Economy

Why Global Businesses are Banking on Africa

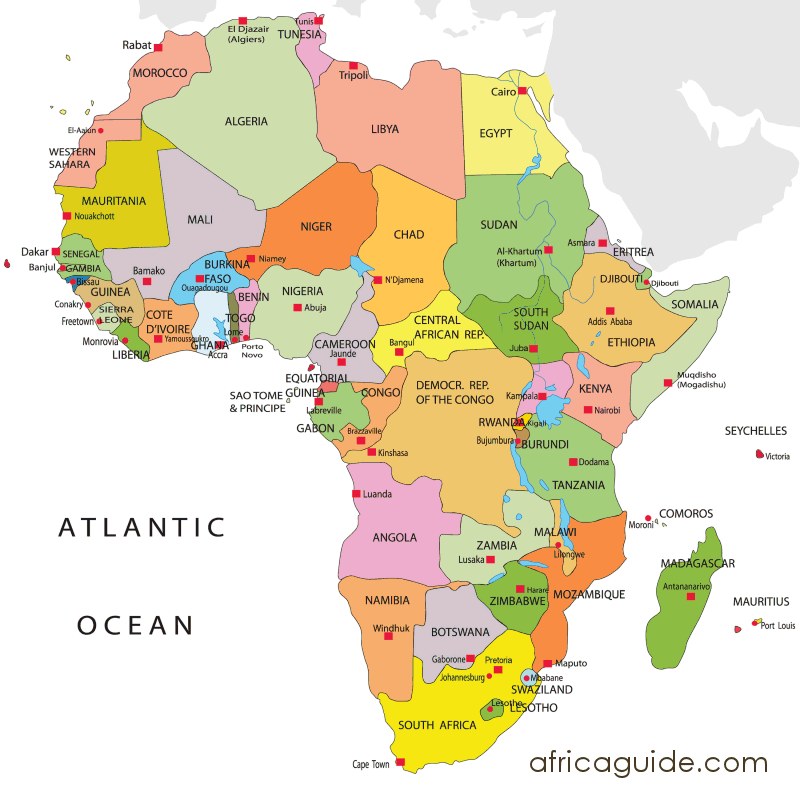

Amid the COVID-19 pandemic, ever-changing lockdown regulations and travel bans for countries in sub-Saharan Africa, the continent has held firm with a positive outlook for its tourism and hospitality sectors. This has been further cemented by the increase in major global businesses either setting up shop in Africa or expanding further across the continent.

Tech hot spots for an expanding ecosystem

Zoho, the global technology company that offers the most extensive suite of business software in the industry, announced the opening of its South African office at the end of 2021 – the company’s flagship – in Cape Town.

“Zoho strongly believes in its growth being closely tied with the growth and development of the broader community that it serves, a strategy we refer to as ‘transnational localism’. As part of this vision, we’re focused on contributing to the creation of self-sufficient economic clusters across the world,” says Hyther Nizam, President MEA at Zoho Group.

In South Africa, Kenya, Nigeria and Egypt, Zoho offers its products in local currencies. Additionally, Zoho has hired individuals in all of these countries for customer-facing roles. And the company is committed to establishing partnerships that will aid local businesses in their digital transformation efforts.

SweepSouth, SA’s leading on-demand home services brand, recently expanded its Pan-African presence by launching into Egypt. Already operating in Kenya and Nigeria, they acquired Egyptian start-up Filkhedma – Egypt’s leading home services marketplace that operates across three cities and serves tens of thousands of customers with cleaning, maintenance and beauty services.

“Africa has massive growth potential for us as a company,” says Aisha Pandor, CEO and co-founder of SweepSouth. “We already operate in three key markets and the acquisition of Filkhedma means that SweepSouth will be one of a few African start-ups operating in the continent’s four key tech ecosystems of South Africa, Egypt, Kenya and Nigeria.

“Egypt has a strong and growing middle-class that has been underserved in the domestic home services arena, which can be said of many other regions across the continent, too. With a compelling economic growth track record and outlook, and an economy that has been resilient in the face of challenging times, it made sense for us to eye this market for our next big leap. Our presence there now primes us for further expansion into other parts of Africa and the Middle East.

“We are entering a rapid growth phase and executing on a number of other new country launches in 2022,” adds Pandor. “Having the Filkhedma team on board is particularly exciting as it’s an intra-African acquisition by two companies in the same vertical. This acquisition almost doubles our addressable market on the continent and enhances the products and services that we already offer.”

An African expansion plan

Ramsay Rankoussi, Vice President, Development, Africa and Turkey for Radisson Hotel Group, says that while the Radisson Hotel Group will continue to pursue organic growth underpinned by domestic and regional travel, the Group will also be exploring other routes through inorganic growth that may be slightly more unconventional and would include different types of partnerships, joint-ventures, co-branding and potential capitalistic approaches.

One of these – Radisson Individuals, a conversion brand that offers smaller hotel operators the opportunity to be a part of the Radisson family without losing their identity – already came to fruition in 2021.

“Africa holds immense potential across various segments and product types – from resorts and city hotels to serviced apartments and boutique offerings. The lack of funding, be it equity or debt, along with the high cost of capital remains the biggest burden across the continent.

“Inorganic growth will certainly help us to not only mitigate materialisation risks but should also unlock synergies and economies of scale with other local and regional chains to the benefit of local communities,” he says.

As such, the Radisson Hotel Group has set its sights on Africa, boosting its African portfolio with 14 signings and five hotel openings in 2021, setting it on a positive path to reach its ambitious goal of more than 150 hotels by 2025.

A recognised business hub

South African serviced office provider The Business Exchange (TBE) recognised the Mauritian potential and in April 2021, the company launched its second investment opportunity in Mauritius – a sectional-title serviced office space.

Beyond the white beaches and get-away-from-it-all lifestyle, Mauritius is increasingly recognised as one of the hottest business hubs on the continent. In fact, the island paradise is currently the highest-ranked economy in sub-Saharan Africa, according to the World Bank’s Ease of Doing Index.

“Mauritius presents a sound environment, both politically and economically. Major international brands, including Samsung, Broll, Expedia and NBA (North America’s National Basketball Association), have already based themselves at our serviced office space there, which speaks to the potential of the location as a foremost business hub,” believes David Seineker, TBE founder and CEO.

Mauritius’s proximity to South Africa – it’s a mere four-hour flight from Johannesburg – is a further advantage, as the City of Gold remains the continent’s foremost business hub. Mauritius is also perfectly positioned en route from Asia and the Middle East to the tip of Africa, making it ideal for expansion into Africa as well as from Africa to the rest of the world. While the strategic relevance of the location was key to TBE’s expansion plans, others look for opportunities in regions that face the same challenges as in the business’s key operational area.

Remote working made easy

Cheapflights, a global travel search site that compares flights, hotels and rental cars, reports that searches from South Africa to the rest of the continent were up 67% on average between September and December last year compared to the same period in 2019. Zimbabwe, Tanzania, Mauritius, Namibia and Mozambique were the most searched countries within the region.

Additionally, the site recently also launched its Work from Wherever Index, which provides travellers looking to work away from home or while on vacation a definitive list of the best countries that are easiest to work from while enjoying a new country.

The results of the Index are based on popular searches made on the Cheapflights site as well as on how well each country scored across six categories. Nigeria ranks 95th globally and 14th amongst countries in the Middle East and Africa region, with its highest scores in the categories of price, travel and weather.

Mauritius, which ranked fourth globally, beating out many European heavyweights, topped the ranking for the Middle East and Africa. The island nation offers great weather, low crime rates and a fairly low cost of living in addition to a remote work visa (also called a digital nomad visa), which is a travel authorisation for on-the-go workers, allowing them to work independently during their stay in a country.

Other African countries that made the list include Seychelles at number 26 globally and number 2 in the region; Réunion (at number 69); Kenya and Tanzania (ranked 80th and 81st, respectively); and Tunisia (ranked 84th); amongst others.

The Work from Wherever Index, as well as the increase in flight searches to the continent, might be additional indicators of renewed business and growing confidence among travellers.

Economy

Champion Breweries Concludes Bullet Brand Portfolio Acquisition

By Aduragbemi Omiyale

The acquisition of the Bullet brand portfolio from Sun Mark has been completed by Champion Breweries Plc, a statement from the company confirms.

This marks a transformative milestone in the organisation’s strategic expansion into a diversified, pan-African beverage platform.

With this development, Champion Breweries now owns the Bullet brand assets, trademarks, formulations, and commercial rights globally through an asset carve-out structure.

The assets are held in a newly incorporated entity in the Netherlands, in which Champion Breweries holds a majority interest, while Vinar N.V., the majority shareholder of Sun Mark, retains a minority stake.

Bullet products are currently distributed in 14 African markets, positioning Champion Breweries to scale beyond Nigeria in the high-growth ready-to-drink (RTD) alcoholic and energy drink segments.

This expansion significantly broadens the brewer’s addressable market and strengthens its revenue base with an established, profitable portfolio that already enjoys strong brand recognition and consumer loyalty across multiple markets.

“The successful completion of our public equity raises, together with the formal close of the Bullet acquisition, marks a defining moment for Champion Breweries.

“The support we received from both existing shareholders and new investors reflects strong confidence in our long-term strategy to build a diversified, high-growth beverage platform with pan-African scale.

“Our focus now is on disciplined execution, integration, and delivering sustained value across markets,” the chairman of Champion Breweries, Mr Imo-Abasi Jacob, stated.

Through this transaction, Champion Breweries is expected to achieve enhanced foreign exchange earnings, expanded distribution leverage across African markets, integrated supply chain efficiencies, portfolio diversification into high‑growth consumer beverage categories, and strengthened presence in the RTD and energy drink segments.

The acquisition accelerates Champion Breweries’ transition from a regional brewing business to a multi-category consumer platform with continental reach.

Bullet Black is Nigeria’s leading ready-to-drink alcoholic beverage, while Bullet Blue has built a strong presence in the energy drink category across several African markets.

Economy

M-KOPA Nigeria Plans Expansion to Edo, Others After N231bn Credit Milestone

By Adedapo Adesanya

Emerging market fintech firm, M-KOPA, has announced plans to deepen its reach in Nigeria to the South South and South East regions, starting with Edo this year, after providing N231 billion in credit to over 1 million customers in the country.

The firm released its first Nigeria-focused Impact Report, which showed that Nigeria is M-KOPA’s fastest-growing market and fastest to reach the milestone.

Since its foray into the Nigerian market in 2019, M-KOPA has been working to dismantle barriers to financial inclusion by providing flexible smartphone financing and digital financial tools that align with how people in the informal economy earn and manage their money.

It operates in six states in the country, including Lagos, Ogun, and Oyo, among others.

The report highlights the company’s contribution to income generation, digital inclusion and economic opportunity for Every Day Earners across the country.

The report showed that M-KOPA has enabled 290,000 first-time smartphone users, while 56 per cent of agents accessed their first income opportunity through the platform.

It showed high income and livelihood gains among its users, with about 77 per cent of customers leveraging smartphones or digital loans obtained through the platform to generate income, indicating that access to financed devices is directly supporting micro-entrepreneurial activity and informal sector productivity.

Furthermore, 75 per cent of users report higher earnings since gaining access to M-KOPA’s services, suggesting measurable improvements in personal revenue streams. On the distribution side, 99 per cent of agents disclose increased earnings, reflecting positive spillover effects across the company’s value chain.

In addition, 81 per cent of long-term customers state that their household expenses have improved, pointing to enhanced financial stability and better consumption smoothing over time.

Speaking on the report, Mr Babajide Duroshola, General Manager, M-KOPA Nigeria, said, “Nigeria represents extraordinary potential, and we’re proud that it has become M-KOPA’s fastest-growing market. Our Impact Report shows that when Every Day Earners gain access to the right digital and financial tools, they use them to create stability and long-term progress for their families. This is about access that unlocks opportunity and sustained prosperity.”

On its expansion plans Nigeria-wide, the M-KOPA helmsman said, “Many of the states we are considering are already similar to the ones we are currently in proximity… So, there is proximity and similarity between these states, and that’s what we are going to do, starting with Edo.”

He noted that as M-KOPA Nigeria continues to expand, the focus remains on ensuring more everyday earners gain access to the digital and financial tools they need to build resilient, prosperous futures in Nigeria’s rapidly digitising economy.

Economy

Tinubu Okays Extension of Ban on Raw Shea Nut Export by One Year

By Aduragbemi Omiyale

The ban on the export of raw shea nuts from Nigeria has been extended by one year by President Bola Tinubu.

A statement from the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, on Wednesday disclosed that the ban is now till February 25, 2027.

It was emphasised that this decision underscores the administration’s commitment to advancing industrial development, strengthening domestic value addition, and supporting the objectives of the Renewed Hope Agenda.

The ban aims to deepen processing capacity within Nigeria, enhance livelihoods in shea-producing communities, and promote the growth of Nigerian exports anchored on value-added products, the statement noted.

To further these objectives, President Tinubu has authorised the two Ministers of the Federal Ministry of Industry, Trade and Investment, and the Presidential Food Security Coordination Unit (PFSCU), to coordinate the implementation of a unified, evidence-based national framework that aligns industrialisation, trade, and investment priorities across the shea nut value chain.

He also approved the adoption of an export framework established by the Nigerian Commodity Exchange (NCX) and the withdrawal of all waivers allowing the direct export of raw shea nuts.

The President directed that any excess supply of raw shea nuts should be exported exclusively through the NCX framework, in accordance with the approved guidelines.

Additionally, he directed the Federal Ministry of Finance to provide access to a dedicated NESS Support Window to enable the Federal Ministry of Industry, Trade and Investment to pilot a Livelihood Finance Mechanism to strengthen production and processing capacity.

Shea nuts, the oil-rich fruits from the shea tree common in the Savanna belt of Nigeria, are the raw material for shea butter, renowned for its moisturising, anti-inflammatory, and antioxidant properties. The extracted butter is a principal ingredient in cosmetics for skin and hair, as well as in edible cooking oil. The Federal Government encourages processing shea nuts into butter locally, as butter fetches between 10 and 20 times the price of the raw nuts.

The federal government said it remains committed to policies that promote inclusive growth, local manufacturing and position Nigeria as a competitive participant in global agricultural value chains.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn