Technology

Growing Nigerian Economy Via Mobile & Telecom Sector

By Adeniyi Ogunfowoke

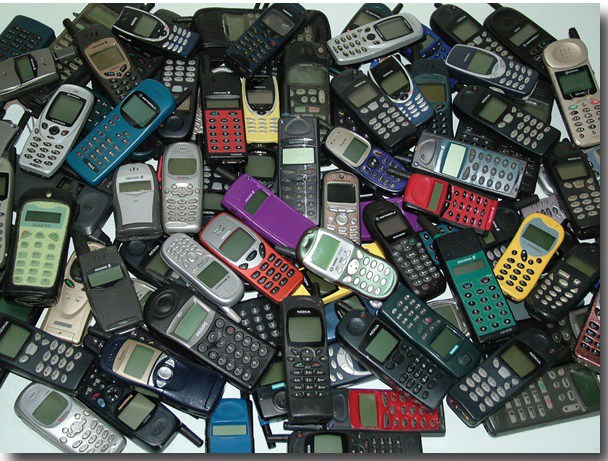

Undoubtedly the giant of Africa, with an estimated population of 194 million people, Nigeria remains the largest mobile market in the continent and still has more potential for growth and for competing on a level-playing ground with the developed nations.

Although the economic growth of the country might not be as fast-paced as its counterparts’, it is full of hopes and promises.

The mobile trends published in the 2017 Nigerian Mobile Report, by Jumia Nigeria, Africa’s biggest e-commerce platform, provided some convictions for this belief.

In summary, the report examined how the market has democratized mobile internet use, the consumer behaviours driving increased smartphone adoption and the role of the different stakeholders within the sector.

Jumia is set to release the 2018 edition of the Mobile Report, which will focus on various mobile trends in the country and in Africa at large. And Juliet Anammah, CEO, Jumia Nigeria is as excited as everyone else about the report.

But, while we patiently wait for the report pending its release, let’s examine some facts and figures from the 2017 report.

There were about 150 million mobile subscribers equivalent to 81 percent penetration (as a percentage of the population) in 2016.

Internet penetration was at 18 percent with 216 million internet users while Nigeria’s internet penetration was much higher at 53 percent; its mobile subscription was similar to Africa’s at 81% penetration (960 million mobile subscribers).

To benchmark this data, a similar report by the Nigerian Communications Commission (NCC) put the number of subscribers, by the end of December 2016 – at 154 million. This subscriber base is a sum total of all the active subscribers for telephony services on each of the licensed service providers utilizing different technologies. The difference in the number of subscribers presented by both reports can be attributed to the lack of accurate census in the country.

Meanwhile, the percentage of internet penetration widened increasingly; number of internet subscribers peaked at 97.2 million (more than half the number of mobile subscriptions) by end of 2016, which represented a much higher penetration rate than the rest of Africa combined.

The subscriber base of internet users in the country was predicted to increase by at least 30 percent by end of 2017.

With the number of Nigerians having access to the internet, mostly through smartphones, growing in leaps and bounds, it’s a clear indication that there is a huge potential for e-commerce in the country.

For instance, Jumia recorded 394 percent growth on the sales of smartphones between 2014 and 2016, mostly driven by an increasing range of lower smartphones price points. And 71 percent of website visitors on Jumia Nigeria in 2016 used their mobile phones to shop, whereas only 53 percent of Jumia African customers did so.

Although, the contribution of the telecom & mobile sector to the country’s GDP was indeed a small fraction, according to a report by the NCC, only 9.13 percent was directly or indirectly accrued from the sector.

Yet, it is worthy of note to mention that it was a great leap from the previous year. E-commerce companies like Jumia, present in 15 African markets, are facilitating the promotion and distribution of both high-end and low-end price points mobile phones in Nigeria.

The NCC is not also relenting in exercising its power to regulate the operations of the licensed telecom operators especially in the area of voice & data tariff.

So, what is the future of the telecom and mobile sector in Nigeria? To witness an improvement over the previous years will require a collective, yet individual effort from both the private and public sectors. Primarily, the growth of the sector, among other things, depends on the availability of affordable mobile phones & data tariff. To the former, Jumia is committed – with its partners – to facilitating and leading the charge in this regard.

The week of March 15th-25th, 2018 will be interesting and exciting for the entire country for two reasons: the 2018 edition (4th report) of the Nigerian Mobile Report will be released at a press conference; and secondly, although still related to the first event is the commencement of Jumia Mobile Week (an entire week dedicated to the sales of mobile phones at the best prices in Nigeria).

Nothing beats the excitement of getting your dream mobile phone at nearly half the price and such was the frenzy all over the Nigerian cyberspace in 2017.

From the moment you spot the juicy deals, the swift race for the fastest fingers, the sigh of relief when you have successfully placed your order and the short wait for your order to be delivered.

Last year, Jumia Mobile Week featured 3 mouth-watering flash sales every day at nearly 50 percent off; both night crawlers and day troopers had a piece of the pie.

MTN also gave out free MTN 4G SIM and 20 percent data bonus on their data plan every time you recharged for the first 3 months. There were also juicy discounts on mobile brands like: Infinix at 40 percent off; Tecno at 20 percent off; Motorola at 50 percent off, and Innjoo at 20 percent off.

So, this year, which brands will top the list of Jumia top selling mobile phones? How much discounts will be available to customers and on what mobile brands? How much money are you hoping to save during this year’s Mobile Week? Which mobile phones will have the best deals this year? How much discount will Jumia offer on purchases done on its mobile App? How do you get to participate in the Treasure Hunt so as to win a coveted prize? How do you participate in the fashion accessory giveaways on social media by your favourite fashion celebrity/icon?

Your guess is as good as mine. But, you will find answers to all of these questions during the week of March 15th through 25th, 2018! Add it to your calendar. Join the conversation on social media using the #JumiaMobileWeek2018, and follow @JumiaNigeria across all social media platforms.

Adeniyi Ogunfowoke is a PR Associate at Jumia Travel.

Technology

Dig Raises $14m Series A to Fuel Social Video Intelligence

By Adedapo Adesanya

A social video intelligence platform, Dig, which gives enterprises the visibility and speed to detect and respond to fast-moving narratives across the most influential video platforms, has closed a $14 million Series A financing round to fuel market expansion and deepen the company’s patented AI platform.

The investment was co-led by New Era Capital Partners and Osage Venture Partners, with participation from 97212 Ventures, Maccabee Ventures, Ginossar Ventures, Itai Tsiddon, and other investors.

Dig will utilise the new capital to scale global sales and marketing, expand coverage across additional video and messaging networks, and continue to enhance its proprietary AI stack, including in-house large language models that reduce compute costs by up to 100 times compared to off-the-shelf services.

The growth of social video platforms, such as TikTok, has led to the video takeover of social media. 2025 is estimated to be the first year in which more than 50 per cent of social media posts will be video posts. This number is expected to grow substantially in the coming years with the emergence of generative video platforms like Veo-3. In a world dominated by social video, the lack of automation leaves brand and insights teams blind to fast-moving risks and consumer signals.

Dig’s selling point is unlike text-only social listening platforms that rely on keyword matching and Boolean queries, the company noted that its video-first LLM-native platform understands briefs and research questions, and is able to detect more than 90 per cent of relevant videos, images, or text posts, automatically filtering out irrelevant mentions by matching narratives rather than keywords.

Dig claims it automatically detects social network policy violations, such as disinformation or deepfakes, and alerts communications teams immediately, prioritizing the threat and recommending next steps before it escalates.

Speaking on the funding, Mr Ofer Familier, Co-founder & CEO of Dig, said, “Social video builds and breaks reputations faster than any other medium. Our mission is to give brands immediate, precise visibility into those narratives, along with the tools to respond before risk becomes a crisis.

“With support from New Era, Osage, and our other partners, we’re doubling down on product innovation and bringing Dig’s value to marketing, communications, and insight teams worldwide.”

“We’re incredibly excited to continue partnering with Dig as they build the future of social video intelligence. When we first backed Dig at Seed, the team predicted video would eclipse text as the language of the internet”, said Mr Ran Simha, Managing Partner, New Era Capital Partners.

“Their growth, to more than 70 enterprise deployments in under 18 months, proves that thesis, and we’re excited to help scale a category-defining company. Brands today face both immense opportunity and real risk in the world of social video – content spreads faster than ever, and a single post can influence perception globally within minutes.

“Dig’s technology empowers companies to truly understand and manage this dynamic landscape, turning social video from a source of unpredictable risk into a strategic growth channel,” Mr Simha added.

“Dig pairs computer-vision depth with a business model that meets Fortune 500 security and ROI standards,” said Mr Nate Lentz from Osage Venture Partners. “The speed at which customers move from proof-of-concept to production is unlike anything we’ve seen in market intelligence software.”

Dig’s platform is deployed across brand, consumer insights, communications, and social media functions. Its current customers include global luxury brands, CPG and fashion brand houses, and Fortune 500 tech firms, who leverage Dig for unique, advanced reputation and insights services, such as early detection of viral narratives, brand perception benchmarking tracker, dynamic customer cohort segmentation, campaign and narrative impact analysis, and others.

Technology

Nigeria Attracts $1bn Infrastructure Investment on Market-Driven Pricing

By Adedapo Adesanya

The Nigerian Communications Commission (NCC) has confirmed that its decision to return to market-driven pricing in the telecoms sector has spurred over $1 billion in infrastructure investment in 2025.

The Executive Vice-Chairman of the NCC, Mr Aminu Maida, made the disclosure in Lagos on Friday, noting that the policy shift, introduced in January and February 2025, allowed mobile network operators to adjust tariffs by up to 50 per cent after nearly a decade of stagnant pricing.

“This act alone has allowed investments to flow in. We will be revealing more specific figures in the coming weeks after verification, but we are talking about over a billion dollars worth of investment in 2025 alone,” he said.

Mr Maida said that the move restored investor confidence in the sector and reversed a trend of under investment that had slowed network growth and service quality improvements.

According to him, the imbalance in the value chain, where tower companies can adjust prices annually for inflation and exchange rates but mobile network operators cannot had discouraged new investment.

“This is an industry that requires continuous investment. The world is moving ahead, and if we do not create the right conditions, we will be left behind,” he said.

The NCC boss said the commission decided to return to the guiding principles of the 2000 Telecom Policy and the 2003 Communications Act, which allowed market forces to determine fair prices while maintaining healthy competition to protect consumers.

He disclosed that some of the new equipment ordered by operators had started arriving in the country since June, with network expansion and upgrade works already underway.

“We are closely tracking the rollout. We hold weekly calls with operators to monitor how many sites are being built, upgrades done and we step in when they encounter challenges with authorities,” Maida said.

He added that the investments would help address capacity challenges, improve service quality, and ensure Nigeria remained competitive in the global telecom landscape.

The NCC boss also highlighted operational cost pressures facing the industry, noting that operators consumed over 40 million litres of diesel monthly to power their base stations, with most of the product imported.

He said the industry’s dependence on foreign exchange (FX) for importing all network hardware and software added to the challenge, as no major telecom equipment was manufactured locally.

“There is nothing you need to build or upgrade a network today in Nigeria that you can buy locally. Everything from the hardware to the software has to be imported and that requires FX,” Mr Maida said.

On protecting telecoms infrastructure, he said the commission was working with the Office of the National Security Adviser to develop a framework for rapid response forces tailored to the unique challenges in each region.

He noted that threats vary by location, with some coastal areas requiring community-based engagement, while high-insecurity zones may need stronger civil defence presence.

According to him, the protection strategy goes beyond force and focuses on addressing structural issues that make telecom sites vulnerable, such as poor security measures, generator theft and community disputes.

Technology

Salesforce Study: CFOs Shift from Caution to Core Strategy, Going All-In on AI

A new global study by Salesforce reveals a fundamental shift in how Chief Financial Officers (CFOs) approach Artificial Intelligence (AI). Once seen as a cautious investment, AI is now a core strategic asset, with financial leaders betting on it for long-term revenue growth, not just cost-cutting.

According to the research, which surveyed 261 global CFOs, the number of financial leaders with a conservative AI strategy has plummeted from 70% in 2020 to just 4% today. This rapid transformation highlights a widespread consensus that AI is no longer an emerging technology, but a crucial engine for enhancing efficiency, optimizing operations, and driving long-term growth.

Redefining ROI and Embracing AI Agents

The study shows that this shift is largely driven by a fundamental rethinking of how CFOs evaluate technology investment returns. Over 61% of CFOs say that AI agents—digital labor capable of performing tasks autonomously—are changing their perspective on ROI. They are moving beyond traditional metrics to encompass a broader range of business outcomes, including revenue generation, productivity gains, and improved decision-making.

“The introduction of digital labor isn’t just a technical upgrade; it represents a decisive and strategic shift for CFOs,” said Robin Washington, President and Chief Operational and Financial Officer at Salesforce. “With AI agents, we’re not merely transforming business models; we’re fundamentally reshaping the entire scope of the CFO function. This demands a new mindset as we expand beyond financial stewards to also become architects of agentic enterprise value.”

The report also found:

- CFOs are dedicating, on average, 25% of their AI budget to AI agents.

- 74% of CFOs believe AI agents will drive revenue, projecting an anticipated increase of nearly 20%.

- Over half (55%) of CFOs believe AI agents will take on more strategic work than routine tasks.

- The top three tasks CFOs are delegating to AI agents are risk assessments (74%), financial forecasting (58%), and expense management (54%).

A New Mindset for a New Era

This new approach requires a mindset shift from valuing short-term savings to recognizing long-term strategic success. The research found that while CFOs faced pressure to accelerate tech investment ROI last year, they now see the value of AI in its ability to deliver long-term business outcomes.

“The ROI of older technology often depends on immediate, measurable results,” said one CFO survey respondent. “While AI’s returns may accrue over the long term through an ongoing process and new business models.”

For African CFOs, this research provides a valuable framework for adoption. According to Linda Saunders, Salesforce Country Manager & Senior Director Solution Engineering for Africa, the report offers a data-driven path to navigate the complexities of AI implementation.

“This research helps African CFOs build a strategic case for AI adoption while addressing concerns around extended ROI timelines,” Saunders said. “It also identifies high-impact areas like risk assessments and financial forecasting, offering a practical starting point with proven success instead of navigating uncharted territory.”

The report also tackles core concerns like security, privacy threats, and the time required to evaluate ROI, encouraging a thoughtful and risk-aware approach to AI implementation.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology5 years ago

Technology5 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN

1 Comment