General

Paris Accord: Nigeria Signs to Achieve 13GW Solar PV by 2030

By Dipo Olowookere

Yesterday, the world was taken aback with the decision of the United States to withdraw from the Paris Climate Accord, which it assented on April 22, 2016 with the agreement coming into force on November 4, 2016 after its acceptance on September 3, 2017.

President Donald Trump, while announcing the withdrawal of the US from the agreement, said the reason was because the deal did not favour America. He hinted that the United States could make a return if it was renegotiated.

Since Thursday’s event, which sparked global outrage, some Nigerians have wondered why the Federal Government assented to when it joined.

It is important to note that the Paris Climate Accord came into place on November 4, 2016, thirty days after the date on which at least 55 Parties to the Convention accounting in total for at least an estimated 55 percent of the total global greenhouse gas emissions have deposited their instruments of ratification, acceptance, approval or accession with the Depositary.

Since then, 147 parties have ratified of 197 Parties to the Convention.

Nigeria is one of the parties that have had its entry ratified. It signed the accord on September 22, 2016 and was ratified on May 16, 2017, and it is expected to come into force on June 15, 2017.

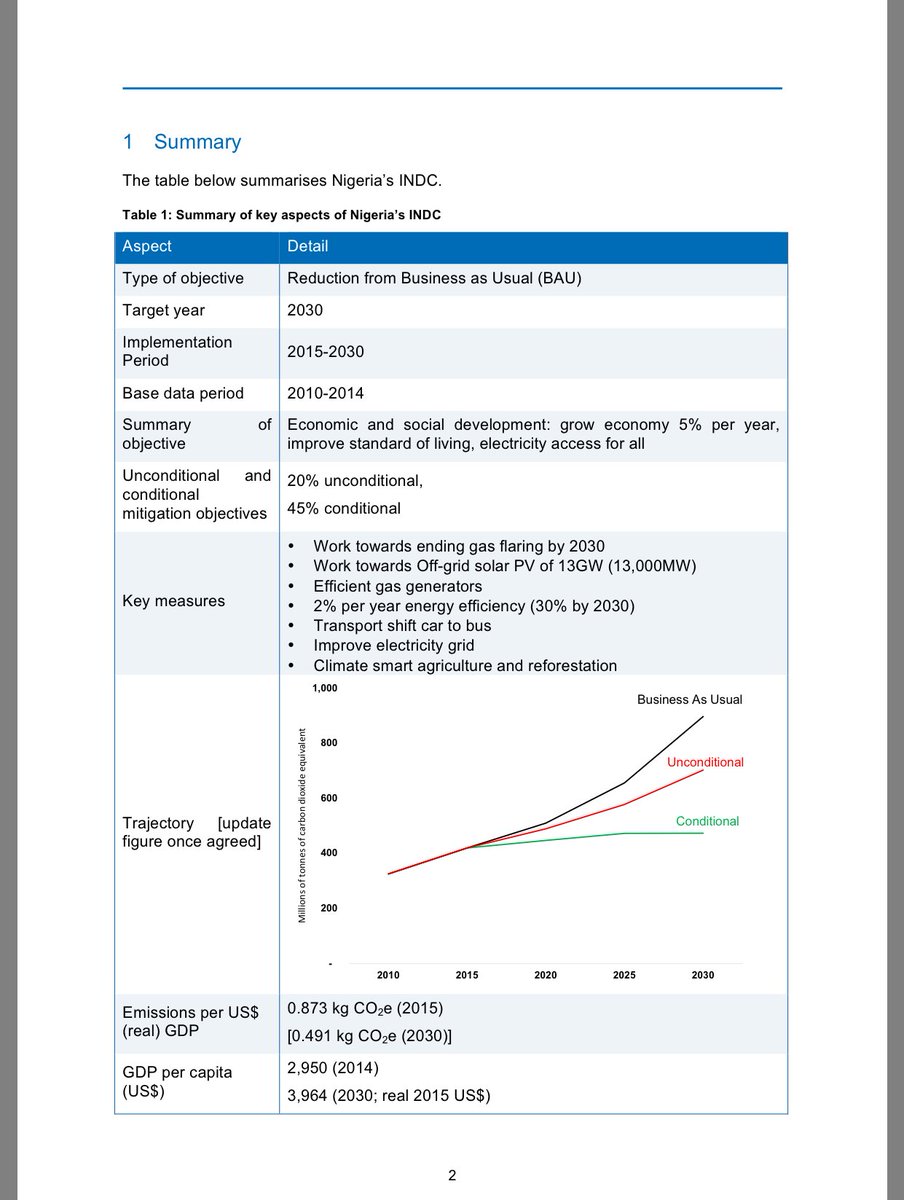

Digs done by Business Post showed that Nigeria agreed to work “towards ending gas flaring by 2030” and also “work towards Off-grid solar PV of 13GW (13,000MW)” at the same period.

The Federal government said it hopes to achieve “efficient gas generators, 2 percent per year energy efficiency (30% by 2030), transport shift car to bus, improve electricity grid, and climate smart agriculture and reforestation.”

The country also promised to achieve Business as Usual (BAU) of around 3.4 tonnes CO2e by 2030.

View the full report of Nigeria Here

General

NPA Working to Eliminate Manual Bottlenecks, Synchronise Operations Across Seaports

By Adedapo Adesanya

The managing director of the Nigerian Ports Authority (NPA), Mr Abubakar Dantsoho, has said the organisation is in collaboration with the International Maritime Organisation (IMO) to deploy the Port Community System (PCS) will eliminate manual bottlenecks and synchronise operations across Nigeria’s seaports.

Mr Dantsoho disclosed this at a recent three-day high-level stakeholder engagement in Lagos titled Achieving a 7-day Cargo Dwell Time, organised by the Presidential Enabling Business Environment Council (PEBEC) in collaboration with the NPA.

The engagement convened the Ports and Customs Efficiency Committee (PCEC) under the Business Environment Enhancement Programme Accelerator (BEEPA) framework, focusing on streamlining port processes to improve efficiency and ease of doing business.

According to the NPA boss, the PCS will serve as the digital backbone of the National Single Window, enabling seamless information exchange among port stakeholders and reducing delays caused by manual documentation.

On her part, the director-general of PEBEC, Mrs Zahrah Mustapha, said the session was designed to go beyond identifying challenges and focus on implementing long-overdue practical solutions.

“Nigeria loses significantly every day due to operational inefficiencies,” Mrs Mustapha said. “These are not just numbers; they represent missed opportunities, jobs not created, and delayed economic growth. This reform is about resilience and unlocking the nation’s economic potential.”

She added that the initiative brings together government regulators and private-sector stakeholders to promote transparency and accountability, with the ultimate objective of reducing cargo dwell time and improving vessel turnaround time.

Recall that the NPA recorded a 100 per cent success rate in PEBEC reforms, ranking fifth among government agencies in 2025 with an 84.2 per cent compliance rating.

Outcomes from the stakeholder engagement are expected to be implemented in the coming months. By addressing operational gaps identified during port inspections, the NPA and PEBEC aim to build a more competitive maritime environment that attracts investment and facilitates seamless trade.

General

Swedfund Puts $15m into Phatisa for Sustainable Food Systems in Africa

By Modupe Gbadeyanka

The sum of $15 million has been invested in Phatisa Food Fund 3 by Swedfund to improve food security, support decent job creation, and contribute to more resilient and sustainable food systems across Africa.

Swedfund’s investment is part of an $86 million first close, together with development finance institutions BII, Norfund, IFC, and FinDev Canada.

The investment aims to improve food security, support decent job creation, and contribute to more resilient and sustainable food systems.

Phatisa will invest in companies seeking to grow or transition ownership, and building on its long track record in the sector, the investment is expected to support companies that can expand production capacity, enhance efficiency and create more stable employment in local and regional markets.

Africa’s food systems are under increasing pressure from population growth, climate impacts, and fragmented value chains. Enhancing production, processing, and distribution is essential to ensure food becomes more accessible and affordable, while strengthening livelihoods.

“Strengthening food systems is essential for inclusive and resilient growth across African markets. Through this investment, we help channel long-term capital to companies that can expand production, support decent jobs, and improve access to affordable and nutritious food.

“The investment also contributes to deeper value chain integration, supporting more stable and sustainable livelihoods over time,” the Investment Manager for Food Systems at Swedfund, Sebastian Süllmann, stated.

Phatisa Food Fund 3 focuses on established companies across the food value chain in multiple African markets.

General

Protest in Abuja Over Senate’s Decision on e-Transmission of Election Results

By Adedapo Adesanya

Some protesters on Monday took over the streets of Abuja to register their displeasure over the Senate’s decision to reject the real-time transmission of election results.

The demonstrators have promised to Occupy National Assembly despite a heavy security presence at the parliament, with personnel drawn from the Nigeria Police Force, the Nigerian Army, and the Nigeria Security and Civil Defence Corps.

Although the Senate has issued several clarifications over reports that it rejected electronic transmission of results, the protesters insist that lawmakers must be explicit by including the phrase “real-time electronic transmission” in the proposed legislation.

Members of civil society organisations, a handful of opposition African Democratic Congress (ADC) members, and some women’s groups are gathered at the entrance of the National Assembly for the protest.

The Nigeria Labour Congress (NLC) on Sunday joined the call on the Senate to legalise the real-time transmission of election results, warning that the National Assembly’s refusal to make the provision law would lead to workers’ mass action.

Amid these threats, the Senate will hold an emergency plenary session on Tuesday, February 10, 2026.

In a notice sent by the Clerk of the Senate, Mr Emmanuel Odo, the lawmakers were directed to convene at the National Assembly complex on the instruction of Senate President Godswill Akpabio.

“I am directed by His Excellency, the President of the Senate, Distinguished Senator Godswill Obot Akpabio, GCON, to inform all Distinguished Senators of the Federal Republic of Nigeria that an Emergency Sitting of the Senate has been scheduled to hold as follows: Date: Tuesday, 10th February, 2026. Time:12:00 Noon. Venue: Senate Chamber,” the notice read.

Mr Odo urged all senators to attend the emergency sitting.

“All inconveniences this will cause to Distinguished Senators are highly regretted, please,” the memo read.

No reason was stated for the meeting, but the development comes amid debates about the e-transmission of election results after the Electoral Act amendment bill passed the third reading at the Senate. The lawmakers had adjourned plenary after that.

Clause 60 (30) of the Electoral Amendment Bill is connected with the electronic transmission of results. On Wednesday, the Senate retained the provision for the electronic transfer of results as contained in the 2022 Electoral Act.

The Upper Chamber rejected moves for the real-time transmission of results and a 10-year ban on vote-buyers and instead retained the sanctions of jail terms and fines.

Since the development, the Senate has come under fire. However, some of its members have clarified that the bill enjoyed the support of a majority of the senators.

Besides the e-transmission issue, the Senate also blocked the download of electronic voters’ cards from the INEC website, reduced the notice period for elections from 360 to 180 days, and cut the timeline for publishing the list of candidates from 150 to 90 days.

The Senate’s position on the transmission of election results contrasts with that of the House of Representatives. However, both chambers have set up conference committees to harmonise their differences, after which a clean copy will be transmitted to the President for assent.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn