Economy

First Trading Session in 2022 on NGX Closes 0.73% Higher

By Dipo Olowookere

The first trading session in 2022 on the Nigerian Exchange (NGX) Limited closed positive on Tuesday, January 4, despite a negative investor sentiment.

Business Post reports that the market closed with 27 price losers and 18 price gainers led by Academy Press, which appreciated by 10.00 per cent to 55 kobo.

Wema Bank grew by 9.72 per cent to trade at 79 kobo, Cornerstone Insurance rose by 8.70 per cent to 50 kobo, Neimeth improved by 8.00 per cent to N1.89, while BUA Cement gained 7.31 per cent to close at N71.95.

Conversely, the trio of Ardova, Northern Nigerian Flour Mill and Vitafoam lost 10.00 per cent each to settle at N11.70, N7.20 and N20.25 respectively, while Chams depreciated by 9.09 per cent to 20 kobo, with Sunu Assurances losing 8.89 per cent to trade at 41 kobo.

However, when the market closed for the day, the All-Share Index (ASI) was up by 309.79 points to settle at 43,026.23 points compared with the previous 42,716.44 points, while the market capitalisation grew by 3.98 per cent or N1.9 trillion to N23.184 trillion from N21.297 trillion.

The industrial goods and banking sectors appreciated during the session by 2.97 per cent and 0.39 per cent respectively, while the consumer goods, energy and insurance counters went down by 0.92 per cent, 0.50 per cent and 0.43 per cent apiece.

A further look at the market data showed that the trading volume went down by 52.41 per cent to 216.7 million from 455.2 million, the trading value fell by 84.67 per cent to N1.5 billion from N9.9 billion, while the number of deals rose by 44.22 per cent to 4,080 deals from 2,829 deals.

Chams ended the day as the most traded stock with the sale of 29.9 million equities valued at N6.1 million as Wema Bank transacted 17.1 million stocks worth N13.3 million to claim the next post.

Zenith Bank exchanged 11.0 million shares for N278.2 million, Transcorp traded 10.8 million stocks valued at N10.5 million, while Sovereign Trust Insurance transacted 10.5 million equities for N2.9 million.

Economy

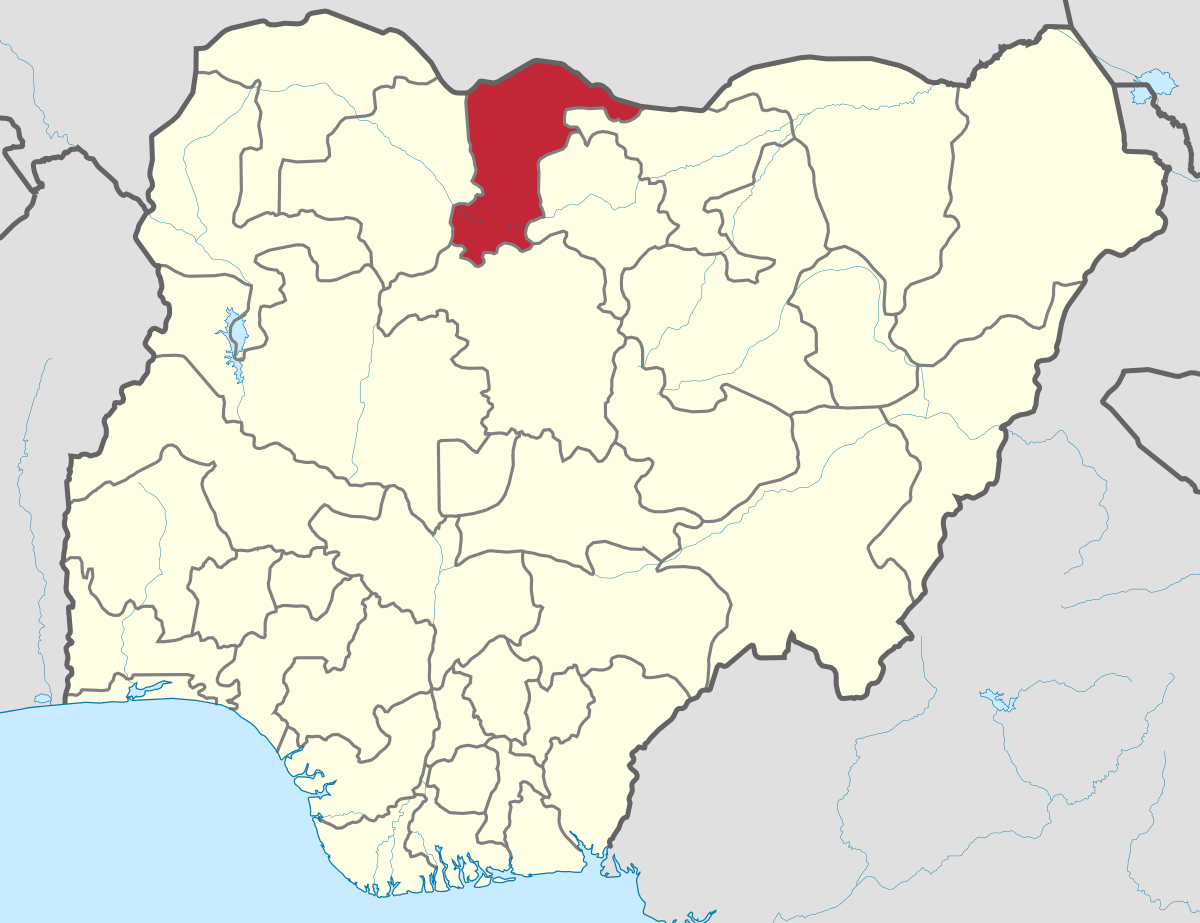

Katsina Provides Additional N500m for Women-owned Businesses

By Modupe Gbadeyanka

The Katsina State government has offered additional N500 million to support women-owned businesses in the state as part of efforts to boost economic activities.

Governor Dikko Umaru Radda announced this at the Women of Influence and Investment Summit hosted by the Katsina Inner Wheel Development Initiative (KIWDI), in partnership with Access Bank Plc.

The event brought together women entrepreneurs, investors, policymakers, and development partners to advance women’s economic empowerment in the state.

The summit, themed Where Influence Meets Investment, focused on positioning women as key drivers of enterprise, leadership, and inclusive growth. It also highlighted the growing collaboration between Access Bank and the Katsina State Government on financial inclusion and SME development.

Mr Radda noted that investing in women was critical to building a productive and sustainable economy.

In her welcome address, the founder of KIWDI, Ms Amina Zayyana, said the summit was designed to connect women to opportunities, training, finance, and markets, stressing that when women-led businesses grow, families and communities benefit.

On her part, the Group Head of Women Banking at Access Bank, Mrs Nene Kunle-Ogunlusi, said the lender was proud to partner with Katsina State and KIWDI in advancing women’s economic participation.

“At Access Bank, we are committed to moving women from potential to prosperity. Through our Women Banking proposition and the ‘W’ Initiative, we provide access to finance, capacity building, and market linkages that help women start, stabilise, and scale their businesses,” she said.

She noted that the W Initiative, launched in 2014, is Access Bank’s flagship women- focused platform, designed to meet the real needs of women entrepreneurs and professionals across Nigeria and Africa.

“Our partnership with Katsina State goes beyond banking. It is about supporting economic empowerment, SME growth, and financial inclusion, especially for women,” she added.

Mrs Kunle-Ogunlusi noted that Access Bank was proud to participate not just as a financial institution, but as a long-term partner in women’s economic advancement across Nigeria and Africa.

“At Access Bank, we made a deliberate decision to change that, not with charity, but with strategy. Not with sympathy, but with solutions. The W Initiative, which was launched in 2014, is Access Bank’s flagship women-focused proposition, created to respond to the real needs of women,” she said.

The banker disclosed that through the W Initiative, the bank has disbursed over N314 billion in loans to women, supporting over 3.6 million female loan beneficiaries, and helping women-owned businesses start, stabilise, and scale up.

Economy

2026 Budget: Reps Threaten Zero Allocation for SON, NAICOM, CAC, Others

By Adedapo Adesanya

The House of Representatives Public Accounts Committee (PAC) has recommended zero allocation for the Standards Organisation of Nigeria (SON), the National Insurance Commission (NAICOM), and the Corporate Affairs Commission (CAC), among others, in the 2026 budget for allegedly failing to account for public funds appropriated to them.

The committee, at an investigative hearing, accused the affected ministries, departments and agencies (MDAs) of shunning invitations to respond to audit queries contained in the Auditor-General for the Federation’s annual reports for 2020, 2021 and 2022.

The affected MDAs include the Federal Housing Authority (FHA), the Federal Ministry of Housing and Urban Development, the Federal Ministry of Women Affairs and Social Development, the National Business and Technical Examinations Board (NABTEB), and the Nigerian Meteorological Agency (NiMet).

Others are Federal University of Gashua; Federal Polytechnic, Ede; Federal Polytechnic, Offa; Federal Medical Centre, Owerri; Federal Medical Centre, Makurdi; Federal Medical Centre, Bida; Federal Medical Centre, Birnin Kebbi; Federal Medical Centre, Katsina; Federal Government College, Kwali; Federal Government Boys’ College, Garki, Abuja; Federal Government College, Rubochi; Federal College of Land Resources Technology, Owerri; Council for the Regulation of Freight Forwarding in Nigeria; and the FCT Secondary Education Board.

The PAC chairman, Mr Bamidele Salam, while speaking on the decision of the committee to recommend a zero budget for the defaulting MDAs, stated that the National Assembly should not continue to appropriate public funds to institutions that disregard accountability mechanisms.

“Public funds are held in trust for the Nigerian people. Any agency that fails to account for previous allocations, refuses to submit audited accounts, or ignores legislative summons cannot, in good conscience, expect fresh budgetary provisions. Accountability is not optional; it is a constitutional obligation,” he said.

The panel maintained that its recommendation for a zero budget for the affected MDAs is aimed at restoring fiscal discipline and strengthening transparency across federal institutions and conforms with extant financial regulations and the oversight powers of the parliament.

Economy

SEC, NOA to Sensitize Nigerians to Illegal Investment Schemes

By Adedapo Adesanya

The Securities and Exchange Commission (SEC) and the National Orientation Agency (NOA) have partnered to enlighten Nigerians on illegal investment schemes in Nigeria.

The director-general of SEC, Mr Emomotimi Agama, stated this during a meeting with his NOA counterpart, Mr Lanre Issa-Onilu, in Abuja on Thursday, according to a statement from SEC.

Mr Agama said the capital market is an available tool for national development, but beyond all that, there is a tendency for people to do the wrong things that will lead to the impoverishment of Nigerians.

According to him, these are not supposed to be, but many people fall victim due to a lack of knowledge. He stated that these schemes are springing up daily, and those involved are defrauding Nigerians, as people are always gullible because of the need to survive.

“As a management, we decided to move out to enlighten people; we cannot assume that people know, we need to go out for mass communication, hence this collaboration. It is only by co-operation that we can achieve the purpose of our existence,” he stated.

The SEC DG solicited the co-operation of the NOA to reach Nigerians because of its capacity and vast network of mass media, in a bid to ensure that the message reaches every nook and cranny of the country.

“This collaboration is important because it will go a long way in ensuring that Nigerians are no longer victims of these fraudulent schemes. We appreciate that you value this country, and we value the work that you do,” he added.

On his part, Mr Issa-Onilu commended the SEC for the capital market’s achievements in recent times, adding that the commission has not been celebrated enough.

“We commend you and thank you on behalf of the country, but most Nigerians are not aware of the opportunities in the capital market. An ignorant society will fall victim to many things that are avoidable. It is our responsibility to enlighten people to make the right decisions.

“We request that you provide information on what you do to enable us to propagate them. Our primary assignment is to serve all government institutions as the communications arm. We do a lot of enlightenment in places like the religious houses, motor parks, town halls, among others.”

Mr Issa-Onilu said the NOA engages in civic education to create the right values that will help most Nigerians be better citizens, saying that “many Nigerians are deficient in good behaviour. Both the Ponzi scheme promoters and those who patronise them are suffering from the wrong attitude and values.

“We have to encourage people to have the right attitude so they do not fall victim to Ponzi schemes. We have created a lot of platforms to interact with Nigerians.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn