Economy

Kuda Urges Users to Upgrade App as Old Version Stops January 9

By Aduragbemi Omiyale

Customers of Kuda, a digital banking platform, have been advised to upgrade their mobile application to the latest version to enable them to enjoy the new features embedded in the app.

A statement from the company said the additions to the recently upgraded app make it easier for users to have more access to financial products and services, including investments and UK-to-Nigeria transfers.

It said the newly-launched money app for Africans in Nigeria and the UK offers convenient, easy access to frictionless and affordable financial services for users as transactions can be done faster and seamlessly.

To enjoy the new service, an existing account holder have to upgrade their Kuda App via the Play Store or App Store on their smartphone to download the new version of the Kuda App.

Thereafter, customers need to sign in to the app with their registered email address and their old Kuda password once and then create a new password. Once this is done, the old version of the Kuda App will be disabled automatically, and the upgraded version with the new features will be installed.

New customers can also onboard by downloading the Kuda App from Play Store or App Store and register by following the registration prompts on the App.

It is important to note that the old app will no longer be supported after January 9, 2023, so updating/downloading the new App is crucial to have continued access to the Kuda range of services.

Some of the new features on the Kuda App are currently not available in the older app.

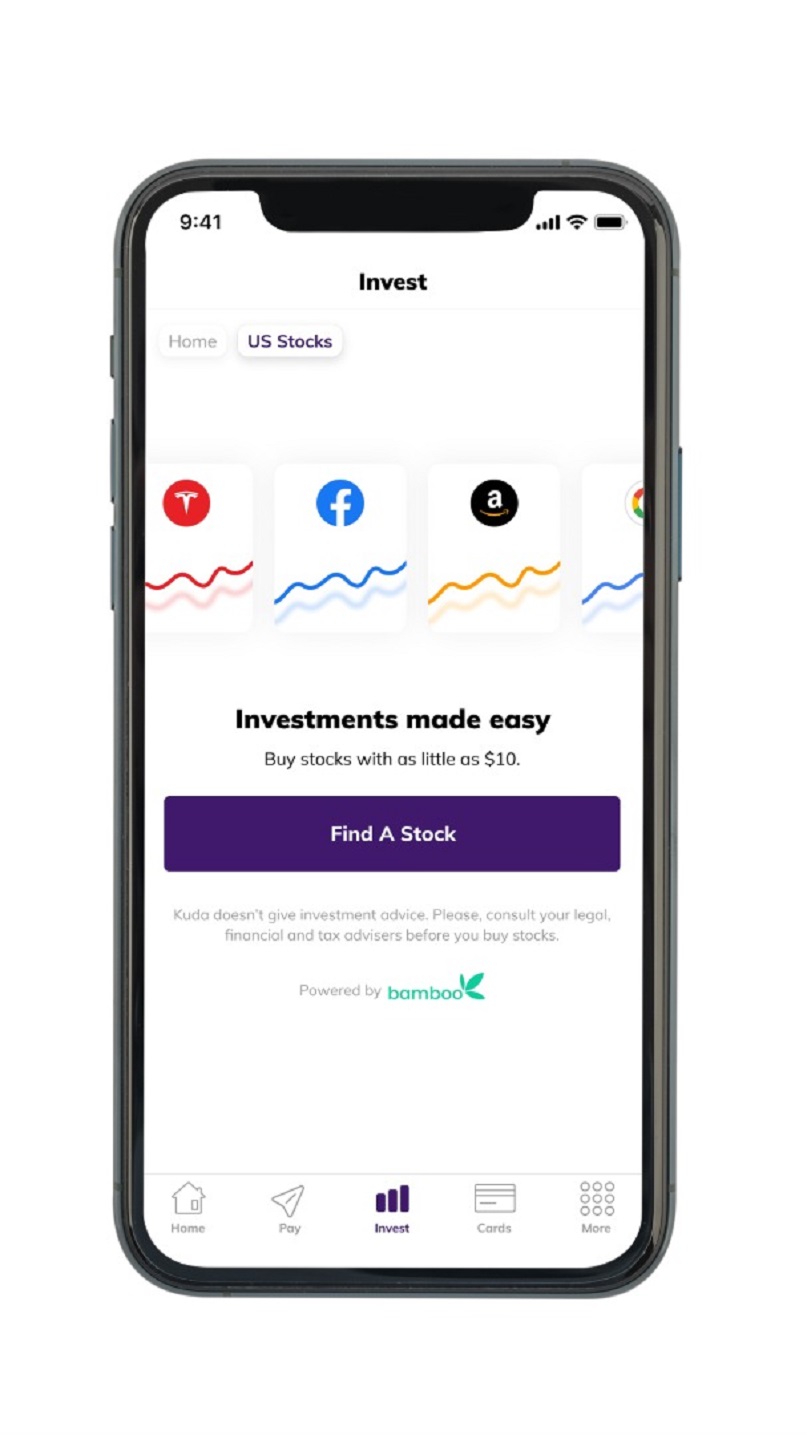

The new version offers users investment opportunities as those in Nigeria can now buy stocks in some of the world’s most successful companies and rising startups at a fraction of the usual cost. In a few minutes, customers can take a step away from local inflation toward financial freedom.

In addition, the new Kuda app makes it easier to save rainy days with Pockets. This is because the upgraded app makes the Spend+Save, a popular feature of the Kuda app, automatically save a preset fraction of card payments.

Furthermore, the new app is a straightforward UK account, as with a valid government-issued UK ID and proof of a UK address, anyone in the UK can open a Kuda UK account to send money to any UK bank account (and receive money) directly.

Lastly, Kuda users in the UK can also send up to £10,000 to Nigeria daily at a transaction fee of just £3, and their Nigerian beneficiaries can receive the money as a transfer or pick up cash at one of several banks in Nigeria.

Economy

Nigeria Posts N5.17trn Surplus as Trade Value Falls to N36.02trn in Q1 2025

By Adedapo Adesanya

Nigeria recorded a trade surplus of N5.17 trillion in the first quarter of 2025, according to the National Bureau of Statistics (NBS) in its latest Foreign Trade in Goods Statistics report.

This affirmed that the country’s exports rose faster than imports for yet another quarter.

The report showed that the country’s total merchandise trade stood at N36.02 trillion in the period under review, higher than the N33.93 trillion recorded in the corresponding period of 2024 by 6.19 per cent, but lower than the N36.60 trillion achieved in the previous quarter by 1.58 per cent.

Total exports were valued at N20.60 trillion, accounting for 57.18 per cent of total trade. This represents a 7.42 per cent increase from ₦19.18 trillion recorded in the first quarter of 2024 and 2.92 per cent higher than the N20.01 trillion posted in the fourth quarter of 2024.

Meanwhile, imports came in at N15.43 trillion during the period, 4.59 per cent more than the N14.75 trillion recorded in the corresponding quarter of 2024, but 7.02 per cent lower than the N16.59 trillion of the preceding quarter.

The NBS report showed that Nigeria’s export trade continued to be dominated by crude oil, which was valued at N12.96 trillion and accounted for about 62.89 per cent of total exports, while non-crude oil exports were valued at N7.64 trillion, representing 37.11 per cent of total exports, and non-oil products contributed N3.17 trillion or 15.38 per cent of the export value.

The NBS noted that India, the Netherlands, the United States, France and Spain were Nigeria’s major export partners during the quarter.

On the import side, China remained Nigeria’s largest trading partner, followed by India, the United States, the Netherlands and the United Arab Emirates.

Major commodities exported during the period included crude oil, liquefied natural gas, petroleum gases, urea and cocoa beans, while key imports included gas oil, motor spirit, crude petroleum oils, cane sugar for refining and durum wheat.

The stats office added that the country’s positive trade balance rose by more than 50 per cent compared with the previous quarter, reflecting a stronger export performance

Economy

Tinubu Writes Senate to Confirm Oyedele as Minister, Magnus Abe as NUPRC Chair

By Adedapo Adesanya

President Bola Tinubu on Tuesday asked the Senate to screen and confirm Mr Taiwo Oyedele as the Minister of State for Finance, to replace Mrs Doris Uzoka-Anite.

The President made the request through a letter read on the floor of the Senate by the Senate President, Mr Godswill Akpabio, after a three-week recess for the budget defence exercise.

The request was subsequently referred to the Committee of the Whole for further legislative consideration.

President Tinubu also sought the confirmation of Mr Magnus Abe as Chairman of the Nigeria Upstream Petroleum Regulatory Commission (NUPRC), alongside two commissioner nominees.

The Senate President also read another letter from the President seeking confirmation of Mr Mainasara Illo as Chief Executive Officer (CEO) of the Nigeria Anti-Doping Centre. The nomination was referred to the Senate committees on Narcotics and Drugs and Sports for joint screening.

Another letter from Mr Tinubu sought confirmation of Mr Francis Ifeanyi Asogwa as a commissioner representing the South-East in a federal commission. The nomination was referred to the Senate Committee on Judiciary, Human Rights, and Legal Matters for screening.

The Senate also received requests from the President to confirm two nominees as commissioners of the Revenue Mobilisation Allocation and Fiscal Commission: Mrs Amina Gamawa from Bauchi State and Mr Abdullahi Murktar from Kaduna State.

All nominations have been referred to the relevant committees for further legislative action and screening.

The nomination of the former fiscal policy partner and Africa tax leader at PriceWaterhouseCoopers (PwC) as minister was announced in a statement by presidential spokesperson, Mr Bayo Onanuga, last week.

Mrs Uzoka-Anite will now move to the Ministry of Budget and National Planning, as the Minister of State, her third portfolio in the administration, the presidential spokesman added.

The 50-year-old is a public policy expert, an accountant, and an economist.

He attended Yaba College of Technology and bagged a Higher National Diploma (HND) in accountancy and finance.

Mr Oyedele also earned a BSc in applied accounting from Oxford Brookes University.

The Senate also received the 2026 statutory budget of the Federal Capital Territory Administration (FCTA) from President Tinubu for consideration and approval.

Economy

Beta Glass Rejigs Board to Drive Next Phase of Innovation, Growth

By Aduragbemi Omiyale

The board of Beta Glass Plc has been reorganised, with the addition of four new executives, who will help to drive the company’s next phase of innovation and growth.

In a statement, Beta Glass announced the appointments of four non-executive directors, who are Mr Nitin Kaul, Ms Olusola Carrena, Mr Bolaji Olatunbosun Osunsanya, and Mr Boye Olusanya.

They are replacing the departing Mr Emmanouil Metaxakis, Mr Vassilis Kararizos, Mr Serge Joris, and Mr Gagik Apkarian from the board.

Their appointments, however, are subject to the ratification of the shareholders of the organisation at the next Annual General Meeting (AGM) on June 26, 2026.

Mr Kaul brings to the team over 25 years of global experience in strategy, mergers and acquisitions, restructuring, and business transformation across developed and emerging markets. He is a Partner, Portfolio Operations and member of the Executive Committee at Helios Investment Partners. Prior to joining Helios, he co-founded a boutique advisory firm focused on M&A and operational improvement for private businesses. He previously served as President of diversified industrial and aftermarket businesses at Gates Corporation, where he

was part of the executive team that led its sale to Blackstone in 2014. Earlier in his career, he held senior leadership roles at Tomkins and began his professional journey at Arthur Andersen. He currently serves on the boards of several companies across emerging markets.

As for Ms Carrena, she is a highly respected financial services leader with over 23 years of experience across investment banking, private equity, and corporate finance in Africa. She serves as Managing Director (Nigeria) on the Investment Team at Helios Investment Partners, where she oversees deal origination, execution, exits, and portfolio management across sectors. Before this, she spent a decade at Stanbic IBTC Capital Limited, rising to Executive Director and Head of Corporate Finance. During her tenure, she led and closed over 30 transactions valued at more than $4 billion across diverse industries, including oil and gas, FMCG, financial services, infrastructure, and healthcare. A CFA Charterholder, she holds a Master’s degree from the University of Alberta and a First-Class degree from the University of Lagos.

For Mr Osunsanya, he is an accomplished CEO, investor, and governance leader with more than 35 years of experience spanning energy, finance, and infrastructure. He previously served as Group CEO of Axxela Ltd., where he led strategic restructuring and significant value growth initiatives. Earlier, he held executive leadership roles at Oando PLC and Access Bank Plc, contributing to business transformation, governance strengthening, and sustainable expansion. He has served on the boards of several publicly listed and private companies, providing oversight in areas of strategy, audit, risk, and corporate governance, and remains an influential voice in Nigeria’s energy and financial sectors.

On the part of Mr Olusanya, he is a transformative business leader with over three decades of cross-industry experience spanning engineering, telecommunications, manufacturing, and agribusiness. He currently serves as chief executive of Flour Mills of Nigeria Plc, where he is leading a strategic transformation agenda focused on value chain integration, sustainability, and digital innovation. He previously served as Chief Executive Officer of 9mobile and as Chief Transformation Officer at Dangote Industries Limited, driving enterprise-wide restructuring and operational efficiency programs. He also served as Group Operating Partner at Helios Investment Partners, overseeing performance optimisation across portfolio companies. In addition, he is Vice Chairman of the Nigerian Economic Summit Group, contributing to national economic policy dialogue and private-sector development.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn