Education

Stanbic IBTC Creates School Fees Payment Products for Parents

By Dipo Olowookere

As children prepare and get excited to resume of the 2019/2020 academic session this month, some parents are running helter skelter looking for how they can pay school fees.

But Stanbic IBTC Bank Plc, a member of Stanbic IBTC Holdings Plc, has come to the rescue with the introduction of a suite of educational payment products that will ease the burden of school fees which parents and guardians have to bear.

Stanbic IBTC Bank Plc, being a Nigerian bank, specifically developed the educational products, taking cognisance of the country’s cultural nuances.

The first of the solutions is the EZ cash loan/advance. Parents and wards, who are strapped for cash at the point when school fees payment are due, can take advantage of the EZ cash loan which gives access to loans, in less than a minute, to pre-approved customers.

Salaried employees can also take advantage of Salary Advance (SALAD), another of the bank’s short-term loans that are quick and easy to get.

Another of Stanbic IBTC Bank Plc’s educational products is an international money transfer solution for payment of school fees and allowances abroad.

Added to that are prepaid cards which can be preloaded with pocket money for children/wards, while the credit cards, which currently offer a 55-day interest moratorium, can be used to seamlessly pay school fees.

According to the CEO of Stanbic IBTC Bank, Dr. Demola Sogunle, the bank attaches a high premium to learning, hence the need to develop solutions which parents and guardians can take advantage of to ensure that their wards get the desired level of education.

“We are a Nigerian bank and we realise that whilst parents and guardians may have desired levels of education for their children, funding may be a deterrent in the pursuit of these dreams.

“We have hence developed these products which will ease the burden of school fees payment while also providing satisfaction to the parents and guardians that their wards are getting good education,” he said.

Mr Sogunle identified a deep understanding of Nigeria and developing tailor-made solutions as factors that distinguishes Stanbic IBTC Bank as a leading Nigerian financial institution.

He added that the bank’s loan products offer fast, simple and convenient ways by which customers can meet their short-term financial obligations to educate their wards, with very convenient repayment terms.

Other benefits of the school fees loans are: access to a revolving line of credit, flexible repayment terms, and the opportunity to access credit up to 100 percent of the customer’s income. With schools resuming for a new term, the school fees loans will help to alleviate the financial burden parents and guardians may face in paying school fees.

The Stanbic IBTC Bank chief explained that the conditions for accessing the loan products were having a salary account with the bank; or having investments with any of the Stanbic IBTC group subsidiaries.

Loan applicants can walk into any branch of the bank and apply for any of the education loans in a few easy steps. The application is then processed and the customer is contacted with feedback.

Stanbic IBTC Holdings is a Nigerian financial institution with eight subsidiaries and an estimated staff strength of 5,000 Nigerians.

Furthermore, 80 percent of the Stanbic IBTC board members are Nigerian.

Education

Nigeria Secures $552m World Bank–Backed Boost for Basic Education

By Adedapo Adesanya

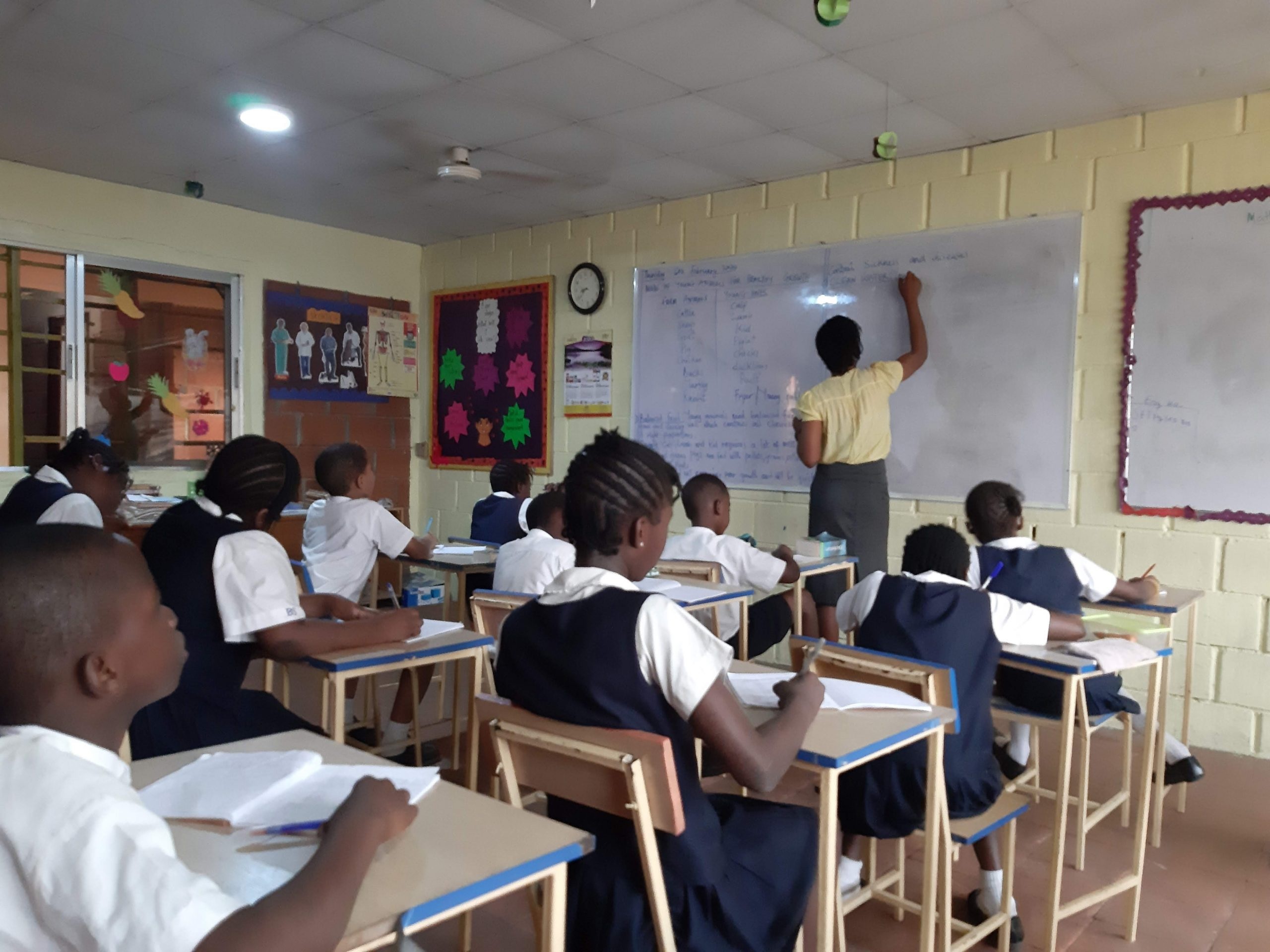

Nigeria has unlocked $552 million under the HOPE-EDU programme to fast-track reforms in the country’s basic education sector, in what has been described as the fastest activation of education financing of such scale in the nation’s history.

The HOPE-EDU initiative, HOPE for Quality Basic Education for All, is co-financed by the World Bank and the Global Partnership for Education. It is structured as a results-driven intervention targeting improved learning outcomes, equitable access to education and stronger institutional capacity at the state level.

The funding, secured through the Federal Ministry of Education, is aimed at strengthening foundational learning, expanding access to quality basic education and reinforcing accountability systems across participating states.

The Minister of Education, Mr Tunji Alausa, said the milestone reflects the administration’s determination to reposition education as a pillar of national development under President Bola Tinubu.

This was disclosed in a statement by the Ministry’s Director of Press and Public Relations, Mrs Folasade Boriowo, on Tuesday.

“The unlocking of the $552 million HOPE-EDU funding in just 12 months represents the fastest activation of education financing of this scale in our history. It reflects clarity of vision, strong intergovernmental coordination, and our unwavering commitment to delivering measurable results for Nigerian children,” the Minister stated.

“Under the leadership of President Tinubu, we are demonstrating that reform can be decisive, accountable, and impactful. These resources will directly strengthen foundational learning, expand access, and reinforce system-wide accountability across participating states,” the statement added.

HOPE-EDU aligns with the Nigeria Education Sector Renewal Initiative (NESRI), a broader reform framework focused on transparency, measurable performance and sector-wide transformation.

The programme also complements other pillars of the reform agenda, including HOPE-Governance and HOPE-Primary Health Care, which seek to address systemic challenges in public financial management, service delivery and policy coordination in key social sectors.

The development comes amid increased budgetary commitment to education. Since 2022, federal allocation to the sector has risen by over 302 per cent, according to the ministry.

In the 2026 fiscal year, the government earmarked N3.520 trillion for education, the highest allocation to date, alongside increased sub-national funding to support state-level priorities and targeted interventions.

The ministry said the latest funding injection is expected to translate into tangible gains in foundational literacy and numeracy, teacher effectiveness, equitable school access and strengthened accountability mechanisms.

Education

NELFUND Extends Student Loan Application Deadline Amid Surge in Interest

By Adedapo Adesanya

The Nigerian Education Loan Fund (NELFUND) has announced an extension to the deadline for its student loan application portal following a notable rise in nationwide interest driven by ongoing awareness campaigns.

In a Monday statement signed by Mrs Oseyemi Oluwatuyi, the fund’s Director of Strategic Communications, the extension was necessitated after a public notice issued last week announcing the closure of the application portal on February 27, 2026.

Mrs Oluwatuyi expressed that the extension was approved due to strong responses from students and key stakeholders across the country, alongside a surge in applications and enquiries.

She stated that the extension window will allow additional time for eligible students to complete their submissions, stressing that further decisions regarding the timeline will be communicated by management in due course.

She wrote, “According to NELFUND, the extension is intended to support several categories of applicants, including students who require more time to complete their applications, prospective applicants who only recently learned about the scheme through nationwide sensitisation programmes, and institutions that have just begun the 2025/2026 academic session.

“It will also accommodate institutions that are yet to submit their verified student lists.”

The chief executive of NELFUND, Akintunde Sawyerr, reaffirmed the fund’s commitment to ensuring equitable access to higher education financing, explaining that the sensitisation activities carried out across Nigeria’s six geopolitical zones have significantly increased awareness and participation in the programme.

“In line with the fund’s mandate to expand access to tertiary education funding, the extension was approved to ensure all eligible students are given a fair opportunity to apply.

“NELFUND also advised institutions that have not yet commenced the 2025/2026 academic session to submit a formal request for an extension along with their approved academic calendar for review,” he stated.

“Students are encouraged to make use of the extended period to complete their applications through the official NELFUND portal before the application window eventually closes.

“The fund reaffirmed its commitment to transparency, accountability, and the delivery of sustainable student financing initiatives aimed at removing financial barriers to higher education in Nigeria,” he added.

NELFUND charges students and members of the public to contact NELFUND via email at in**@******ov.ng or visit its official social media platforms for further enquiries.

Education

Prodigy Finance Offers African Students $2,500 Scholarship

By Modupe Gbadeyanka

Up to $2,500 in scholarship support has been provided by Prodigy Finance for 10 African students, alongside application fee reimbursement for 100 applicants applying through NovaGrad, the education access platform of Prodigy Finance.

This scholarship includes two forms of support, from applying to enrolment, both accessed through NovaGrad.

First, tuition and living expense support of up to $2,500 per student for 10 students, where financial support clearly bridges the gap between receiving an offer and being able to enrol.

Awards are limited, and competitive students who demonstrate strong merit and genuine financial need, have a realistic shortlist of universities, and can submit a complete application through NovaGrad within the stated deadlines will be given priority. Shortlisted applicants may be asked to provide additional documentation to confirm eligibility and reimbursement details before support is issued.

Second, application fee support, providing application fee reimbursement up to $200 per student for students who submit their university applications through NovaGrad.

A total of 100 students will be selected for this opportunity. This support is issued as a reimbursement once the application submission is verified and accepted via the platform.

Applications submitted outside NovaGrad do not qualify. Students register or log in on NovaGrad, enter a valid waiver code if applicable, submit their university application via NovaGrad, and once verified, the reimbursement is processed.

Prodigy Finance has supported postgraduate students heading to some of the world’s leading universities for years. Its scholarship programmes are focused on where funding and guidance can make the biggest difference, and that focus shifts year to year, from India and Latin America to Africa, as well as established global markets.

“African students have consistently demonstrated exceptional ambition and academic strength. Over the years, we have seen students from across the continent succeed at some of the world’s top institutions.

“This scholarship gives them a focused opportunity, and NovaGrad helps bring clarity to every step around it,” the Global Chief Business Officer at Prodigy Finance, Sonal Kapoor, said.

Also commenting, the spokesperson for NovaGrad, Ms Mariana Alcocer, said, “African students are among the most talented we see, yet many still lack the exposure or networks that help others access global education. This programme is about recognising that talent and creating a pathway forward.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn