Media OutReach

‘Buy gold, ask questions later’. Octa broker comments on Trump’s first 100 days in office

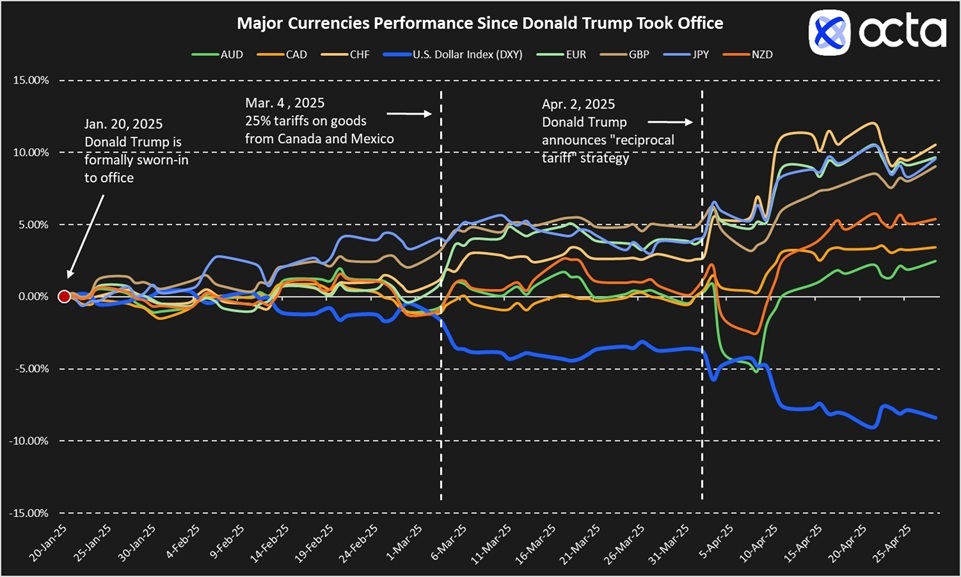

Donald Trump assumed office on 20 January 2025, and market volatility has been rising ever since. Some of Trump’s initiatives, particularly his aggressive trade policies, have sent shockwaves through equities, currencies, and commodities, leaving retail forex traders scrambling to adjust. Meanwhile, larger investors struggled to adapt to the rapid pace of proposed reforms and their far-reaching consequences. Overall, the first 100 days of President Trump saw heightened risk aversion and widespread uncertainty, which resulted in sharp fluctuations in asset prices and currency exchange rates as traders reacted to every policy announcement, tweet, and speech from President Trump and his new administration. Below is a list of just a few of the notable days that shook the markets.

Major market-moving events

- 20 January. The U.S. Dollar Index (DXY) dropped by more than 1.20% after news surfaced that the new administration will not immediately impose trade tariffs, prompting a rally in the currencies of some U.S. trading partners: notably, the Mexican peso (MXN), the Euro (EUR) and the Canadian dollar (CAD). It should be noted that prior to the sharp decline, the greenback had been rising almost uninterruptedly since September 2024, almost reaching a three-year high ahead of Trump’s inauguration as the market assumed that higher tariffs would spur inflation, prompting the Federal Reserve (Fed) to pursue a more hawkish monetary policy.

- 1–3 February. In the future, historians may label 1 February as the official start of a global trade war. On this day, Donald Trump imposed a 25% tariff on imports from Canada and Mexico, along with an additional 10% tariff on China. The market’s reaction was highly negative. U.S. stock futures slumped in early Asian trading on Monday, 3 February, with Nasdaq futures down 2.35% and S&P 500 futures 1.8% lower. U.S. oil prices jumped more than $2, while gasoline futures jumped more than 3%. Meanwhile, the Canadian dollar and Mexican peso weakened substantially, with USDCAD surging past the 1.47900 mark, a 22-year high, and USDMXN touching a 3-year high as economists warned that both countries were at risk of recession once the tariffs kick in. Later that day, Trump agreed to delay 25% tariffs on Canada and Mexico for a month after both countries agreed to take tougher measures to combat migration.

- 3–5 March. This is when the market began to seriously worry about the health of the global economy and a risk-off sentiment became evident. As fresh 25% tariffs on most imports from Mexico and Canada, along with the 20% tariffs on Chinese goods, were scheduled to take effect on 4 March, investors started to sell-off the greenback and flock into gold (XAUUSD) as well as into alternative safe-haven currencies, such as the Swiss franc (CHF) and the Japanese yen (JPY). In just three trading sessions (from 3–5 March), DXY plunged by more than 3% while the gold price gained more than 2%.

- 6 March. Donald Trump signed an executive order establishing a U.S. cryptocurrency reserve. However, it was unclear how exactly this reserve would work and just how much it would differ from Bitcoin holdings already in place. Many crypto enthusiasts were disappointed, which triggered a five-day downturn in BTCUSD, culminating in Bitcoin briefly dipping below the crucial $80,000 level on 10 March.

- 2 April. The trade war entered the next stage when Trump unveiled his long-promised ‘reciprocal’ tariffs strategy, essentially imposing import duties on more than a hundred countries. The market route began with equity markets losing billions of dollars in valuation. S&P 500 lost more than 11% in just two days, while DXY dropped to a fresh six-month low.

- 9–11 April. Trade war drama continued to unfold. Financial markets were stunned by President Trump’s abrupt reversal on tariffs. Duties on trading partners, which had taken effect less than 24 hours prior, were largely rolled back as the President announced a 90-day freeze on the reciprocal tariffs. However, a 10% blanket tariff was still applied to most nations. In contrast, the trade conflict with China escalated sharply. Following China’s 84% retaliatory tariff on U.S. goods, the U.S. increased tariffs on Chinese imports to 125%. This, combined with existing duties, brought the total U.S. tariff burden on Chinese imports to 145%. Kar Yong Ang, a financial market analyst at Octa broker, comments: ‘I will remember that day for a long time. Traders were stunned by Trump’s sudden U-turn on trade policy and really struggled to make sense of it all. A knee-jerk reaction was to simply buy gold and ask questions later.’

Apart from country-based tariffs, Trump also introduced additional import tariffs on aluminium and steel and ordered a probe into duties on copper imports. Overall, his aggressive trade policies have fueled speculation about the global recession, which explains why gold has been one of the best-performing assets since Trump took office. Kar Yong Ang comments: ‘We are dealing with a rather unusual situation. Even a global depression is not out of the question as tariffs may disrupt supply chains, hurting global output while also contributing to stronger inflationary pressure. This will certainly complicate monetary policy decisions. If I were to describe Trump’s first 100 days in just two words, it would be “run for safety”.’ Indeed, Trump’s recent public criticism of Jerome Powell, the Fed’s Chairman, added more fuel to the fire of nervous investor sentiment.

Overall, the full effect of Trump’s policies is yet to materialise, but the potential impact on global trade and the macroeconomy is substantial. The IMF, citing escalating trade tensions, downgraded its 2025 global growth forecast to 2.8% and warned of potential stock market crashes and a 7% contraction in the world economy should trade wars persist. Although Scott Bessent, the U.S. Treasury Secretary, hinted at de-escalating U.S.-China trade tensions, it is clear that investors should still get used to living in a period of heightened volatility and uncertainty. Kar Yong Ang has this advice for an average retail trader: ‘Focus more on short-term trades with tight stop-losses as opposed to long-term position-trading, cut exposure to U.S. equities, diversify into gold and other safe-haven currencies like Swiss franc and most importantly, keep your mind clear and be ready to quickly switch from one position to another’.

___

Disclaimer: This content is for general informational purposes only and does not constitute investment advice, a recommendation, or an offer to engage in any investment activity. It does not take into account your investment objectives, financial situation, or individual needs. Any action you take based on this content is at your sole discretion and risk. Octa and its affiliates accept no liability for any losses or consequences resulting from reliance on this material.

Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision. Past performance is not a reliable indicator of future results.

Availability of products and services may vary by jurisdiction. Please ensure compliance with your local laws before accessing them.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

![]() Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In Southeast Asia, Octa received the ‘Best Trading Platform Malaysia 2024’ and the ‘Most Reliable Broker Asia 2023’ awards from Brands and Business Magazine and International Global Forex Awards, respectively.

Media OutReach

Zoho Corporation Surpasses One Million Paying Organisations as Customers

On its 30th Anniversary, Zoho Corporation exceeds milestone of 150 million users

SINGAPORE – Media OutReach Newswire – 5 March 2026 – Zoho Corporation, a global technology company, today marked its 30th anniversary with the announcement of two major company milestones. Zoho Corporation, consisting of Zoho, ManageEngine, Qntrl, and TrainerCentral, is now a trusted technology provider to more than one million paying customers and more than 150 million users globally. Today’s announcement follows significant YoY customer (32%) and revenue (20%) growth in 2025.

Zoho Corporation would foremost like to thank every one of its customers, big and small, whose loyalty and support has had an outsized impact on the company’s foundation, growth, and future success. To honor that commitment, Zoho Corporation is shining a light on a few dedicated customers, whose success it is proud to have helped support.

“‘What made us stick with Zoho for so long is consistency and trust. Zoho continues to invest in its platform with a clear long-term vision, not short-term trends. The products are stable, well integrated, and designed to support real business needs, which allows us to confidently recommend Zoho to our clients year after year,” said Alexon Garcia, Technical Delivery Manager, Devtac, Philippines. “As Zoho turns 30, we would like to thank the people building the products. Your focus on privacy, value, and practical innovation truly sets Zoho apart in the market. It shows that the company is built for the long run and not driven by hype.”

“For almost a decade of using Zoho Desk and Zoho SalesIQ, we have seen a huge improvement in the way we handle tickets and access reports, enabling our team to make faster, data-driven decisions. Over time, Zoho has naturally become an integral part of our daily operations because it is easy to use, reasonably priced, and continues to evolve based on real feedback from its users. A big thank you to the Zoho team for building such a powerful SaaS platform—we look forward to continuing to grow together in the years to come,” said Wildan Zubaidi, VP of Customer Experience, PT Biznet Gio Nusantara, Indonesia.

“During periods of rapid business expansion and operational complexity, particularly when organizations needed to move from fragmented systems to integrated digital platforms, Zoho played a critical role. Solutions such as Zoho CRM, Creator, Analytics, and Finance applications enabled faster decision-making, improved visibility, and operational resilience, especially during times of disruption and digital transformation. These moments reinforced Zoho’s value not just as a software provider, but as a strategic enabler,” said Henry Soo, Founder, DataDevelop Consulting Ltd., Hong Kong.

Recent customers to Zoho Corporation include: In the United States, Rapid Response Monitoring and Synergy Home Care; In India, Mercedes-Benz India, Force Motors, Joyalukkas and Union Bank of India; in the UK/European Union, Flora Food Group, Handl Tyrol and Atout France; in Middle East-Africa, Al-Ahli Saudi FC and Al Qadsiah FC; in LATAM, Grupo Gonher; and in Brazil, Creditas and Editora Globo.

“Being bootstrapped, private, and built entirely in-house makes Zoho an outlier among competitors,” says Sridhar Vembu, Co-founder and Chief Scientist, Zoho Corporation. “But vendors don’t need our help, businesses do, which is why delivering customer value has, for 30 years, been Zoho Corporation’s North Star. Before any innovation, strategy, or guiding principle becomes a product, pivot, or policy, it must first affirm the question, ‘Will this help businesses?’ We are incredibly grateful that companies around the world have responded so positively to our customer-first approach over the past three decades, and will continue to meet the evolving needs of businesses with powerful, scalable, and affordable solutions.”

To learn more about the unique growth stories of Zoho Corporation’s customers over 30 years, visit here.

Hashtag: #ZohoCorporation

https://www.zoho.com![]() https://www.linkedin.com/company/zohoapac

https://www.linkedin.com/company/zohoapac

The issuer is solely responsible for the content of this announcement.

About Zoho Corporation

With 60+ apps in nearly every major business category, Zoho Corporation is one of the world’s most prolific technology companies. Zoho is privately held and profitable with more than 19,000 employees globally with headquarters in Austin, Texas and international headquarters in Chennai, India. Zoho APAC HQ is located in Singapore. For more information, please visit: www.zoho.com/

Zoho respects user privacy and does not have an ad-revenue model in any part of its business, including its free products. The company owns and operates its data centers, ensuring complete oversight of customer data, privacy, and security. More than 150 million users around the world, across hundreds of thousands of companies, rely on Zoho everyday to run their businesses, including Zoho itself. For more information, please visit: https://www.zoho.com/privacy-commitment.html

Media OutReach

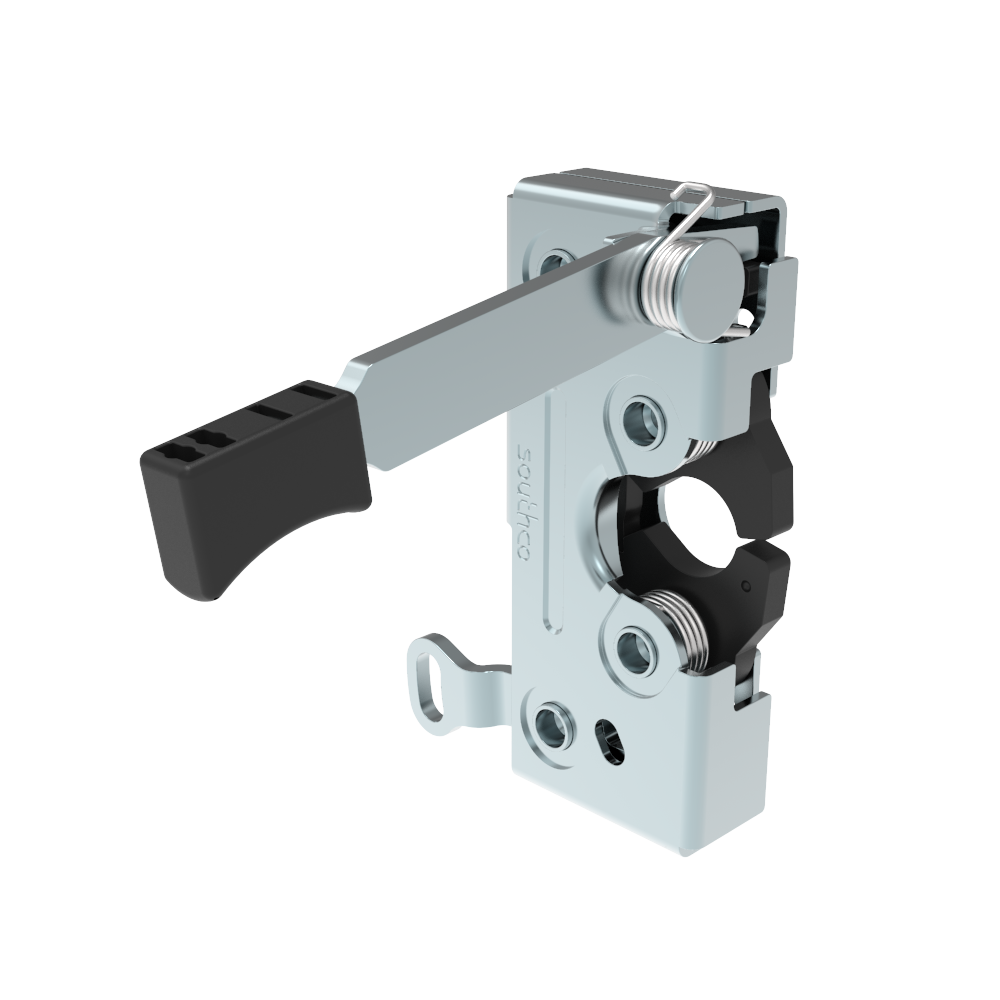

Southco’s New Heavy-Duty Rotary Latch Simplifies Cab Access While Enhancing Operator Safety

The new R4-50 Rotary Latch provides the heavy-duty performance that modern machinery demands, to tackles vibrations, safety-risking accidental releases, and complex access delays in rough environments.

Engineered for demanding conditions, the R4-50 delivers:

- Independent interior and exterior actuation – making it easier and safer to enter and exit equipment cabs.

- A pre-loaded interior hand lever – purpose-built for high-impact environments, reducing noise and vibration while ensuring smoother, more reliable operation.

- Accidental actuation prevention – minimizing unintended movement to keep operators secure and equipment protected.

- Flexible release options – including remote actuator connection via cable or rod, or direct push release, to meet different cab design needs.

Southco’s R4 Rotary Latch series is highly durable, and is available in a variety of configurations that meet customer needs with little to no modification, including compact mechanical and electromechanical designs made of durable materials suitable for any environment. R4-50 Rotary Latches with Dual Triggers are compliant with FMVSS 206 impact standards, IP65 dust and water intrusion standards, EN 45545-3 fire protection standards, as well as applicable vibration standards.

As a heavy-duty upgrade to Southco’s trusted R4 Rotary Latch line, the R4-50 with Dual Triggers combines operator safety, rugged durability, and simplified access in one cost-effective system. The latch is also compatible with Southco AC actuators, offering OEMs a low-investment, high-value option for enhancing their cab entry solutions.

Global Product Manager Cynthia Bart adds, “The new R4-50 Rotary Latch with Dual Triggers offers a complete, highly versatile cab door entry system for use in heavy-duty construction and agricultural vehicles. The latches are compatible with Southco AC Actuators, allowing designers to quickly and affordably upgrade their existing designs.”

For more information about the functionality of R4-50 Rotary Latches, please visit southco.com or email the 24/7 customer service department at in**@*****co.com

Hashtag: #Southco

The issuer is solely responsible for the content of this announcement.

About Southco

Southco, Inc. is the leading global designer and manufacturer of engineered access solutions. From quality and performance to aesthetics and ergonomics, we understand that first impressions are lasting impressions in product design. For over 75 years, Southco has helped the world’s most recognized brands create value for their customers with innovative access solutions designed to enhance the touch points of their products in transportation and industrial applications, medical equipment, data centers and more. With unrivalled engineering resources, innovative products and a dedicated global team, Southco delivers the broadest portfolio of premium access solutions available to equipment designers throughout the world.

Media OutReach

DBS Hong Kong collaborates with Know Your Customer Limited to further improve digital account opening for SMEs

Leveraging Know Your Customer’s cutting-edge digital compliance platform, DBS Hong Kong will gain real-time access to comprehensive business verification data — including instant retrieval of official company documents and automatic identification of complex ultimate beneficial ownership (UBO) networks across more than 140 jurisdictions.

This AI-powered automation addresses the traditionally manual and cumbersome SME onboarding processes by streamlining the end-to-end business KYC process, efficiently verifying corporate structures and ownership, reducing manual effort and accelerating onboarding timelines. The result is significantly enhanced operational efficiency and a faster, more seamless onboarding experience for DBS Hong Kong’s business customers.

[Lareina Wang, Head of SME Banking, DBS Bank Hong Kong] said,

” At DBS Hong Kong, we are dedicated to reimagining the customer onboarding experience through continuous digital innovation. By engaging Know Your Customer, we leverage advanced technology to streamline CDD workflows, delivering faster service to our customers. This collaboration also represents a major advancement in automating SME onboarding processes that have historically been complicated and manual, solidifying SME banking position of DBS in the market of Hong Kong. “

Claus Christensen, CEO and Co-Founder of Know Your Customer, added,

“Our service provided to DBS Hong Kong exemplifies how financial technology can simplify complex onboarding challenges. With our global data coverage and AI-powered automation, we empower DBS Hong Kong to accelerate KYC processes and provide business customers with an unrivalled onboarding journey. Together, we are shaping the future of digital banking.”

In recognition of its visionary digital strategy, DBS Hong Kong was named Asia’s Best Digital Bank in 2025 by Euromoney. The bank also continues to lead digital innovation, evidenced by over 70% of Hong Kong SMEs already integrating or exploring AI and digital technologies as part of their operations, according to its recent SME survey.

This transformative collaboration underscores DBS Hong Kong’s unwavering commitment to innovation and delivering safe and trusted digital onboarding solutions in Asia’s rapidly evolving financial landscape.

Hashtag: #KnowYourCustomer

The issuer is solely responsible for the content of this announcement.

About DBS Bank (Hong Kong) Limited

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank’s “AA-” and “Aa1” credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “![]() World’s Best Bank” by Global Finance, “

World’s Best Bank” by Global Finance, “![]() World’s Best Bank” by Euromoney and “

World’s Best Bank” by Euromoney and “![]() Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “

Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “![]() World’s Best Digital Bank” by Euromoney and the world’s “

World’s Best Digital Bank” by Euromoney and the world’s “![]() Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “

Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “![]() Safest Bank in Asia” award by Global Finance for 17 consecutive years from 2009 to 2025. In 2026, DBS won the “Triple A award – Best Digital Customer Onboarding Experience – Hong Kong”

Safest Bank in Asia” award by Global Finance for 17 consecutive years from 2009 to 2025. In 2026, DBS won the “Triple A award – Best Digital Customer Onboarding Experience – Hong Kong”

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by uplifting lives and livelihoods of those in need. It provides essential needs to the underprivileged, and fosters inclusion by equipping the underserved with financial and digital literacy skills. It also nurtures innovative social enterprises that create positive impact.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit ![]() www.dbs.com.

www.dbs.com.

About Know Your Customer Limited

Know Your Customer Limited is an award-winning RegTech company specialised in next-generation business verification solutions for financial institutions and regulated organisations worldwide. For teams struggling with inefficient client due diligence and onboarding processes, Know Your Customer offers an intuitive digital compliance workspace that combines unmatched real-time registry data, covering over 140 countries, seamless integrations, and AI-powered smart automation. This streamlined approach transforms the compliance function at its core, allowing customers to customise their solutions by selecting only the functionalities they need, all accessible via a robust REST API.

Founded in Hong Kong in 2015, with a local presence in Singapore, Dublin, London, and Shanghai, Know Your Customer has built a global customer base across 11 verticals and 18 jurisdictions. The company also maintains a wide network of technology and data partners, ensuring high-quality entity data and enhanced compliance processes for its customers.

For more information visit ![]() https://knowyourcustomer.comor follow Know Your Customer Limited on

https://knowyourcustomer.comor follow Know Your Customer Limited on ![]() LinkedIn or

LinkedIn or ![]() X.

X.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn