Economy

NSE Eyes 2020 for Demutualization, Writes SEC for No Objection

By Adedapo Adesanya

The Nigerian Stock Exchange (NSE) has reiterated its commitment to becoming a demutualized exchange very soon. This disclosure was made by the National Council President of the Nigerian Stock Exchange, Otunba Abimbola Ogunbanjo, in an exclusive chat with Business Post on Monday, September 30, 2019.

Mr Ogunbanjo expressed his desire to ensure that the exchange was listed on its trading platform, allowing many Nigerians to be part of the organisation, which is said would be a good development.

In his chat with us, he said with the progress being made, this long-awaited demutualisation should happen in 2020, noting that the process was in an advanced stage.

He said, “By this time next year, we will be a demutualized exchange and we will be making good money for the people of Nigeria.”

He, however, noted that this was subject to the approval of members at a meeting, hinting that this could hold anytime soon.

“Hopefully, in the next coming weeks we will take another meeting to get our members to approve the new entity called Nigerian Stock Exchange Limited,” he said.

He expressed hopes that the exchange could make it pass the hurdle that has been holding the exchange from listing its shares.

Also, on Monday, at the 58th Annual General Meeting (AGM) of NSE in Lagos, CEO of the exchange, Mr Oscar Onyema, noted that the exchange had made significant progress as regard its demutualization.

“We have gone ahead, completed and submitted the documentation to the Securities and Exchange Commission (SEC) for the no-objection.

“When we get approval for the no-objection, we will have a meeting with members to get their final vote and when we get their final vote, we then resubmit a formal application to the SEC to complete the demutualization process.

He also said the exchange will be registered appropriately with the Corporate Affairs Commission (CAC).

Business Post reports that in late 2018, President Muhammadu Buhari signed into law the bill to demutualise the stock exchange.

The demutualisation of the nation’s bourse allows it to be publicly quoted, opening up the capital market and as well make it conform to global best practices and more attractive to investors.

Economy

Nigeria Repays $3.4bn COVID-19 Loan to Exit IMF Debtor List

By Adedapo Adesanya

The International Monetary Fund (IMF) has removed Nigeria from its Total IMF Credit Outstanding list after repaying the $3.4 billion pandemic loan.

The global lender provided funding support to some countries after the COVID-19 pandemic in 2020, which crumbled the global economic and made some nations struggling to survive.

Nigeria was among the countries that relied on the IMF for funding support and it has repaid the loan, prompting the lender to remove its name from the debtors’ list.

The journey towards clearing this debt began in earnest in 2023, when the nation’s IMF debt stood at $1.61 billion, reaching $472 million by January 2025.

Commenting on the development, the Senior Special Assistant to the President on Digital Engagement and Strategy, Mr O’tega Ogra, described the clearance as a “strategic reset” for the nation’s financial policy.

He emphasized that this achievement is a reflection of the administration’s focus on fiscal discipline, long-term sustainability, and economic resilience.

“This milestone signals a new chapter for Nigeria, one marked by clarity, capacity, and fiscal responsibility.

“We are no longer defined by aid dependence but by our capacity to stand tall and manage our financial future on our terms,” Mr Ogra stated.

While Nigeria’s exit from the IMF’s debtor list is a symbolic moment of progress, Mr Ogra made it clear that the country would continue to engage with the IMF and other international partners, but now on a more proactive, strategic basis.

“Global partnerships remain essential, but we approach them from a place of strength, not dependency,” he added.

Economy

Nigeria Woos Norway on Debt Restructuring, Tax Transparency, Climate Finance

By Adedapo Adesanya

Nigeria has called for deeper collaboration with Norway in the areas of debt restructuring, tax transparency, and climate finance, as part of its broader strategy to unlock sustainable development opportunities through global partnerships.

According to a statement, this call was made by the Minister of State for Finance, Mrs Doris Uzoka-Anite, during a high-level bilateral meeting with the Norwegian Deputy Minister of International Development, Ms Stine Renate Håheim, held on the sidelines of the recent 2025 United Nations Meetings in New York.

Mrs Uzoka-Anite emphasized that Nigeria is prioritizing partnerships that can accelerate its economic reform agenda and climate resilience goals.

“We are actively seeking partners who understand the urgency of our development needs, especially in areas such as climate finance, debt restructuring, and tax cooperation,” she said.

She spoke on Nigeria’s interest in NORAD’s Energy for Development platform, which supports sustainable energy solutions across developing economies.

The Minister noted that Nigeria is eager to tap into the initiative to fast-track energy access and reduce emissions.

“Our energy transition plan aligns with global climate goals, and we believe collaboration under NORAD’s platform will be instrumental in delivering clean, affordable energy to millions of Nigerians,” she added.

The meeting also spotlighted the need for greater transparency in international tax cooperation frameworks.

“Improving tax transparency is critical to domestic resource mobilization. We welcome Norway’s support in helping us strengthen systems that fight illicit financial flows,” Mrs Uzoka-Anite stressed.

Ms Håheim acknowledged Nigeria’s regional importance and expressed readiness to explore areas of mutual interest, particularly in promoting inclusive growth and green development.

The statement added that the bilateral engagement reflects Nigeria’s diplomatic outreach at the 2025 UN Meetings, reinforcing its drive to forge strategic alliances that enhance governance, unlock financing for development, and boost resilience in the face of current global economic challenges.

Economy

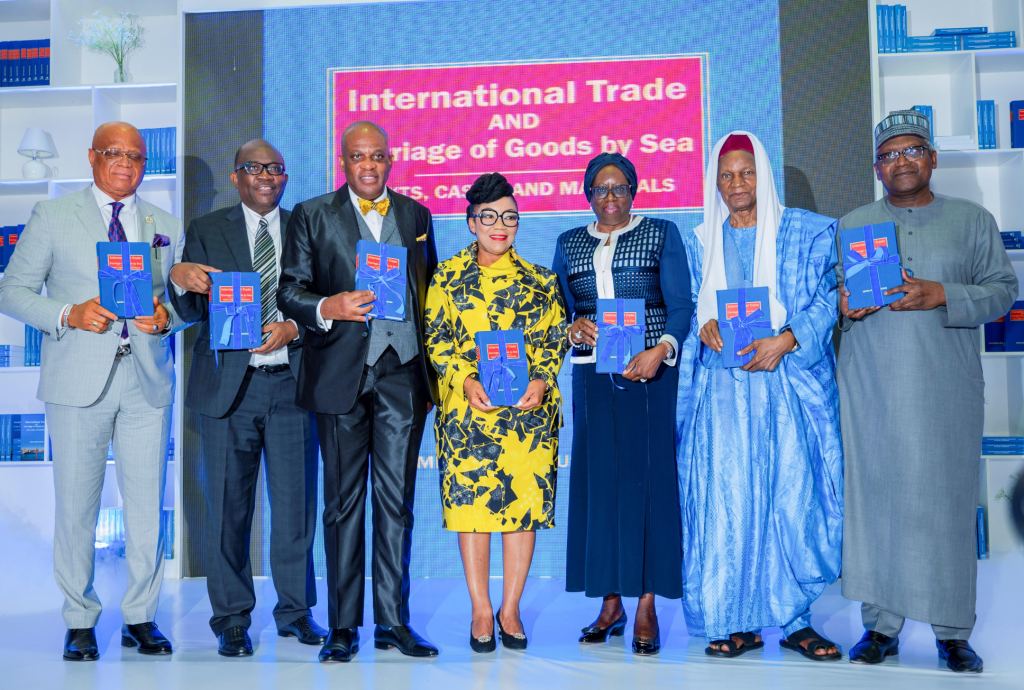

Usoro’s Maritime Law Book to Drive Judicial, Economic Reforms

By Modupe Gbadeyanka

Stakeholders have projected that the maritime law book authored by Mrs Mfon Ekong Usoro will drive judicial and economic reforms in Nigeria.

At the presentation of the book titled International Trade and Carriage of Goods by Sea: Text, Cases, and Materials in Lagos on Tuesday, the piece was described as a timely intervention to strengthen the country’s judicial processes and economic development, particularly in the area of international trade.

The book, which integrates both local and international legal standards, aims to serve as a reference point for legal professionals, regulators, financial institutions and participants in the trade and shipping industries.

The Chief Justice of Nigeria (CJN), Mrs Kudirat Kekere-Ekun, who wrote the forward, said the publication would serve as a foundational text that would enhance the judiciary’s capacity to resolve disputes related to trade and shipping efficiently.

She said the book presents a practical approach to interpreting legal issues around carriage contracts, cargo liabilities and dispute resolution under both local and international frameworks.

“By simplifying complex concepts through case studies, diagrams and statutory references, the book will strengthen the quality of judicial decisions and enhance legal education in this essential sector.

“This text is exactly what our legal system needs. It commands respect for local precedents while drawing on legal judgments from other jurisdictions, guiding our courts to a uniform approach and giving our practitioners the confidence to negotiate, mitigate and arbitrate across borders,” she said.

On his part, the president of the Dangote Group, Mr Aliko Dangote, described the book as essential for businesses operating in global trade.

“This is the kind of resource that improves certainty in commercial transactions and boosts confidence among business operators,” he stated, praising the author’s contribution to trade and legal practice in Nigeria.

The book reviewer, Mr Adedolapo Akinrele (SAN), described the text as a unique, structured resource, citing over 200 cases, extensive chapters and global conventions to illustrate key concepts in maritime and international trade law.

He emphasised its practicality and relevance to both seasoned professionals and new entrants in the legal and commercial sectors.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN