Economy

Nigeria—No be Juju be this?

By Prince Charles Dickson PhD

This is not just primitive rural superstition; [juju] is practised by all kinds of people, from illiterate herd boys to multi-degreed university professors. If you don’t understand the power of this belief, you will never truly grasp the rich albeit often incomprehensible spirituality of Africa. Lawrence Anthony, The Elephant Whisperer.

Nobody respects the law of Nigeria. Judges don’t. Police don’t. Lawyers don’t. Politicians don’t. Citizens don’t. Why? Because there are no consequences. Those who fear the laws are the downtrodden who have no godfathers. That is why stealing a goat is more dangerous than stealing billions. Nigeria is a country of absurdities. J. S. Okutepa. (SAN)

No be juju be this…

So, wetin be or what is juju?

juju; plural noun: jujus.

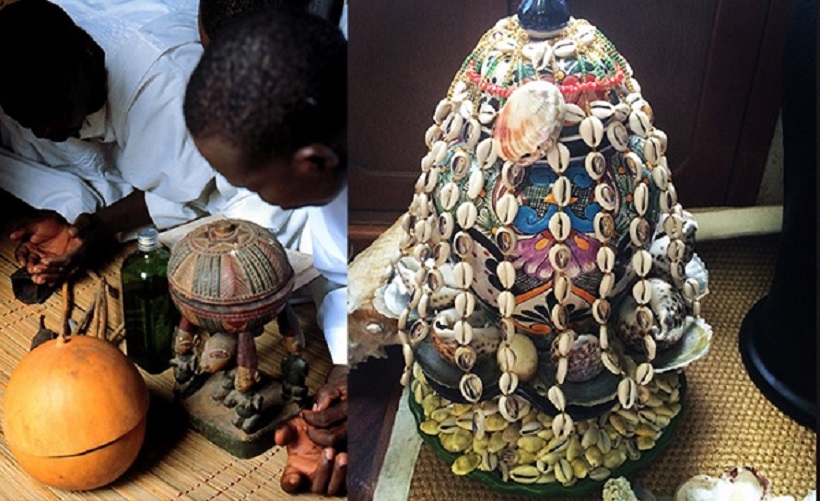

A charm or fetish, especially of a type used by some West African peoples. Supernatural power attributed to a charm or fetish. “Juju and witchcraft”.

Juju, an object that has been deliberately infused with magical power or the magical power itself; it also can refer to the belief system involving the use of juju. Juju is practised in West African countries such as Nigeria, Benin, Togo, and Ghana, although its assumptions are shared by most African people.

Juju comes from the traditional African religion popularly known as voodoo. Juju refers specifically to objects used in conjunction with spells or curses, and like any practice or belief, it can be manipulated to create power over people.

Witches and juju things are absolutely fascinating—they can fly on broomsticks, do magic spells with their wands and stir up incredible potions in their cauldrons. They can ask for and do the unimaginable. In Nigeria, it is just about the unthinkable things they can and cannot do or are held liable for doing or not allowing to happen.

The Harry Potter books for example have made witches (and wizards) really cool recently – who wouldn’t want to be as smart as Hermione Granger, as brave as Ginny Weasley or play Quidditch as well as Cho Chang? However, in Nigeria, it is about child rights abuse and killings.

This admonition is not about juju or witchcraft but it is about juju and the witchcraft ‘worrying’ Nigeria. Kindly follow me for the next few paragraphs and then we can share thoughts.

Almost eight years and the government could not get one refinery working at full capacity, providing employment and serving Nigerians in a land blessed with the resources. A nation of all typologies of expertise in the oil sector and still cannot simply have an agreement on whether there is subsidy or not and what to do with it—no be juju be that!

Police follow PHCN abi DisCo officials to disconnect electricity from another police station. Meanwhile, DisCo is indebted to the Water Board and the Water Board is indebted to local contractors that supply purifying chemicals and the contractors cannot pay local tax because they are indebted to the local electrician who repairs household electronics destroyed as a result of terrible electricity current supplied to homes. We have changed names, balkanized the utility company, privatized it, funded it yet the energy problem persists, it is one hellish vicious cycle—No be juju be that!

How many times have you seen policemen wear protective gloves, or collect forensic evidence? Do we have a data bank? A country of different data capture for NIN, another for driver’s licence, another for BVN, even another set of data for ‘unavailable’ Nigerian passports (printed in another country). Yet, there’s ‘no-go-to’ data bank, wait…have you seen a desktop in a local police station, not-to-talk of a laptop, apart from the ‘big boys’—No be juju be that!

We close factories to build places of worship and then pray for jobs, every national celebration has an interdenominational service and Juma’at prayers as accompaniment, yet we are a religiously wicked people. Every Christian with his personal juju-man, and every Muslim her own ‘boka-man’. We do interfaith prayers at official events, meetings and steal afterwards, and then do thanksgiving; saying ‘na God ooo’—No be juju be that!

A government official builds a hospital and calls it world-class, and yet he goes to another country for healthcare. They commission schools they describe as world-class and yet they are kids, are schooling in puppet colleges in other climes. They live in villages and build castles in the US, and beg these dudes for aid and loans—no be juju be that!

We are venting on power relations across balance of the geographical spread called Nigeria. In other words, we want power to go the South, the North has had its share, we are talking Muslim-Muslim ticket, and can’t say Christian-Christian ticket. No one is talking about the Ogboni-Krishna ticket.

Sadly, we are stuck with if the President is from here the Vice must be from there in the only nation with the aberrations such as South-South, North East, North West, South East and too many juju-like political expediency laced necessities such as federal character, catchment area, indigene and non-indigene, educationally disadvantaged; still no way, In fact, historically, we have no history so we cannot agree on who is at fault or what the solution is—No be juju be that!

Who remembers in 2015, the Witches and Wizards Association of Nigeria (WITZAN) announced that it had endorsed Goodluck Jonathan as its candidate for the 2015 presidential election.

“We just held a meeting of witches in Kogi State where it was revealed to me that Jonathan would win the presidential election. He has the support of all witches to continue in office,” said a certain Dr Iboi, the President of the association.

Well, we can see that WITZAN’s pick ended up not winning the race. The following year, WITZAN made a cry for help, as the association released a statement for Nigerians to stop persecuting them, we are waiting for them towards 2023—no be juju be that!

Last week in the news, brother and mother colluded to murder a sibling. Another son attempted to kill his mother. Young lads ate their ‘poo’ in public and in the same week, three lads, the oldest being 20, beheaded the girlfriend of one of them, all for money ritual. A trend that has seen a scary rise in the last two years, and being the pretentious people that we are, acting like it’s new, only a few years back it was ‘panties stealing’ and till date, nobody has been arrested, prosecuted, convicted, and jailed—no be juju be that!

Our Federal Road Safety Corps Officers only work during the day and close by 5:00 pm and the roads can be left unsafe at night. Nigerians cannot be ‘de-jujulized’ by praying, by big grammar, by protests, the juju has to be engaged, the gatekeepers of power and resources in Nigeria are not up to 5000 but their juju is strong and is holding the nation down.

It is a sad reality that 2023 really does not offer much if we refuse to address the witchcraft that has beset the motherland if we refuse to see that all is not well and keep behaving like a bewitched people, a big storm is not far away, and if we don’t act, the disaster that looms—Only time will tell.

Economy

Customs Oil and Gas Free Trade Zone in Rivers Collects N53.98bn Revenue

By Adedapo Adesanya

The Nigeria Customs Service (NCS) Oil and Gas Free Trade Zone Command in Rivers State says it has achieved a record-breaking revenue collection of N53.98 billion between January and November 2024, exceeding its annual target by 2.3 per cent and nearly doubling the N26.80 billion generated in 2023.

This was disclosed by the Customs Area Controller, Oil and Gas Free Trade Zone, Onne, Comptroller Seriki Usman, during a press briefing at the command’s headquarters, where he attributed the success to strategic collaboration with stakeholders, operational efficiency, and a focus on regulatory compliance.

He said, “A notable achievement of the command was its record-breaking revenue collection of N53.98 billion. This figure represents a 2.3 per cent increase over our annual target for 2024 and a remarkable 98.6% rise compared to the N26.80 billion collected in 2023.

“Our record-breaking revenue underscores the importance of effective trade facilitation and regulatory compliance. This achievement reflects the commitment of our officers, the collaboration with stakeholders, and the critical role of the Oil and Gas Free Trade Zone in driving Nigeria’s economic growth,” he said.

He explained that the Command successfully facilitated the export of key products such as refined sugar, fertiliser, liquefied natural gas, LNG, and crude oil from major facilities, including Bundu Sugar Refinery, Notore Chemical PLC, and Bonny Island.

“The seamless management of imports and exports within the free trade zone has enhanced operations for licensed enterprises,” he noted.

Speaking on the significance of these achievements, Comptroller Usman emphasized the need to maintain the momentum.

“This accomplishment is not just about numbers but about fostering trade growth, innovation, and creating a conducive environment for businesses to thrive within the free trade zone.”

On regulatory compliance, Comptroller Usman reassured Nigerians of the Command’s commitment to ensuring adherence to international trade regulations while fostering economic progress.

“Our focus remains on enhancing service delivery, promoting ease of doing business, and driving revenue generation that supports the nation’s development goals,” he said.

The command emphasized that collaboration with stakeholders, particularly the Oil and Gas Free Trade Zone Authority, has been pivotal in achieving these milestones, and called for continued partnership to sustain trade growth and improve service delivery.

As the year comes to a close, the command has reiterated its resolve to solidify its role as a critical revenue driver and trade facilitator in Nigeria’s oil and gas sector.

Mr Usman said the performance reflects the command’s vital role in strengthening Nigeria’s non-oil revenue base and its determination to remain a key player in the country’s economic transformation efforts.

“We remain committed to sustaining our achievements, fostering trust among stakeholders, and contributing significantly to the nation’s economic growth,” Comptroller Usman concluded.

Economy

FAAC Disburses 1.727trn to FG, States Local Councils in December 2024

By Modupe Gbadeyanka

The federal government, the 36 states of the federation and the 774 local government areas have received N1.727 trillion from the Federal Accounts Allocation Committee (FAAC) for December 2024.

The funds were disbursed to the three tiers of government from the revenue generated by the nation in November 2024.

At the December meeting of FAAC held in Abuja, it was stated that the amount distributed comprised distributable statutory revenue of N455.354 billion, distributable Value Added Tax (VAT) revenue of N585.700 billion, Electronic Money Transfer Levy (EMTL) revenue of N15.046 billion and Exchange Difference revenue of N671.392 billion.

According to a statement signed on Friday by the Director of Press and Public Relations for FAAC, Mr Bawa Mokwa, the money generated last month was about N3.143 trillion, with N103.307 billion used for cost of collection and N1.312 trillion for transfers, interventions and refunds.

It was disclosed that gross statutory revenue of N1.827 trillion was received compared with the N1.336 trillion recorded a month earlier.

The statement said gross revenue of N628.972 billion was available from VAT versus N668.291 billion in the preceding month.

The organisation stated that last month, oil and gas royalty and CET levies recorded significant increases, while excise duty, VAT, import duty, Petroleum Profit Tax (PPT), Companies Income Tax (CIT) and EMTL decreased considerably.

As for the sharing, FAAC disclosed that from the N1.727 trillion, the central government got N581.856 billion, the states received N549.792 billion, the councils took N402.553 billion, while the benefiting states got N193.291 billion as 13 per cent derivation revenue.

From the N585.700 billion VAT earnings, the national government got N87.855 billion, the states received N292.850 billion and the local councils were given N204.995 billion.

Also, from the N455.354 billion distributable statutory revenue, the federal government was given N175.690 billion, the states got N89.113 billion, the local governments had N68.702 billion, and the benefiting states received N121.849 billion as 13 per cent derivation revenue.

In addition, from the N15.046 billion EMTL revenue, FAAC shared N2.257 billion to the federal government, disbursed N7.523 billion to the states and transferred N5.266 billion to the local councils.

Further, from the N671.392 billion Exchange Difference earnings, it gave central government N316.054 billion, the states N160.306 billion, the local government areas N123.590 billion, and the oil-producing states N71.442 billion as 13 per cent derivation revenue.

Economy

Okitipupa Plc, Two Others Lift Unlisted Securities Market by 0.65%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange recorded a 0.65 per cent gain on Friday, December 13, boosted by three equities admitted on the trading platform.

On the last trading session of the week, Okitipupa Plc appreciated by N2.70 to settle at N29.74 per share versus Thursday’s closing price of N27.04 per share, FrieslandCampina Wamco Nigeria Plc added N2.49 to end the session at N42.85 per unit compared with the previous day’s N40.36 per unit, and Afriland Properties Plc gained 50 Kobo to close at N16.30 per share, in contrast to the preceding session’s N15.80 per share.

Consequently, the market capitalisation added N6.89 billion to settle at N1.062 trillion compared with the preceding day’s N1.055 trillion and the NASD Unlisted Security Index (NSI) gained 19.66 points to wrap the session at 3,032.16 points compared with 3,012.50 points recorded in the previous session.

Yesterday, the volume of securities traded by investors increased by 171.6 per cent to 1.2 million units from the 447,905 units recorded a day earlier, but the value of shares traded by the market participants declined by 19.3 per cent to N2.4 million from the N3.02 million achieved a day earlier, and the number of deals went down by 14.3 per cent to 18 deals from 21 deals.

At the close of business, Geo-Fluids Plc was the most active stock by volume on a year-to-date basis with a turnover of 1.7 billion units worth N3.9 billion, followed by Okitipupa Plc with the sale of 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.3 million units sold for N5.3 million.

In the same vein, Aradel Holdings Plc remained the most active stock by value on a year-to-date basis with the sale of 108.7 million units for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with a turnover of 297.3 million units worth N5.3 billion.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN