Feature/OPED

2023 Electricity Act and NDDC’s Illumination of 5 Ondo LGAs After Decades of Darkness

By Jerome-Mario Utomi

Each passing day brings to mind evidence that the Niger Delta region is on the march to becoming a zone of peace and sustainable development as promised some months ago by the Chairman of the Governing Board of the Niger Delta Development Commission (NDDC). Through their actions and inactions so far, the board and management have demonstrated to be the true response to the social and economic challenges in the Niger Delta region.

Reports and organised commentaries from critical stakeholders also indicate that both the governing board and management are laced with the capacity to articulate the developmental needs of the people of the region as encapsulated in the agency’s mission and vision statement ‘to offer a lasting solution to the socioeconomic difficulties of the Niger Delta region and facilitate the rapid and sustainable development of the Niger Delta region into a region that is economically prosperous, socially stable, ecologically regenerative and politically peaceful’.

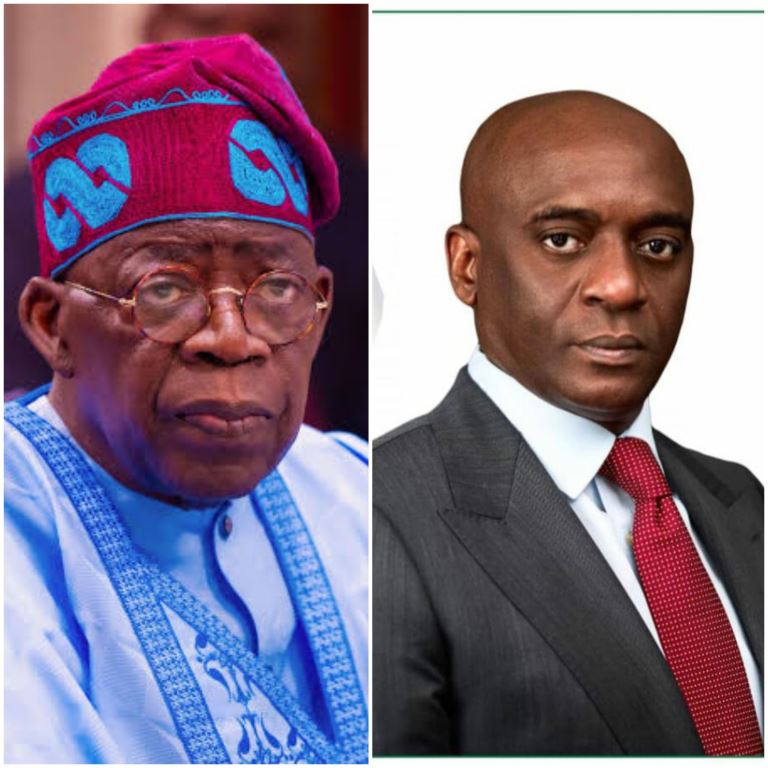

Out of so many examples supporting the above assertion, the latest that stands out is the recent news report that the NDDC, in line with President Bola Ahmed Tinubu, renewed hope agenda, completed and connected the 132/33kv electricity substation built at Ode-Erinje in the Okitipupa Local Government Area of Ondo State to the national grid.

Aside from the power station boosting economic activities in the state coupled with a promise by the agency to replicate this legacy project across all states in the Niger Delta, also very remarkable is the fact that the power substation would provide electricity to over 2,000 communities across five local government areas within the oil-producing region of Ondo State that had been without electricity for the past 15 years, and will significantly impact lives by ending decades of darkness.

“We are committed to lighting up all the local government areas and the oil-producing communities in Ondo South Senatorial District. This is part of NDDC’s mandate to provide infrastructure and development projects in the Niger Delta region.”

Very unique is the awareness that before the ‘dust of excitement’ that trailed the agency’s breakthrough in Ondo state could settle, another was up, this time around in Edo State. It was reported a few days ago that the agency is in a similar style set to commission a 1×15mva 33/11kv electricity project, electricity injection sub-station in Amufi-Ikpoba Okha Local Government Area, Benin City, Edo State.

Without a doubt, these double feats, for reasons that will be stated in the subsequent paragraphs, have finally made Niger Deltans with critical minds conclude that NDDC is serious with its ambitious goal of transitioning from a transactional entity to one deeply committed to sustainable development and transformation in the region.

Here are the points why NDDC’s current effort is not only newsy but adjudged commendable.

Electricity is globally recognised as one of the most important blessings that science has given to mankind. It has also become a part of modern life and one cannot think of a world without it. Electricity has many uses in our day-to-day life. It is used for lighting rooms, working fans and domestic appliances like electric stoves, air conditioners, and more. All these provide comfort to people. In factories, large machines are worked with the help of electricity. Essential items like food, cloth, paper and many other things are the product of electricity.

Also, the world is in agreement that modern means of transportation and communication have been revolutionized by it. Electric trains and battery cars are quick means of travel. Electricity, it was recently argued, provides means of amusement, radio, television and cinema, which are the most popular forms of entertainment as a result of electricity. Modern equipment like computers and robots have also been developed because of electricity. Electricity plays a pivotal role in the fields of medicines and surgery too — such as X-ray, and ECG. The use of electricity is increasing day by day.

More specifically and of course a fundamental reason why what NDDC governing board and management are presently doing in the region should be appreciated is the fact that it is seamlessly in concord with President Tinubu’s burning desire to have electricity reach every nook and cranny of the country-a desire that birthed the 2023 Electricity Act, which replaced the Electricity and Power Sector Reform Act of 2005.

The 2023 Electricity Act brought about the de-monopolisation of Nigeria’s electricity generation, transmission, and distribution of electricity at the National level and empowers states, companies, and individuals to generate, transmit and distribute electricity.

It replaced the Electricity and Power Sector Reform Act of 2005. It provides a framework to guide the post-privatization phase of the Nigerian Electricity Supply Industry (NESI) as well as encourage private sector investments in the sector. States can issue licenses to private investors who can operate mini-grids and power plants within the state. However, the Act precludes interstate and transnational electricity distribution.

Under the Electricity Act 2023, the Nigerian Electricity Regulatory Commission (NERC) will be able to regulate the electricity sector within Nigeria without prejudice to the powers of the states to make laws and create electricity markets within those states and to regulate those markets.

The Act mandates how NERC can transition regulatory responsibilities from itself to state regulators when they are established. Until a state has passed its electricity market laws, NERC will continue to regulate electricity business exclusively carried out in those states.

The Act grants lawmakers the power to carry out oversight responsibilities and function over the NESI through its respective Committees on Power in the Senate and House of Representatives. This is to be carried out notwithstanding the supervisory powers of any government Ministry over government-owned enterprises or other entities operating in the Nigerian electricity supply industry.

Electricity generation licensees are obligated to meet renewable generation obligations as may be prescribed by NERC. Under the Act, electricity generating companies will be mandated to either generate power from renewable energy sources, purchase power generated from renewable energy or procure any instrument representing renewable energy generation.

It also mandates the imposition of renewable purchase obligations on distribution or supply licensees.

The Act also states that anyone may construct, own or operate an undertaking for generating electricity not exceeding 1 megawatt (MW) in aggregate at a site or an undertaking for distribution of electricity with a capacity not exceeding 100 kilowatts (KW) in aggregate at a site, or such other capacity as NERC may determine from time to time, without a license.

Indeed, while there is no argument anymore that the 2023 Electricity Act has revolutionized electricity generation and supply in the country, which has, in turn, brought significant stability in power supply in the country, of which credit goes to Mr President, this piece will in a similar vein align with the recently formed opinion by Niger Deltans of goodwill that under Mr Chiedu Ebie-led governing board and management of NDDC, the interventionist agency has finally gotten a board with the understanding that they must serve our communities and embrace its aspirations, both now and in the future, by assuring the people economic growth, education, health, security, stability, comfort, leisure opportunities and freedom in ways that will allow for the most conducive atmosphere to achieve the targets that will guarantee our welfare and a bright future.

Utomi is the Programme Coordinator for Media and Public Policy at Social and Economic Justice Advocacy (SEJA), Lagos

Feature/OPED

How Christians Can Stay Connected to Their Faith During This Lenten Period

It’s that time of year again, when Christians come together in fasting and prayer. Whether observing the traditional Lent or entering a focused period of reflection, it’s a chance to connect more deeply with God, and for many, this season even sets the tone for the year ahead.

Of course, staying focused isn’t always easy. Life has a way of throwing distractions your way, a nosy neighbour, a bus driver who refuses to give you your change, or that colleague testing your patience. Keeping your peace takes intention, and turning off the noise and staying on course requires an act of devotion.

Fasting is meant to create a quiet space in your life, but if that space isn’t filled with something meaningful, old habits can creep back in. Sustaining that focus requires reinforcement beyond physical gatherings, and one way to do so is to tune in to faith-based programming to remain spiritually aligned throughout the period and beyond.

On GOtv, Christian channels such as Dove TV channel 113, Faith TV and Trace Gospel provide sermons, worship experiences and teachings that echo what is being practised in churches across the country.

From intentional conversations on Faith TV on GOtv channel 110 to true worship on Trace Gospel on channel 47, these channels provide nurturing content rooted in biblical teaching, worship, and life application. Viewers are met with inspiring sermons, reflections on scripture, and worship sessions that help form a rhythm of devotion. During fasting periods, this kind of consistent spiritual input becomes a source of encouragement, helping believers stay anchored in prayer and mindful of God’s presence throughout their daily routines.

To catch all these channels and more, simply subscribe, upgrade, or reconnect by downloading the MyGOtv App or dialling *288#. You can also stream anytime with the GOtv Stream App.

Plus, with the We Got You offer, available until 28th February 2026, subscribers automatically upgrade to the next package at no extra cost, giving you access to more channels this season.

Feature/OPED

Turning Stolen Hardware into a Data Dead-End

By Apu Pavithran

In Johannesburg, the “city of gold,” the most valuable resource being mined isn’t underground; it’s in the pockets of your employees.

With an average of 189 cellphones reported stolen daily in South Africa, Gauteng province has become the hub of a growing enterprise risk landscape.

For IT leaders across the continent, a “lost phone” is rarely a matter of a misplaced device. It is frequently the result of a coordinated “snatch and grab,” where the hardware is incidental, and corporate data is the true objective.

Industry reports show that 68% of company-owned device breaches stem from lost or stolen hardware. In this context, treating mobile security as a “nice-to-have” insurance policy is no longer an option. It must function as an operational control designed for inevitability.

In the City of Gold, Data Is the Real Prize

When a fintech agent’s device vanishes, the $300 handset cost is a rounding error. The real exposure lies in what that device represents: authorised access to enterprise systems, financial tools, customer data, and internal networks.

Attackers typically pursue one of two outcomes: a quick wipe for resale on the secondary market or, far more dangerously, a deep dive into corporate apps to extract liquid assets or sellable data.

Clearly, many organisations operate under the dangerous assumption that default manufacturer security is sufficient. In reality, a PIN or fingerprint is a flimsy barrier if a device is misconfigured or snatched while unlocked. Once an attacker gets in, they aren’t just holding a phone; they are holding the keys to copy data, reset passwords, or even access admin tools.

The risk intensifies when identity-verification systems are tied directly to the compromised device. Multi-Factor Authentication (MFA), widely regarded as a gold standard, can become a vulnerability if the authentication factor and the primary access point reside on the same compromised device. In such cases, the attacker may not just have a phone; they now have a valid digital identity.

The exposure does not end at authentication. It expands with the structure of the modern workforce.

65% of African SMEs and startups now operate distributed teams. The Bring Your Own Device (BYOD) culture has left many IT departments blind to the health of their fleet, as personal devices may be outdated or jailbroken without any easy way to know.

Device theft is not new in Africa. High-profile incidents, including stolen government hardware, reinforce a simple truth: physical loss is inevitable. The real measure of resilience is whether that loss has any residual value. You may not stop the theft. But you can eliminate the reward.

Theft Is Inevitable, Exposure is Not

If theft cannot always be prevented, systems must be designed so that stolen devices yield nothing of consequence. This shift requires structured, automated controls designed to contain risk the moment loss occurs.

Develop an Incident Response Plan (IRP)

The moment a device is reported missing, predefined actions should trigger automatically: access revocation, session termination, credential reset and remote lock or wipe.

However, such technical playbooks are only as fast as the people who trigger them. Employees must be trained as the first line of defence —not just in the use of strong PINs and biometrics, but in the critical culture of immediate reporting. In high-risk environments, containment windows are measured in minutes, not hours.

Audit and Monitor the Fleet Regularly

Control begins with visibility. Without a continuous, comprehensive audit, IT teams are left responding to incidents after damage has occurred.

Opting for tools like Endpoint Detection and Response (EDR) allows IT teams to spot subtle, suspicious activities or unusual access attempts that signal a compromised device.

Review Device Security Policies

Security controls must be enforced at the management layer, not left to user discretion. Encryption, patch updates and screen-lock policies should be mandatory across corporate devices.

In BYOD environments, ownership-aware policies are essential. Corporate data must remain governed by enterprise controls regardless of device ownership.

Decouple Identity from the Device

Legacy SMS-based authentication models introduce avoidable risk when the authentication channel resides on the compromised handset. Stronger identity models, including hardware tokens, reduce this dependency.

At the same time, native anti-theft features introduced by Apple and Google, such as behavioural theft detection and enforced security delays, add valuable defensive layers. These controls should be embedded into enterprise baselines rather than treated as optional enhancements.

When Stolen Hardware Becomes Worthless

With POPIA penalties now reaching up to R10 million or a decade of imprisonment for serious data loss offences, the Information Regulator has made one thing clear: liability is strict, and the financial fallout is absolute. Yet, a PwC survey reveals a staggering gap: only 28% of South African organisations are prioritising proactive security over reactive firefighting.

At the same time, the continent is battling a massive cybersecurity skills shortage. Enterprises simply do not have the boots on the ground to manually patch every vulnerability or chase every “lost” terminal. In this climate, the only viable path is to automate the defence of your data.

Modern mobile device management (MDM) platforms provide this automation layer.

In field operations, “where” is the first indicator of “what.” If a tablet assigned to a Cape Town district suddenly pings on a highway heading out of the city, you don’t need a notification an hour later—you need an immediate response. An effective MDM system offers geofencing capabilities, automatically triggering a remote lock when devices breach predefined zones.

On Supervised iOS and Android Enterprise devices, enforced Factory Reset Protection (FRP) ensures that even after a forced wipe, the device cannot be reactivated without organisational credentials, eliminating resale value.

For BYOD environments, we cannot ignore the fear that corporate oversight equates to a digital invasion of personal lives. However, containerization through managed Work Profiles creates a secure boundary between corporate and personal data. This enables selective wipe capabilities, removing enterprise assets without intruding on personal privacy.

When integrated with identity providers, device posture and user identity can be evaluated together through multi-condition compliance rules. Access can then be granted, restricted, or revoked based on real-time risk signals.

Platforms built around unified endpoint management and identity integration enable this model of control. At Hexnode, this convergence of device governance and identity enforcement forms the foundation of a proactive security mandate. It transforms mobile fleets from distributed risk points into centrally controlled assets.

In high-risk environments, security cannot be passive. The goal is not recovery. It is irrelevant, ensuring that once a device leaves authorised hands, it holds no data, no identity leverage, and no operational value.

Apu Pavithran is the CEO and founder of Hexnode

Feature/OPED

Daniel Koussou Highlights Self-Awareness as Key to Business Success

By Adedapo Adesanya

At a time when young entrepreneurs are reshaping global industries—including the traditionally capital-intensive oil and gas sector—Ambassador Daniel Koussou has emerged as a compelling example of how resilience, strategic foresight, and disciplined execution can transform modest beginnings into a thriving business conglomerate.

Koussou, who is the chairman of the Nigeria Chapter of the International Human Rights Observatory-Africa (IHRO-Africa), currently heads the Committee on Economic Diplomacy, Trade and Investment for the forum’s Nigeria chapter. He is one of the young entrepreneurs instilling a culture of nation-building and leadership dynamics that are key to the nation’s transformation in the new millennium.

The entrepreneurial landscape in Nigeria is rapidly evolving, with leaders like Koussou paving the way for innovation and growth, and changing the face of the global business climate. Being enthusiastic about entrepreneurship, Koussou notes that “the best thing that can happen to any entrepreneur is to start chasing their dreams as early as possible. One of the first things I realised in life is self-awareness. If you want to connect the dots, you must start early and know your purpose.”

Successful business people are passionate about their business and stubbornly driven to succeed. Koussou stresses the importance of persistence and resilience. He says he realised early that he had a ‘calling’ and pursued it with all his strength, “working long weekends and into the night, giving up all but necessary expenditures, and pressing on through severe setbacks.”

However, he clarifies that what accounted for an early success is not just tenacity but also the ability to adapt, to recognise and respond to rapidly changing markets and unexpected events.

Ambassador Koussou is the CEO of Dau-O GIK Oil and Gas Limited, an indigenous oil and natural gas company with a global outlook, delivering solutions that power industries, strengthen communities, and fuel progress. The firm’s operations span exploration, production, refining, and distribution.

Recognising the value of strategic alliances, Koussou partners with business like-minds, a move that significantly bolsters Dau-O GIK’s credibility and capacity in the oil industry. This partnership exemplifies the importance of building strong networks and collaborations.

The astute businessman, who was recently nominated by the African Union’s Agenda 2063 as AU Special Envoy on Oil and Gas (Continental), admonishes young entrepreneurs to be disciplined and firm in their decision-making, a quality he attributed to his success as a player in the oil and gas sector. By embracing opportunities, building strong partnerships, and maintaining a commitment to excellence, Koussou has not only achieved personal success but has also set a benchmark for future generations of African entrepreneurs.

His journey serves as a powerful reminder that with determination and vision, success is within reach.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn