World

Maghreb is Russia’s Source of Economic, Political Opportunities—Chtatou

By Kester Kenn Klomegah

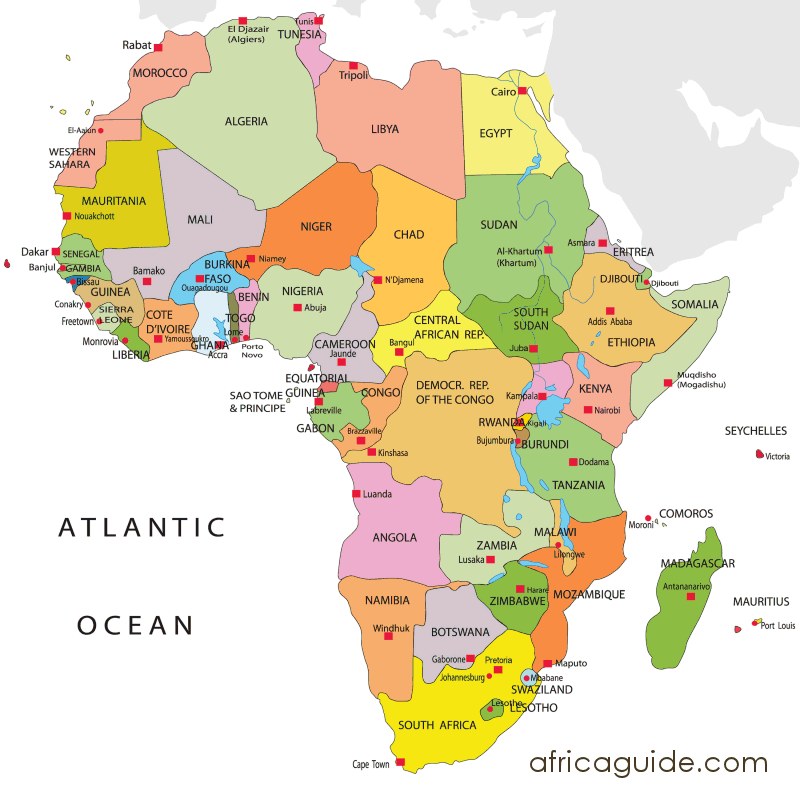

The Maghreb region, with an estimated population of over 100 million people, has been an interesting geographical region for key global players due to its tremendous untapped natural resources.

Algeria, Libya, Mauritania, Morocco, and Tunisia established the Arab Maghreb Union in 1989 to promote cooperation and economic integration.

The union included Western Sahara implicitly under Morocco’s membership and ended Morocco’s long cold war with Algeria over this territory. However, this progress was short-lived, and the union is now dormant.

However, the region is an important gateway to Europe and to sub-Saharan Africa. Europe particularly has some investment, so also the United States.

Now Russia is steadily making its way through war-torn Libya and politically troubled Morocco and Tunisia. That compared Russia has significant trust-based relations with Egypt.

As Russia feverishly preparing for the second all-African leaders’ summit, Kester Kenn Klomegah held an emailed insightful interview focusing on some aspects of Russia-Maghreb relations with Dr Chtatou Mohamed, a senior professor of Middle Eastern politics at the International University of Rabat (IUR) as well as education science at Mohammed V University in Rabat, Morocco. The following are excerpts from the interview:

In terms of geopolitical diplomacy, how do we assess Russia’s interest and approach since the Soviet collapse in the Maghreb region? Do the current political changes pose challenges for Russia?

Given its geographical remoteness, the Maghreb did not constitute – unlike the Middle East – a pole of major strategic interest for the Soviet Union, and this until the period of decolonization in the 1950s.

From this point on, and especially with the Algerian war of independence, Moscow began to invest in this sub-region of the Arab world. In fact, as in the Mashreq, the Soviet position strategic criteria, which explained the choice of a partnership with Algeria as early as 1962, and then, to a lesser extent, with Colonel Qadhafi’s Libya after he took power in 1969.

However, it was more in the name of the “anti-imperialist” struggle than of real ideological proximity that these alliances were formed. Indeed, during the entire Cold War period, Soviet power could not count on local relays to strengthen its influence.

The Maghrebi parties of communist persuasion were indeed far from having the weight and influence of their Middle Eastern counterparts, such as in Iraq or Iran. They were promptly removed from power and even repressed after independence, even if some of their leaders were later co-opted by the regimes in place, particularly in Morocco and Algeria.

Nevertheless, the revolutionary Third Worldism claimed by Algiers as well as by Tripoli, even if it did not claim to be based on Marxist-Leninist ideology, was perceived by the USSR as conforming to its interests and its politico-strategic projections.

For all that, the leaders of the two “friendly” Maghreb countries, while taking into account the interest that extended cooperation with Moscow (which also passed by links with satellite countries of Eastern Europe, particularly in terms of security with the German Democratic Republic), they were careful to keep a certain distance from this partner, refusing any form of subjection according to the principles of non-alignment.

Today, the Maghreb is not a fundamental interest for Russia, but rather a source of economic and political opportunities. The Russian redeployment in the Maghreb, which began during Vladimir Putin’s second term in 2004 and has been over the last decade, relies on new vectors, distinct from the old anti-imperialist aura from which the Soviet Union had benefited in Algeria and Libya. Three, in particular, stand out: (1) Investment in the economic sphere; (2) Increased cooperation in the security field, and; (3) A shared vision of international and regional issues.

Today, the federal state of Russia is increasingly present in the countries of North Africa; strategic partnership with Algeria, Morocco and Egypt, and is among the key players in the Libyan crisis.

Russia and the Maghreb countries seek above all to cultivate their economic relations. These relations cover various fields such as energy, agricultural products, tourism, space or, in the case of Algeria, the sale of arms.

For Moscow, this also responds to the need to deal with the sanctions of the European Union imposed following the annexation of Crimea in 2014, seeking alternatives to European products, especially agro-food. Russia meets a similar desire on the Maghreb side, where there is a desire to diversify the partnerships dominated until now by the countries of the European Union.

In 2016, Russia thus became, bypassing France, the first supplier of wheat to Algeria and has remained so since. It should be noted that the Russian economic projection in the region does not necessarily respond to a state strategy driven by the Kremlin, but often satisfies commercial ambitions in search of new opportunities, although the political authorities can facilitate contacts with the various Maghrebi economic actors.

The North African countries have considerably developed their relations with Russia, as they did before with China, without however prohibiting themselves from cooperating with the other Western powers. Their objective is to take advantage of any opportunity that arises to develop their economies and avoid remaining aligned and dependent on a single pole as in the days of the Cold War, given that the world is increasingly multipolar.

Therefore, questions arise, what are the mutual interests behind this revival in relations between Russia and the countries of North Africa, and what are the future prospects of these relations?

Russia has a war fleet and a merchant fleet in the Black Sea. This sea is located between Europe, the Caucasus and Anatolia, it is a semi-enclosed sea since it only communicates with the Mediterranean through the Bosphorus Strait, the Sea of Marmara and the Dardanelles Strait. Therefore, the Mediterranean is an unavoidable access corridor for Russian ships, connected to its Black Sea ports, to go to the Atlantic Ocean via the Strait of Gibraltar, or to the Indian Ocean via the Suez Canal.

For the Kremlin, the countries of North Africa are of paramount geostrategic importance on the maritime level, because its merchant ships and warships transiting in the Mediterranean Sea cross 3 obligatory passages which are bordered by: Egypt for the Suez Canal, Tunisia for the Strait of Sicily and Morocco for the Strait of Gibraltar. These compulsory passages are, from the point of view of freedom of navigation, locks that can be easily controlled by the countries that border them on both sides.

On the geo-economic level, the five Arab countries of North Africa present themselves for the Kremlin as an unavoidable interface to enter the African continent, rich in raw materials and presented as the great world consumer market in the future because of the demographic explosion of its population. It was during his visit to Algeria in 2006 that Putin laid the first milestone for Russia’s return to Africa. It is also Egypt, which played a leading role in the organization of the 1st Russia-Africa summit in October 2019 in Sochi.

Russia’s economic interests in Africa are increasingly growing in recent years, Moscow’s trade with African countries exceeded $20 billion in 2019. This figure is still lower than that of China ($204 billion), the US and even some European countries such as France and Germany.

Russia aims to diversify its trade with African countries by focusing on high technology, such as civil nuclear power (in Egypt) and satellite launches (in Angola and Tunisia). Russia is also very active in the medical sector in Africa, a vaccination campaign against the Ebola virus in Guinea, etc…

The United States and European Union have concrete strategic instruments, for instance, the U.S.-Maghreb FTA and Euro-Mediterranean Partnership. What could be described as Russia’s strategic economic tool in North Africa?

While China has been the focus of public attention on the African continent for some years, Moscow is no longer behind. After a prolonged absence since the demise of the Soviet Union, Russia is becoming more and more active, mixing armed forces presence, arms sales, economic investment, soft power and diplomatic support.

At the BRICS summit in Johannesburg on July 27, 2018, the Russian President raised the idea of a Russian-African summit bringing together all the continent’s leaders and himself. This ambitious initiative does not leave the traditional players established in this field worried that the Russian proposals will prove attractive enough for a number of local heads of state.

Indeed, Russia intends to return to the continent where its presence has often been fluctuating. Even in the 1970s, the height of the Soviet grip on Africa, its presence was episodic, with rare exceptions, such as in Algeria, Libya and Angola. Then the gradual removal of many heads of state who were allies of the Soviet Union led Mikhail Gorbachev, from 1988 onwards, to gradually weaken ties with the continent. These did not survive the disappearance of the USSR in 1991, and the Yeltsin period sounded the death knell for these friendships. It was not until the second term of Vladimir Putin, from 2008, that timid initiative were taken to remind certain countries of Russia’s past role.

One of the notable changes from the Cold War era is that the new Russian policy in the Maghreb no longer relies solely on the historical partner of Algeria, but also extends to previously neglected states, namely Morocco and Tunisia, because of their political and historical ties to the Western world. Libya is a special case.

Russia’s renewed interest in the Maghreb is based on a number of parameters that have already been essentially well identified. First and foremost, there is the development of economic partnerships, whether in the fields of armaments, energy, infrastructure or agriculture. Next, in order of priority, are security issues, with the fight against terrorism and jihadism, but more broadly the effects of the Libyan crisis, even if Russia’s investment in this issue appears less developed and partisan than it appears at first glance.

The emphasis placed on the political-diplomatic aspect, crystallized from the Arab uprisings and more particularly since the overthrow of the Libyan regime following NATO’s intervention in 2011, constitutes the most novel parameter of this Russian reinvestment. As in the rest of the Arab world, Moscow is defending the status quo, or rather a “principle of conservation” defined by its support for the regimes in place, non-interference in the internal affairs of a state, and its opposition to regime change through foreign military intervention.

While Russia’s preferred visions and modes of action in the Maghreb seem to be fairly well identified, the perceptions and expectations, but also the possible reservations on the Maghreb are more rarely expressed by the leaders of these countries and little-studied at the academic level. Perhaps we should look at this, as far as the powers that be are concerned, a concern for discretion regarding the sensitive aspects of this foreign policy component – this is particularly true for Algeria – an area on which they generally communicate little and for the academic research community in North Africa, a lack of knowledge related to the history, geography and culture of contemporary Russia.

If there is undoubtedly, on the Maghreb side and with important nuances from one country to another, a manifest interest in a development or a deepening of the partnership with Moscow, questions may remain about Russia’s objectives, especially in Rabat and Tunis. Despite this, the general and regional orientations of Russian policy are generally well perceived in the Maghreb capitals, because they correspond to local visions without, however, having the intrusive character that sometimes reproached to the historical European partners (France, Italy, Spain) and American partners.

Thus, the Russian approach responds to expectations of diversification in terms of partnership which correspond to an economic rather than a strategic necessity. This relationship appears to be facilitated by a convergence of views on major regional issues and the principles governing international relations, perhaps also because of the limits set for it. However, certain expectations on the Maghreb side could be disappointed, particularly concerning economic investments, but also a possible attempt at Russian mediation to facilitate a settlement process for the Libyan crisis, knowing that Moscow has some conditions.

One of the discreet tools used by Russia in the Maghreb and Africa is the Wagner Group that is present in Algeria providing tactical help to the Polisario Front fighting Morocco over Western Sahara and in Libya, on the side of Marshal Haftar forces.

The Wagner Group should be approached as a nebulous or informal entity since it is a structure without any legal existence. Unlike other Russian private military companies, of which there are many and of which RSB-Group is a well-known example, Wagner is not registered as a commercial company. Wagner’s lack of a defined legal status is advantageous for the Russian government, as it allows it to deny responsibility for its actions when the group is mobilized in different fields.

The links between the Russian executive and Wagner are important and take various forms. First, logistically, the training of the members of the Wagner group took place in Russia, in a military base belonging to the Russian armed forces. Some of the weapons available to Wagner members in Syria and Libya came from the Russian military surplus, and their deployment is usually carried out by Russian military aircraft. The Wagner Group is furthermore financed by a businessman considered close to Vladimir Putin, Yevgeny Prigozhin, who has secured some fairly large contracts in the Kremlin, particularly in the catering business.

Thus, there are obvious military logistical links and personal affinities between the Wagner Group and the Russian government. However, the link between the two entities is not organic and not all of Wagner’s interventions are linked to the Russian executive. Sometimes they proceed from a more lucrative logic, specific to the personal interests of Yevgeny Prigozhin.

First of all, the Wagner Group is able to participate in armed operations. In this, it is not just a private military company but a mercenary company. As an example, the group was employed by the Syrian government to liberate the Syrian Al Sha’er oil field in Homs from the Islamic State after the battle of Palmyra in 2016, but also as support to the Syrian Arab Army (SAA) in the fighting in Khusham in February 2018. Wagner has also provided support for Marshal Haftar’s offensives against Tripoli in 2019 and 2020. The group has participated in armed operations in northern Mozambique against Islamist insurgents seeking to establish an independent state in Cabo Delgado province and more recently engaged with the Central African Republic’s army against the Patriot Coalition.

With regard to Russian strategy in the region, there has been a renewed interest in sub-Saharan Africa over the past decade. Defence diplomacy, that is, strengthening the country’s presence via the military tool (training or physical presence), has been an important instrument for Russia since 2014-2015, particularly in this region. About twenty agreements have thus been signed between Moscow and sub-Saharan African countries in the field of defence since that date.

Economic issues also motivate the renewed Russian interest in the region. In the field of armaments, the countries of the zone are an interesting clientele for Russia. In 2010, they represented 10% of Russian arms sales. Today they account for 30%, making Russia the leading supplier of arms to the region.

Finally, the Russian strategy has a geopolitical dimension. While the context between Russia and Western countries is highly troubled and characterized in particular by a regime of sanctions and counter-sanctions, Moscow has more room for manoeuvre with the countries of sub-Saharan Africa. However, the tensions between Russia and Western countries are also present in sub-Saharan Africa: the issues surrounding the Wagner group are one of the facets of this crisis.

Do you detect any competition and rivalry among key foreign players for influence in the region? In your opinion, how effective and useful the emerging China-Russia alliance could be in Maghreb countries?

The impression is striking of a flashback to the West-Russia tensions that characterized the second half of the 20th century, from the aftermath of World War II until the collapse of the USSR in 1991. The two rival camps are beginning to openly sketch out the comparison, although observers note significant differences.

Following the gradual advent of the multi-polarity of the world since the beginning of the 2000s, most Mediterranean Arab countries have opened up to practically all the major world powers, the USA, China, Russia, the European powers and the powers emerging. The objective is to better serve the interests of their people and find solutions to the problems that prevent their development by exploiting the opportunities presented by each of these powers.

Currently, the geopolitical relations of most Mediterranean Arab countries with Russia are good, even for those who were allies of the USA during the period of world bipolarity along the years of the Cold War (the case of Egypt and Morocco).

Algiers, on October 2, 2021, the Algerian government decides to recall its ambassador in Paris and close its airspace to French military aircraft. This decision was prompted by a speech by Emmanuel Macron on the Algerian memory issue, which was deemed disrespectful. This incident represents the second act of a political-diplomatic standoff between Algeria and France, which decided in late September to drastically reduce the issuance of visas to nationals of Maghreb countries. Since this measure, relations between the two countries have continued to deteriorate, further weakening the popularity of France on an African continent that is already attracting the covetousness of many powers such as Russia, a historical ally of Algeria, whose eyes are now turned towards Mali.

Since the early 2000s, Russia has placed Africa and the Mediterranean at the centre of its foreign policy. This position became even more important in 2015 when Moscow saw Syria as a way to reaffirm its status as an international power while defending its security and economic interests, which are the fight against terrorism and the development of trade agreements around energy.

In such a paradigm, the regional power that is Algeria is a choice ally, especially since their relations have been at a good level since the end of the Cold War. Moscow and Algiers share a similar conception of domestic and foreign policy. The report of the Mediterranean Foundation for Strategic Studies highlights this:

“In the end, Russia and Algeria share many common representations and biases: a focus on the sacrosanct stability (particularly through the importance given to the fight against terrorism), a preference for flexibility in diplomatic relations and a willingness to contribute – through mediation – to the resolution of conflicts. The two countries share the same aspiration to assert themselves as an independent power and to establish themselves as a regional and international power, respectively. This convergence of vision pushes the two states to help each other. One example is the case of Vladimir Putin who does not hesitate to relay the anti-colonialist speeches of Algiers by encouraging African countries to mobilize for political and economic independence. The Russian president thus urged “African countries to stop their dependence on France and to work to develop the continent considered the richest in the world” (Algérie Patriotique. (21 Octobre 2020). « Alger et Moscou ne veulent plus laisser Rabat et Paris jouer seuls en Afrique »).

However, once we move away from political statements, it is easy to see that, behind its airs of mentor, Russia is an actor who enjoys a form of dependence from Algeria via unequal cooperation in several key areas. Thus, in 2017, Dmitri Medvedev, then head of the Russian state, signed with Algiers no less than six (6) documents on Russian-Algerian cooperation in a multitude of areas such as justice, energy, education or health. It is also not anecdotal that the choice of the vaccine in the fight against Covid-19 was the Sputnik-V vaccine. Such a choice clearly reflects Algeria’s distrust of other Western powers, but above all Russia’s unavoidable position as the sponsor of an Algerian state that is too weak to prosper alone. By offering its help to a fragile Algeria, Russia ensures, without exposing itself, a real anchorage on the African continent.

After the 2008 crisis, Beijing’s geopolitical positioning on the international stage remains highly ambiguous. On the one hand, China is described as a developing country because of the domestic economic and political problems it faces (the nature of its economic growth, environmental challenges, the fight against inequality, social tensions). These structural obstacles require reforms that slow down its international deployment. On the other hand, China is perceived as a major emerging country, given its strong economic growth and its status as the world’s second-largest economy, which mechanically pushes it to take a greater interest in international issues and to move away from its policy of “non-interference.

Today, Beijing’s positioning is characterized by approaches that are sometimes cautious when the issues concern it less, and sometimes more assertive when it comes to neighbourhood issues where its interests may be directly at stake. In the end, this ambivalent policy and its internal problems explain China’s positioning: a true emerging power on the economic level, it is not yet complete so on the geopolitical level.

Nevertheless, China already carries so much weight on the international scene that it is changing the world order. The question is to know how willing and able it will be to transform the functioning of the international system. In many ways, the emergence of the Russia-China alliance will strengthen the hand of these two countries politically, economically and socially in the Maghreb. Many see the emergence of such an important block as a viable alternative to the West that has oppressed and exploited the region for centuries. Today many Maghrebi students go east to study and many businessmen go there to do commerce.

How is Russia’s “soft power” working in this region? What could be the expectations from the Maghreb bloc during the forthcoming second Russia-Africa summit planned this November 2022?

The North Africa region has undergone extremely rapid modernization. Growing literacy (in less than fifty years, societies in the region have achieved a literacy rate of over 70% among adults and close to 100% in all countries among 15-24-year-olds, including women) or the affirmation of the place of women are signs of modernization in progress. The demographic and socio-cultural structures of these countries are changing and the political order of their societies, which explains some of the instability in the region and the “Arab Spring”. Other countries, where frustrations are great and where the states are struggling to respond to the political and economic aspirations of their populations could experience similar episodes.

In recent years, the alleged return of Russia to the African continent has attracted attention. It is not only the media that are interested in it, but also diplomats and governments of countries that, since the fall of the USSR, are in economic competition on the continent.

The increase in this interest began with the holding of the first Russia-Africa summit in Sochi in October 2019. The second summit, scheduled for 2022, is helping to reinforce the hypothesis of Russia’s repositioning on the continent. Is this a real geostrategic turning point? Or can we rather suspect tactical re-compositions in search of arms export markets or the exploitation of rare minerals?

The private security company Wagner, run by a man close to Vladimir Putin, has become the main instrument of Moscow’s re-engagement on the continent, against a backdrop of rivalry and tension with the West.

Is this the beginning of a strategic shift that would see a new “Russafrique” supporting “Chinafrique” in an anti-Western conspiracy? Or a media fantasy dramatizing punctual and opportunistic, often fragile, breakthroughs? The arrival of Russian instructors and paramilitaries from the private security company Wagner, which is close to the Kremlin, in Mali at the end of 2021, is raising questions in Europe and the United States about Moscow’s plans in Africa. Through the multiplication of defence agreements and the activities of the Wagner Group, Russia has succeeded in meddling in several African countries: Mali, Libya, Sudan, Central African Republic, Mozambique… An advance that is sometimes erratic, contested or deceptive, and which extends over about five years.

In Egypt, in 2014, Russia got closer to the newly elected President Al-Sissi. It took advantage of the American disengagement following the Arab Spring and signed a $3.5 billion arms contract. Other agreements will link the two countries: military cooperation treaties (supply of arms and training), an agreement for the construction of the first Egyptian nuclear power plant, an economic outlet for its grain, et cetera. More recently, the two countries signed a contract to supply Russian Su-35 fighter planes to Egypt.

Russia is thus rapidly becoming the main arms seller in Africa. Over the period 2014-2019, it provided 49% of the arms sold to the continent, far ahead of the other main contributors: the United States (14%), China (13%) and France (6.1%).

However, these contracts mainly concern North Africa, the picture being much more mixed for West Africa, for example. Russia has not been involved in any major arms agreement with Mali, with the exception of the 2016 agreement where Mali signed a contract with Russia for four Mi-35M combat helicopters.

Russia’s return to Africa is not limited to debt cancellation and arms sales. In 2018, Russia’s trade with the African continent reached $20 billion (17.2% more than the previous year) and its investments reached $5 billion (a far cry from the $130 billion invested per year by China). Its ability to offer technologies sought after by African countries gives it a place of choice. For example, it cooperates with Algeria, Nigeria, Zambia and Egypt in the nuclear field. Moreover, its companies are particularly present in the exploitation of minerals, oil or gas. Gazprom, Rosneft and Lukoil are very active in the Sahara, North Africa, Nigeria and Ghana.

These links have also been strengthened from a diplomatic point of view, with the organization of the first Russia-Africa summit in Sochi in October 2019, which will have enabled Russia to bring together some thirty African heads of state and to sign several bilateral treaties (the joint statement mentions “92 agreements, contracts and memoranda of understanding […] with a total value of 1,400 billion rubles”. This is in line with Russia’s goal of doubling its trade with African states by 2024 (which would make it a direct competitor of France).

Russian realpolitik may explain Russia’s growing influence in Africa. Unlike other actors such as the United States or France, which may make the granting of aid or the signing of partnerships conditional on the respect of certain principles, Russia does not demand any conditions related to democracy or human rights. This is the case in Nigeria, where the United States cancelled a contract that had already been signed for human rights violations by Nigerian forces in the fight against Boko Haram. This withdrawal allowed Russia to sign a new arms contract with the country.

With the decision to return and raise its influence on the continent, and especially the Maghreb region, Russia has to make consistent efforts, at least, in addressing significant aspects of the Sustainable Development Goals (SDGs) in Africa. However, the worsening of the Libyan crisis and the deterioration of relations with European states are the only two obstacles that could limit or more seriously slow down this nascent economic cooperation. The next few years will undoubtedly be decisive for the realization of structuring projects between the Russian Federation and the Maghreb.

World

AfBD, AU Renew Call for Visa-Free Travel to Boost African Economic Growth

By Adedapo Adesanya

The African Development Bank (AfDB) and the African Union have renewed their push for visa-free travel to accelerate Africa’s economic transformation.

The call was reinforced at a High-Level Symposium on Advancing a Visa-Free Africa for Economic Prosperity, where African policymakers, business leaders, and development institutions examined the need for visa-free travel across the continent.

The consensus described the free movement of people as essential to unlocking Africa’s economic transformation under the African Continental Free Trade Area (AfCFTA).

The symposium was co-convened by AfDB and the African Union Commission on the margins of the 39th African Union Summit of Heads of State and Government in Addis Ababa.

The participants framed mobility as the missing link in Africa’s integration agenda, arguing that while tariffs are falling under AfCFTA, restrictive visa regimes continue to limit trade in services, investment flows, tourism, and labour mobility.

On his part, Mr Alex Mubiru, Director General for Eastern Africa at the African Development Bank Group, said that visa-free travel, interoperable digital systems, and integrated markets are practical enablers of enterprise, innovation, and regional value chains to translate policy ambitions into economic activity.

“The evidence is clear. The economics support openness. The human story demands it,” he told participants, urging countries to move from incremental reforms to “transformative change.”

Ms Amma A. Twum-Amoah, Commissioner for Health, Humanitarian Affairs and Social Development at the African Union Commission, called for faster implementation of existing continental frameworks.

She described visa openness as a strategic lever for deepening regional markets and enhancing collective responses to economic and humanitarian crises.

Former AU Commission Chairperson, Ms Nkosazana Dlamini-Zuma, reiterated that free movement is central to the African Union’s long-term development blueprint, Agenda 2063.

“If we accept that we are Africans, then we must be able to move freely across our continent,” she said, urging member states to operationalise initiatives such as the African Passport and the Free Movement of Persons Protocol.

Ghana’s Trade and Industry Minister, Mrs Elizabeth Ofosu-Adjare, shared her country’s experience as an early adopter of open visa policies for African travellers, citing increased business travel, tourism, and investor interest as early dividends of greater openness.

The symposium also reviewed findings from the latest Africa Visa Openness Index, which shows that more than half of intra-African travel still requires visas before departure – seen by participants as a significant drag on intra-continental commerce.

Mr Mesfin Bekele, Chief Executive Officer of Ethiopian Airlines, called for full implementation of the Single African Air Transport Market (SAATM), saying aviation connectivity and visa liberalisation must advance together to enable seamless travel.

Regional representatives, including Mr Elias Magosi, Executive Secretary of the Southern Africa Development Community, emphasised the importance of building trust through border management and digital information-sharing systems.

Ms Gabby Otchere Darko, Executive Chairman of the Africa Prosperity Network, urged governments to support the “Make Africa Borderless Now” campaign, while tourism campaigner Ras Mubarak called for more ratifications of the AU Free Movement of Persons protocol.

Participants concluded that achieving a visa-free Africa will require aligning migration policies, digital identity systems, and border infrastructure, alongside sustained political commitment.

World

Nigeria Exploring Economic Potential in South America, Particularly Brazil

By Kestér Kenn Klomegâh

In this interview, Uche Uzoigwe, Secretary-General of NIDOA-Brazil, discusses the economic potential in South America, particularly Brazil, and investment incentives for Brazilian corporate partners for the Federal Republic of Nigeria (FRN). Follow the discussion here:

How would you assess the economic potential in the South American region, particularly Brazil, for the Federal Republic of Nigeria? What investment incentives does Nigeria have for potential corporate partners from Brazil?

As the Secretary of NIDOA Brazil, my response to the questions regarding the economic potentials in South America, particularly Brazil, and investment incentives for Brazilian corporate partners would be as follows:

Brazil, as the largest economy in South America, presents significant opportunities for the Federal Republic of Nigeria. The country’s diverse economy is characterised by key sectors such as agriculture, mining, energy, and technology. Here are some factors to consider:

- Natural Resources: Brazil is rich in natural resources like iron ore, soybeans, and biofuels, which can be beneficial to Nigeria in terms of trade and resource exchange.

- Growing Agricultural Sector: With a well-established agricultural sector, Brazil offers potential collaboration in agri-tech and food security initiatives, which align with Nigeria’s goals for agricultural development.

- Market Size: Brazil boasts a large consumer market with a growing middle class. This represents opportunities for Nigerian businesses looking to export goods and services to new markets.

- Investment in Infrastructure: Brazil has made significant investments in infrastructure, which could create opportunities for Nigerian firms in construction, engineering, and technology sectors.

- Cultural and Economic Ties: There are historical and cultural ties between Nigeria and Brazil, especially considering the African diaspora in Brazil. This can facilitate easier business partnerships and collaborations.

In terms of investment incentives for potential corporate partners from Brazil, Nigeria offers several attractive incentives for Brazilian corporate partners, including:

- Tax Incentives: Various tax holidays and concessions are available under the Nigerian government’s investment promotion laws, particularly in key sectors like agriculture, manufacturing, and technology.

- Repatriation of Profits: Brazil-based companies investing in Nigeria can repatriate profits without restrictions, thus enhancing their financial viability.

- Access to the African Market: Investment in Nigeria allows Brazilian companies to access the broader African market, benefiting from Nigeria’s membership in regional trade agreements such as ECOWAS.

- Free Trade Zones: Nigeria has established free trade zones that offer companies the chance to operate with reduced tariffs and fewer regulatory burdens.

- Support for Innovation: The Nigerian government encourages innovation and technology transfer, making it attractive for Brazilian firms in the tech sector to collaborate, particularly in fintech and agriculture technology.

- Collaborative Ventures: Opportunities exist for joint ventures with local firms, leveraging local knowledge and networks to navigate the business landscape effectively.

In conclusion, fostering a collaborative relationship between Nigeria and Brazil can unlock numerous economic opportunities, leading to mutual growth and development in various sectors. We welcome potential Brazilian investors to explore these opportunities and contribute to our shared economic goals.

In terms of this economic cooperation and trade, what would you say are the current practical achievements, with supporting strategies and systemic engagement from NIDOA?

As the Secretary of NIDOA Brazil, I would highlight the current practical achievements in economic cooperation and trade between Nigeria and Brazil, alongside the supporting strategies and systemic engagement from NIDOA.

Here are some key points:

Current Practical Achievements

- Increased Bilateral Trade: There has been a notable increase in bilateral trade volume between Nigeria and Brazil, particularly in sectors such as agriculture, textiles, and technology. Recent trade agreements and discussions have facilitated smoother trade relations.

- Joint Ventures and Partnerships: Successful joint ventures have been established between Brazilian and Nigerian companies, particularly in agriculture (e.g., collaboration in soybean production and agricultural technology) and energy (renewables, oil, and gas), demonstrating commitment to mutual development.

- Investment in Infrastructure Development: Brazilian construction firms have been involved in key infrastructure projects in Nigeria, contributing to building roads, bridges, and facilities that enhance connectivity and economic activity.

- Cultural and Educational Exchange Programs: Programs facilitating educational exchange and cultural cooperation have led to strengthened ties. Brazilian universities have partnered with Nigerian institutions to promote knowledge transfer in various fields, including science, technology, and arts.

Supporting Strategies

- Strategic Trade Dialogue: NIDOA has initiated regular dialogues between trade ministries of both nations to discuss trade barriers, potential markets, and cooperative opportunities, ensuring both countries are aligned in their economic goals.

- Investment Promotion Initiatives: Targeted initiatives have been established to promote Brazil as an investment destination for Nigerian businesses and vice versa. This includes showcasing success stories at international trade fairs and business forums.

- Capacity Building and Technical Assistance: NIDOA has offered capacity-building programs focused on enhancing Nigeria’s capabilities in agriculture and technology, leveraging Brazil’s expertise and sustainable practices.

- Policy Advocacy: Continuous advocacy for favourable trade policies has been a key focus for NIDOA, working to reduce tariffs and promote economic reforms that facilitate investment and trade flows.

Systemic Engagement

- Public-Private Partnerships (PPPs): Engaging the private sector through PPPs has been essential in mobilising resources for development projects. NIDOA has actively facilitated partnerships that leverage both public and private investments.

- Trade Missions and Business Delegations: Organised trade missions to Brazil for Nigerian businesses and vice versa, allowing for direct engagement with potential partners, fostering trust and opening new channels for trade.

- Monitoring and Evaluation: NIDOA implements a rigorous monitoring and evaluation framework to assess the impact of various initiatives and make necessary adjustments to strategies, ensuring effectiveness in achieving economic cooperation goals.

Through these practical achievements, supporting strategies, and systemic engagement, NIDOA continues to play a pivotal role in enhancing economic cooperation and trade between Nigeria and Brazil. By fostering collaboration and leveraging shared resources, we aim to create a sustainable and mutually beneficial economic environment that promotes growth for both nations.

Do you think the changing geopolitical situation poses a number of challenges to connecting businesses in the region with Nigeria, and how do you overcome them in the activities of NIDOA?

The changing geopolitical situation indeed poses several challenges for connecting businesses in the South American region, particularly Brazil, with Nigeria. These challenges include trade tensions, shifting alliances, currency fluctuations, and varying regulatory environments. Below, I will outline some of the specific challenges and how NIDOA works to overcome them:

Current Challenges

- No Direct Flights: This challenge is obviously explicit. Once direct flights between Brazil and Nigeria become active, and hopefully this year, a much better understanding and engagement will follow suit.

- Trade Restrictions and Tariffs: Increasing trade protectionism in various regions can lead to higher tariffs and trade barriers that hinder the movement of goods between Brazil and Nigeria.

- Currency Volatility: Fluctuations in the value of currencies can complicate trade agreements, pricing strategies, and overall financial planning for businesses operating in both Brazil and Nigeria.

- Different regulatory frameworks and compliance requirements in both countries can create challenges for businesses aiming to navigate these systems efficiently.

- Supply Chain Disruptions: Changes in global supply chains due to geopolitical factors may disrupt established networks, impacting businesses relying on imports and exports between the two nations.

Overcoming Challenges through NIDOA.

NIDOA actively engages in discussions with both the Brazilian and Nigerian governments to advocate for favourable trade policies and agreements that reduce tariffs and improve trade conditions. This year in October, NIDOA BRAZIL holds its TRADE FAIR in São Paulo, Brazil.

What are the popular sentiments among the Nigerians in the South American diaspora? As the Secretary-General of the NIDOA, what are your suggestions relating to assimilation and integration, and of course, future perspectives for the Nigerian diaspora?

As the Secretary-General of NIDOA, I recognise the importance of understanding the sentiments among Nigerians in the South American diaspora, particularly in Brazil.

Many Nigerians in the diaspora take pride in their cultural roots, celebrating their heritage through festivals, music, dance, and culinary traditions. This cultural expression fosters a sense of community and belonging.

While many individuals embrace their new environments, they often face challenges related to cultural differences, language barriers, and social integration, which can lead to feelings of isolation.

Many express optimism about opportunities in education, business, and cultural exchange, viewing their presence in South America as a chance to expand their horizons and contribute to economic activities both locally and back in Nigeria.

Sentiments regarding acceptance vary; while some Nigerians experience warmth and hospitality, others encounter prejudice or discrimination, which can impact their overall experience in the host country. NIDOA BRAZIL has encouraged the formation of community organisations that promote networking, cultural exchange, and social events to foster a sense of belonging and support among Nigerians in the diaspora. There are currently two forums with over a thousand Nigerian members.

Cultural Education and Awareness Programs: NIDOA BRAZIL organises cultural education programs that showcase Nigerian heritage to local communities, promoting mutual understanding and appreciation that can facilitate smoother integration.

Language and Skills Training: NIDOA BRAZIL provides language courses and skills training programs to help Nigerians, especially students in tertiary institutions, adapt to their new environment, enhancing communication and employability within the host country.

Engaging in Entrepreneurship: NIDOA BRAZIL supports the entrepreneurial spirit among Nigerians in the diaspora by facilitating access to resources, mentorship, and networks that can help them start businesses and create economic opportunities.

Through its AMBASSADOR’S CUP COMPETITION, NIDOA Brazil has engaged students of tertiary institutions in Brazil to promote business projects and initiatives that can be implemented in Nigeria.

NIDOA BRAZIL also pushes for increased tourism to Brazil since Brazil is set to become a global tourism leader in 2026, with a projected 10 million international visitors, driven by a post-pandemic rebound, enhanced air connectivity, and targeted marketing strategies.

Brazil’s tourism sector is poised for a remarkable milestone in 2026, as the country expects to welcome over 10 million international visitors—surpassing the previous record of 9.3 million in 2025. This expected surge represents an ambitious leap, nearly doubling the country’s foreign-arrival numbers within just four years, a feat driven by a combination of pent-up global demand, strategic air connectivity improvements, and a highly targeted marketing campaign.

World

African Visual Art is Distinguished by Colour Expression, Dynamic Form—Kalalb

By Kestér Kenn Klomegâh

In this insightful interview, Natali Kalalb, founder of NAtali KAlalb Art Gallery, discusses her practical experiences of handling Africa’s contemporary arts, her professional journey into the creative industry and entrepreneurship, and also strategies of building cultural partnership as a foundation for Russian-African bilateral relations. Here are the interview excerpts:

Given your experience working with Africa, particularly in promoting contemporary art, how would you assess its impact on Russian-African relations?

Interestingly, my professional journey in Africa began with the work “Afroprima.” It depicted a dark-skinned ballerina, combining African dance and the Russian academic ballet tradition. This painting became a symbol of cultural synthesis—not opposition, but dialogue.

Contemporary African art is rapidly strengthening its place in the world. By 2017, the market was growing so rapidly that Sotheby launched its first separate African auction, bringing together 100 lots from 60 artists from 14 foreign countries, including Algeria, Ghana, Mali, Nigeria, Senegal, and others. That same year during the Autumn season, Louis Vuitton Foundation in Paris hosted a major exhibition dedicated to African art. According to Artnet, sales of contemporary African artists reached $40 million by 2021, a 434% increase in just two years. Today, Sotheby holds African auctions twice a year, and in October 2023, they raised $2.8 million.

In Russia, this process manifests itself through cultural dialogue: exhibitions, studios, and educational initiatives create a space of trust and mutual respect, shaping the understanding of contemporary African art at the local level.

Do you think geopolitical changes are affecting your professional work? What prompted you to create an African art studio?

The international context certainly influences cultural processes. However, my decision to work with African themes was not situational. I was drawn to the expressiveness of African visual language—colour, rhythm, and plastic energy. This theme is practically not represented systematically and professionally in the Russian art scene.

The creation of the studio was a step toward establishing a sustainable platform for cultural exchange and artistic dialogue, where the works of African artists are perceived as a full-fledged part of the global cultural process, rather than an exotic one.

To what extent does African art influence Russian perceptions?

Contemporary African art is gradually changing the perception of the continent. While previously viewed superficially or stereotypically, today viewers are confronted with the depth of artistic expression and the intellectual and aesthetic level of contemporary artists.

Portraits are particularly impactful: they allow us to see not just an abstract image of a “continent,” but a concrete personality, character, and inner dignity. Global market growth data and regular auctions create additional trust in African contemporary art and contribute to its perception as a mature and valuable movement.

Does African art reflect lifestyle and fashion? How does it differ from Russian art?

African art, in my opinion, is at its peak in everyday culture—textiles, ornamentation, bodily movement, rhythm. It interacts organically with fashion, music, interior design, and the urban environment. The Russian artistic tradition is historically more academic and philosophical. African visual art is distinguished by greater colour expression and dynamic form. Nevertheless, both cultures are united by a profound symbolic and spiritual component.

What feedback do you receive on social media?

Audience reactions are generally constructive and engaging. Viewers ask questions about cultural codes, symbolism, and the choice of subjects. The digital environment allows for a diversity of opinions, but a conscious interest and a willingness to engage in cultural dialogue are emerging.

What are the key challenges and achievements of recent years?

Key challenges:

- Limited expert base on African contemporary art in Russia;

- Need for systematic educational outreach;

- Overcoming the perception of African art as exclusively decorative or ethnic.

Key achievements:

- Building a sustainable audience;

- Implementing exhibition and studio projects;

- Strengthening professional cultural interaction and trust in African

contemporary art as a serious artistic movement.

What are your future prospects in the context of cultural diplomacy?

Looking forward, I see the development of joint exhibitions, educational programs, and creative residencies. Cultural diplomacy is a long-term process based on respect and professionalism. If an artistic image is capable of uniting different cultural traditions in a single visual space, it becomes a tool for mutual understanding.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn