to name a replacement for him.

The delay in confirming the MPC nominees has led to uncertainty over the January meeting of the committee, which has operational independence in setting interest rates as well as formulating monetary policies for the country.

Speaking on the issue Sunday, a senior CBN official who pleaded to remain anonymous, said the matter was beyond the CBN.

She explained: “The CBN is not in a position to push for the confirmation of the nominees. It is something between the presidency and the Senate.

“We would have loved to get the confirmation so that our MPC and even the Board of Governors would be up and running.”

When asked about the likely implication of not holding the meeting, the CBN official said: “The implications are very clear. Apart from being a national disgrace, it would be an international embarrassment that the CBN cannot hold its MPC because of the lack of quorum. I don’t think it has ever happened to any country.”

Economy

Morison Industries Lists N400.3m Private Placement Shares on Customs Street

By Aduragbemi Omiyale

The additional shares sold by Morison Industries Plc through private placement have been listed on the Nigerian Exchange (NGX) Limited.

The additional equities were brought to Customs Street last week, according to a circular issued by the Head of Issuer Regulation Department of the NGX, Mr Godstime Iwenekhai.

The company listed a total of 266,838,125 ordinary shares of 50 Kobo each at N1.50 per unit, amounting to N400.3 million, Business Post reports.

The listing of these new stocks of Morison Industries has increased the fully paid-up shares of the organisation to 1,256,000,000 ordinary shares of 50 Kobo each from 989,161,875 ordinary shares of 50 Kobo each.

“Trading licence holders are hereby notified that additional 266,838,125 ordinary shares of 50 Kobo each of Morison Industries Plc were (on) Tuesday, January 13, 2026, listed on the daily official list of Nigerian Exchange Limited.

The additional shares listed on NGX arose from the company’s private placement of 266,838,125 ordinary shares of 50 Kobo each at N1.50 per share.

“With the listing of the additional shares, the total issued and fully paid-up shares of Morison Industries Plc have now increased from 989,161,875 to 1,256,000,000 ordinary shares of 50 Kobo each,” the disclosure disclosed.

Economy

Bankers Forecast Single-Digit Inflation for Nigeria in 2026

By Adedapo Adesanya

The Chartered Institute of Bankers of Nigeria (CIBN) has projected a single-digit inflation rate for Nigeria at 9.84 per cent in its wider optimistic forecast for this year.

In its 12th National Economic Outlook and Its Implication for Businesses in 2026, the bankers group saw a better metric compared to those of the Central Bank of Nigeria (CBN) and the International Monetary Fund (IMF).

The CBN and the IMF respectively see Nigeria’s economy growing at 4.49 per cent and 4.2 per cent, and the inflation rate dropping to 14.45 per cent and 18 per cent while the foreign reserves rise to N45.78 billion and $43 billion respectively this year.

However, in the outlook presentation by Professor Biodun Adedipe, the CIBN projects a 4.51 per cent GDP growth rate and a 9.84 per cent inflation rate. It forecast the exchange rate stabilizing at N1,420/$1 and the foreign reserves hitting $50.8 billion.

Business Post reports that Professor Adedipe, corporate finance scholar and founder of B. Adedipe Associates Ltd, has been presenting the national economic outlook since 12 years ago, with the firm claiming to initiate the trend in Nigeria, before even the CBN and others caught on with it.

Last week, after a revised approach Nigeria’s headline inflation eased to 15.5 per cent year-on-year in December 2025, down from 17.33 per cent in the preceding month. On a month-on-month basis, headline inflation slowed to 0.54 per cent in December, compared to 1.22 per cent in November.

Ahead of the data release, the National Bureau of Statistics (NBS) had cautioned that the rebasing exercise could result in a temporary “artificial spike” in the December inflation figures.

Mr Adeyemi Adeniran, the statistician-general of the federation, said the adjustment in the reference period, known as the base year, would affect the headline number.

“This artificial spike is a result of the base effect of December 2024, which is equated to 100, following the rebasing exercise,” Mr Adeniran said.

Economy

NCR Nigeria Records 60.79% Week-on-Week Rise on NGX

By Dipo Olowookere

Eighty equities appreciated on the floor of the Nigerian Exchange (NGX) Limited last week compared with the 84 equities recorded in the previous week, as 17 equities depreciated versus 22 equities in the preceding week, while 50 equities remained unchanged versus 42 equities of the earlier week.

NCR Nigeria gained 60.79 per cent to finish at N128.55, SCOA Nigeria grew by 59.36 per cent to N14.90, Deap Capital expanded by 48.67 per cent to N4.46, Jaiz Bank soared by 45.73 per cent to N8.19, and Omatek surged by 38.28 per cent to N1.77.

At the other end, Ikeja Hotel lost 12.38 per cent to settle at N35.05, Austin Laz declined by 9.20 per cent to N3.75, Eterna crashed by 7.71 per cent to N32.30, Universal Insurance went down by 7.69 per cent to N1.20, and Eunisell retreated by 7.57 per cent to N156.95.

The bourse remained bullish in the week, with the All-Share Index (ASI) up by 2.36 per cent to 166,129.50, and the market capitalisation up by 2.48 per cent to N106.354 trillion.

Similarly, all other indices finished higher apart from the AFR Div Yield index, which depreciated by 0.15 per cent.

In the five-day trading week, investors traded 4.607 billion shares worth N130.636 billion in 263,439 deals, in contrast to the 4.164 billion shares valued at N94.026 billion transacted in 248,254 deals a week earlier.

Further analysis showed that financial stocks led the activity chart with 3.126 billion units worth N47.225 billion traded in 94,186 deals, contributing 67.84 per cent and 36.15 per cent to the total trading volume and value, respectively.

Services equities followed with 353.436 million units sold for N5.096 billion in 17,764 deals, while ICT shares exchanged 277.263 million equities valued at N18.009 billion in 28,525 deals.

Sovereign Trust Insurance, Access Holdings, and Linkage Assurance were the busiest stocks last week, trading 1.406 billion units valued at N9.735 billion in 11,732 deals, contributing 30.52 per cent and 7.45 per cent to the total trading volume and value apiece.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn