Economy

Why Global Businesses are Banking on Africa

Amid the COVID-19 pandemic, ever-changing lockdown regulations and travel bans for countries in sub-Saharan Africa, the continent has held firm with a positive outlook for its tourism and hospitality sectors. This has been further cemented by the increase in major global businesses either setting up shop in Africa or expanding further across the continent.

Tech hot spots for an expanding ecosystem

Zoho, the global technology company that offers the most extensive suite of business software in the industry, announced the opening of its South African office at the end of 2021 – the company’s flagship – in Cape Town.

“Zoho strongly believes in its growth being closely tied with the growth and development of the broader community that it serves, a strategy we refer to as ‘transnational localism’. As part of this vision, we’re focused on contributing to the creation of self-sufficient economic clusters across the world,” says Hyther Nizam, President MEA at Zoho Group.

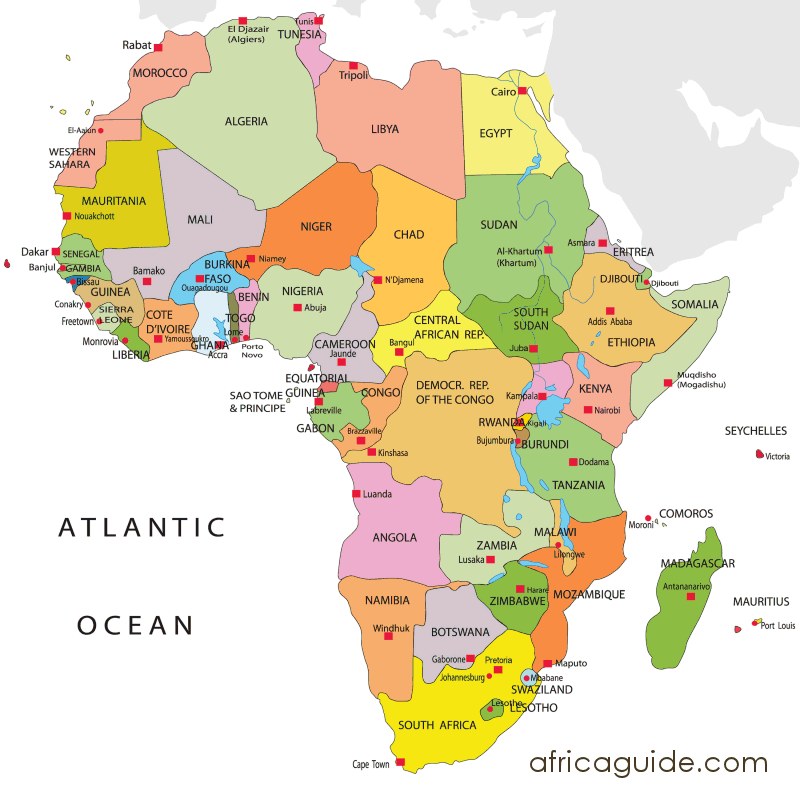

In South Africa, Kenya, Nigeria and Egypt, Zoho offers its products in local currencies. Additionally, Zoho has hired individuals in all of these countries for customer-facing roles. And the company is committed to establishing partnerships that will aid local businesses in their digital transformation efforts.

SweepSouth, SA’s leading on-demand home services brand, recently expanded its Pan-African presence by launching into Egypt. Already operating in Kenya and Nigeria, they acquired Egyptian start-up Filkhedma – Egypt’s leading home services marketplace that operates across three cities and serves tens of thousands of customers with cleaning, maintenance and beauty services.

“Africa has massive growth potential for us as a company,” says Aisha Pandor, CEO and co-founder of SweepSouth. “We already operate in three key markets and the acquisition of Filkhedma means that SweepSouth will be one of a few African start-ups operating in the continent’s four key tech ecosystems of South Africa, Egypt, Kenya and Nigeria.

“Egypt has a strong and growing middle-class that has been underserved in the domestic home services arena, which can be said of many other regions across the continent, too. With a compelling economic growth track record and outlook, and an economy that has been resilient in the face of challenging times, it made sense for us to eye this market for our next big leap. Our presence there now primes us for further expansion into other parts of Africa and the Middle East.

“We are entering a rapid growth phase and executing on a number of other new country launches in 2022,” adds Pandor. “Having the Filkhedma team on board is particularly exciting as it’s an intra-African acquisition by two companies in the same vertical. This acquisition almost doubles our addressable market on the continent and enhances the products and services that we already offer.”

An African expansion plan

Ramsay Rankoussi, Vice President, Development, Africa and Turkey for Radisson Hotel Group, says that while the Radisson Hotel Group will continue to pursue organic growth underpinned by domestic and regional travel, the Group will also be exploring other routes through inorganic growth that may be slightly more unconventional and would include different types of partnerships, joint-ventures, co-branding and potential capitalistic approaches.

One of these – Radisson Individuals, a conversion brand that offers smaller hotel operators the opportunity to be a part of the Radisson family without losing their identity – already came to fruition in 2021.

“Africa holds immense potential across various segments and product types – from resorts and city hotels to serviced apartments and boutique offerings. The lack of funding, be it equity or debt, along with the high cost of capital remains the biggest burden across the continent.

“Inorganic growth will certainly help us to not only mitigate materialisation risks but should also unlock synergies and economies of scale with other local and regional chains to the benefit of local communities,” he says.

As such, the Radisson Hotel Group has set its sights on Africa, boosting its African portfolio with 14 signings and five hotel openings in 2021, setting it on a positive path to reach its ambitious goal of more than 150 hotels by 2025.

A recognised business hub

South African serviced office provider The Business Exchange (TBE) recognised the Mauritian potential and in April 2021, the company launched its second investment opportunity in Mauritius – a sectional-title serviced office space.

Beyond the white beaches and get-away-from-it-all lifestyle, Mauritius is increasingly recognised as one of the hottest business hubs on the continent. In fact, the island paradise is currently the highest-ranked economy in sub-Saharan Africa, according to the World Bank’s Ease of Doing Index.

“Mauritius presents a sound environment, both politically and economically. Major international brands, including Samsung, Broll, Expedia and NBA (North America’s National Basketball Association), have already based themselves at our serviced office space there, which speaks to the potential of the location as a foremost business hub,” believes David Seineker, TBE founder and CEO.

Mauritius’s proximity to South Africa – it’s a mere four-hour flight from Johannesburg – is a further advantage, as the City of Gold remains the continent’s foremost business hub. Mauritius is also perfectly positioned en route from Asia and the Middle East to the tip of Africa, making it ideal for expansion into Africa as well as from Africa to the rest of the world. While the strategic relevance of the location was key to TBE’s expansion plans, others look for opportunities in regions that face the same challenges as in the business’s key operational area.

Remote working made easy

Cheapflights, a global travel search site that compares flights, hotels and rental cars, reports that searches from South Africa to the rest of the continent were up 67% on average between September and December last year compared to the same period in 2019. Zimbabwe, Tanzania, Mauritius, Namibia and Mozambique were the most searched countries within the region.

Additionally, the site recently also launched its Work from Wherever Index, which provides travellers looking to work away from home or while on vacation a definitive list of the best countries that are easiest to work from while enjoying a new country.

The results of the Index are based on popular searches made on the Cheapflights site as well as on how well each country scored across six categories. Nigeria ranks 95th globally and 14th amongst countries in the Middle East and Africa region, with its highest scores in the categories of price, travel and weather.

Mauritius, which ranked fourth globally, beating out many European heavyweights, topped the ranking for the Middle East and Africa. The island nation offers great weather, low crime rates and a fairly low cost of living in addition to a remote work visa (also called a digital nomad visa), which is a travel authorisation for on-the-go workers, allowing them to work independently during their stay in a country.

Other African countries that made the list include Seychelles at number 26 globally and number 2 in the region; Réunion (at number 69); Kenya and Tanzania (ranked 80th and 81st, respectively); and Tunisia (ranked 84th); amongst others.

The Work from Wherever Index, as well as the increase in flight searches to the continent, might be additional indicators of renewed business and growing confidence among travellers.

Economy

Customs Street Chalks up 0.12% on Santa Claus Rally

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited witnessed Santa Claus rally on Wednesday after it closed higher by 0.12 per cent.

Strong demand for Nigerian stocks lifted the All-Share Index (ASI) by 185.70 points during the pre-Christmas trading session to 153,539.83 points from 153,354.13 points.

In the same vein, the market capitalisation expanded at midweek by N118 billion to N97.890 trillion from the preceding day’s N97.772 trillion.

Investor sentiment on Customs Street remained bullish after closing with 36 appreciating equities and 22 depreciating equities, indicating a positive market breadth index.

Guinness Nigeria chalked up 9.98 per cent to trade at N318.60, Austin Laz improved by 9.97 per cent to N3.20, International Breweries expanded by 9.85 per cent to N14.50, Transcorp Hotels rose by 9.83 per cent to N170.90, and Aluminium Extrusion grew by 9.73 per cent to N16.35.

On the flip side, Legend Internet lost 9.26 per cent to close at N4.90, AXA Mansard shrank by 7.14 per cent to N13.00, Jaiz Bank declined by 5.45 per cent to N4.51, MTN Nigeria weakened by 5.21 per cent to N504.00, and NEM Insurance crashed by 4.74 per cent to N24.10.

Yesterday, a total of 1.8 billion shares valued at N30.1 billion exchanged hands in 19,372 deals versus the 677.4 billion shares worth N20.8 billion traded in 27,589 deals in the previous session, implying a slump in the number of deals by 29.78 per cent, and a surge in the trading volume and value by 165.72 per cent and 44.71 per cent apiece.

Abbey Mortgage Bank was the most active equity for the day after it sold 1.1 billion units worth N7.1 billion, Sterling Holdings traded 127.1 million units valued at N895.9 million, Custodian Investment exchanged 115.0 million units for N4.5 billion, First Holdco transacted 40.9 million units valued at N2.2 billion, and Access Holdings traded 38.2 million units worth N783.3 million.

Economy

Yuletide: Rite Foods Reiterates Commitment to Quality, Innovation

By Adedapo Adesanya

Nigerian food and beverage company, Rite Foods Limited, has extended warm Yuletide greetings to Nigerians as families and communities worldwide come together to celebrate the Christmas season and usher in a new year filled with hope and renewed possibilities.

In a statement, Rite Foods encouraged consumers to savour these special occasions with its wide range of quality brands, including the 13 variants of Bigi Carbonated Soft Drinks, premium Bigi Table Water, Sosa Fruit Drink in its refreshing flavours, the Fearless Energy Drink, and its tasty sausage rolls — all produced in a world-class facility with modern technology and global best practices.

Speaking on the season, the Managing Director of Rite Foods Limited, Mr Seleem Adegunwa, said the company remains deeply committed to enriching the lives of consumers beyond refreshment. According to him, the Yuletide period underscores the values of generosity, unity, and gratitude, which resonate strongly with the company’s philosophy.

“Christmas is a season that reminds us of the importance of giving, togetherness, and gratitude. At Rite Foods, we are thankful for the continued trust of Nigerians in our brands. This season strengthens our resolve to consistently deliver quality products that bring joy to everyday moments while contributing positively to society,” Mr Adegunwa stated.

He noted that the company’s steady progress in brand acceptance, operational excellence, and responsible business practices reflects a culture of continuous improvement, innovation, and responsiveness to consumer needs. These efforts, he said, have further strengthened Rite Foods’ position as a proudly Nigerian brand with growing relevance and impact across the country.

Mr Adegunwa reaffirmed that Rite Foods will continue to invest in research and development, efficient production processes, and initiatives that support communities, while maintaining quality standards across its product portfolio.

“As the year comes to a close, Rite Foods Limited wishes Nigerians a joyful Christmas celebration and a prosperous New Year filled with peace, progress, and shared success.”

Economy

Naira Appreciates to N1,443/$1 at Official FX Market

By Adedapo Adesanya

The Naira closed the pre-Christmas trading day positive after it gained N6.61 or 0.46 per cent against the US Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEM) on Wednesday, December 24, trading at N1,443.38/$1 compared with the previous day’s N1,449.99/$1.

Equally, the Naira appreciated against the Pound Sterling in the same market segment by N1.30 to close at N1,949.57/£1 versus Tuesday’s closing price of N1,956.03/£1 and gained N2.94 on the Euro to finish at N1,701.31/€1 compared with the preceding day’s N1,707.65/€1.

At the parallel market, the local currency maintained stability against the greenback yesterday at N1,485/$1 and also traded flat at the GTBank forex counter at N1,465/$1.

Further support came as the Central Bank of Nigeria (CBN) funded international payments with additional $150 million sales to banks and authorised dealers at the official window.

This helped eased pressure on the local currency, reflecting a steep increase in imports. Market participants saw a sequence of exchange rate swings amidst limited FX inflows.

Last week, the apex bank led the pack in terms of FX supply into the market as total inflows fell by about 50 per cent week on week from $1.46 billion in the previous week.

Foreign portfolio investors’ inflows ranked behind exporters and the CBN supply, but there was support from non-bank corporate Dollar volume.

As for the cryptocurrency market, it witnessed a slight recovery as tokens struggled to attract either risk-on enthusiasm or defensive flows.

The inertia follows a sharp reversal earlier in the quarter. A heavy selloff in October pulled Bitcoin and other coins down from record levels, leaving BTC roughly down by 30 per cent since that period and on track for its weakest quarterly performance since the second quarter of 2022. But on Wednesday, its value went up by 0.9 per cent to $87,727.35.

Further, Ripple (XRP) appreciated by 1.7 per cent to $1.87, Cardano (ADA) expanded by 1.2 per cent to $0.3602, Dogecoin (DOGE) grew by 1.1 per cent to $0.1282, Litecoin (LTC) also increased by 1.1 per cent to $76.57, Solana (SOL) soared by 1.0 per cent to $122.31, Binance Coin (BNB) rose by 0.6 per cent to $842.37, and Ethereum (ETH) added 0.3 per cent to finish at $2,938.83, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn