Economy

Union Bank to Boost 2021 Earnings, Cuts NPL Ratio to 4.0%

By Dipo Olowookere

Shareholders of the Union Bank of Nigeria (UBN) have been assured of more value for their investment in the financial institution.

This assurance was given by the outgoing Managing Director of Union Bank, Mr Emeka Emuwa. The banker will cease to head the lender from Thursday, April 1, 2021.

A few days ago, the bank released its audited financial statements for the year ended December 31, 2020, and in the period, it recorded sustained growth in key income lines and significantly improved fundamentals despite the constrained operating environment largely due to the impact of the COVID-19 pandemic.

Reason for good performance

Union Bank attributed this sterling performance to its investments in technology and progressive work culture over the past eight years.

The lender said these strategies enabled a swift response to the pandemic that allowed its workforce to transition to remote working while maintaining the productivity required to deliver this strong set of results in 2020.

Mr Emuwa assured that in 2021, shareholders should expect improved results as “the bank will focus on enhancing revenues and shareholder value by revving up customer acquisition, engagement and transactions through seamless customer journeys and an optimized service delivery platform.”

CEO on Union Bank 2020 Results

Commenting on the performance of the company in the previous financial year, Mr Emuwa, who has led the lender for eight years, stated that, “The bank has delivered a strong set of results notwithstanding the impact of COVID-19 on our operations and the wider economy, enabling the board of directors to continue to return value to shareholders with a proposed dividend payment for the second year in a row.

“This demonstrates the strong foundations we have built, as we continue to deliver against our target of becoming a leading financial institution in Nigeria.”

“For the full year, we grew across key income lines. Net income after impairments grew 8.3 per cent from N95.5 billion to N103.4 billion and translated into 2.8 per cent growth in profit before tax to N25.4 billion from N24.7 billion.

“The core of this performance is driven by the growth in our loan book, with a 23.8 per cent increase in gross loans to N736.7 billion from N595.3 billion in 2019.

“The pandemic accelerated trends in customer behaviour and we have seen a rapid increase in digital adoption with a 38 per cent year-on-year increase in active users on our UnionMobile channel with total active users now at 2.9 million.

“Our UnionOne and Union360 platforms for businesses grew by 11 per cent from 25,000 users to 27,700 users and 94 per cent of transactions in the bank are now done digitally, up from 89 per cent in 2019.

“We also aggressively grew UnionDirect (our agent network) by 6x from 3,100 to 18,100 in line with our focus on our retail business. With our investments yielding positive results, we are well-positioned as a strong leader in the retail and digital space.”

Concluding, he said, “As I retire, following eight years of rebuilding and repositioning this storied institution, I am convinced that with the excellent management team and a clear strategy in place, Union Bank is well-positioned to continue to compete and deliver value to its shareholders.”

Dividend recommended

In the period under consideration, Union Bank recommended the payment of 25 kobo as a dividend and this has spurred interest in the company’s equities at the stock market.

CFO speaks

In his reaction to the results, the Chief Financial Officer of Union Bank, Mr Joe Mbulu, expressed satisfaction with the “top and bottom-line performance in 2020, in light of the impact of the pandemic and economic challenges.”

According to him, “Significant inflationary pressures and the translation of currency depreciation drove growth in our cost base.

“However, we maintained strong control, limiting operating expense increase to 10 per cent (N77.9 billion from N70.8 billion), well below the rate of inflation. Consequently, we saw a marginal increase in our cost to income ratio to 75.4 per cent from 74.1 per cent.

“Our customer deposits hit a milestone during the year, crossing the N1 trillion mark to N1.131 trillion from N886.3 billion in FY 2019, an increase of 27.1 per cent.

“Low-cost deposits were up by 17 per cent, constituting 68 per cent of total deposits helping to push the cost of funds down by 1.4 per cent.

“We continued to proactively manage our growing risk asset portfolio and recorded better asset quality, with our NPL ratio improving from 5.8 per cent to 4.0 per cent. This achievement, combined with solid capital adequacy at 17.5 per cent and continued top-line growth, provides the platform for strong growth going forward.

“We will continue to grow our loan portfolio in 2021, which we expect to be a significant driver of growth, combined with our value chain synergies across our business which will drive customer and transaction growth during the year and beyond.

“Our UBUK subsidiary remains classified as Available for Sale as the sale process continues albeit delayed due to the pandemic-induced lockdowns.”

Economy

NEITI Backs Tinubu’s Executive Order 9 on Oil Revenue Remittances

By Adedapo Adesanya

Despite reservations from some quarters, the Nigeria Extractive Industries Transparency Initiative (NEITI) has praised President Bola Tinubu’s Executive Order 9, which mandates direct remittances of all government revenues from tax oil, profit oil, profit gas, and royalty oil under Production Sharing Contracts, profit sharing, and risk service contracts straight to the Federation Account.

Issued on February 13, 2026, the order aims to safeguard oil and gas revenues, curb wasteful spending, and eliminate leakages by requiring operators to pay all entitlements directly into the federation account.

NEITI executive secretary, Musa Sarkin Adar, called it “a bold step in ongoing fiscal reforms to improve financial transparency, strengthen accountability, and mobilise resources for citizens’ development,” noting that the directive aligns with Section 162 of Nigeria’s Constitution.

He noted that for 20 years, NEITI has pushed for all government revenues to flow into the Federation Account transparently, calling the move a win.

For instance, in its 2017 report titled Unremitted Funds, Economic Recovery and Oil Sector Reform, NEITI revealed that over $20 billion in due remittances had not reached the government, fueling fiscal woes and prompting high-level reforms.

Mr Adar described the order as a key milestone in Nigeria’s EITI implementation and urged amendments to align it with these reforms.

He affirmed NEITI’s role in the Petroleum Industry Act (PIA) and pledged close collaboration with stakeholders, anti-corruption bodies, and partners to sustain transparent management of Nigeria’s mineral resources.

Meanwhile, others like the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) have kicked against the order, saying it poses a serious threat to the stability of the oil and gas industry, calling it a “direct attack” on the PIA.

Speaking at the union’s National Executive Council (NEC) meeting in Abuja on Tuesday, PENGASSAN President, Mr Festus Osifo, said provisions of the order, particularly the directive to remit 30 per cent of profit oil from Production Sharing Contracts (PSCs) directly to the Federation Account, could destabilise operations at the Nigerian National Petroleum Company (NNPC) Limited.

Mr Osifo firmly dispelled rumours of imminent protests by the union, despite widespread claims that the controversial executive order threatens the livelihoods of 10,000 senior staff workers at NNPC.

He noted, however, that the union had begun engagements with government officials, including the Presidential Implementation Committee, and expressed optimism that common ground would be reached.

Mr Osifo, who also serves as President of the Trade Union Congress (TUC), expressed concerns that diverting the 30 per cent profit oil allocation to the Federation Account Allocation Committee (FAAC), without clearly defining how the statutory management fee would be refunded to NNPC, could affect the salaries of hundreds of PENGASSAN members.

Economy

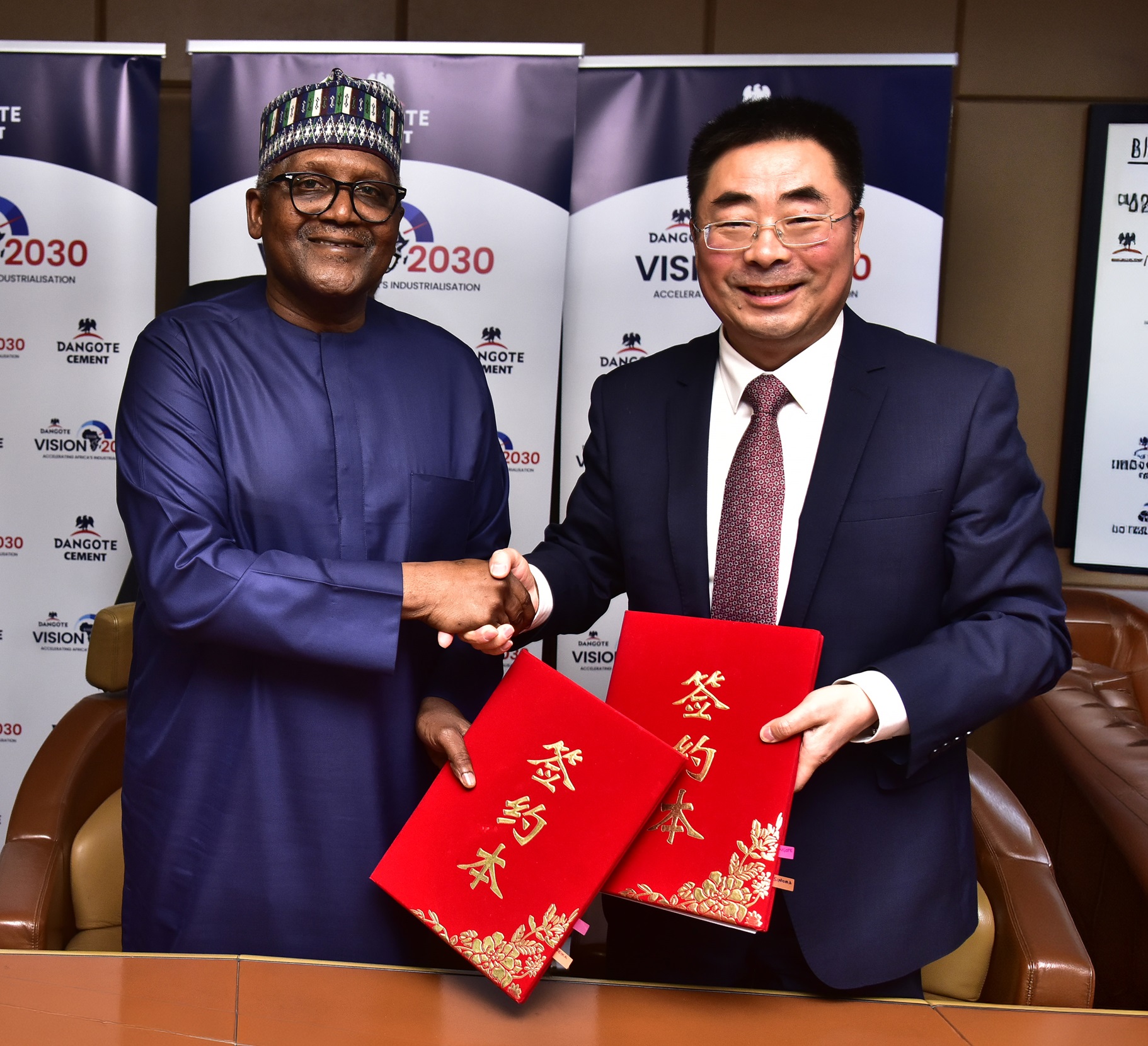

Dangote Cement Deepens Dominance, Export Activities With $1bn Sinoma Deal

By Aduragbemi Omiyale

To strengthen its domestic market dominance, drive its export activities, optimise existing operational assets and enhance production efficiency and capacity expansion, Dangote Cement Plc has sealed $1 billion strategic agreements with Sinoma International Engineering for cement projects across Africa.

The president of Dangote Industries Limited, the parent firm of Dangote Cement, Mr Aliko Dangote, disclosed that the deal reinforces the company’s long-term growth strategy and aligns with the broader aspirations of the Dangote Group’s Vision 2030.

According to him, Sinoma will construct 12 new projects and expand others for the cement organisation across Africa, helping to achieve 80 million tonnes per annum (MTPA) production capacity by 2030, while supporting the group’s overarching target of generating $100 billion in revenue within the same period.

Under the Strategic Framework Agreement, Sinoma will collaborate with Dangote Cement on the delivery of new plants, brownfield expansions, and modernisation initiatives aimed at strengthening operational performance across key markets.

The new projects include a new integrated line in Northern Nigeria with a satellite grinding unit, a new line in Ethiopia and other projects in Zambia/Zimbabwe, Tanzania, Sierra Leone and Cameroon. In Nigeria, Sinoma will also handle different projects in Itori, Apapa, Lekki, Port Harcourt and Onne.

The projects signal Dangote Cement’s sustained commitment to consolidating its leadership position within the African cement industry, while enhancing its competitiveness on the global stage.

Chairman of the Dangote Cement board, Mr Emmanuel Ikazoboh, during the agreement signing event in Lagos, explained that the new projects would enable the company to play a critical role in actualising Dangote Group’s Vision 2030.

The new projects, when completed, will increase Dangote Cement’s capacity and dominant position in Africa’s cement industry.

On his part, the Managing Director of Dangote Cement, Mr Arvind Pathak, said the agreement reflects the company’s determination to grow its investments across African markets to close supply gaps and support the continent’s infrastructural ambitions.

According to him, Dangote Cement is committed to making Africa fully self‑sufficient in cement production, creating more value and linkages, leading to increased economic activities and a reduction in unemployment.

Economy

Lokpobiri Begs Lawmakers to Reschedule Oil Revenue Executive Order Probe

By Adedapo Adesanya

A joint National Assembly probe into President Bola Tinubu’s new oil revenue executive order was stalled on Thursday following a request for more time by the Minister of Petroleum Resources, Mr Heineken Lokpobiri.

The hearing was convened to scrutinise the executive order directing that royalty oil, tax oil, profit oil, profit gas and other revenues due to the Federation under various petroleum contracts be paid directly into the Federation Account.

Mr Lokpobiri told lawmakers that although he attended out of respect for parliament, he had been notified of the hearing only a day earlier and had not obtained all the relevant documents needed to defend the policy adequately.

He appealed for the session to be rescheduled.

Co-chairman of the joint committee and Chairman of the Senate Committee on Gas, Mr Agom Jarigbe, put the request to a voice vote, and lawmakers approved the adjournment.

A new date is expected to be communicated to the minister.

The executive order signed last week also scrapped the 30 per cent Frontier Exploration Fund created under the Petroleum Industry Act (PIA) and discontinued the 30 per cent management fee on profit oil and profit gas previously retained by the Nigerian National Petroleum Company (NNPC) Limited.

Anchored on Sections 5 and 44(3) of the Constitution, the presidency said the directive was aimed at safeguarding oil and gas revenues, curbing excessive deductions and restoring the constitutional entitlements of federal, state and local governments to the

However, the order has sparked criticism within the industry, one of which was from the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN), whose president, Mr Festus Osifo, called for an immediate withdrawal of the order, warning that it could undermine the PIA and erode investor confidence.

Meanwhile, at another session, the Chairman of the Senate Committee on Finance, Senator Mohammed Sani Musa, disclosed that President Tinubu would soon transmit proposals to amend certain provisions of the PIA to align with current economic realities.

He noted that while many expect the executive order to boost revenue automatically, Nigeria has yet to achieve its desired income levels.

He did not specify which sections of the law would be targeted, but suggested that the drive to enhance revenue generation would necessitate legislative adjustments.

The PIA, signed into law in 2021 by the late ex-President Muhammadu Buhari, overhauled the governance, regulatory and fiscal framework of Nigeria’s oil and gas sector, commercialised the NNPC and restructured revenue-sharing arrangements.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn