Economy

Expert Insights: Selecting the Best Currency Pairs to Trade at Night

If you are a night owl and looking to maximize your Forex trading potential, you’re in luck! A group of traders from Traders Union (TU) have compiled an informative guide on the best Forex pairs to trade at night. Whether you’re a beginner or an experienced trader, this information will be of great value to you. The article covered the best currency pairs to trade at night, backed up by detailed research and expert analysis. Stay tuned!

Understanding сurrency pairs

Currency pairs simply show the value of one currency compared to another. Think of it like a ratio: in the EUR/USD pair, if it’s at 1.302, 1 euro is equal to 1.302 U.S. dollars. TU’s analysts often highlight the EUR/USD pair as a popular one, where traders swap euros for U.S. dollars in their trades.

Currency pairs are grouped into three main categories.

Majors – these always involve the U.S. dollar and are frequently traded. Examples:

- EUR/USD

- USD/JPY

- GBP/USD

Crosses – these are pairs of two major currencies, but don’t include the U.S. dollar. Some of the commonly traded crosses are:

- EUR/GBP

- GBP/JPY

- EUR/CHF

Exotic Pairs – these combine a major currency with one from a smaller or emerging market. They can be riskier but also offer potential rewards. A few examples include:

- USD/SGD

- USD/HKD

- EUR/TRY

According to experts at Traders Union, while beginners might find comfort in trading majors due to their stability, seasoned traders often dabble in exotics for potentially higher returns, albeit with added risk.

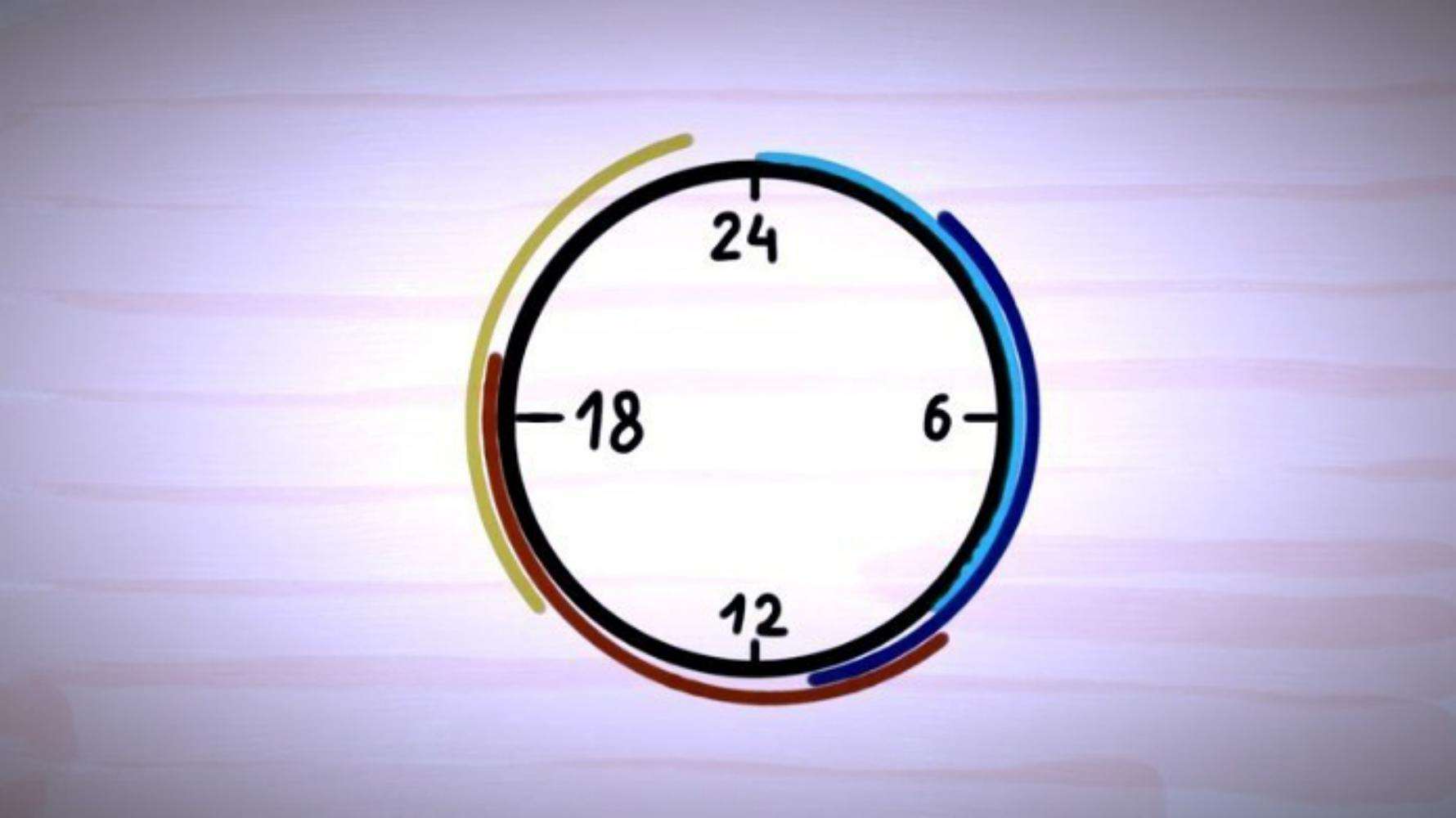

Navigating night trading in Forex

Forex night trading means buying and selling currencies after regular market hours. The exact times can vary, depending on the exchange. Traders can do this because it allows them to react to global events or financial news that occur outside of normal market hours. If you’re thinking about night trading, the experts suggest keeping track of the hours for each exchange and knowing when different regions’ trading times overlap. Thanks to this, the chances of buying or selling will increase. Just remember to stay updated on worldwide news, so you can make smart trading choices even at night!

Top currency pairs for night trading

Based on the guidance of TU’s experts, here are some top pairs you might want to explore:

Night session favorites

- AUD/NZD – often shows significant price movements during the night.

- AUD/JPY and NZD/JPY – are known to provide trading opportunities during overnight sessions.

Daily trading champions

- EUR/USD (Fibre) – this pair dominates with about 23% of daily trade volume.

- USD/JPY (Gopher) – offers predictable price movements, contributing to 13.5% of daily trades.

- GBP/USD (Cable) – known for its volatility, it covers about 6% of daily trade volume.

- AUD/USD (Aussie) -influenced by commodity prices, it also accounts for 6% of daily trades.

- USD/CAD – tied closely to oil prices, it represents 5% of daily trade volumes.

- USD/CHF (Swissie) – a popular choice, contributing to around 5% of daily global trades.

With this list, both new and experienced traders can better navigate the world of Forex during the nighttime hours.

Conclusion

Navigating the 24-hour world of Forex trading presents both challenges and opportunities. For those drawn to the stillness of night trading, understanding the dynamics of specific currency pairs becomes crucial. Traders Union analysts provide invaluable insights into the most potent pairs for nighttime endeavors, from the volatility of the GBP/USD to the predictable movements of the USD/JPY. By leveraging this knowledge and staying updated on global economic shifts, traders-whether novice or seasoned — can optimize their strategies, ensuring they are well-prepared to seize opportunities, no matter the hour.

Economy

NASD OTC Securities Exchange Soars 1.48%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange rallied by 1.48 per cent on Monday, March 9, spurred by six price gainers at the close of business.

The sextuplet was led by Nipco Plc, which added N28.00 to trade at N313.00 per unit versus the previous price of N285.00 per unit, FrieslandCampina Wamco Nigeria Plc appreciated by N8.65 to sell for N133.85 per share versus last Friday’s closing value of N125.20 per share, Central Securities Clearing System (CSCS) Plc increased by N2.43 to N83.78 per unit from N81.35 per unit, Afriland Properties Plc gained 75 Kobo to close at N19.50 per share compared with the previous N18.75 per share, UBN Property Plc jumped by 21 Kobo to close at N2.38 per unit compared with the preceding session’s N2.17 per unit, and Industrial and General Insurance (IGI) Plc rose 5 Kobo to sell at 52 Kobo per share versus 47 Kobo per share.

As a result, the market capitalisation added N37.22 billion to settle at N2.556 trillion versus the preceding session’s N2.519 trillion, and the NASD Unlisted Security Index (NSI) went up by 62.20 points to 4,273.12 points from 4,201.57 points.

Yesterday, the volume of securities decreased by 67.6 per cent to 1.1 million units from 3.4 million units, the value of securities depleted by 24.3 per cent to N47.3 million from N62.4 million, and the number of deals went down by 18.2 per cent to 36 deals from 44 deals.

The most traded stock by value on a year-to-date basis was CSCS Plc with 37.6 million units valued at N2.3 billion, trailed by Okitipupa Plc with 6.3 million units sold for N1.1 billion, and MRS Oil Plc with the sale of 3.4 million units for N506.8 million.

As for the most traded stock by volume on a year-to-date basis, it was Resourcery Plc with 1.05 billion units worth N408.7 million, followed by Geo-Fluids Plc with 123.1 million units traded for N481.6 million, and CSCS Plc with 37.6 million units transacted for N2.3 billion.

Economy

Oil Market Dips Below $100 as Trump Signals De-escalation

By Adedapo Adesanya

Oil prices fell in the later session of Monday after initially crossing the $100 per barrel mark as the escalating Iran war by the United States and Israel squeezed world energy supplies, boosted the Dollar, and dampened hopes of interest-rate cuts.

Earlier, Brent crude futures climbed to a high of $119.50 per barrel, and the US West Texas Intermediate (WTI) to $117.48 a barrel. However, it dropped later after US President Donald Trump suggested that the US conflict with Iran could soon wind down.

Data gathered by Business Post showed that the price of the Brent crude grade dropped 5.4 per cent to $87.68 per barrel, and the US WTI lost 7.4 per cent to trade at $84.21 a barrel.

President Trump is expected to review a set of options to tame oil prices, reflecting White House worries that the surge in oil prices will hurt US businesses and consumers ahead of the November midterm elections, when the ruling Republicans are hoping to retain control of Congress.

Reuters reported that the US is discussing with counterparts from the Group of Seven major economies a possible joint release of crude oil from strategic reserves. It also reported they are weighing other options, including restricting US exports, intervening in oil futures markets, waiving some federal taxes and lifting requirements under a US law called the Jones Act that domestic fuel must move only on US-flagged ships.

The Trump administration officials are also exercising diplomatic pressure on Gulf allies to help restore production and shipping of oil.

Market analysts have warned that Gulf producers are only able to sustain normal production for roughly 25 days if the Strait is completely blocked.

The expanding US-Israeli war with Iran led some major Middle Eastern oil producers to cut supplies due to fears of prolonged disruption to shipping through the Strait of Hormuz chokepoint.

Oil-driven inflation fears and delayed rate-cut expectations likely strengthened US yields and the Dollar, outweighing safe-haven demand.

The recent 10-day conflict in Iran is beginning to ripple through the global aviation industry, threatening what had been a strong outlook for aircraft demand.

JP Morgan has warned that Iran’s oil production could be slashed in half and oil exports could virtually stall if the US-Israel seize Iran’s Kharg Island, worsening the ongoing global oil shock. The island is regarded as the backbone of Iran’s oil infrastructure, handling approximately 90 per cent of its crude exports.

Economy

Buying Pressure Inflates NGX Performance Indices by 0.12%

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited ended its first trading session of this week on a positive note after it improved by 0.12 per cent on Monday.

Buying pressure across key sectors of Customs Street influenced the growth achieved yesterday despite the global instability triggered by the war in Iran by the United States and Israel.

Energy stocks on the local bourse have continued to benefit from the crisis, which has raised the price of crude oil above $100 per barrel.

The energy index was up by 2.07 per cent during the session, and the consumer goods sector appreciated by 0.58 per cent, while the insurance and banking indices depreciated by 3.05 per cent and 0.99 per cent, respectively.

When the closing gong was struck on Monday, the All-Share Index (ASI) increased by 228.82 points to 197,196.97 points from 196,968.15 points, and the market capitalisation garnered N147 billion to settle at N126.584 trillion compared with last Friday’s N126.437 trillion.

The trio of Conoil, Legend Internet, and Omatek advanced by 10.00 per cent each to N185.90, N7.04, and N2.42 apiece, as NGX Group chalked up 9.97 per cent to trade at N166.00, and Oando appreciated by 9.96 per cent to N54.65.

Conversely, Aluminium Extrusion shrank by 10.00 per cent to N13.95, SCOA Nigeria declined by 9.90 per cent to N30.95, RT Briscoe lost 9.87 per cent to finish at N10.87, Sunu Assurances crashed by 9.81 per cent to N4.32, and Union Dicon lost 9.76 per cent to settle at N14.80.

The most active stock for the session was Fortis Global Insurance with 120.4 million units worth N174.1 million, Access Holdings exchanged 32.2 million units valued at N818.5 million, Chams traded 28.3 million units for N110.5 million, Zenith Bank transacted 25.3 million units worth N2.4 billion, and Japaul sold 21.6 million units valued at N82.1 million.

At the close of trades, market participants bought and sold 762.5 million shares for N31.2 billion in 86,488 deals during the session, in contrast to the 586.2 million shares valued at N30.6 billion traded in 62,699 deals in the preceding session, implying a spike in the trading volume, value, and number of deals by 30.08 per cent, 1.96 per cent, and 37.94 per cent apiece.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn