Economy

IMF Insists Nigeria Must Raise Taxes, Adopt Unified FX Regime for Macroeconomic Stability

By Dipo Olowookere

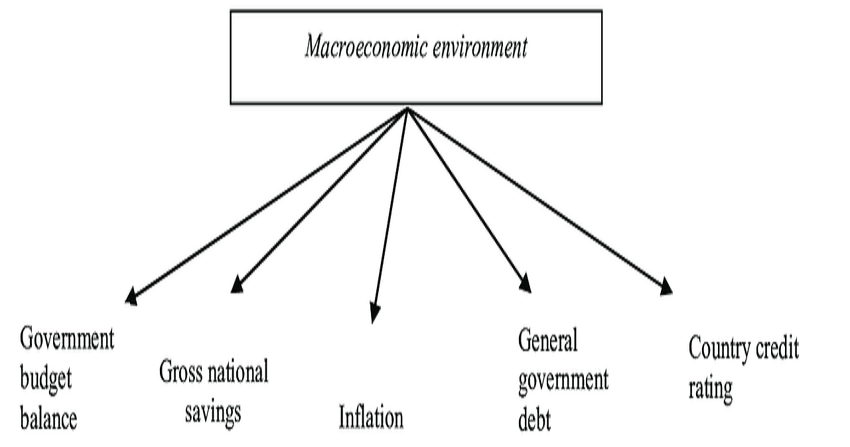

If Nigeria intends to achieve macroeconomic stability, it must take the bold step to put in place “decisive fiscal and monetary” policies, the International Monetary Fund (IMF) has declared.

These policies, according to the global lender, include increasing the tax rates, especially the value-added tax (VAT), from 7.5 per cent to double digits, adopting a single exchange rate regime, removing subsidies on petrol, and raising the benchmark interest rate to curb inflation, which is slightly above 21 per cent.

In a statement issued on Wednesday after the conclusion of its Executive Board’s consultation with Nigeria, the IMF said it was impressed with the growth recorded by the country’s economy after COVID-19 hit in 2020.

In the statement made available to Business Post, the IMF attributed this recovery to “favourable oil prices and buoyant consumption activities.”

“Nigeria’s economy has recouped the output losses sustained during the COVID-19 pandemic,” the organisation stated, praising the federal government for “containing and managing the COVID-19 infections.”

But it warned that “socio-economic conditions remain difficult” as a result of “higher domestic food prices, worsened the scarring effects of the pandemic, particularly on the most vulnerable—with Nigeria being among the countries with the lowest food security.”

“The near-term outlook faces downside risks, while there are upside risks in the medium term. Higher international food and fertilizer prices and continued widening of the parallel market premium could culminate in the de-anchoring of inflation expectations,” it said.

However, the IMF said if the country hopes to surmount these problems, the country must make “bold fiscal reforms to create needed policy space, [and] put public debt on sound footing” because high fuel subsidy costs have further widened “the general government fiscal deficit” in 2022.

The IMF “urged the authorities to deliver on their commitment to remove fuel subsidies by mid-2023 and increase well-targeted social spending.”

“Strengthening revenue mobilization, including through tax administration reforms, expanding the tax automation system and strengthening taxpayer segmentation, and improving tax compliance is also a priority.

“In the medium term, directors recommended modernizing customs administration, rationalizing tax incentives, and raising tax rates to the levels of the Economic Community of West African States (ECOWAS),” it also said after advising Nigeria last November to raise VAT to 15 per cent.

The body emphasised that the Central Bank of Nigeria (CBN) must further increase the policy rate if needed, and implement additional actions, including fully sterilizing central bank financing of fiscal deficits and phasing out credit intervention programs.

Last year, the bank raised the Monetary Policy Rate (MPR) by 5.00 per cent to 16.50 per cent in an attempt to bring down inflation, which moderated in December to 21.34 per cent. Last month, it further jerked the rate higher by 100 basis points.

Economy

Okitipupa Plc, Two Others Lift Unlisted Securities Market by 0.65%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange recorded a 0.65 per cent gain on Friday, December 13, boosted by three equities admitted on the trading platform.

On the last trading session of the week, Okitipupa Plc appreciated by N2.70 to settle at N29.74 per share versus Thursday’s closing price of N27.04 per share, FrieslandCampina Wamco Nigeria Plc added N2.49 to end the session at N42.85 per unit compared with the previous day’s N40.36 per unit, and Afriland Properties Plc gained 50 Kobo to close at N16.30 per share, in contrast to the preceding session’s N15.80 per share.

Consequently, the market capitalisation added N6.89 billion to settle at N1.062 trillion compared with the preceding day’s N1.055 trillion and the NASD Unlisted Security Index (NSI) gained 19.66 points to wrap the session at 3,032.16 points compared with 3,012.50 points recorded in the previous session.

Yesterday, the volume of securities traded by investors increased by 171.6 per cent to 1.2 million units from the 447,905 units recorded a day earlier, but the value of shares traded by the market participants declined by 19.3 per cent to N2.4 million from the N3.02 million achieved a day earlier, and the number of deals went down by 14.3 per cent to 18 deals from 21 deals.

At the close of business, Geo-Fluids Plc was the most active stock by volume on a year-to-date basis with a turnover of 1.7 billion units worth N3.9 billion, followed by Okitipupa Plc with the sale of 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.3 million units sold for N5.3 million.

In the same vein, Aradel Holdings Plc remained the most active stock by value on a year-to-date basis with the sale of 108.7 million units for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with a turnover of 297.3 million units worth N5.3 billion.

Economy

Naira Trades N1,533/$1 at Official Market, N1,650/$1 at Parallel Market

By Adedapo Adesanya

The Naira appreciated further against the United States Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N1.50 or 0.09 per cent to close at N1,533.00/$1 on Friday, December 13 versus the N1,534.50/$1 it was transacted on Thursday.

The local currency has continued to benefit from the Electronic Foreign Exchange Matching System (EFEMS) introduced by the Central Bank of Nigeria (CBN) this month.

The implementation of the forex system comes with diverse implications for all segments of the financial markets that deal with FX, including the rebound in the value of the Naira across markets.

The system instantly reflects data on all FX transactions conducted in the interbank market and approved by the CBN.

Market analysts say the publication of real-time prices and buy-sell orders data from this system has lent support to the Naira in the official market and tackled speculation.

In the official market yesterday, the domestic currency improved its value against the Pound Sterling by N12.58 to wrap the session at N1,942.19/£1 compared with the previous day’s N1,954.77/£1 and against the Euro, it gained N2.44 to close at N1,612.85/€1 versus Thursday’s closing price of N1,610.41/€1.

At the black market, the Nigerian Naira appreciated against the greenback on Friday by N30 to sell for N1,650/$1 compared with the preceding session’s value of N1,680/$1.

Meanwhile, the cryptocurrency market was largely positive as investors banked on recent signals, including fresh support from US President-elect, Mr Donald Trump, as well as interest rate cuts by the European Central Bank (ECB).

Ripple (XRP) added 7.3 per cent to sell at $2.49, Binance Coin (BNB) rose by 3.5 per cent to $728.28, Cardano (ADA) expanded by 2.4 per cent to trade at $1.11, Litecoin (LTC) increased by 2.3 per cent to $122.56, Bitcoin (BTC) gained 1.9 per cent to settle at $101,766.17, Dogecoin (DOGE) jumped by 1.2 per cent to $0.4064, Solana (SOL) soared by 0.7 per cent to $226.15 and Ethereum (ETH) advanced by 0.6 per cent to $3,925.35, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

Economy

Index Gains 0.63% as Value of Nigerian Exchange Crosses N60trn

By Dipo Olowookere

For the fourth consecutive trading session, the Nigerian Exchange (NGX) Limited closed higher on Friday by 0.63 per cent on sustained renewed buying pressure.

Apart from the energy and industrial goods sectors which closed flat, every other sector ended in the green territory, according to data obtained from the bourse.

Business Post reports that the insurance index appreciated by 1.52 per cent, the banking space improved by 0.63 per cent, and the consumer goods counter expanded by 0.46 per cent.

As a result, the All-Share Index (ASI) gained 617.47 points to settle at 99,378.06 points compared with the preceding day’s 98,760.59 points and the market capitalisation went up by 375 billion to close at N60.242 trillion, in contrast to Thursday’s closing value of N59.867 trillion.

The volume of transactions on Customs Street yesterday grew by 11.13 per cent to 544.2 million shares from the 489.7 million shares transacted a day earlier.

The value of transactions increased during the session by 49.30 per cent to N10.6 billion from N7.1 billion and the number of deals went up by 1.93 per cent to 8,464 deals from the 8,304 deals posted in the previous trading session.

The busiest equity for the trading day was Japaul with the sale of 71.7 million units valued at N158.0 million, eTranzact exchanged 70.7 million units worth N477.5 million, Tantalizers sold 57.3 million units for N101.2 million, FCMB traded 33.0 million units worth N297.3 million, and Universal Insurance transacted 27.1 million units valued at N9.6 million.

A total of 36 stocks ended on the gainers’ chart, while 15 stocks finished on the losers’ table, indicating a positive market breadth index and strong investor sentiment.

The trio of Aradel Holdings, Ikeja Hotel and Caverton gained 10.00 per cent each to trade at N550.00, N8.80, and N1.98, respectively, as Africa Prudential rose by 9.87 per cent to N17.25 and Golden Guinea Breweries soared by 9.64 per cent to N8.64.

On the flip side, Austin Laz lost 10.00 per cent to close at N1.62, ABC Transport crashed by 8.00 per cent to N1.15, Royal Exchange slumped by 7.69 per cent to 60 Kobo, Secure Electronic Technology plunged by 5.26 per cent to 54 Kobo, and The Initiates crumbled by 4.26 per cent to N2.25.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN