Travel/Tourism

Africa’s Freight Demand Rises 15.9% on Asian Investment Flows

By Dipo Olowookere

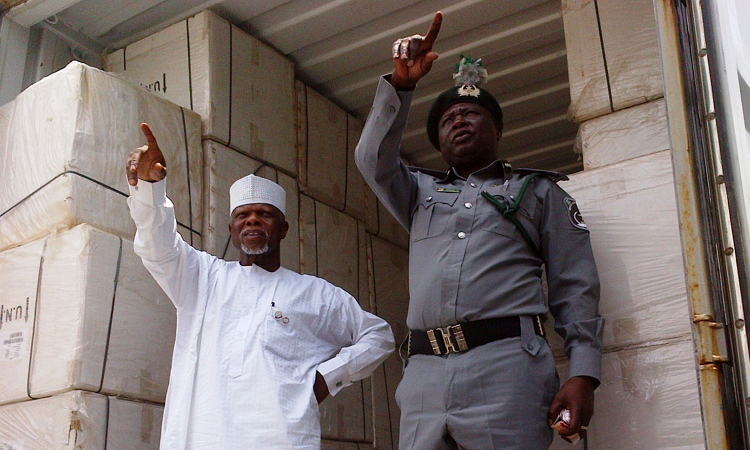

A new report released last week by the International Air Transport Association (IATA) has shown that African carriers saw increase in freight demand by 15.9 percent in February 2018 compared to the same month last year – the largest increase of any region.

The report disclosed that capacity increased by 3.9 percent and was helped by very strong growth on the trade lanes to and from Asia driven by ongoing foreign investment flows into Africa.

IATA said while the surge in demand on the route looks to have stabilized, volumes still increased by nearly 24 percent in year-on-year terms in January.

Globally, the report revealed that air freight markets for February 2018 recorded 6.8 percent increase in demand measured in freight tonne kilometres (FTKs) compared to the same period last year.

Adjusting for the potential Lunar New Year distortions by combining growth in January 2018 and February 2018, demand increased by 7.7 percent. This was the strongest start to a year since 2015.

Freight capacity, measured in available freight tonne kilometres (AFTKs), grew by 5.6 percent year-on-year in February 2018.

Furthermore, demand growth outstripped capacity growth for the 19th month in a row, which is positive for airline yields and the industry’s financial performance.

The continued growth in air cargo demand is consistent with ongoing robust global trade flows. There are, however, signs that the best of the upturn for air freight has passed. Demand drivers for air cargo are moving away from the highly supportive levels seen last year.

In recent months the Purchasing Managers’ Index (PMI) for manufacturing and export orders has softened in a number of key exporting nations including Germany, China and the US. And the seasonally- adjusted demand for air cargo which rose at a double-digit annualized rate for much of 2017 is now trending at 3 percent.

“Demand for air cargo continues to be strong, with 6.8 percent growth in February. The positive outlook for the rest of 2018, however, faces some potentially strong headwinds, including escalation of protectionist measures into a full-blown trade war.

“Prosperity grows when borders are open to people and to trade, and we are all held back when they are not,” said Alexandre de Juniac, IATA’s Director General and CEO.

The report also said North American airlines’ freight volumes expanded 7.3 percent in February 2018 compared to the same period a year earlier, and capacity increased by 4.1 percent.

Seasonally-adjusted volumes are broadly trending sideways. The weakening of the US dollar over the past year has helped boost demand for air exports.

Data from the US Census Bureau shows a 10.2 percent year-on-year increase in air export volumes from the US in January 2018, compared to a slower rise in imports of 6.7 percent.

In the same vein, European airlines posted a 5.7 percent increase in freight volumes in February 2018. This was almost half the rate of the previous month and the slowest of all regions.

Capacity increased 3.8 percent. Seasonally-adjusted volumes have been volatile in 2018 with the jump in demand in January largely reversed in month-on-month terms in February.

The strength of the Euro and the risks from protectionist measures may impact the European freight market which has benefitted from strong export orders, particularly in Germany, in recent years.

Also, Asia-Pacific airlines saw demand in freight volumes grow 6.5 percent in February 2018 and capacity increase by 7.2 percent, compared to the same period in 2017.

The upward-trend in seasonally-adjusted volumes has returned, with volumes currently trending upwards at an annualized pace of between 6.0 percent and 7.0 percent.

As the largest freight-flying region, carrying close to 37 percent of global air freight, the risks from protectionist measures impacting the region are disproportionately high.

Travel/Tourism

Musawa, Governor Mba Commission Enugu Christmas Village

By Dipo Olowookere

The Enugu Christmas Village has been commissioned by the Minister of Arts, Tourism, Culture, and the Creative Economy, Ms Hanatu Musawa; and the Governor of Enugu State, Mr Peter Mba.

This development officially kicked off the holiday season in the state, giving residents and others from across Nigeria and outside the opportunity to relax in an atmosphere of love, positioning Enugu as a key destination for cultural and holiday tourism.

Facilitated by Omu Resort, a leading tourism promoter in Africa, the Enugu Christmas Village is set to become the heartbeat of holiday celebrations in the state.

The company has already organised a 25-day festival at the village designed to attract residents, visitors, and dignitaries from across the region.

With its vibrant atmosphere and festive attractions, the Enugu Christmas Village boasts an array of attractions such as a waterpark, roller skating, archery, amusement rides, and much more.

At its centre is a breathtaking display of 500,000 Christmas lights, illuminating the village in a magical glow that promises to captivate visitors of all ages.

The festival goes beyond the lights and rides, offering a rich tapestry of events that celebrate the state’s cultural heritage.

Highlights include Afrobeat Concert, Praise Night, Highlife Concert Street Carnival, Cultural Parade and a Grand Fireworks Show.

One of the most anticipated moments is the Santa Street Storm, where over 100 Santa Claus figures riding tricycles will parade through the streets, distributing gifts to orphanages and the less privileged, spreading joy and goodwill.

Running from December 7 to December 31, 2024, the Enugu Christmas Festival is more than just a celebration of the holiday season. It underscores the state’s cultural vibrancy and its potential as a leading tourist destination.

The festival offers a unique opportunity for families and friends to come together, celebrate, and unwind in a festive atmosphere. It is also expected to fosters unity and showcases the rich cultural heritage of Enugu State, while promoting arts, tourism, and community well-being.

Travel/Tourism

Emirates Unveils Airbus A350-900 in Dubai

By Aduragbemi Omiyale

One of the leading airline operators, Emirates Airline, has officially unveiled its first Airbus A350-900 at an exclusive event showcase in Dubai attended by aerospace partners, government officials and dignitaries, members of the media, as well as aviation enthusiasts.

The Emirates A350 features three spacious cabin classes, accommodating 312 passengers in 32 next-generation Business Class lie-flat seats, 21 Premium Economy seats and 259 generously pitched Economy Class seats.

The latest onboard products reflect the airline’s commitment to delivering a premium passenger experience while optimising operational efficiency. The Emirates A350 is the first new aircraft type to join Emirates’ fleet since 2008.

Apart from its newly delivered A350, Emirates operates two other aircraft types around the world to 140 destinations – the widebody Boeing 777 aircraft and the iconic ‘double decker’ Airbus A380 aircraft.

The A350’s introduction will enable Emirates to expand into new destinations globally, including mid-sized airports unsuited for larger aircraft. The Emirates A350 will be delivered in two versions – one for regional routes and one for ultra long-haul routes.

The Emirates A350 takes technology to another level. Customers can now adjust their electric window blinds at the touch of a button.

The aerBlade dual blind system will feature in Business and Premium Economy Class offering two shaded options, and the aerBlade single blind systems will make a debut in Economy Class, with all blinds showing the Emirates Ghaf tree motif when closed.

Business Class on the Emirates A350 will feature 32 luxurious leather ‘S Lounge seats’, inspired by the Mercedes S Class for an exceptional travel experience. The A350 aircraft will feature brand new additions of wireless charging on the side cocktail table in Business Class, and in-seat lighting controls with 5 streams of light. The 1-2-1 seat configuration in the A350 Business Class ensures a very private, exclusive experience.

Speaking at the event, the chairman of Emirates Airline, Mr Ahmed bin Saeed Al Maktoum, said, “Today is an exciting milestone for Emirates as we showcase our first A350 and usher in a new era for our fleet and network growth.

“This aircraft sets the stage for Emirates to spread its wings farther by offering added range, efficiency and flexibility to our network, enabling us to meet customer demand in new markets and unlock new opportunities in the cities that we serve.

“Onboard, our updated interiors and seating configurations will help us deliver a more elevated and comfortable experience to travellers across every cabin class.

“The 65 Emirates A350s joining our fleet in the coming years fit into the airline’s broader plans to support our visionary leadership’s Dubai’s D33 Strategy, which will transform the city into a pivotal hub in the global economy by expanding its connectivity and reach.”

Travel/Tourism

Air Peace Employees Undergo Training at Boeing Global Learning Institute

By Aduragbemi Omiyale

Some employees of Air Peace have upgraded their aviation safety skills at a training course organised by Boeing through the Boeing Global Learning Institute (BGLI) in collaboration with Cranfield University, United Kingdom as part of a shared commitment to shaping the future of aviation leadership.

Over the years, Air Peace has recognized that a deep, unwavering commitment to safety is key to its continued success.

The programme is aimed at building upon that vision, enabling executives to lead with confidence, manage risks effectively, and create high-performing teams that prioritize safety at every level.

In the five-day in-person training, all the executives and others in the various departments of Air Peace were taught advanced safety leadership skills and gained practical tools to implement the new knowledge.

The Head of Aerospace at Cranfield University, Prof Graham Braithwaite, said, “This collaboration ensured that the training directly addresses the challenges Air Peace faces, culminating in real-world capstone projects that would have a lasting impact.”

Reinforcing this position, the Lecturer for Organisational Resilience and Change at Cranfield School of Management, Fabian Steinmann, who was excited at the great progress Air Peace made over the years, said that they are happy to learn and share knowledge and find ways to strengthen the system, making it robust and flexible to adapt to the ever-changing environment.

“Safety is at the heart of everything we do at Cranfield so the privilege we have is that we travelled around the world, picked up the good practices, learned more about the culture and the operation in various countries so we’re here to facilitate that exchange with Nigeria and Air Peace to see how we share some of the good practices and lessons learned from all around the world and translate them into their operation.”

Also, the Senior Organisational Consultant and Programme Manager at Boeing Global Learning Institute, Harry Magui, said, “The Boeing company has long recognised the importance of supporting continuous learning of our aviation partners.

“To that end, the Boeing Global Learning Institute designs and delivers numerous learning programmes to both emerging and established leaders of our partners.

“These efforts aim to develop leadership, business, and technical skills so that our partners can improve their business processes, increase operational efficiency and enable leaders to strengthen their teams to ultimately grow their business.’

Alluding to the great work Air Peace has done in making safety a pre-condition rather than just a priority, Magui said, “We’re here to partner with our great partner, Air Peace who have been phenomenal in advancing the Aviation Industry in Nigeria, so we are here to support them to harness more opportunities in the future with the Advanced Leadership in Safety Excellence Training for all its top leadership within the organization.”

The Safety Manager at Air Peace, Captain Godfrey Ogbogu, said, “This class is quite essential and we’re lucky to have our resource persons impact knowledge on us. It is a well-structured training, especially for Air Peace because of where we are now and where we hope to go in the future.

“The whole essence of this class is to reinforce what we know before and be exposed to other avenues of learning. The aviation industry is ever-changing and dynamic, and Air Peace has to be abreast of such developments.”

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN