Jobs/Appointments

How Businesses Can Focus on Employees to Avoid The Great Resignation

By Hyther Nizam

Across the globe, The Great Resignation has become a source of concern among businesses. It refers to the unprecedented number of workers quitting their jobs in the Covid-19 and post-pandemic eras.

In Nigeria, businesses have recently seen their fair share of voluntary employee resignations. Most notable was the “big quit,” an exodus of top tech talents from Nigerian Banks. Nigerian millennials and Gen Zers, who comprise a large percentage of job-hoppers, also account for the majority of the young workforce population in the country. Now, they are re-evaluating their working experiences after the hard hit of the pandemic. The Deloitte Global 2022 Gen Z and Millennial Survey reveals that the youngest generations in the workplace are now seeking balance, prioritising happiness, and expressing higher expectations for compensation.

With an unemployment rate of just over 33%, you may think few employed Nigerians can really afford to leave their jobs. But the truth is, even here, employers aren’t immune to The Great Resignation. Thanks to the rise of remote work, Nigerian workers (especially those with in-demand skills) can truly compete in the global job market, and not limit themselves to regional roles. They have faced many of the same pressures as other workers around the world as a result of the pandemic, meaning they have the same temptations to start their own businesses or enter the freelance market.

What can businesses do to avoid losing employees to the Great Resignation? While the answer may vary depending on industry and market, the one universally key solution is to earn employee support.

The importance of employee loyalty

Before digging into how organisations can earn employee support, it’s important to remember why it matters. Losing an employee can take a big toll on your company (with the effect magnified for smaller organisations). On average, it takes 41 days to fill a position. That’s 41 days other people in the business have to do all of a former employee’s duties in addition to their own.

Further, replacing an employee can be incredibly expensive. According to the analytics and advisory company, Gallup, it can cost one-half to two times the employee’s annual salary to replace them. Whichever way you cut it, you could give that employee a substantial salary increase and it would still be more financially viable than replacing them.

It’s also worth pointing out that there’s a positive correlation between good employee experiences and good customer experiences. That makes sense—a single positive interaction with an employee can dramatically alter how a customer perceives and experiences the company. The chances of a positive interaction taking place are much slimmer in companies that have high levels of employee turnover and a lack of institutional experience.

Building employee support

With that in mind, how should companies go about building the employee experiences they need to ensure they have the full support of their workers?

The HR team can leverage cloud technology and implement a comprehensive human resource management system (HRMS) in order to automate most of their mundane manual tasks. Through HRMS, an organisation can also create a self-service model so employees have a single portal for various activities, such as applying for leave and adding medical claims. By creating workflows, the company can ensure that when a request is raised, the appropriate approver is automatically notified. Automating processes will free up the HR team to focus on employee engagement activities.

Rethinking talent acquisition

The rise of remote work as a result of the pandemic saw many people leave big cities for smaller towns and villages. For some, the move was inspired by the prospect of a better quality of life; for others, it was about being closer to family.

Rather than lament the loss of centralised offices in big cities, smart organisations should see this as an opportunity. Instead of fighting over the same pool of talent available in metro cities, they can create opportunities for those living in non-urban centres or rural areas, and invest in skill development.

At Zoho, for instance, we have always believed that talent is everywhere, though opportunities are not. We have traditionally hired people from all backgrounds and opened offices away from city centres in order to tap under-utilised talent in smaller towns and rural areas. We expanded this approach during the pandemic by opening smaller, satellite offices wherever we had enough employees residing, instead of prompting them to come back to the office. We have been hiring locally in these satellite offices. By creating opportunities in the sought-after tech sector in non-urban and rural areas, we help communities retain talent and flourish. This adds a sense of purpose to the job, which also helps in retaining talent.

The right (virtual) environment

Even if an organisation meets its employees’ needs when it comes to working location, it’s still important for it to provide the best possible working environment (even if it’s a virtual one).

One of the most effective ways of doing this is to take a considered approach to the software solutions your employees work with on a daily basis. Rather than a patchwork of software solutions, for example, organisations can benefit from a unified enterprise software suite that meets all their needs—from documentation to meetings, to CRM. In an increasingly hybrid work environment, keeping data and processes on a unified system leads to better visibility and fosters cross-functional collaboration.

A holistic approach

Employers looking to ensure that their businesses do not fall prey to The Great Resignation need to have an understanding of the concerns Gen Z and millennial employees have with respect to the workplace and their career paths. They should be deliberate in creating a flexible working experience where the employee can thrive in a globally competitive environment.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

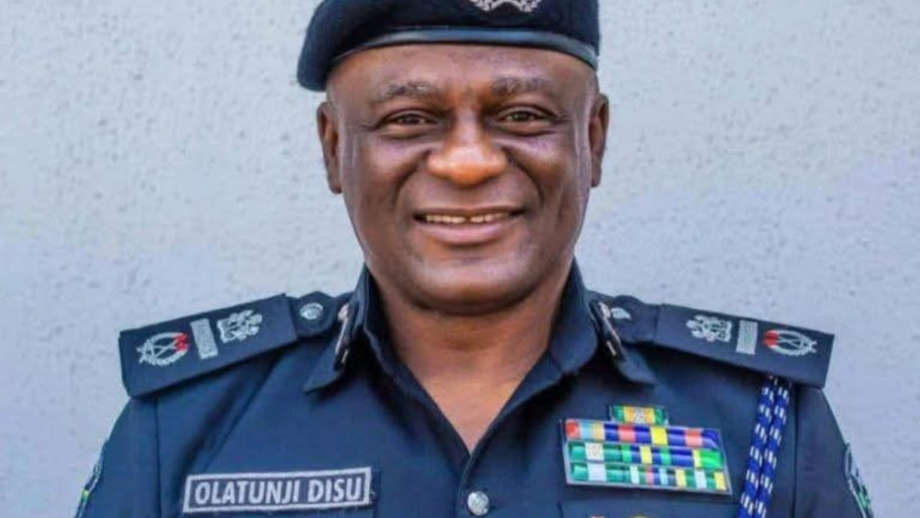

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn