Economy

Unveiling The Best Forex Traders In Nigeria: Who Tops The List In 2023?

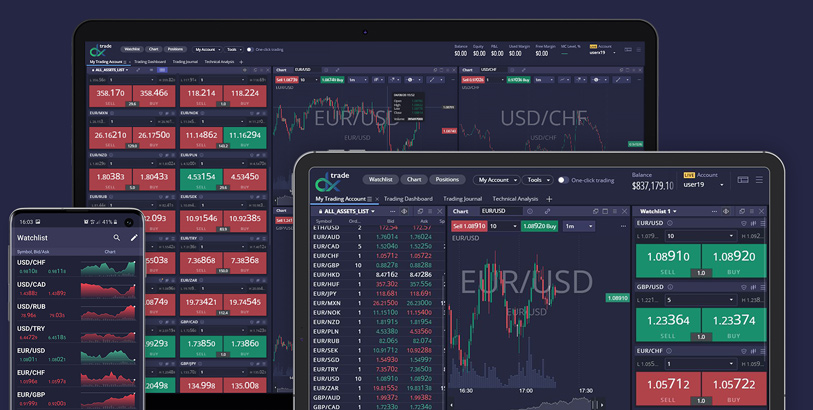

Forex trading has become a big deal in Nigeria over recent years, with many seeing it as a good way to make money. With Nigeria’s large population, there are a lot of people who might want to try their hand at it. Already, over two million Nigerians are involved in trading on this huge global market where trillions of dollars change hands daily. For those looking to get into it, following the lead of the best Forex traders in Nigeria can be super helpful. That’s why the folks at Traders Union (TU) have put together a list of the best Forex traders in Nigeria for you to check out.

Nigeria’s top Forex millionaires

TU’s experts have identified the big players in Nigeria’s Forex scene, and here’s a quick rundown:

- Uche Paragon – this top trader from Lagos is worth over $20 million and even runs his own trading businesses.

- Dapo Willis – a $10 million net worth and a connection with billionaire Aliko Dangote.

- Ejimi Adegbeye – young and talented, Ejimi started trading at 19 and now boasts $5 million to his name.

- Damilare Ogundare – also known as HabbyFX, Dami’s trading genius is worth a cool $5 million.

- Jeffrey Benson – this law graduate turned trader has a net worth of $1.5 million.

- Patrick Ogagbor – from bank worker to Forex pro, Patrick turned his $200 start to a current worth of $600,000.

If you’re inspired by Forex trading in Nigeria, these are the names to know!

Top tips for Forex’s success in Nigeria

To master Forex trading in Nigeria, check out a simple guide from the Syndicate’s experts to start your journey:

- Choose a regulated broker: it keeps your money safe and your trading honest.

- Practice first: use a demo account to refine your strategy without risks.

- Be wise with leverage: high leverage can mean big profits or big losses. Start low.

- Focus on major pairs: pairs like EUR/USD and USD/JPY are among the most traded and reliable.

- Set a stop-loss: decide beforehand how much you’re willing to lose on a trade and set an automatic exit point.

Remember, patience and smart strategies pave the way to Forex’s success!

Common beginner trading blunders

Stepping into the trading world? Here’s a quick heads-up! TU’s analysts have highlighted some typical slip-ups newbie traders often fall into:

- No clear plan – trading without a roadmap can lead you astray.

- Holding onto losses – don’t wait forever hoping the market will turn.

- Misusing leverage – it can boost profits but can also intensify losses.

- Ignoring risk-to-reward – always weigh if potential earnings justify the risks.

- Being overly emotional – letting feelings guide trades often leads to rash decisions.

Remember, everyone makes mistakes. The key is to learn from them and trade wisely!

Forex trading in Nigeria

Forex trading is allowed in Nigeria. But, experts at Traders Union point out that it’s not as regulated as one might hope. While the Central Bank of Nigeria keeps an eye on financial markets, online retail trading often slips through the cracks. This means traders need to be extra careful and watch out for dodgy brokers or scams.

Conclusion

Forex trading in Nigeria is a world where seasoned professionals like Uche Paragon and Ejimi Adegbeye have carved niches for themselves, setting standards for newcomers. But as with any high-reward venture, the risks are equally potent. TU, through its diligent analysts and experts, sheds light on both the promises and risks of Nigeria’s Forex market. From highlighting the champions of one to laying out foundational trading tips to sounding alarms on potential risks, the experts provide a comprehensive lens to navigate this dynamic domain. Aspiring traders would do well to heed this advice, ensuring they tread with caution and strategy, always prioritizing knowledge over impulse.

Economy

Quidax, Lisk to Unlock Stablecoins, On-chain Financial Opportunities

By Aduragbemi Omiyale

A partnership designed to expand access to stablecoins and on-chain financial opportunities for everyday users and businesses has been entered into between Quidax and Lisk.

The partnership provides a critical gateway for the developer community, as builders on the Lisk network can now leverage Quidax’s robust digital asset infrastructure to access stablecoins and local currencies at competitive rates.

This institutional-grade infrastructure is designed to power “future-forward” financial products, ranging from neobanks and cross-border payment platforms to regional exchanges and global fintech solutions. It will also allow Quidax customers to trade and move value seamlessly using USDT, USDC, LSK, and Ether (ETH) on the Lisk network.

The collaboration will also accelerate the adoption of Web3 solutions that solve real-world financial challenges for millions of customers across Africa by combining Quidax’s deep local liquidity and compliant framework with Lisk’s scalable L2 technology.

In 2024, Quidax became the first crypto exchange to receive a provisional operating license from Nigeria’s Securities and Exchange Commission (SEC).

“The partnership with Lisk enables us to extend our platform to serve more people and cater to the increasing demand from products and services that want to integrate our stablecoin and digital assets product to build products across Africa,” the Chief Infrastructure Officer at Quidax, Mr Morris Ebieroma, said.

Also commenting, the Ecosystem Lead for Africa at Lisk, Ms Chidubem Emelumadu, said, “Africa represents one of the most critical frontiers for blockchain innovation, where the demand for reliable and inclusive financial tools is urgent.

“Our partnership with Quidax expands access to stablecoins and on-chain financial opportunities for everyday users and businesses. At the same time, it gives founders building on Lisk the critical infrastructure they need to create solutions that can scale meaningfully across the continent,” she added.

Economy

Customs Urges Freight Forwarders to Adopt Automated Licence, Permit System

By Adedapo Adesanya

The Nigeria Customs Service (NCS) has urged freight forwarders to adopt its automated Licence and Permits Processing system to reduce the cost of doing business.

This advice was given by the Assistant Comptroller-General of Customs, Mr Muhammed Babadede, during a stakeholders’ engagement on automation held in Lagos on Monday.

He noted that the reform responds to longstanding demands for faster, more transparent and simpler procedures for industry stakeholders, disclosing that Comptroller-General of Customs, Mr Bashir Adeniyi, has approved the full automation of the service’s licences and permits processes.

“For years, stakeholders dealt with paperwork, long queues and uncertainty from manual processing. Those days are coming to an end.

“This sensitisation is across all zones. The goal is to ensure stakeholders understand the automated system before implementation,” Mr Babadede said.

He said automation would enable applications and renewals from offices or mobile phones, eliminating visits to customs formations, assuring stakeholders of a fair and consistent process, and reducing errors associated with manual documentation.

He said automation would improve record-keeping, supervision and service delivery without increasing pressure on officers.

The Deputy Comptroller-General, Tariff and Trade, CK Naigwan, also represented by Mr Babadede, reiterated management’s commitment to seamless implementation.

Meanwhile, the Comptroller of Customs for Licence and Permit Unit, Mrs Ngozika Anozie, praised the Comptroller-General for driving innovation within the Service, saying the automation aligns Customs procedures with global best practice and strengthens institutional efficiency.

According to her, the reform reflects the three-point agenda of the Chairman of the World Customs Organisation, Mr Adeniyi, centred on consolidation, collaboration and innovation.

She said the system would enhance the ease of doing business in the maritime sector and boost national revenue generation.

“Automation will cut business costs and reduce travel risks for stakeholders

“They will no longer travel repeatedly to Abuja, paying for transport, hotels and feeding to process licences and permits,” she said, adding that the platform would automatically reject fake documents and accept genuine submissions, curbing fraudulent practices.

“The CGC is determined to sanitise the system, and we are committed to achieving that objective,” Mrs Anozie said.

On his part, the Assistant Superintendent of Customs, Mr Ibrahim Usman, said the Licence and Permit Unit operates under the Tariff and Trade Department.

He explained that the unit ensures proper issuance of licences and permits and compliance with import regulations.

Mr Usman said all licences and permits expire on December 31 of their issuance year.

He added that the portal would become fully operational after nationwide sensitisation, with stakeholders duly informed.

Customs Area Controller, Tincan Island Command, Mr Frank Onyeka, thanked stakeholders for their continued support.

He urged them to take the exercise seriously to achieve seamless processing across Customs operations.

Stakeholders raised concerns about online payment integration and potential technical disruptions.

Officials addressed the questions and pledged continued engagement to ensure smooth implementation nationwide.

Economy

Oyedele Links Nigeria’s Stock Market Surge to Fiscal Reforms

By Adedapo Adesanya

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr Taiwo Oyedele, has linked the surge in the nation’s stock market to ongoing fiscal reforms aimed at strengthening investor confidence and stabilising the economy.

Speaking at the 3rd PUU Capital Market Colloquium on Monday in Abuja, Mr Oyedele described the ongoing reforms as one of the most consequential fiscal resets in Nigeria’s modern history, noting that they are designed to build trust in the economy, stimulate inclusive growth, and foster a more investment-friendly environment.

According to him, the impact of these reforms is already visible on the trading floor of the Nigerian Exchange (NGX) Limited. As of mid-February 2026, the All-Share Index recorded a 25.3 per cent return within the first seven weeks of the year, while market capitalisation crossed the psychological N100 trillion mark in January before reaching an all-time high of over N125 trillion by February 20.

On January 13, 2026, the index reached an all-time high of 165,837.33 points, extending a rally that had already delivered a 51.2 per cent return in 2025, the strongest performance in nearly two decades.

Mr Oyedele linked the strong performance to structural reforms that had improved transparency, enhanced foreign exchange liquidity, and provided greater predictability in tax administration.

“The results of these policies are already evident on the trading floor. As of mid-February 2026, the Nigerian Stock Exchange (NGX) showed exceptional performance with the All-Share Index (ASI) recording a robust 25.3 per cent return in just the first seven weeks of the year, with market capitalisation crossing the psychological N100 trillion mark in January, and reaching an all-time high of over N125 trillion by 20 February 2026.

“Confidence continues to grow from both foreign and domestic investors, driven by the structural reforms and strong performance in key sectors like energy, industrial and financial services,” he said.

He explained that historically, Nigeria’s tax system had been fragmented and costly to comply with, discouraging investment and limiting efficient capital allocation.

“To address this, the new tax framework provides a unified, transparent and predictable environment where businesses can plan effectively, and investors can price risk appropriately,” he said.

He outlined several provisions in the new tax laws aimed at deepening the capital market. These include a full Capital Gains Tax exemption on proceeds reinvested in Nigerian shares within the same year, higher tax-exempt thresholds for small and retail investors, and a legal framework to reduce corporate income tax from 30 per cent to 25 per cent.

Other measures include the removal and reduction of certain transaction taxes, such as stamp duties on share transfers and withholding tax on bonus shares, as well as provisions that protect foreign investors from being taxed on naira gains without accounting for foreign exchange losses.

He emphasised that the ultimate goal is not merely to celebrate rising market indices but to translate financial market growth into tangible economic development, including financing for infrastructure, factories, innovation and job creation.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn