Jobs/Appointments

Omoluabi Mortgage Bank Awaits CBN Approval of Adekunle as MD

By Dipo Olowookere

The board of Omoluabi Mortgage Bank Plc has announced a change to its composition with the appointment of few individuals, though subject to the approval of the Central Bank of Nigeria (CBN).

In a statement signed by the company secretary, Olabisi Fayombo, it was disclosed that the organisation has a new Managing Director and he is Mr Adewole Adekunle.

Others appointed to the board were Mr Yemi Adefisan as a non-executive director, Mrs Feyintola Ibidunni Olatunde-Agbeja as an independent director, Mr Olufemi Adesina as a non-executive director, and Mr Oyewole Olowu as an executive director.

The new Managing Director, Mr Adewole Adekunle, is a thorough-bred banking professional with over 22 years’ experience cutting across retail, commercial, corporate banking, public sector, corporate strategy, corporate & structured finance, risk management, credit collections & recoveries and legal.

He was at various times head of branch operations, profit centre manager, branch manager, regional director and Group Head in Omega Bank (now Keystone Bank), Standard Trust Bank (now UBA), Broad Bank (now Union Bank) and Sterling Bank where he left in 2018 on General Management Cadre.

He has honed relevant skills in building and leading high performing teams and brings on board a deep knowledge of the market, personal acumen, team leadership skills and business fundamentals relevant to mortgage banking.

Mr Adekunle holds a Bachelors of Technology degree in Applied Meteorology from the Federal University of Technology, Akure, two Master in Business Administration degrees in Marketing and Finance from University of Ado Ekiti and Metropolitan School of Business & Management, UK respectively.

He also holds a Master in Business Law (LLM) from the Metropolitan School of Business & Management, UK and a Certificate in Global Management (CGM) from the Institut Européen d’Administration des Affaires (INSEAD), Fontainebleau, France.

He is a member of the Nigeria Institute of Management, Honorary Senior Member of the Chartered Institute of Bankers of Nigeria, Alumnus of the prestigious INSEAD Global Management Program and Lagos Business School’s Advanced Management Program.

On his part, Mr Adefisan has been widely exposed to business formation, strategy and planning in the course of his career spanning over 20 years, traversing through banking, oil and gas, real estate, manufacturing and logistics industry.

He is a consummate banker and financial expert having previously worked with Seven Up Bottling Company Plc, Pacific Bank Limited (Unity Bank Plc), Crystal Microfinance Bank Limited, Skye Bank Plc and Fast Credit Limited.

He holds two Master in Business Administration degrees from Ladoke Akintola University and Metropolitan School of Business and Management, United Kingdom.

A Fellow of Microfinance Association UK, National Institute of Marketing of Nigeria and Institute of Management Consultants. He is also a member of the Nigerian Institute of Management (Chartered), Institute of Directors Nigeria and Nigerian Economic Summit Group (NESG). He seats on the board of over 15 companies across Africa and currently serves as the Group Chief Executive of CITITRUST Holdings Plc.

For Mrs Olatunde-Agbeja, she is a Fellow of the Institute of Chartered Accountants of Nigeria who graduated in 1980 with a Bachelor of Science Degree in Computer Science and Mathematics from the University of Lagos, Lagos.

Thereafter, she became an Audit Trainee at the accounting firm of Peat, Marwick, Ani, Ogunde & Co. (now KPMG) and qualified as a Chartered Accountant in 1987.

She joined the services of the Central Bank of Nigeria (CBN) as a Senior Supervisor in 1986 and her experience spanned over 32 years in the key areas such as banking operations, internal audit, banking and other financial institutions supervision amongst others.

She was appointed an Assistant Director of the CBN in 2006, and further appointed as the Branch Controller of CBN Abeokuta Branch, Ogun State where she retired as a Director in September 2018. She joined Boff & Company as Executive Director, Finance and Administration in February 2019.

On the part of Mr Adesina, a financial, marketing and management professional, he is armed with over 20 years of extensive and diverse experience in finance, private equity, banking, and venture capital marketing, marketing communication, sales and administration.

He started his career with KPMG before moving to the business group of a top Nigerian bank. He later moved to the Financial Control and Strategic Planning unit of the bank. He has worked with a number of other firms. In 2005, he became the pioneer Managing Director of Fluffy Enhancing lives Funds Limited, a private equity firm.

He consults for a lot of businesses, including Oasis Shefa Int’l Limited, Jineda Global Limited (both oil brokerage firms) and Consultoria Foresighta Limitada, a Brazillian firm.

He is a fellow of the National Institute of Marketing of Nigeria, fellow of the Certified Institute of Purchasing Supply of Nigeria. He holds MBA from Kensington University, Glendale, California. He also sits on the board of Fluffy Funds Limited, WheelyWheely Logistics Limited and Livingsprings Helicopters Limited.

Another appointee, Mr Adewole, is an Estate Management graduate of Obafemi Awolowo University, Ile-lfe, Osun State. He also has a National Diploma in Surveying and Geoinformatics from the Federal polytechnic, Ado- Ekiti.

He worked with Zain Nigeria and then moved on to Portal Realties Limited where with diligence and hard work he rose to the position of the General Manager Sales Division. He co-founded Capital Metropolis Synergy Limited, a real estate development and consultancy outfit in Abuja.

For Mr Olowu, he is a graduate of Accounting from the Lagos State University. His experience cuts across both the public sector and the banking industry. He worked with the Raw Materials Research Development Council (RMRDC), Federal Ministry of Science & Technology as a State Accountant in the Lagos State Liaison Office for 10 years before joining the banking sector.

He is a versatile mortgage banker with over 15years experience in banking operations, e-banking, credit, business development and retail banking. He had worked with Lagoon Homes Savings and Loans Limited (Mortgage Bankers), Resort Savings and Loans Plc. (Mortgage Bankers) and Jubilee-Life Mortgage Bank Plc, from where he joined Omoluabi Mortgage Bank Plc.

He holds an MBA (Finance) and an Honorary Fellow Institute of Corporate Administration (FCA).

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

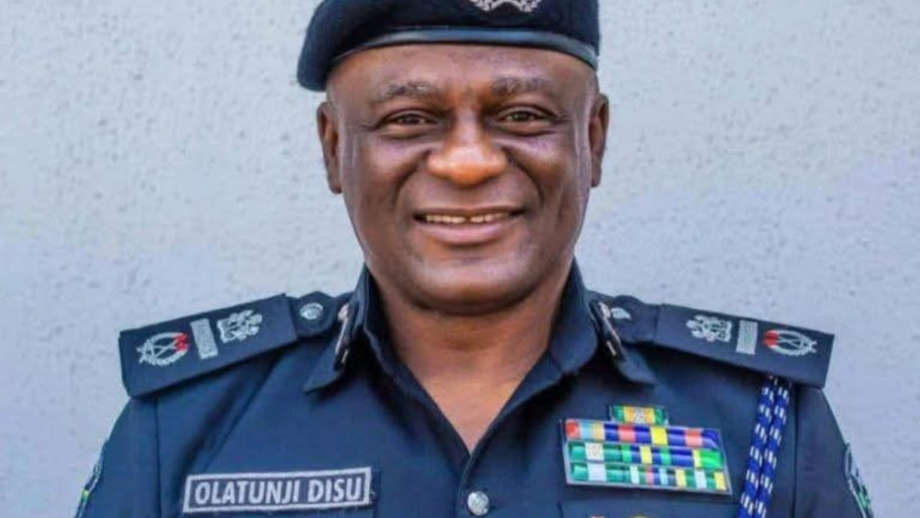

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn