General

EFCC Declares MBA Forex Owner Wanted Over N231bn

By Modupe Gbadeyanka

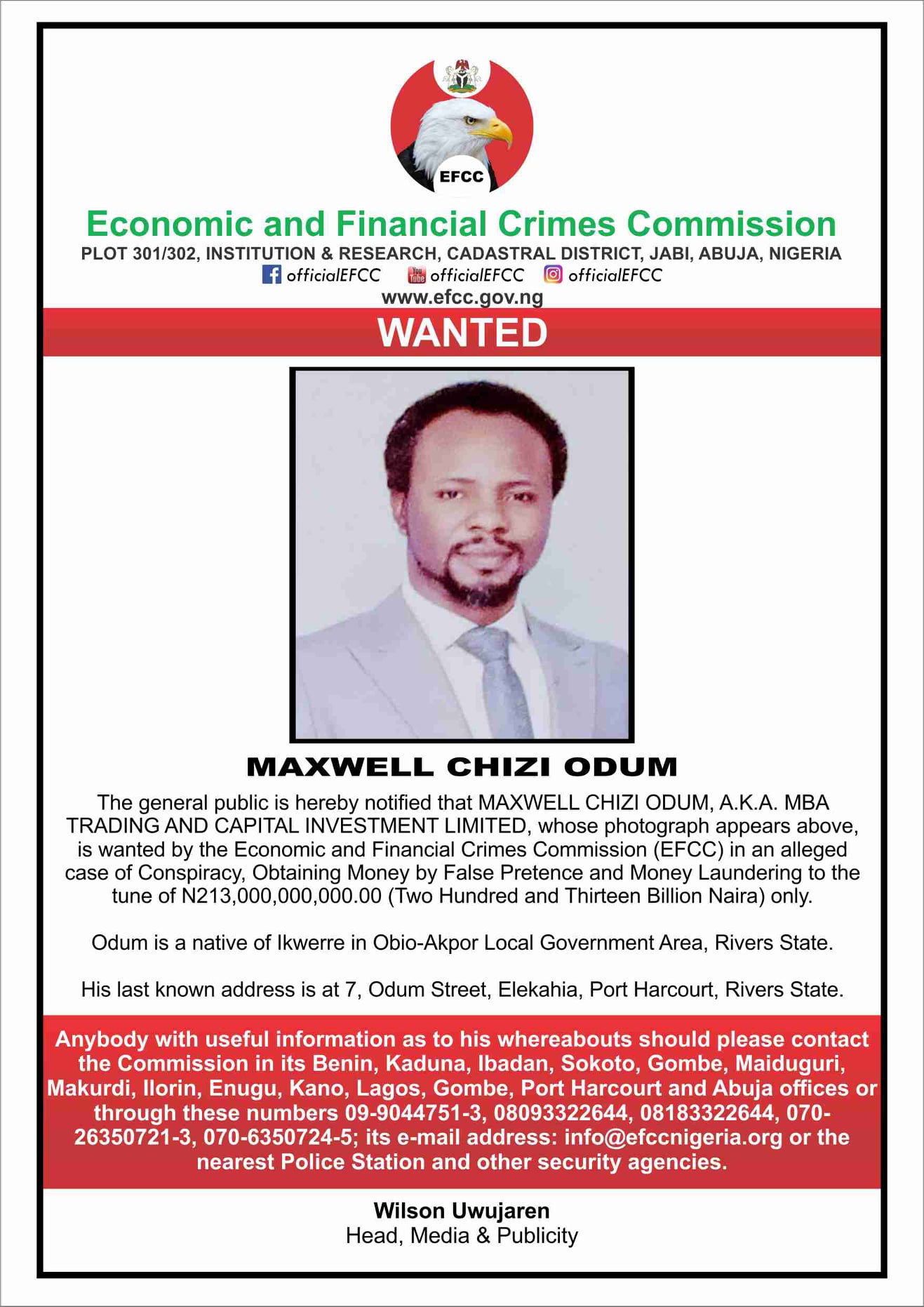

Mr Maxwell Chizi Odum, the founder and chief executive of MBA Trading and Capital Investment Limited, otherwise known as MBA Forex, has been declared wanted by the Economic and Financial Crimes Commission (EFCC).

A statement issued by the Head of Media and Publicity of the EFCC, Mr Wilson Uwujaren, confirmed this development on Wednesday.

According to the anti-graft agency, the self-acclaimed investor is wanted for allegations bordering on fraud to the tune of N213.0billion.

Members of the public with vital information that could lead to his arrest have been urged to make them available. His last known address, the EFCC said, was in Port Harcourt, Rivers State.

“The general public is hereby notified that Maxwell Chizi Odum, a.k.a. Mba Trading And Capital Investment Limited, whose photograph appears above, is wanted by the Economic and Financial Crimes Commission (EFCC) in an alleged case of conspiracy, obtaining money by false pretence and money laundering to the tune of N213,000,000,000.00 (Two Hundred and Thirteen Billion Naira) only.

“Odum is a native of Ikwerre in Obio-Akpor Local Government Area, Rivers State. His last known address is at 7, Odum Street, Elekahia, Port Harcourt, Rivers State.

“Anybody with useful information as to his whereabouts should please contact the commission in its Benin, Kaduna, Ibadan, Sokoto, Gombe, Maiduguri, Makurdi, llorin, Enugu, Kano, Lagos, Gombe, Port Harcourt and Abuja offices or through these numbers 09-9044751-3, 08093322644, 08183322644, 070-

26350721-3, 070-6350724-5; its e-mail address: [email protected] or the nearest Police Station and other security agencies,” the statement stated.

Recall that about nine months ago, MBA Forex claimed it has been unable to refund funds of investors to them because of the actions taken by the Central Bank of Nigeria (CBN).

The firm, which is involved in foreign exchange (forex) trading and investment in capital investment, said the banking sector regulator in Nigeria “suspended any dealings in our [bank] accounts.”

According to the chief executive of the organisation, Mr Maxwell Odum, “All other payment gateways we normally use for the easy payout of funds have also [been] blacklisted.”

He disclosed that this has made it quite difficult for some investors to get their money back from the company.

Mr Odum explained that the apex bank said it blocked the company’s bank accounts “to carry out some checks to ensure that we have been acting lawfully.”

However, the MBA Forex chief assured that those who invested in the firm would get their funds back as the “process has already commenced while some have already received their funds.”

Leave a Reply

General

SERAP Sues Tinubu Over Failure to Probe Missing N57bn

By Adedapo Adesanya

The Socio-Economic Rights and Accountability Project (SERAP) has filed a lawsuit against President Bola Tinubu for not probing allegations of N57 billion of public funds said to be missing, diverted or stolen from the Federal Ministry of Humanitarian Affairs and Poverty Alleviation in 2021.

The allegations were documented in the 2021 audited report released last month by the Office of the Auditor-General of the Federation.

Joined in the suit as respondent is the Attorney General of the Federation and Minister of Justice, Mr Lateef Fagbemi (SAN).

In the suit number FHC/L/MISC/876/2024 filed last Friday at the Federal High Court, Lagos, SERAP is asking the court “to compel President Tinubu to direct Mr Fagbemi to work with appropriate anti-corruption agencies to promptly probe allegations that over N57 billion of public funds are missing, diverted or stolen from the Federal Ministry of Humanitarian Affairs and Poverty Alleviation in 2021.”

It also asked the court “to compel President Tinubu to direct Mr Fagbemi to work with appropriate anticorruption agencies to prosecute anyone suspected to be responsible for the missing N57 billion, if there is sufficient admissible evidence, and to recover any missing public funds.”

In the suit, the group argued that, “Investigating the allegations and prosecuting those suspected to be responsible for the missing N57 billion and recovering the missing funds would end the impunity of perpetrators.”

“The allegations amount to stealing from the poor. There is a legitimate public interest in ensuring justice and accountability for these grave allegations.

“Poor Nigerians have continued to pay the price for the widespread and grand corruption in the Federal Ministry of Humanitarian Affairs and Poverty Alleviations and other ministries, departments and agencies [MDAs].”

“The consequences of corruption are felt by citizens on a daily basis. Corruption exposes them to additional costs to pay for health, education and administrative services.”

“The allegations also suggest a grave violation of the public trust, the Nigerian Constitution 1999 (as amended), the country’s anticorruption legislation and international anticorruption obligations,” the statement said in parts.

The suit filed on behalf of SERAP by its lawyers, Kolawole Oluwadare and Oluwakemi Agunbiade, noted that, “Granting the reliefs sought would go a long way in addressing corruption in ministries, departments and agencies [MDAs] and the country’s budget deficit and debt problems.”

“According to the 2021 annual audited report by the Office of the Auditor-General of the Federation, the Federal Ministry of Humanitarian Affairs and Poverty Alleviation, [the Ministry] in 2021 failed to account for over N54 billion [N54,630,000,000.00] meant to pay monthly stipends to Batch C1 N-Power volunteers and non-graduate trainees between August and December 2021,” the organisation said.

General

SMEDAN, Others to Help Small Business Owners Cut Costs

By Adedapo Adesanya

The Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) is collaborating with Rolling Energy to convert 100,000 vehicles to Compressed Natural Gas (CNG) in 18 months as part of efforts to support small businesses struggling to navigate the tough operating environment.

The Director-General of SMEDAN, Mr Charles Odii, disclosed this at the unveiling of a CNG Conversion and Training Centre in Abuja, noting that another partner is Pi-CNG.

“This new centre is designed to convert vehicles to run on CNG, an affordable and environmentally friendly alternative to traditional fuels.

“With its capacity to convert nine vehicles daily and a dedicated team of 20 technicians, the centre will help SMEs reduce transportation costs and adapt to changing energy needs.

“It will also train young Nigerians in CNG conversion, maintenance, and repair, equipping them with practical skills and opening up new business opportunities,” he stated.

According to Mr Odii, the mandate of the Pi-CNG initiative is to roll out about one million converted cars in the next 18 months.

“We at SMEDAN are committing to taking 10 per cent of those cars to be converted at our centres,’’ he said.

He added that the project aligned with SMEDAN’s GROW Nigerian strategy, which focuses on providing SMEs with Guidance, Resources, Opportunities, and Workforce Support.

“By adopting CNG, we are helping SMEs cut costs while promoting sustainable energy practices. This effort is particularly timely as businesses face rising fuel costs following subsidy removal.

“SMEDAN is also committed to improving access to critical infrastructure for SMEs. We are upgrading Industrial Development Centres across the country to provide affordable tools and power tailored to the needs of small businesses,” Mr Odii said.

On his part, the Californian Secretary of Transportation, Mr Toks Omishakin, praised Nigeria’s efforts in adopting cleaner energy alternatives, such as CNG, but urged stakeholders to look beyond CNG and invest in long-term renewable solutions.

“I see a tremendous opportunity for collaboration between California and Nigeria in exploring renewable energy solutions like solar, wind, and hydrogen,” he said.

The Executive Vice Chairman of the Presidential CNG Initiative, Mr Toyin Zubair, commended SMEDAN and other stakeholders for their contributions, emphasising the need to harness Nigeria’s vast natural gas resources to drive the economy.

“Nigeria has one of the largest gas reserves in the world. By using this resource locally to power vehicles and industries, we can reduce costs and create a cleaner environment,” Mr Zubair said.

The chief executive of Rolling Energy, Mr Mubarak Danbatta, explained that the conversion process prioritised safety and affordability, making it accessible to SMEs.

“With less than N4,000, a vehicle can be fully fueled with CNG, compared to over N60,000 for petrol. This is a significant relief for businesses.

“CNG is not a business for the rich. It is a business for everyone. And the good thing is that this partnership is being done with SMEDAN and Pi-CNG for the benefit of SMEs,” Mr Danbatta said.

General

Lagos to Get New Building Code in 2025

By Adedapo Adesanya

The Lagos State Government has expressed its readiness to get a brand-new Building Code next year, to achieve the high-performance standards needed to make Lagos a sustainable and Smart City.

The government’s readiness was disclosed at the Lagos State Executive Council Retreat on the Domestication of the Lagos Building Code, organised by the Office of the Special Adviser on e-GIS and Urban Development, held at Ikeja GRA on Wednesday.

Speaking during the retreat, Lagos State Governor, Mr Babajide Sanwo-Olu emphasised the need for more collaboration among all the ministries and agencies in the built sector, to ensure the state development in line with global best practices.

He said the motive behind the Lagos Building Code is to have a building regulation that would make Lagos much more resilient.

“We (Lagos State Government) are the first to domesticate the National Building Code, which is the creation of the Federal Government. We are not doing anything outside the vision at the sovereign and sub-sovereign levels. But what is unique about our own is the fact that all the cabinet members see the need to have an input because it would be an outcome that would affect lives and different ministries and agencies.

“So, there is a need for everybody to have a say, and at the end of the day, collectively we will resolve to have a way.

“What we are trying to do is for Lagos State to do what is obtainable internationally: have a building regulation in which we have a standard of construction in design, manner of land use occupancy, and use of building materials, which we believe would eventually improve and help with health, safety, and occupancy issues.

“It is all about building sustainably, making Lagos a lot more resilient and able to absorb shock in the future and able to stand in the comity of developed cities and city-states as we see in various parts of the world,” he said.

The Special Adviser to the Governor on eGIS and Urban Development, Mr Olajide Babatunde, stated that the Lagos Building Code is to complement the existing regulatory framework and provide a comprehensive solution to the challenges of land use, physical development, and urban planning.

Mr Babatunde said the Lagos Building Code will regulate building control, planning permission, and address the issues of setbacks; take care of the safety and sustainability of the environment; and also prevent the collapse of buildings.

“We have been working on the domestication of the National Building Code, and by next year, we are going to have our own brand-new Lagos Building Code. We have worked with professional bodies and people from academia, market women, and the public in general, and through a participatory approach, we can come out with a document that is acceptable to everyone and useful to the entire state,” he said.

Also speaking, the Special Adviser to the Governor on Infrastructure, Mr Olufemi Daramola, described the Lagos State Building Code initiative by the Babajide Sanwo-Olu administration as the next step to Green Lagos that will enable the state to plan buildings properly and ensure durable infrastructure in the state.

During the retreat, members of the Lagos State Executive Council brainstormed and advocated aggressive sensitisation for residents of the State on the Lagos Building Code before implementation.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN

Pingback: Fraud, Ponzi Schemes and Terror Financing: A Story About Banking In Nigeria - West Africa Weekly