General

Silence Laboratories Raises $4.1m for Privacy-Preserving Computing

By Adedapo Adesanya

Silence Laboratories has announced securing $4.1 million in funding to enable privacy-preserving collaborative computing led by Pi Ventures and Anurag Arjun, along with several prominent angel investors.

In a statement shared with Business Post, the company said with the market for privacy-enhancing technologies (PETs) growing globally at a compound annual growth rate of 26.6 per cent, there is growing demand.

In recognition of this, Silence Laboratories is offering to provide mathematical guarantees for techno-legal expectations as part of a mission to create infrastructure to enable complex data collaborations between enterprises and entities, without any sensitive information being exposed to the other engaging parties.

This would allow companies to work together on processing data, without needing to share data with the other party – allowing more sectors to benefit from new technology, with less risk.

The funding will be used to scale the company’s tech and business teams and enrich the company’s robust research and development (R&D) pipeline.

In the modern age, large companies are wrestling to leverage their customers’ data to provide ever-better AI-enhanced experiences but a key barrier to leveraging this opportunity is mounting public concern around data privacy, as ever-greater data processing poses risks of data leaks by hackers and malicious insiders.

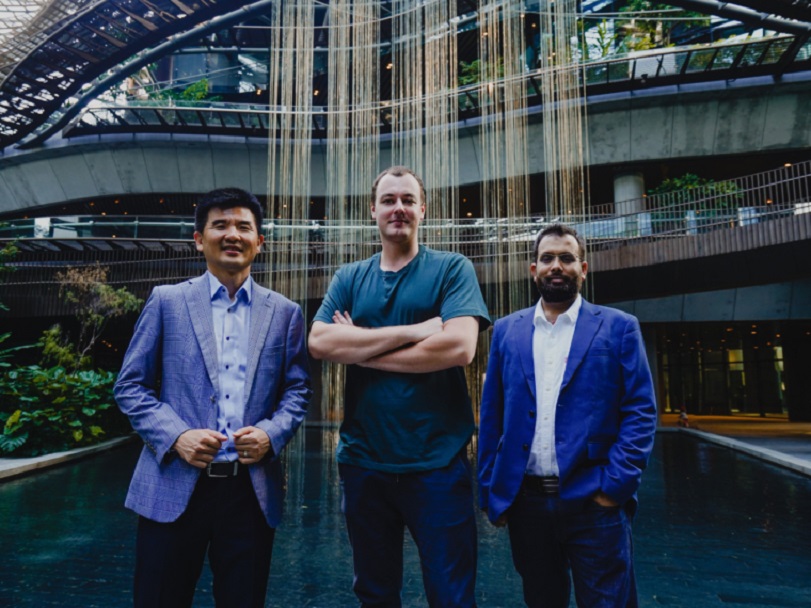

Founded in 2021 by Dr Jay Prakash (CEO), Dr Andrei Bytes (CTO), and Dr Tony Quek, the firm has also recently been expanding its global leadership team across cryptography, infrastructure business, and engineering.

Leveraging modern cryptography, the company already has one of the fastest distributed signature (authorization) libraries in production (Silent Shard), which has been audited by some of the best security auditing companies like Trail of Bits.

These libraries have led to the establishment of strong partnerships with leading digital asset infrastructure and protocol companies like BitGo, MetaMask, EigenLayer, Biconomy, and EasyCrypto.

These products on offer by the company use multi-party computation (MPC) as its core cryptographic primitives.

Commenting on the announcement, Mr Prakash said, “In today’s digital ecosystem, trust, and privacy are not merely options but imperatives for sustainable growth.

“With this new injection of funds, Silence Laboratories is poised to redefine privacy by enabling businesses to fully embrace the power of AI while rigorously protecting their most vital asset – customer trust.

“Our privacy-enhancing technologies assure that collaboration and innovation can flourish in an environment where the confidentiality and integrity of data are uncompromised.”

On his part, the Managing Director of Pi Ventures, Mr Mr Shubham Sandeep, said, “Secure data collaboration to enable privacy-preserving compute is an ever-growing problem, especially in highly regulated domains such as finance and healthcare. This requires solutions based on zero-trust cryptographic guarantees instead of relying on third-party data vendors who are prone to security breaches.

“The MPC infrastructure developed by the world-class team at Silence Laboratories is the fastest in the world, easily configurable, application agnostic, and provides full control to the user.

“We are excited to double down on our investment as we have seen the fantastic progress of the company over the last 18 months.”

“The Silence team is an amazing team with deep cryptography expertise and is working on a set of groundbreaking products in privacy and authentication infrastructure and I am really excited to support their journey.

“Privacy-preserving infrastructure combined with blockchain and fintech rails is going to be huge!” added MrAnurag Arjun from Kira Studio and former co-founder of Polygon.

General

Court Acquits Abba Kyari of 23-Count Asset Declaration Charge

By Adedapo Adesanya

Justice James Omotosho of the Federal High Court in Abuja has discharged and acquitted the suspended Deputy Commissioner of Police Abba Kyari of a 23-count charge of alleged non-declaration of assets filed against him by the National Drug Law Enforcement Agency (NDLEA).

Mr Kyari is being charged alongside his two brothers, who were accused of swearing to false affidavits to conceal the origin of some properties.

The court in its judgment held that the NDLEA failed to provide sufficient evidence to prove its case against the defendants, which is mostly the non-declaration of land properties.

Justice Omotosho noted that proving ownership of landed properties can be done through traditional history, title, acts of possession and possession by connection.

The prosecution did not provide any of these documents to show that the said properties located in Fountain Estate, Kasana, which belong to Ramatu Kyari, are truly owned by the police officer.

Also, the court held that the prosecution did not provide the same material evidence linking Mr Kyari to properties in Linda Choko Road, Asokoro and also Maiduguri in Borno State.

Mr Kyari, in his defense said the properties in Borno belonged to his father, which he left for him and his siblings.

It was judged that the prosecution did not prove otherwise, adding that the prosecution charged Mr Kyari’s brothers in bad faith for alleged conspiracy, which they failed to prove.

General

NCC Arraigns Netnaija’s Emma Analike Over Alleged Copyright Infringement

By Modupe Gbadeyanka

The chief executive of Netnaija Media Enterprises, Mr Emmanuel Analike, has been arraigned before a Federal High Court sitting in Abuja by the Nigerian Copyright Commission (NCC).

The suspect appeared before Justice Suleiman Liman on Wednesday over allegations bordering on copyright infringement.

He was accused by the NCC of using his online platform to make movies and others not belonging to him available for users to download on the internet.

According to the agency, Mr Analike has infringed copies of audio-visual materials distributed online via his website for online users. Netnaija is an online movie and music download site.

The prosecution counsel, Ms Gladys Isaac-Ojo, who works with the NCC, told the court that the defendant committed an offence contrary to and punishable under Section 44 (1) (a) of the Copyright Act, 2022.

However, Mr Analike pleaded not guilty to the charges preferred against him, prompting his counsel, Nnemeka Ejiofor, seek his bail.

The lawyer informed the court that the application was filed on Monday and supported by 23 paragraphs of affidavits and a written address.

But the judge refused to give a bench ruling and adjourned the ruling of the bail application to Monday, March 9, 2026, ordering the remand of the Netnaija chief in Kuje Correctional Centre.

General

Entries Open for ClimateLaunchpad Green Business Ideas Competition

By Modupe Gbadeyanka

Entries for the 2026 edition of the world’s largest green business ideas competition, ClimateLaunchpad, have opened.

In 2025, the programme, organised by Climate KIC, received over 2,700 applications from 40 countries. The winning ventures gain prize money, investor connections, and access to a global cleantech network.

This year’s edition is expected to be bigger and better, with climate innovators, green venture builders, and entrepreneurs from around the world given the opportunity to apply.

Since its inception in 2014, the programme has supported nearly 5,000 ideas across 97 countries, and this year, it is expanding its presence in Asia with Singapore hosting both the regional final and global grand final for the first time.

Participants move through several stages, including an initial mini-course to refine the concept, an intensive multi-day Boot Camp led by expert trainers, targeted coaching to perfect value propositions and investor pitches, national and regional finals, and a place at the global grand final, with prizes and access to a global climate network.

“Strengthening ClimateLaunchpad’s presence in Asia marks a profound new chapter for this programme and for the climate innovation movement more broadly. Asia is where so much of the world’s climate and nature future will be shaped, through business leadership, public-private partnerships and long-term strategic thinking,” the chief executive of Climate KIC, Kirsten Dunlop, stated.

“We look forward to supporting this momentum with new business ideas and innovation ecosystem collaborations across more than a dozen countries.

“This expansion opens space for deeper cross-cultural connections and for first-time founders to turn sparks of imagination into solutions that serve both people and planet,” Dunlop added.

Also commenting, the chief executive of Better Earth Ventures, Ms Rebecca Sharpe, said, “We are proud to host ClimateLaunchpad’s regional and global grand final in Singapore and to convene an international group of climate entrepreneurs from more than 50 countries.

“Climate solutions are emerging from every corner of the world, and bringing them together creates the kind of cross-border exchange and collaboration this moment demands. Our focus is to ensure early-stage founders have the structure, ecosystem access and support needed to move from idea to credible impact.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn