Feature/OPED

Understanding the Psychology of Marketing as Regard Nigerians

By Kenneth Horsfall

I tell you this with a great fact Nigerians are peculiar people, Nigerians are not like every African, they are a very different breed of people. They think differently, not like every African. So, today I am going to be teaching you how to really understand the psychology of marketing when dealing with Nigerians so you can take advantage of it and sell anything to a Nigerian and he or she will buy. To begin our class, let’s define what Marketing Psychology is.

What Is Marketing Psychology

Marketing psychology attempts to understand the way that consumers think, feel, reason, and make decisions. The goal of marketing is to convince people and making a calculated emotional appeal can be just what you need to land a lasting customer.

You may be asking what is the relationship between psychology and marketing?

Marketing is building relationships between brands and consumers, which includes stoking loyalty and awareness in consumers. Psychology, on the other hand, is the study of the human mind and human behaviour.

Let’s just go further to explain how this truly works. Marketing psychology closely relates to consumer behaviour: the study of how and why we purchase goods or services. Borrowing insights from behavioural sciences, such as neuroscience and cognitive sciences, marketing psychology looks at how people’s feelings and perceptions influence their buying habits. So, now you get the point abi?

Psychological tactics that influence how Nigerian consumer’s behaviour

Good news! You don’t have to be a psychologist to stage a successful emotional appeal to your potential customers in Nigeria. Many successful marketers use these strategies to great effect. With a bit of research and experimentation – you can too.

An important component of successful marketing is understanding how and why people think and act in certain ways. All of your marketing efforts should stem from this understanding. If, for example, you’re a content marketer creating an infographic, your efforts will be far more successful if you begin with your end consumer in mind. Who are they and why should they care about your infographic? What action(s) do you want them to take as a result of the infographic? Is progress measurable?

Reverse engineering, this process can be illuminating. At this point, you may be thinking that this is all very obvious. But how well do you truly understand your customer? Are they a two-dimensional idea or a three-dimensional person? What motivates them to make a decision?

Understanding how people operate can be the difference between good marketing and great marketing.

To help you further I’m going to share with you 6 psychological tips for marketing to Nigerians

- Nigerians Are Very Impulsive

Have you ever been waiting in line at the grocery store only to grab a few “last minute” items before your transaction? Those items weren’t placed there on accident. It’s quite intentional and has been enabling impulse buys for decades. Flash sales in email marketing campaigns are another way this psychological marketing tactic is applied. How can you use people’s impulsive nature to satisfy their needs?

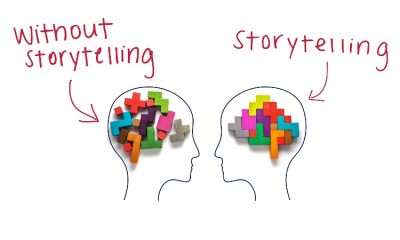

- A Picture Is Worth A Thousand Words

Our brains can process images a whole lot faster than they can comprehend the written word. This is for good reason. Long before Harry Potter, people needed the ability to quickly assess the lay of the land in order to survive. Play into this. We live in a visual world. Spend some time pondering your use of visuals. People will form an instant impression based on visual appearance.

- Colour Psychology

Colours have an enormous impact on our moods and emotions – possessing the profound ability to influence our perceptions. We associate certain colours with whimsy, others with trust, and others with sensuality. Depending on what you’re selling, be aware of your use of colour. It is important to send a consistent message on all fronts. Appeal to the subconscious mind first, and logic later.

- The Pen Is Mightier Than The Sword

Certain words or phrases, while cliched, evoke an emotional response. Organic. Gluten-free. Certified. Testimonial. Authentic. There is a perfectly good reason that words like these are plastered all over products: it works. People continue to go for it. Think about the products and services you’re marketing and try to find the words that have the potential to elicit an emotional response. Use them when talking about your products.

- The Power of “Yes”

Yes, is a powerful word. It is the green light that gets you in the door. Getting people to say yes to little things before going for the win is a time-honoured sales strategy. It creates a sense of connection and agreeability. This is as popular today as ever. Many businesses use social media in this way: warm an audience up with social ads, get them to take a small action (watch a video or sign up for an email list), create trust, and convert. This whole process is a series of small agreements that gradually open the door to a sale.

- Nigerians love to make Decisions Emotional

The decision-making process is emotionally driven. Even people that pride themselves on being rational aren’t immune. We all make decisions based on two things: what satisfies our needs and what aligns with how we are. Marketers would be wise to try to elicit an emotional response from potential customers.

To conclude our class today on understanding the psychology of marketing to Nigerians, we will check out why will Nigerians buy your product or service.

Nigerians don’t care about you, how much success you’ve achieved or even what you have to sell.

Nigerians care about themselves first, second, third and up to infinity.

Nigerians are naturally selfish; including me, including you, that is reading this article is a Nigerian!

If you want Nigerians to buy what you have to sell, here is what you need to do;

Forget about what you want or don’t want and focus on giving them what they want and getting rid of what they don’t want!

The 40/40/20 Rule of Marketing – Here is a fact that explains why Nigerian customers will buy. The “40/40/20 rule” explains what constitutes the response for a marketing campaign. It breaks down like this: 40% of the success of your marketing is dependent on the target audience; 40% of the success of your marketing is dependent on what you’re offering [product or service]; 20% of the success of your marketing is dependent on creativity. That’s just it.

Why will Nigerians buy your product or service? – Nigerians buy for the following reasons. Provide these reasons and the sale becomes natural.

Utility – why should I buy this? Nigerians buy because they are interested in two things. These two things they are interested in are the same two things you and I are interested in. Because all of us are only interested in the following two things: Getting rid of a PROBLEM you have and don’t want and/or Creating a RESULT that you want and don’t have.

The utility they said is the satisfaction derived from the consumption of a particular product or service. In other words, utility = satisfaction derived = value. Products or services sell not because you have bills to pay, or because you have needs to be met. In fact, if you ever hope of selling anything, you have to get ‘YOU’ out of the equation and focus on ‘THEM’. Products or services sell because your Nigerian customers want utility.

Credibility – why should I buy from you? The second reason why Nigerians will buy from you is credibility. Nigerians buy from people they trust. After a Nigerian sees the utility in what you are offering for sale, the next thing they want to see is credibility. Are you for real? Can you really deliver this utility? Are you capable of delivering on your promise? This is very crucial for making the sale.

Relevance – why should I buy NOW? I see the value in your offering, I trust your ability to deliver, but is what you are selling relevant to my current situation? I am interested in what you are offering for sale, based on a certain track record, I think I trust your brand, but how well is your solution –product/service suitable for my current needs? This is the most crucial phase of the three reasons why Nigerians buy. To successfully get over this phase, two key skills are required; The ability to question skillfully and the ability to listen carefully

To uncover the relevance of your product/service to the current needs of the customer, you’ve got to dig deep beyond the surface. Nigerians find it naturally difficult to express their deep desires until skillfully led. The more you skillfully ask questions and listen carefully and patiently to the answers, the more the customer will open up and talk to you.

Takeaway: As an entrepreneur, you are trying to sell to Nigerians the best way to do it is to create the kind of environment where the Nigerians feel comfortable expressing themselves openly and honestly. Your goal is to see things like a Nigerian, see things from their perspective and make them trust you then see how they will run to you with their money.

Kenneth Horsfall is the creative director and founder of K.S. Kennysoft Studios Production Ltd, fondly called Kennysoft STUDIOs, a Nigerian Video and Animation Production Studio. Horsfall is also the founder and lead instructor at Kennysoft Film Academy and can be reached via di******@*************io.com

Feature/OPED

Iran-Israel-US Conflict and CBN’s FX Gains: A Stress Test for Nigeria’s Monetary Stability

By Blaise Udunze

At the 304th policy meeting held on Wednesday, the 25th February, the Central Bank of Nigeria’s (CBN) Monetary Policy Committee cut the rate by 50 basis points to 26.5 per cent from 27 per cent, which has been widely described as a cautious transition from prolonged tightening to calibrated easing. The CBN stated that the decision followed 11 consecutive months of disinflation. The economy witnessed headline inflation easing to 15.10 per cent in January 2026, and food inflation falling sharply to 8.89 per cent. Foreign reserves are climbing to $50.45 billion, their highest level in 13 years. The Purchasing Managers’ Index is holding at an expansionary 55.7 points.

As reported in the paper, no doubt that the macroeconomic narrative appears encouraging. On a closer scrutiny, the sustainability of these gains is now being tested by forces far beyond the apex bank’s policy corridors. This is as a result of the clear, direct ripple effect of the escalating conflict between Iran and Israel, with direct military involvement from the United States, which has triggered one of the most significant geopolitical energy shocks in decades. For Nigeria, the timing is delicate. Just as the CBN signals confidence in disinflation and stability, global volatility threatens to complicate and possibly distort its monetary path.

The rate cut, though welcomed by many analysts, must be understood in context. Nigeria remains in an exceptionally high-rate environment. An MPR of 26.5 per cent is still restrictive by any standard. The Cash Reserve Ratio (CRR) remains elevated at 45 per cent for commercial banks, and this effectively sterilises nearly half of deposits, while liquidity ratios are tight, and lending rates to businesses often exceed 30 per cent once risk premiums are included. The adjustment is therefore incremental, not transformational.

The Director/CEO of the Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf, has repeatedly noted that Nigeria’s deeper challenge lies in weak monetary transmission. According to him, even when the benchmark rate falls, structural rigidities, high CRR, elevated deposit costs, macroeconomic uncertainty, and crowding-out from government borrowing prevent meaningful relief from reaching manufacturers, SMEs, agriculture, and other productive sectors. Monetary easing, without structural reform, risks becoming cosmetic. The point is that even before structural reforms take effect, the fact is that an external shock will first reshape the landscape.

The Iran-Israel conflict and US involvement have reignited fears in global energy markets. Joint U.S. and Israeli strikes on Iranian targets and retaliatory missile exchanges across the Gulf have unsettled oil traders. Brent crude, already rising in anticipation of escalation, surged toward $70-$75 per barrel and could climb higher if shipping through the Strait of Hormuz, through which nearly 20 per cent of global oil supplies pass, faces disruption. It is still an irony that a major crude exporter is also an importer of refined petroleum products.

Higher crude prices offer a theoretical windfall. For Nigeria’s economy, it is well known that oil remains its largest source of foreign exchange and accounts for roughly 50 per cent of government revenue. The good thing is that rising prices could boost reserves, improve forex liquidity, strengthen the naira, and ease fiscal pressures. In theory, this external cushion could support macroeconomic stability and reinforce the CBN’s easing posture.

However, the upside is constrained by structural weaknesses. Nigeria’s oil production remains below optimal capacity. A significant portion of crude exports is tied to long-term contracts, limiting immediate gains from spot price surges. As SB Morgen observed in its analysis, Nigeria’s “windfall” is volatile and limited by soft production performance.

More critically, Nigeria’s dependence on imported refined products exposes it to imported inflation. Rising global crude prices increase the cost of petrol, diesel, jet fuel and gas. With fuel subsidies removed, these increases are passed directly to consumers and businesses. Depot pump prices have already adjusted upward amid Middle East tensions.

Energy costs are a primary driver of Nigeria’s inflation, and this has remained sacrosanct. When fuel prices rise, transportation, logistics, food distribution, power generation, and manufacturing costs will definitely skyrocket, as well as the inflationary impulse spreads quickly through the economy. This will push households to face higher food and transportation costs. Businesses see shrinking margins. Real incomes erode.

Thus, the same oil shock that boosts government revenue may simultaneously reignite inflationary pressure, precisely at a moment when the CBN has begun cautiously easing policy.

This dynamic introduces a difficult policy dilemma, even as this could be for the fragile gains of the MPC. This is to say that if energy-driven inflation resurges, the CBN may be forced to pause or reverse its easing cycle. It is clearly spelt that high inflation typically compels tighter monetary conditions. As Yusuf warned, geopolitical headwinds that elevate inflation often push central banks toward higher interest rates. A renewed tightening would strain credit conditions further, undermining growth prospects.

There is also the risk of money supply expansion. Increased oil revenues, once monetised, can expand liquidity in the domestic system. Historically, surges in oil receipts have been associated with monetary growth, inflationary pressure, and exchange rate volatility. Without sterilisation discipline, a revenue boost could ironically destabilise macro fundamentals.

The exchange rate dimension compounds the complexity. Heightened geopolitical risk, just as it is currently playing out with the Iran-Israel conflict, often triggers global flight to safety. This will eventually lure investors to retreat to U.S. Treasuries and gold. Emerging markets face capital outflows. If it happens that foreign portfolio investors withdraw from Nigeria’s fixed-income market in response to global uncertainty, pressure on the naira could intensify.

Already, the CBN has demonstrated sensitivity to exchange rate dynamics by intervening to prevent excessive naira appreciation. A sharp rate cut in the midst of global volatility could destabilise carry trades and spur dollar demand. What should be known is that the 50-bps reduction reflects not just domestic disinflation, but global risk management such as geopolitical tensions, oil prices, and foreign investor sentiment.

Beyond macroeconomics, geopolitical implications carry security concerns. Analysts warn that a widening Middle East conflict could embolden extremist narratives across the Sahel and it directly has security consequences for Nigeria and the broader region. Groups such as Boko Haram and ISWAP may exploit anti-Western framing to recruit and mobilise more followers in the Sahel region, thereby giving the extremist groups new propaganda opportunities. The pebble fear is that a diversion of Western security resources away from West Africa could create regional vacuums. What the Nigerian economy will begin to experience is that security instability will disrupt agricultural output, logistics corridors, and investor confidence, feeding back into inflation and slow economic growth, and as ripple effects, the economy becomes weaker.

Nigeria’s diplomatic balancing act adds another layer of fragility because it is walking on a tactful tightrope. The country is trying not to upset anyone, but maintains cautious neutrality, urging restraint while preserving ties with Western allies and Middle Eastern partners. Yet rising tensions globally between major powers, including Russia and China, complicate the geopolitical chessboard. Invariably, this will have a direct impact as trade flows, remittances, and investment patterns may change unexpectedly, affecting Nigeria’s economy.

With the current conflict in the Middle East, the prospects for economic growth also face renewed strain or are under increased pressure. The stock markets in developed countries have been fluctuating a lot because people are worried that there will be problems with the energy supply. If the whole world does not grow fast, then people will use less oil over time. This means that the good things that happen to Nigeria because of oil prices will probably not last, and any extra money Nigeria gets from oil prices now will be lost. Nigeria will not get to keep the money from high oil prices for a long time. The oil prices will affect Nigeria. Then the effect will go away. One clear thing is that since Nigeria relies heavily on oil exports, this commodity dependence exposes the country to significant risk.

Meanwhile, Nigeria’s domestic fundamentals remain structurally challenged. The recapitalisation of banks, with 20 of 33 institutions meeting new capital thresholds, strengthens resilience, but does not guarantee credit expansion into productive sectors. Banks continue to prefer risk-free government securities over private lending in uncertain environments.

Fiscal discipline remains essential. Elevated debt service obligations absorb substantial revenue. Election-related spending poses upside inflation risks. This understanding must be adhered to, that without credible deficit reduction and revenue diversification, monetary easing may be undermined by fiscal expansion.

At the moment, given the current global and domestic uncertainties, the 50 per cent interest cut rate appears less like a pivot toward growth and more like a signal of cautious optimism under conditional stability. The policy decision is based on several key expectations with the assumptions that disinflation will persist, exchange rate stability will hold, and global conditions will not deteriorate dramatically.

But the Iran-Israel-U.S. conflict introduces uncertainty into all three assumptions, which is wrongly perceived as behind the rate cut that inflation will keep coming down, that the exchange rate will stay stable, and global conditions won’t worsen, are all undermined by the unfolding conflict.

If the global oil prices rise sharply and fuel becomes more expensive locally, overall prices in the economy could increase again, which means inflation could accelerate. Another dangerous trend is that if foreign investors pull capital out of Nigeria, exchange rate stability could weaken, seeing the naira coming under pressure. If global growth slows, export earnings could decline. Each of these scenarios would constrain the CBN’s flexibility.

This is not to dismiss potential upsides. Higher oil prices, if production improves, could bolster reserves and moderate fiscal deficits. Forex liquidity could strengthen the naira. Investment in upstream oil and gas could gain momentum. Historically, crude price increases have correlated with improved GDP performance and stock market optimism in Nigeria.

Yet history also warns of volatility. A good example is during the 2022 Ukraine conflict, oil prices spiked above $100 per barrel, which created a potential revenue windfall for oil-exporting countries, but Nigeria struggled to translate that temporary advantage into sustained economic improvement. Inflation persisted. In the case of Nigeria, the deep-rooted systemic or structural weaknesses and inefficiency diluted the benefits that should have been gained.

The lesson is clear because temporary external windfalls or short-term luck cannot substitute for structural and deep internal economic reforms.

The point is that sustainable development demands diversification beyond oil, to strengthening multiple parts of its economy at the same time, such as improved refining capacity, infrastructure investment, agricultural security, logistics efficiency, and fiscal consolidation. Monetary policy, as the action taken by the CBN at the MPC meeting by adjusting interest rates or attempting to control money supply, can anchor expectations and moderate volatility, but it cannot build productive capacity; it will only help to reduce short-term economic swings.

The CBN’s decision to cut the interest rate appears cautious. It is not a bold shift but rather a small adjustment. This shows that the bank is being careful and optimistic about the economy. It also knows that there are still problems. The trouble in the Middle East, like the fighting that affects the oil supply, reminds the people in charge that Nigeria’s economy is closely tied to what happens with energy around the world. This includes things like inflation, the value of money, and how fast the economy grows.

Until structural reforms reduce dependence on volatile oil cycles and imported fuel, Nigeria’s monetary policy will remain reactive to external crises. To really make the economy strong and stable, Nigeria needs to make some changes. It requires resilience against geopolitical storms.

The MPC has taken a step. Whether it marks a turning point depends less on 50 basis points and more on how Nigeria navigates a world increasingly defined by conflict-driven volatility.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: bl***********@***il.com

Feature/OPED

How Secure Is Nigeria…?

Prince Charles Dickson, PhD

A country’s security is not measured by the number of uniforms on the road. It is measured by whether an ordinary mother can sleep without one ear open, whether a trader can return from the market without rehearsing ransom instructions in her head, whether a doctor can drive to an emergency without praying not to meet a checkpoint more dangerous than the patient he is trying to save.

Nigeria today has security everywhere and safety nowhere.

That is the paradox. We have the architecture of force, but not the confidence of protection. We have commands, theatres, operations, task forces, and an alphabet soup of interventions. Yet for many citizens, insecurity still arrives first, and the state arrives later, sometimes not at all. Even the federal government has repeatedly acknowledged that the police ought to be the frontline institution for internal security, and that modern policing requires better training, technology, and professionalism. It has also admitted that police training facilities have fallen into serious dilapidation and need an overhaul.

So, the question is no longer whether Nigeria has security institutions. It does. The more uncomfortable question is whether the current federal policing model, as designed and practised, is still fit for the country we have become.

The Nigeria Police Force remains a centrally commanded institution, with authority cascading from the Inspector-General through Deputy Inspectors-General, Assistant Inspectors-General, Commissioners, and downward through the ranks. Administratively, it is split into eight departments. On paper, that looks orderly, neat, even reassuring. But Nigeria is not a paper country. It is a noisy federation of griefs, distances, fractures, ambitions, and emergencies. A chain of command that may satisfy legal elegance can also produce operational remoteness, delayed responsiveness, and a politics of policing in which local pain must wait for federal mood.

This is where the politics begins.

Who does the police truly serve in practice: the republic, the constitution, the citizen, or the powerful? That question hurts because Nigerians already know the answer in their bones. More than 100,000 officers are reportedly assigned to VIP protection out of an estimated 371,800 personnel. That means a startling share of police manpower is concentrated around the elite while ordinary communities make do with thin patrols, slow response, and the old folklore of “call anybody you know.” In effect, the state has built a two-tier policing culture: one for those with sirens, another for those with silence.

And when public policing weakens, Nigeria reaches reflexively for the military.

That too has become normal, and that is precisely the problem. The country now lives under a strange internal-security arrangement in which police are constitutionally primary, but the military increasingly occupies the emotional and operational space of first responder. Analysts have described this as a role lost to the military: a situation in which soldiers are overstretched, police are underpowered, and the public is trapped in a dangerous vacuum between both. New task forces and command theatres may project action, but they can also conceal a deeper institutional confession: that the police have not been built to carry the burden of modern internal security.

This is why I remain cautious when the state celebrates “combined operations,” “joint architecture,” and the multiplication of theatres. Coordination is necessary, yes. But coordination is not the same thing as competence. A nation cannot keep responding to civil insecurity as though every problem is a battlefield problem. Kidnapping, urban crime, community violence, organised extortion, digital fraud, and intelligence-led prevention all require policing that is forensic, local, trusted, and fast. The 21st century does not only ask for men with rifles. It asks for institutions with memory, data, integrity, and legitimacy.

And legitimacy is expensive.

You cannot demand ethical policing from men and women whom the system has abandoned to shabby welfare, poor housing, weak equipment, and thinning morale. Reuters reported in late 2025 that a low-ranking police officer earned about ₦80,000 monthly net pay. Around the same period, former IGP Mike Okiro publicly warned that economic hardship, poor welfare, and years of neglect were crippling police morale. An investigation by The ICIR in February 2026 described dilapidated barracks in Lagos where police families live inside cracked, ageing buildings that are tragedies waiting to happen. This is not merely a welfare issue. It is a security issue. A poorly paid, poorly housed, poorly equipped officer is not just vulnerable. He is recruitable by temptation.

So, is state police the answer?

Maybe. But only maybe.

The argument for state police is no longer fringe. In February 2024, federal and state authorities publicly agreed on the need for state police as insecurity worsened. As of March 1, 2026, the Senate says it intends to complete the constitutional amendment for state police before the end of the year, while also discussing safeguards against abuse by governors. That last phrase matters. Because state police can become either the localisation of safety or the localisation of tyranny. In the hands of disciplined constitutionalism, it may deepen community intelligence, faster response, and contextual policing. In the hands of bad politics, it could become a uniform errand boy for governors, godfathers, and vendetta.

So, let us not romanticise decentralisation. A broken institution does not become healthy merely by being copied 36 times.

State police without safeguards, independent oversight, diversity protections, judicial remedies, professional standards, and funding clarity may only decentralise abuse. Yet federal policing without radical reform has already produced a structure too centralised to feel local, too politicised to feel neutral, and too stretched to feel present. That is the Nigerian trap: the old model is failing, but the new model can also fail if designed as another elite bargain.

The real issue, then, is deeper than federal versus state. It is whether Nigeria truly wants citizen-centred policing or merely a rearrangement of command.

For years, we have treated the police as a ceremonial symbol, a regime accessory, or a checkpoint economy. We post them at politicians’ gates, attach them to convoys, and then act surprised when villages, highways, schools, and neighbourhoods feel abandoned. We invoke reform, but often mean procurement. We invoke modernisation, but often mean new uniforms and fresh rhetoric. Yet even the Presidency has admitted that true reform goes beyond repainting buildings or buying weapons. It requires a fundamental overhaul of institutional mentality and memory. That, perhaps, is the most honest sentence said about the police in recent years.

How secure is Nigeria?

Not secure enough to keep pretending that force projection is the same as public safety.

Until the police are rebuilt as a serious, modern, welfare-backed, intelligence-driven, citizen-facing institution, we will keep living inside a republic where the hierarchy is protected, the theatres are busy, the communiqués are polished, and the people remain one phone call away from abandonment—May Nigeria win!

Feature/OPED

History is Watching: Tinubu’s Moment to Rescue Nigeria’s Stolen Future

By Blaise Udunze

Governance is not complicated. It is about people and the resources entrusted to serve them. When resources are managed wisely, the people prosper, and prosperity spreads. Mismanage them, and poverty multiplies. Nigeria’s tragedy is not scarcity. It is stewardship.

For decades, Nigeria, described as Africa’s largest oil producer, has earned hundreds of billions of dollars, yet remains home to some of the world’s poorest citizens. That contradiction is not accidental. It is systemic. It reflects policy distortion, institutional weakness, and a culture of impunity that has too often treated public wealth as political spoils rather than a national trust.

The Abuja-based Independent Media and Policy Initiative (IMPI) recently captured this paradox bluntly by saying, Nigeria’s poverty crisis is not the result of inadequate resources, but of persistent failure to manage them prudently and sustainably. It described the crisis as a “self-inflicted economic malady.” That phrase should trouble every public official.

Between 1980 and 2015, Nigeria rode multiple oil booms. Instead of converting windfalls into diversified productivity, the country succumbed to what economists call the Dutch disease. Oil revenues surged. The naira appreciated. Imports became cheaper. Domestic production became uncompetitive. Agriculture declined. Manufacturing withered.

IMPI’s analysis shows that between 1980 and 1986, exchange rate appreciation crippled local industries and turned Nigeria from a major agricultural exporter into a net food importer. Cocoa, palm oil, and rubber, once pillars of export strength, gave way to dependency. A parallel distortion emerged, the so-called “Nigerian disease.” Rural labour migrated to cities in search of oil-fueled wage spikes. Farming declined. Food insecurity deepened, which has continued to linger each day. Over-mechanised and poorly coordinated agricultural investments, uncompleted irrigation projects, and subsidies skewed toward politically connected elites widened inequality. Oil wealth created the wrong impression of prosperity while hollowing out the economy’s productive core.

Former Vice President Yemi Osinbajo once framed the issue plainly: Nigeria’s challenge is not geographical restructuring but resource management and service delivery. After decades of vast oil earnings, the uncomfortable question remains. Where is the infrastructure?

If mismanagement were purely historical, recovery might simply require time and discipline. But the problem is not confined to the past, and this is because between 2010 and 2026, an estimated $214 billion, roughly N300 trillion, has been flagged as missing, diverted, unrecovered, irregularly spent, or trapped in non-transparent fiscal structures. These figures reveal that they are not speculative but arise from audit reports, legislative investigations, civil society litigation, and investigative findings across administrations.

The oil sector alone provides sobering examples. In 2014, unremitted oil revenues triggered national outrage. Years later, audit queries continue to trail the Nigerian National Petroleum Company Limited. The names of institutions change. The pattern persists. The Central Bank of Nigeria has also faced audit alarms over trillions in unremitted surpluses and questionable intervention facilities. Auditor-General has flagged failures to remit operating surpluses into the Consolidated Revenue Fund, alongside hundreds of billions allegedly disbursed to unidentified beneficiaries under intervention schemes, which is alarming and a common fraudulent practice.

Across ministries, departments, and agencies, trillions have been cited in unsupported expenditures, unremitted taxes, procurement irregularities, and statutory liabilities left unrecovered. The institutions differ. The language of audit reports varies. The years change. The pattern does not.

A natural occurrence, which is the plain truth, and unarguably, is that when electricity funds disappear, the grid collapses. Also, when agricultural loans remain unrecovered, food prices surge. The same goes when social investment programmes stall due to bureaucratic lack of transparency; the vulnerable remain exposed. Nigeria borrows not only because revenue is insufficient but because leakage is persistent.

The 2026 fiscal projections sharpen the dilemma. This has continued to raise concern as seen in the proposed N58.47 trillion budget, which carries a N25.91 trillion deficit, with N15.9 trillion allocated to debt servicing. What signifies a systemic failure is that nearly half of the projected federal revenue will service past loans before development priorities are funded. The truth be told, borrowing is not inherently destructive. Economies such as the United States deploy deficit financing strategically to expand productivity. The difference lies in what the borrowing finances.

To date, Nigeria’s deficits are increasingly funded by recurrent obligations rather than productivity-enhancing infrastructure. This is why Nigeria’s domestic borrowing persistently crowds out private-sector credit, driving up interest rates and stifling enterprise. Time after time, the nation has continued to witness how weak revenue mobilisation, overt oil dependence, and institutional inefficiencies compound the strain, and for these reasons, public debt is projected to has surpass N177.14 trillion by the end of 2026, which is driven by the budget deficit in 2026 Appropriation Bill.

Based on what is obtainable in other advance country, debt becomes sustainable only when borrowed funds are channeled into growth-enhancing investments, institutions ensure transparency and value for money, and economic expansion outpaces debt accumulation. When these conditions weaken, deficits evolve into a fiscal trap.

Despite some of the challenges occasioned by mismanaged resources and leakages, policymakers project cautious optimism. The Central Bank forecasts GDP growth of approximately 4.49 percent, moderating inflation, and foreign reserves exceeding $50 billion. On paper, stability appears to be returning. But stability is not prosperity.

Take, for instance, between 2006 and 2014, Nigeria recorded average GDP growth rates of six to seven percent, peaking near eight percent. Yet poverty remained stubbornly high, judging by the lived experience of the populace. This shows that growth without inclusion is only an arithmetic, not development. Today, households confront elevated food prices despite the report that food inflation fell from 29.63 per cent in January 2025 to 8.89 per cent in January 2026, energy costs, and unemployment. Yes, one may say that the exchange-rate unification and fuel subsidy removal were economically rational reforms. However, without aggressive domestic production expansion and credible social safety nets, adjustment costs fall heavily on citizens.

The concept of the “resource curse,” coined by Professor Richard Auty, explains why resource-rich nations often experience weaker institutions and lower long-term growth than resource-poor peers. Nigeria truly exemplifies that irony. Yet the curse is not inevitable. This is because countries such as Norway and Botswana transformed natural resource wealth into long-term prosperity through disciplined institutions, sovereign wealth management, and uncompromising transparency, which happens to be foreign to Nigeria’s system. The difference was not geology. It was governance.

Former President Olusegun Obasanjo has never been quite over resource plundering as he lamented that Nigeria has squandered divine gifts. The same lies with the former Minister George Akume, who warned that no nation grows if a quarter of its resources are consistently mismanaged. The former Anambra governor, Peter Obi, observed bluntly that wealth cannot be entrusted to those without integrity. The United Nations is also amongst those who have repeatedly warned that mismanaged natural resources fuel instability and conflict. Where institutions are weak, resource wealth becomes combustible. Nigeria has navigated that edge for decades.

Nigeria does not suffer from a shortage of reform announcements. It suffers from a gap between announcement and enforcement. The Treasury Single Account was designed to consolidate public funds under constitutional oversight. Yet significant funds have periodically remained outside complete transparency. The problem is that audit findings often accumulate without visible recovery, prosecution, or systemic reform.

The reality is that if every naira saved from subsidy reform is not transparently reinvested in infrastructure, healthcare, education, and productivity, public trust will erode further. If intervention facilities are not tracked and repaid, agriculture will stagnate. If oil revenues are not fully remitted and independently audited, diversification will remain rhetorical, just as they have defined the system today. What will definitely propel a change when visible enforcement, recoveries, prosecutions, and institutional strengthening must replace quiet reports and circular memos.

President Bola Ahmed Tinubu stands at a consequential intersection due to the critical issues unfolding. His administration has initiated painful but necessary reforms in the areas of fuel subsidy removal, exchange-rate unification, and fiscal restructuring. One stands to say that these measures aim to restore macroeconomic order. But for a fact, macroeconomic stability is a foundation, not a destination. His presidency will either mark the beginning of Nigeria’s fiscal rescue or consolidate a system that mortgages tomorrow to survive today.

Human capital cannot remain peripheral. Education aligned with labour-market needs, vocational capacity, healthcare access, and social protection are economic multiplier, not welfare indulgences. Capital expenditure must prioritise integrated infrastructure like power transmission, logistics corridors, and digital connectivity, that unlocks productivity. Every earned naira must enter the Federation Account transparently. Every statutory surplus must be constitutionally remitted. Every diversion must carry a consequence.

One thing that must be understood today is that Nigeria’s future will not be determined solely by oil output or GDP growth percentages. It will be determined by whether resources translate into reliable electricity, functioning roads, expanding industries, competitive exports, and rising household incomes. A nation can borrow to build bridges. Or it can borrow to pay salaries. The former compounds growth. The latter compounds debt.

If deficits translate into visible infrastructure, industrial expansion, thriving private enterprise, and strengthened revenue generation, history will record this era as a bold recalibration. If not, it will be remembered as deferred reckoning.

Nigeria has been wealthy for decades. What it has lacked is disciplined guardianship of that wealth. End the era of systemic leakage and institutional silence, or preside over its continuation. The choice is stark but clear. The point is, this is not just about one leader’s legacy; it is about the future of over 200 million Nigerians and generations.

And for nearly 200 million Nigerians, the outcome will define not just a presidency, but a generation.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: bl***********@***il.com

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn