Economy

Experts Seek Urgent Action on Food Security Threat in West Africa

By Modupe Gbadeyanka

Governments of the West African nations have been urged to quickly take actions that would address food security threat in the region.

According to a report titled ‘The Cost of Ocean Destruction,’ which was released to celebrate the World Fisheries Day, vessels arrested for illegally fishing in West African waters are still carrying on with business as usual.

The report, released by Greenpeace Africa, detailed how West African fishermen and communities continue to suffer from the consequences of overfishing and illegal fishing in this region and it provides specific recommendations for governments on how to solve the crisis.

Greenpeace appealed to West African governments as well as nations fishing in, or importing seafood from the region, to stand together to protect millions of Africans against the unceasing onslaught of industrial fishing fleets.

Greenpeace is also demanding that authorities provide follow-up information on fishing vessels and crews that were arrested during a joint patrol by Greenpeace and African fisheries inspectors last spring.

According to the project leader in Greenpeace Netherlands, Pavel Klinckhamers, “The current situation in West Africa is a result of decades of overfishing and inaction, but it is also a result of commitments from West African governments and foreign fishing nations, like China, South Korea and the EU, that were simply never translated into reality.

“Coastal communities are the ones paying the price and they cannot wait any longer. African states and foreign fishing nations in the region have to change course and put in place the policies that these communities need in order to survive.”

In only 20 days, Greenpeace and fisheries inspectors from Guinea, Guinea Bissau, Sierra Leone and Senegal came across 17 vessels contravening applicable rules, while 11 of these vessels were arrested for infractions which included involvement in illegal transshipment, fishing in breach of their license conditions, using illegal nets and shark finning.

However, only six months later, all 17 vessels are still licensed to fish in West African waters, and in most cases, local authorities are not responding to requests from Greenpeace to clarify what legal steps were taken after the arrests.

Chinese authorities have ordered provincial authorities to punish the captains of some of the Chinese vessels involved in infringements, while specific subsidies to their operations have also been cancelled.

The general lack of information on each case is symptomatic of the lack of transparency and accountability of governments when it comes to fisheries policies.

“West African countries keep signing new and opaque fishing agreements with foreign countries without putting in place the means to monitor their activities and sufficiently take the interests of local small-scale fishermen into account.

“This kind of practice has disastrous consequences for the marine environment, for local fishermen and hence for African communities as well,” Pavel Klinckhamers said.

One of the main fishing players in the region, China, is currently conducting a revision of its Provisions for the Administration of Distant Water Fishery.

The review will include new sanctions for IUU fishing, however It is still crucial to ensure transparency, effective implementation, and the strengthening and effective enforcement of punishment measures by coastal West African countries, when vessels break the law.

Also, a number of new fisheries agreements are currently in the making. Last month China signed long term fisheries agreements with Sierra Leone and Mauritania and the EU is working on a fisheries agreement with Guinea Bissau, since the current protocol will expire later this month.

According to unconfirmed information, Senegal and Russia are also holding conversations around reintroducing Russia’s industrial fishing fleet, that was kicked out of Senegal back in 2012.

“This is not a quick fix, and we need everyone involved in West African fisheries to cooperate. For African states in particular, they need to manage shared resources jointly and ensure priority is given to the labor intensive, small-scale sector. This sector which directly employs one million people and generates €3 billion annually. At the same time, we need foreign fishing nations to ensure their fleets do not undermine the sustainability of fisheries in the countries they operate in,“ Ibrahima Cisse, senior oceans campaign manager in Greenpeace Africa, said.

For more than 15 years, Greenpeace and other NGOs have warned against overexploitation of fish stocks in West African waters and its serious impacts on livelihoods, food security and employment for millions of people in this region. Also, we have outlined how substantial progress can be made through strong cooperation and harmonization of West African fisheries policies and legislation.

In fact, regional cooperation has been at the core of an already established mandate for West African countries of the Sub regional Fisheries Commission, SRFC, since 1985.

Still, very little has been done in reality to turn the tides for West African waters, and the situation out at sea in West Africa and the consequences on land, are alarming.

Economy

Fitch Sees Nigeria’s External Debt at $5.2bn, Maintains Stable Outlook

By Adedapo Adesanya

Fitch Ratings has projected Nigeria’s external debt service to reach $5.2 billion this year from $4.7 billion in 2024, though it maintained a stable outlook for the country in its latest rating.

The agency also cited a minor delay in the payment of a Eurobond coupon due on March 28, 2025, as a reflection of persistent challenges in public finance management.

The rating firm had upgraded Nigeria’s long-term foreign-currency issuer default rating to ‘B’ from ‘B-’, with a stable outlook.

The $5.2 billion in debt service, according to Fitch, includes $4.5 billion in amortisation payments and a $1.1 billion Eurobond repayment due in November.

The development highlights the growing pressure on public finances despite ongoing economic reforms by the federal government.

Fitch noted, “The government external debt service is moderate but expected to rise to $5.2 billion in 2025 (with $4.5bn of amortisations, including a $1.1 billion Eurobond repayment due in November 2025), from $4.7 billion in 2024, and fall to $3.5 billion in 2026.”

It warned that although Nigeria’s external debt service remains within manageable levels, high-interest costs, weak revenue performance, and limited fiscal space remain significant concerns, adding that general government debt was expected to remain at about 51 per cent of GDP in 2025 and 2026.

However, it expressed concerns over the government’s revenue position, noting that interest payments will consume a substantial portion of income.

“We expect general government revenue-to-GDP to rise but to remain structurally low (averaging 13.3 per cent in 2025–2026), largely accounting for a high general government interest/revenue ratio, above 30 per cent, with federal government interest/revenue ratio of nearly 50 per cent,” it stated.

The company observed that Nigeria’s gross reserves rose to $41 billion at the end of 2024, before declining to $38 billion due to debt service payments.

Despite this, Fitch expects the country’s reserves to average five months of current external payments over the medium term, above the median for similarly rated economies, adding that recent policy reforms had contributed to increased foreign exchange inflows and better monetary stability, with inflation projected to average 22 per cent in 2025.

“Net official FX inflows through the CBN and autonomous sources rose by about 89 per cent in Q4 2024. We expect continued formalisation of FX activity to support the exchange rate, although we anticipate modest depreciation in the short term,” a part of the report stated.

It commended the government’s commitment to economic reforms, including the removal of fuel subsidies, liberalisation of the exchange rate, and tightening of monetary policy, noting that these steps had improved policy credibility and strengthened Nigeria’s ability to absorb shocks.

However, the agency warned that risks to Nigeria’s external and fiscal position remained, particularly if oil prices fall or policy implementation slows down.

Economy

Forex Trading in Nigeria: Beginner Tips, Trends and the Benefits of STIC Cashback

Forex trading is booming across Nigeria, drawing in thousands of new traders eager to make money from currency markets. This beginner-friendly guide explains how to get started, where to learn the basics, and how services like STIC Cashback can boost your profits through the best forex cashback Nigeria offers. Discover how to use the cashback forex calculator, what platforms to trust and how to trade smarter, not harder.

Forex trading is growing rapidly in Nigeria, with more and more individuals turning to the foreign exchange market to build wealth, create side income, or gain financial independence. Thanks to increasing access to online brokers and mobile-friendly platforms, people across the country—from Lagos to Abuja—are exploring how to trade forex like never before.

As this trend picks up momentum, both beginners and experienced traders are seeking smarter ways to trade. One powerful way to get more out of every trade is through cashback forex programs, with STIC Cashback leading the charge as the best forex cashback Nigeria has to offer.

Why forex trading is on the rise in Nigeria

Forex trading, or the exchange of one currency for another, offers flexibility, liquidity and global access. With the Nigerian economy becoming more integrated into global markets, forex is becoming an attractive financial opportunity for many Nigerians.

People are drawn to the 24-hour nature of the forex market, the low barrier to entry and the chance to learn and grow independently. Whether you’re trading major currency pairs like EUR/USD or looking into CFDs (contracts for difference), forex offers endless possibilities.

However, entering the market without preparation can be risky. That’s why it’s essential to start with a guide like the one found at sticcashback.com/blog/how-to-trade-forex-for-beginners. It provides the fundamentals on how to trade forex for beginners, including broker selection, setting up your account and managing risk.

Getting started: How to trade forex for beginners

As highlighted in the STIC Cashback blog linked above, starting with a solid foundation is key. Here’s a quick roadmap for beginners:

- Learn the basics – Understand how currency pairs work, how pips are calculated and what affects market movements.

- Choose a trusted broker – Work with brokers partnered with STIC Cashback to enjoy cashback benefits on every trade.

- Set goals and risk levels – Define your trading plan and use tools like stop-losses and take-profit orders.

- Start small, grow smart – Begin with a demo account or micro-lots, especially if you’re still learning.

When paired with the cashback forex calculator, beginners can estimate how much they’ll earn back from their trades through cashback—something that can significantly impact long-term profitability.

The power of cashback forex programs

Forex trading can involve fees and commissions, which add up quickly over time. Cashback forex programs offer a simple but powerful way to reduce those costs by returning a portion of your trading volume as real money.

Here’s where STIC Cashback shines.

- Weekly cashback – STIC Cashback provides a weekly cashback forex payment based on how much you trade.

- Low withdrawal minimum – You can withdraw once your cashback hits just $50.

- No catch – You earn your cashback simply by trading with STIC Cashback’s trusted broker partners.

- Best rates – Their offer is widely considered among the best forex cashback Nigeria users can access today.

With STIC Cashback, traders get back a portion of every trade. This effectively lowers trading costs and increases profitability. The STIC Cashback forex calculator lets you forecast your cashback earnings based on your trading volume, helping you plan smarter and making it far and away the best forex cashback Nigeria has to offer.

Why Nigerian traders trust STIC Cashback

STIC Cashback stands out for its transparency, fast payments and strong relationships with reliable brokers. Nigerian traders love STIC Cashback because:

- It’s easy to use.

- It works with top brokers who accept Nigerian traders.

- Payments are reliable, safe and timely.

- You can calculate your rewards using the cashback forex calculator before you even trade.

As a service built for both beginner and expert traders, STIC Cashback is helping make forex more profitable and accessible and is easily the best forex cashback Nigeria can offer its traders. Whether you’re just starting or already trading daily, it makes sense to earn extra from each trade.

Partner with trusted brokers, trade with confidence

One of the biggest benefits of using STIC Cashback is access to their network of trusted broker partners. These brokers meet high standards for safety, speed and transparency, ensuring you can trade forex and CFDs confidently.

When you trade through one of these brokers and use STIC Cashback, you’re not only gaining an edge through low spreads and strong platforms, but you’re also earning a rebate every week. It’s the perfect blend of efficiency and extra income.

Join Nigeria’s growing forex community today

With forex trading gaining popularity in Nigeria, there’s never been a better time to start. Thanks to resources like the STIC Cashback beginner’s guide and tools like the cashback forex calculator, new traders can begin with clarity and confidence.

Sign up today at www.sticcashback.com and start trading with one of STIC Cashback’s broker partners. Tap into the best forex cashback Nigeria traders can rely on. Whether you’re looking to trade full-time or just want to earn from market movements in your spare time, STIC Cashback can help you grow your account faster.

Economy

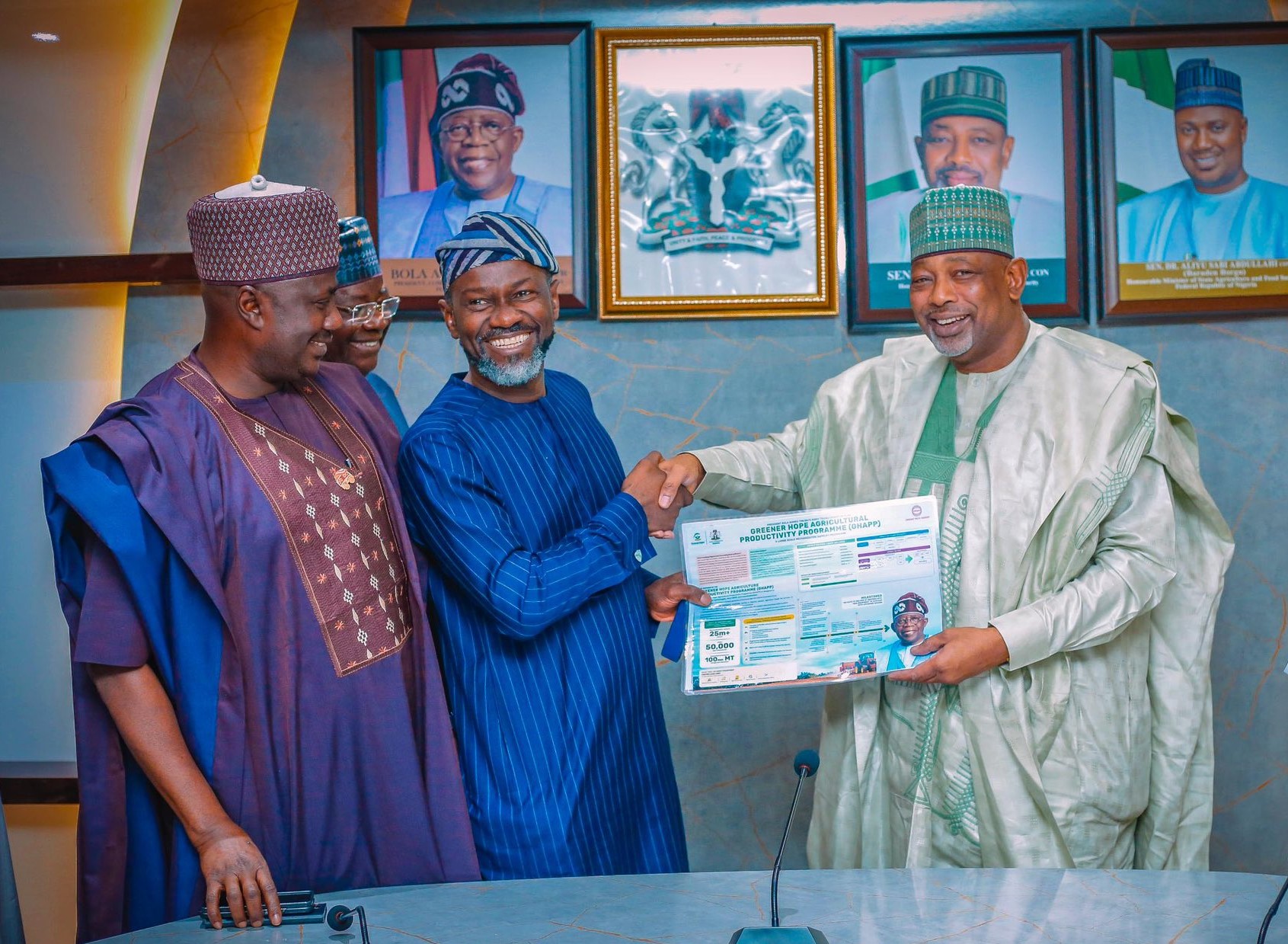

Genesis Energy, Katsina Seal $500m Investment Deal

By Adedapo Adesanya

The Katsina State government has attracted an investment worth about $500 million for the development, financing and execution of a series of major energy infrastructure projects across the state.

The state government recently sealed the deal with a United Kingdom-based leading Pan-African clean energy infrastructure development and asset management company, Genesis Energy Holding.

The Memorandum of Understanding (MOU) between the two parties outlines a strategic partnership for the development, financing, construction, operation, and maintenance of key energy projects.

In addition, these projects aim to accelerate the industrialisation and socio-economic advancement of Katsina State and provide clean, reliable, and sustainable energy solutions for the region.

It also provides the framework for the collaborative development of a diverse portfolio of energy projects, focusing on solar, wind, hydro, mini-grids, and natural gas solutions.

The Governor of Katsina State, Mr Dikko Radda, described the partnership as “a significant step toward providing reliable, cost-effective, and environmentally friendly power solutions, fostering economic growth, and attracting investments to Katsina State.”

“This MOU represents a major milestone in our ongoing efforts to build resilient infrastructure that will not only address Katsina’s immediate energy needs but also lay the foundation for a prosperous and greener future for generations to come.

“The first of the series of projects being constructed under this partnership will shortly be commissioned before the end of this April 2025,” he added.

On his part, the Chairman and CEO of Genesis Energy, Mr Akin II Omoboriowo, noted that, “Lighting Up Africa is more than just a vision for Genesis; it is the very heartbeat that drives us. We are committed to enduring the rigorous process of developing and financing projects to bring sustainable energy solutions to the continent.

“For Genesis Energy, this marks a significant milestone as we continue to actively partner with Katsina State in achieving energy independence, creating a pivotal opportunity to industrialize the state and position it as a major player in clean and renewable energy generation.”

The primary objective of this collaboration is to address the state’s growing energy needs and support the Nigerian Government’s broader energy security and sustainability goals.

The MOU lays the foundation for creating a multi-phased energy platform that will provide power to critical sectors, including healthcare, industry, and agriculture while contributing to the regional transition to a green economy.

The key initiative of the MOU involves powering critical sectors and providing critical energy infrastructure across key sites across the State, deploying suitable energy technologies.

Phase One of the projects is expected to be executed concurrently across multiple initiatives, aimed at promoting energy independence, facilitating industrialisation, creating jobs, and displacing significant amounts of CO² emissions.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN