Economy

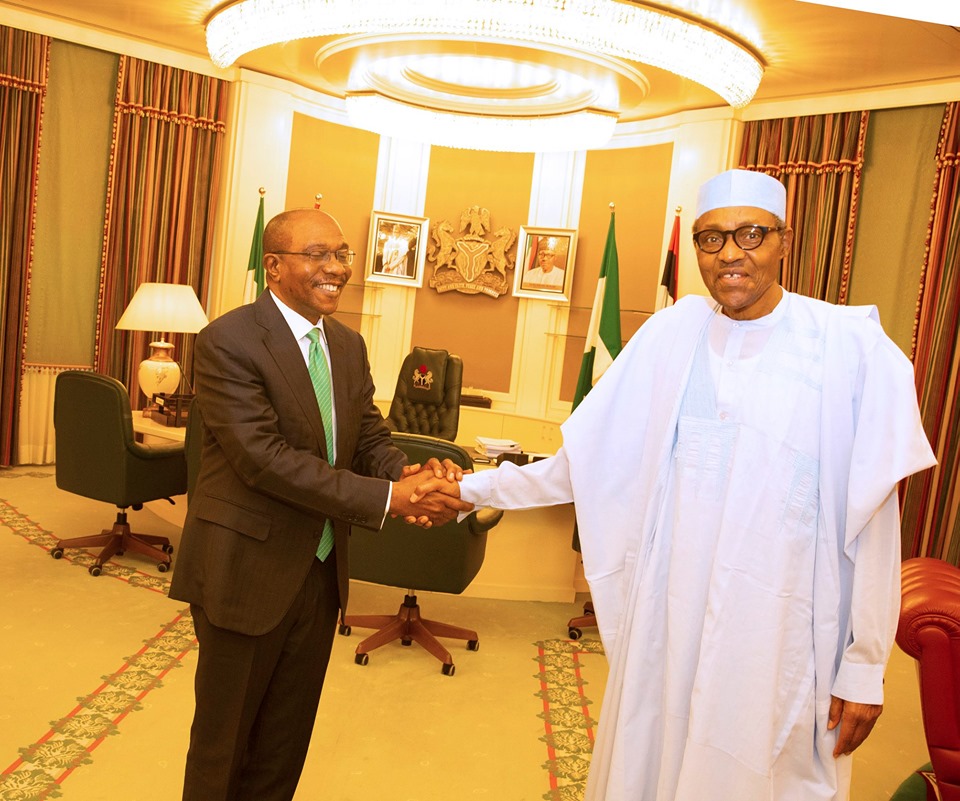

FG’s Heavy CBN Borrowings Could Crash Economy—Fitch

By Aduragbemi Omiyale

The Nigerian government has been advised to reduce its borrowings from the Central Bank of Nigeria (CBN) for funding the budget deficits.

In a statement issued on Wednesday, the rating agency said the constant running to the apex bank to get funds “could raise risks to macroeconomic stability.”

Just like others in the emerging economies, the fiscal authorities in Nigeria approached the central bank to finance their spending last year because of the COVID-19 pandemic, which brought the world to its knees.

The federal government “directly borrowed 1.9 per cent” of the nation’s Gross Domestic Product (GDP) from Mr Godwin Emefiele’s-led CBN in 2020.

These funds were used by the government finance the 2020 budget deficit and Fitch said it believes that the balance of the government in the Ways and Means facility (WMF) domiciled with the CBN stands around N9.8 trillion, which is 6.7 per cent of GDP at end-2019.

“Unlike the government, we include this balance in our metrics for Nigeria’s government debt. Borrowing from the facility accounted for 30 per cent of the FGN’s debt at end-2019, on our estimates,” the agency noted.

Fitch warned Nigeria to reduce its use of the facility in 2021 because of its weaknesses in public finance management and the current weak institutional safeguards.

It said normally, the limit for the use of the WMF facility by the government should be 5 per cent of the previous year’s fiscal revenues, but the recent borrowing from the “CBN has repeatedly exceeded that limit in recent years, and reached around 80 per cent of the FGN’s 2019 revenues in 2020.”

In the statement, Fitch said it “views the Nigerian government’s fiscal revenue and expenditure projections for 2021 as broadly realistic, which should preclude further significant borrowing by the sovereign from the CBN facility this year.

“The government may nonetheless use the facility more extensively if the deficit proves wider than forecast or if external financing falls short of planned amounts.

“Monetary financing of the fiscal deficit raises challenges to monetary policy implementation, as tight management of domestic liquidity is a key tool under the CBN’s policy of prioritising the stability of the naira. It could also complicate official efforts to bring inflation back under control.”

A few days ago, the National Bureau of Statistics (NBS) said inflation in Nigeria went higher to 15.75 per cent in December 2020 and according to Fitch, this is “a credit weakness.”

Economy

Okitipupa Plc, Two Others Lift Unlisted Securities Market by 0.65%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange recorded a 0.65 per cent gain on Friday, December 13, boosted by three equities admitted on the trading platform.

On the last trading session of the week, Okitipupa Plc appreciated by N2.70 to settle at N29.74 per share versus Thursday’s closing price of N27.04 per share, FrieslandCampina Wamco Nigeria Plc added N2.49 to end the session at N42.85 per unit compared with the previous day’s N40.36 per unit, and Afriland Properties Plc gained 50 Kobo to close at N16.30 per share, in contrast to the preceding session’s N15.80 per share.

Consequently, the market capitalisation added N6.89 billion to settle at N1.062 trillion compared with the preceding day’s N1.055 trillion and the NASD Unlisted Security Index (NSI) gained 19.66 points to wrap the session at 3,032.16 points compared with 3,012.50 points recorded in the previous session.

Yesterday, the volume of securities traded by investors increased by 171.6 per cent to 1.2 million units from the 447,905 units recorded a day earlier, but the value of shares traded by the market participants declined by 19.3 per cent to N2.4 million from the N3.02 million achieved a day earlier, and the number of deals went down by 14.3 per cent to 18 deals from 21 deals.

At the close of business, Geo-Fluids Plc was the most active stock by volume on a year-to-date basis with a turnover of 1.7 billion units worth N3.9 billion, followed by Okitipupa Plc with the sale of 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.3 million units sold for N5.3 million.

In the same vein, Aradel Holdings Plc remained the most active stock by value on a year-to-date basis with the sale of 108.7 million units for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with a turnover of 297.3 million units worth N5.3 billion.

Economy

Naira Trades N1,533/$1 at Official Market, N1,650/$1 at Parallel Market

By Adedapo Adesanya

The Naira appreciated further against the United States Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N1.50 or 0.09 per cent to close at N1,533.00/$1 on Friday, December 13 versus the N1,534.50/$1 it was transacted on Thursday.

The local currency has continued to benefit from the Electronic Foreign Exchange Matching System (EFEMS) introduced by the Central Bank of Nigeria (CBN) this month.

The implementation of the forex system comes with diverse implications for all segments of the financial markets that deal with FX, including the rebound in the value of the Naira across markets.

The system instantly reflects data on all FX transactions conducted in the interbank market and approved by the CBN.

Market analysts say the publication of real-time prices and buy-sell orders data from this system has lent support to the Naira in the official market and tackled speculation.

In the official market yesterday, the domestic currency improved its value against the Pound Sterling by N12.58 to wrap the session at N1,942.19/£1 compared with the previous day’s N1,954.77/£1 and against the Euro, it gained N2.44 to close at N1,612.85/€1 versus Thursday’s closing price of N1,610.41/€1.

At the black market, the Nigerian Naira appreciated against the greenback on Friday by N30 to sell for N1,650/$1 compared with the preceding session’s value of N1,680/$1.

Meanwhile, the cryptocurrency market was largely positive as investors banked on recent signals, including fresh support from US President-elect, Mr Donald Trump, as well as interest rate cuts by the European Central Bank (ECB).

Ripple (XRP) added 7.3 per cent to sell at $2.49, Binance Coin (BNB) rose by 3.5 per cent to $728.28, Cardano (ADA) expanded by 2.4 per cent to trade at $1.11, Litecoin (LTC) increased by 2.3 per cent to $122.56, Bitcoin (BTC) gained 1.9 per cent to settle at $101,766.17, Dogecoin (DOGE) jumped by 1.2 per cent to $0.4064, Solana (SOL) soared by 0.7 per cent to $226.15 and Ethereum (ETH) advanced by 0.6 per cent to $3,925.35, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

Economy

Index Gains 0.63% as Value of Nigerian Exchange Crosses N60trn

By Dipo Olowookere

For the fourth consecutive trading session, the Nigerian Exchange (NGX) Limited closed higher on Friday by 0.63 per cent on sustained renewed buying pressure.

Apart from the energy and industrial goods sectors which closed flat, every other sector ended in the green territory, according to data obtained from the bourse.

Business Post reports that the insurance index appreciated by 1.52 per cent, the banking space improved by 0.63 per cent, and the consumer goods counter expanded by 0.46 per cent.

As a result, the All-Share Index (ASI) gained 617.47 points to settle at 99,378.06 points compared with the preceding day’s 98,760.59 points and the market capitalisation went up by 375 billion to close at N60.242 trillion, in contrast to Thursday’s closing value of N59.867 trillion.

The volume of transactions on Customs Street yesterday grew by 11.13 per cent to 544.2 million shares from the 489.7 million shares transacted a day earlier.

The value of transactions increased during the session by 49.30 per cent to N10.6 billion from N7.1 billion and the number of deals went up by 1.93 per cent to 8,464 deals from the 8,304 deals posted in the previous trading session.

The busiest equity for the trading day was Japaul with the sale of 71.7 million units valued at N158.0 million, eTranzact exchanged 70.7 million units worth N477.5 million, Tantalizers sold 57.3 million units for N101.2 million, FCMB traded 33.0 million units worth N297.3 million, and Universal Insurance transacted 27.1 million units valued at N9.6 million.

A total of 36 stocks ended on the gainers’ chart, while 15 stocks finished on the losers’ table, indicating a positive market breadth index and strong investor sentiment.

The trio of Aradel Holdings, Ikeja Hotel and Caverton gained 10.00 per cent each to trade at N550.00, N8.80, and N1.98, respectively, as Africa Prudential rose by 9.87 per cent to N17.25 and Golden Guinea Breweries soared by 9.64 per cent to N8.64.

On the flip side, Austin Laz lost 10.00 per cent to close at N1.62, ABC Transport crashed by 8.00 per cent to N1.15, Royal Exchange slumped by 7.69 per cent to 60 Kobo, Secure Electronic Technology plunged by 5.26 per cent to 54 Kobo, and The Initiates crumbled by 4.26 per cent to N2.25.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN