Feature/OPED

2023 Handover Date and Tasks Before Okowa

By Jerome-Mario Chijioke Utomi

Recently, this author has seen people (Deltans and non Deltans alike) argue that the success of the administration of the Governor of Delta State, Mr Ifeanyi Okowa, particularly in the infrastructural development and promotion of technical education in the state dwarfed that of his predecessors.

These efforts on the part of the Governor contributed appreciably to why Delta State was ranked the Best State in Human Capital Development in the 2017 States Peer Review by the National Competitiveness Council of Nigeria, and also in 2020.

It is also responsible for why Delta as a state was adjudged to be the Second Least Poor State, coming only after Lagos, Nigeria’s business hub, according to the Nigerian Bureau of Statistics (NBS).

Despite the validity of the above declarations, I have also within this span, observed critics argue but scantly that Delta is a small state, oil-producing, and, therefore, can achieve its goals and record developments easily. That the success so far recorded in the state has nothing to do with creative leadership but a function of the availability of natural resources in the state.

Like the first group mentioned above, I have in a recent post among other things noted that the ongoing development in Delta State tellingly justifies the popular belief that creative concepts of leaders can bring both disruptive and constructive aspects; laced with the capacity to shatter set patterns of thinking, can threaten the status quo, or at the very least stir up people’s anxieties.

While noting that Okowa has in the past six years demonstrated that strategic success cannot be reduced to a formula, nor can one become a strategic thinker by reading a book, but through constant demonstration of competence, connection and character, the piece submitted that if one had visited the coastal areas of Delta State before May 29, 2015, till date, he/she may have concluded that the area was a location that has apparently never heard of civilization.

But under Governor Okowa’s administration, the people are coming to understand that education and infrastructural development of an area are the best tools for shaping the future of the people and not devices for an exclusive privileged few.

Among all the reactions/comments received, a particular one from a supposedly coastal dweller seems to stand out as it was a positive reaction with a sprinkle of agenda-setting.

Essentially, it read in part; Okowa has deflected the age-long excuse by previous administrations that the coastal region cannot be developed because the terrain is a marshy-a feature that renders construction difficult if not impossible, can no longer be sustained, this particular reader/respondent in line appreciated the Governor for the level of good/internal road networks and other infrastructural development- a feat that he said qualifies the Governor as the first to give a sense of belonging to the people of the region.

He, however, concluded that for the Governor to finish strong, he should construct road networks that will link Warri to Escravos terminals in Warri South-West Local Council Area of Delta and another from Escravos to Forcados terminal in Burutu Local Government Area as well as complete Ayakoromo Bridge to link communities in Ughelli South and Burutu Council Areas.

More specifically, further analysis of his comment reveals that while the first part of his comment acts as a morale booster to the state governor, the second part is the demand for the construction of road networks that will link Warri to Escravos terminals in Warri South-West Local Council Area of Delta and another from Escravos to Forcados terminal in Burutu Local Government Area, as well as complete Ayakoromo Bridge to link communities in Ughelli South and Burutu Council Areas, performs agenda-setting function for the state governor and his team.

Continuing, he said the bridge project has lingered for a very long time having been awarded by the now outgone Emmanuel Udughan administration. The project has in fact thrust a responsibility and extremely important destiny; to complete this process of socioeconomic rejuvenation of the people of the riverine community which the state has spent far too long a time doing.

Like the Bomadi Bridge which was executed by Chief James Onanefe Ibori’s administration, connecting three local government areas, (Burutu, Ughele and Patani), likewise, the Ayakoromo bridge going by commentaries, when completed, promises to promote the socioeconomic lives and wellbeing of Deltans living in over in four local governments of the state.

Take, as an illustration, the Bobougbene community and its environs are reputed for the production of palm oil in commercial quantity and supply to Warri metropolis, and Okwuagbe markets in Ugheli South. The bridge when completed will provide easy access to these markets. Even more, it will open up the majority of communities that are yet to have access to the ‘uplands’.

In reputation terms, there are more reasons to applaud Governor Okowa’s effort in this direction. It is said that a leader’s image is an amalgam of a variety of factors, and followers must at intervals evaluate these perceived factors in order to dictate if they are in a positive or negative light.

Particularly, an image is capable of saying much more about a leader than any of his long speeches and verbal declarations and once established, the image becomes not just the leader’s picture but remains highly durable.

Even as this is being internalized, there exists yet another area of concern that in my view needs urgent attention in the coastal area of the state. It is in the areas of bringing primary and secondary schools close to communities in the coastal/riverine communities in the state.

Just very recently, I listened with rapt attention to King Monday Whiskey, Udurhie I, the Ovie of Iderhe Kingdom, speak on the challenges children of his kingdom need to confront to access education.

King Whiskey, who spoke in Lagos, among other things lamented that children in the Niger Delta must attain the age of 12 before starting from primary one because it is only at that age that children can be able to paddle their boat successfully to the other side of the community where their school is located.

In such a case, says Damilola Adeparua, a public affairs commentator, it is arguable that the percentage of uneducated women will be very high since it is only at the age of 12 boys can be allowed to paddle boats, then it will take a supernatural girl of 12 to start at that age. This makes the global statistics feasible that just 39% of rural girls attend secondary school and this is far fewer than that of rural boys, which is 45%, compared to urban girls, which is 59% and urban boys 60%.

Some of the girls who even live in communities which have access to free education and have their schools located in places where it is accessible are denied their right to education based on religious reasons, while some are hampered by poverty.

The issue of children’s education deprivation is not limited to girls as posited by UNICEF that one in every 5 of the world’s out-of-school children is in Nigeria.

Even though primary education is officially free and compulsory, about 10.5 million of the country’s children aged 5-14 years are not in school. Only 61 per cent of 6-11 year-olds regularly attend primary school and only 35.6 per cent of children aged 36-59 months receive early childhood education. Delta State, particularly the people of the coastal communities, is in my opinion not insulated from this challenge.

Why the state urgently needs to act on this new awareness is that school is far or close to the home according to what experts are saying definitely affects the student in many ways.

For the students living far from the school, the long commute every day is physically and mentally tiring and as a result, it’s harder to focus on studying after getting home. Their lifestyle is usually more hectic because of the travel. Most, if not all school-related events are actually near the school so the student has to travel to attend all that, too.

Comparatively, those who live closer to the school, are usually better connected to school and its events because, most, if not all school-related events happen near the school. And because of the small distance, they’re more up to date with it.

Also, a maximum of students who attend a particular school, live close to it, so they’re better connected with each other compared to the folks who live away and therefore tend to have more contacts and more connections. They are also more likely to become popular in school because they know a lot of people. They also are mentally more relaxed because they have a lot of time on their hands and they don’t necessarily have to deal with travelling.

The UNICEF survey says something else; there are still a huge number of those who are in school but are learning nothing, noting that schooling does not always lead to learning. In Nigeria, there are more non-learners in school than out of school, it concluded.

Admittedly, while the people of the region seem certain to make an increasing contribution to the development of the state as a handful of them can now afford the luxury of education and access to good amenities, it is clear in hindsight that the Governor tackled this outlined challenges before handing over to the yet to be identified administration come 2023.

Achieving this feat will give the people of the region sense to feel that they have a governor that not only cares but act as a technique to support the people understanding of the Governor’s vision.

Most importantly, the state needs to pay attention to present challenges in the region as development professionals warn that preparing for the future involves, first of all, training our young citizens to lead the development process, driven by a sense of their absolute duty to maintain our economic evolution. This will encourage them to place their dynamic potential at the service of our society.

Indeed, the state has a wealth of young talents, and it is the responsibility of each and every sector of society to nurture them. This can only be done through proper education, training, support and encouragement; and by scouting for special skills and talents, while also nurturing creative initiatives.

Jerome-Mario Chijioke Utomi is the Programme Coordinator (Media and Public Policy), Social and Economic Justice Advocacy (SEJA), Lagos. He can be reached via [email protected]/08032725374

Feature/OPED

Navigating Nigeria’s $1 Trillion Roadmap: Growth Indexes and PR Intelligence That Define Success in 2026

By Nosa Iyamu

As we navigate the threshold of 2026, the Nigerian economic landscape is finally shedding the “survivalist” skin that defined the previous two years. The data from 2025 paints a compelling picture of a nation pivoting toward stability. Headline inflation, which sat at a staggering 34.8% in December 2024, underwent a significant decline through 2025, cooling to 14.45% by November. This disinflationary trend, paired with economic reforms such as the Nigerian Electricity Regulatory Commission’s (NERC) aggressive reforms and strategic shifts in the Oil and Gas sector, has effectively reopened the floodgates for Foreign Direct Investment (FDI). The narrative has shifted from a desperate scramble for survival to a strategic quest for sustainability. Investors who were once hesitant are now looking at Nigeria not as a volatility risk, but as a market undergoing profound structural re-engineering. This transition is marked by a renewed focus on transparency and a commitment to market-driven policies that reward institutional resilience and long-term planning.

Building on the stability achieved last year, 2026 is projected to be a period of “Growth Consolidation.” With GDP expansion forecasted between 4.1% and 4.2% and headline inflation expected to settle into a manageable range of 12.5% to 20%, the mandate for brands should shift. It is no longer about merely surviving the storm of volatility; it is about scaling within high-impact corridors that have been cleared by these macroeconomic reforms. Strategic opportunities are ripening in four key sectors: Energy, driven by the Electricity Act 2023 and NERC’s cost-reflective market reforms; Healthcare, anchored by the landmark $5.1B Bilateral MOU between the U.S. and Nigeria; Financial Services, fueled by post-recapitalization lending power; and the Digital Economy, accelerated by the 5G rollout and the maturity of social commerce. Brands playing in these spaces and other industries must recognize that the consumer of 2026 is more discerning, having been refined by the economic hardships of the past, and will only reward businesses that offer clear value and authentic connection.

Perhaps the most pivotal anchor for 2026 is that $2 billion bilateral health Memorandum of Understanding (MOU) signed between the U.S. and Nigeria. This five-year agreement, which began its full implementation cycle in early 2026, is far more than a healthcare play; it is a massive economic stimulus and a resounding vote of global confidence in Nigeria’s institutional reforms. It signals that Nigeria is ready for high-level international cooperation and that the groundwork for a stable, productive economy is being laid. As we march toward the ambitious goal of a $1 trillion economy by 2030, visibility is no longer the endgame for any serious brand. To survive and thrive during this transition from subsistence to high productivity, brands must be deeply understood. It is about moving from the “top of mind” awareness to “top of heart” resonance, where the brand’s purpose aligns with the aspirations of a nation on the move.

In the fast-evolving communications landscape of 2026, visibility has become a cheap commodity, but clarity is a premium asset. The Public Relations industry has officially entered the era of Narrative Intelligence. Traditional Search Engine Optimization (SEO) is being rapidly superseded by Generative Engine Optimization (GEO). As consumers increasingly rely on AI agents and large language models (LLMs) rather than scrolling through pages of search results, brands must ensure they aren’t just “present” on the web—they must be cited as authoritative, credible voices by AI models. This requires a shift from keyword stuffing to high-context storytelling and data-backed authority. If an AI agent cannot summarize your brand’s value proposition accurately in two sentences, you are effectively invisible to the next generation of digital consumers. Narrative Intelligence is about ensuring your brand’s story is coherent, consistent, and machine-readable across all digital touchpoints.

However, this AI-driven world brings a darker side – the proliferation of Deepfakes and hyper-realistic misinformation. As the 2027 political cycle begins to warm up in late 2026, the Nigerian digital space could become a minefield of synthetic media designed to manipulate public opinion. For brands, this represents a significant reputational risk. PR professionals must now act as “Narrative Bodyguards,” deploying advanced AI detection tools to monitor, detect, and neutralize synthetic media before it erodes brand equity. Authenticity is no longer a buzzword or a marketing slogan; it is a defensive necessity. Brands must lean into “Responsible Communication,” ensuring that every piece of content is verifiable and that their response mechanisms for crisis management are faster than the speed of a viral deepfake. Trust, once lost in this high-speed environment, is nearly impossible to regain.

The era of the “Press Release for the sake of it” is officially dead. In 2026, Nigerian boardrooms are demanding a direct, quantifiable line between PR activity and business impact. This marks the definitive death of vanity metrics. Success is no longer measured by the thickness of a press clipping file or the number of generic “likes” on a social media post. Instead, we are seeing a shift from volume to impact, where the primary KPIs are how a campaign drives customer acquisition, increases investor interest, or improves employee retention. Measurement has shifted focus to quality over quantity; it is about the sentiment of the conversation and the conversion rate of the audience. If your PR strategy does not move the needle on the set measurable objectives, it is considered mere noise. PR is now a performance-driven discipline, integrated deeply into the sales and growth funnels of the modern Nigerian enterprise.

The age of the N100 million celebrity brand ambassador is also rapidly fading. Battle-hardened by years of economic shifts and broken promises, Nigerian consumers are increasingly skeptical of high-gloss, low-substance celebrity endorsements. In 2025, the Creator Economy has professionalized and matured. We will see the ascendancy of Niche Creators—the personal finance expert on TikTok, the sustainable farmer on YouTube, or the tech-policy analyst on Instagram. These voices offer what traditional celebrities cannot: community, deep credibility, and a mastery of their craft. Brands in 2026 will pivot toward long-term “Responsible Communication” partnerships with these creators who speak the hyper-local language of their audience. The “next big creator” is no longer a movie star; they are a subject matter expert with a loyal, high-intent community that values authentic insight over superficial fame.

While we must continue to support and prioritize independent media platforms to maintain democratic health, the reality is that traditional newsrooms continue to shrink under the weight of digital disruption. In response, savvy brands are increasingly becoming their own media houses. “Owned Media”—newsletters, podcasts, proprietary research reports, and custom-built community platforms—is the new frontier for brand storytelling. By owning the platform, brands can ensure their story is not diluted or lost in the noise of a fragmented media landscape. This allows for Direct Empathy, speaking to the consumer’s daily reality without a third-party filter. It provides Narrative Control, which is essential in an era of deepfakes, and grants Data Ownership, allowing brands to deeply understand who is engaging with their story and why. Owned media is the bridge that moves a brand from being seen to being truly understood and must be a strategy for 2026.

The 2026 landscape is a high-stakes arena of immense complexity and opportunity. With the active involvement of global powers like China, Russia, and the USA in trade and commerce, and a renewed national commitment to fighting insecurity to protect the $1 trillion goal, Nigeria is a land of profound transformation. But for a brand to capture this opportunity, it must move beyond the surface-level metrics of the past. Brands must empathize through genuine partnerships, drive cross-sector collaboration, and tell stories that resonate with the Nigerian spirit of resilience. The verdict for the year is clear: Trust is the new currency. In a world of AI-generated noise and economic restructuring, the brands that win will be those that have spent the time to build a foundation of understanding. The mandate for 2026 is simple: Don’t just show up. Ensure your audience knows exactly who you are, what you stand for, and why you are essential to their future.

Nosa Iyamu is the CEO of IVI PR

Feature/OPED

On the Gazetted Tax Laws: What if Dasuki Was Indifferent?

By Isah Kamisu Madachi

For over a week now, flipping through the pages of Nigerian newspapers, social media, and other media platforms, the dominant issue trending nationwide has been the discovery of significant discrepancies between the gazetted version of the tax laws made available to the public and what was actually passed by the Nigerian legislature.

Since this shocking discovery by a member of the House of Representatives, opinions from tax experts, public affairs analysts, activists, civil society organisations, opposition politicians, and professional bodies have been pouring in.

Many interesting events capable of burying the tempo of the debate have recently surfaced in the media, yet the tax law discussion persists due to how deeply entrenched public interest is in the contested laws.

However, while many view the issue from angles such as a breach of public trust, a violation of legislative privilege by the executive council, the passage of an ill-prepared law and so on, I see it from a different, narrower, and governance-centred perspective.

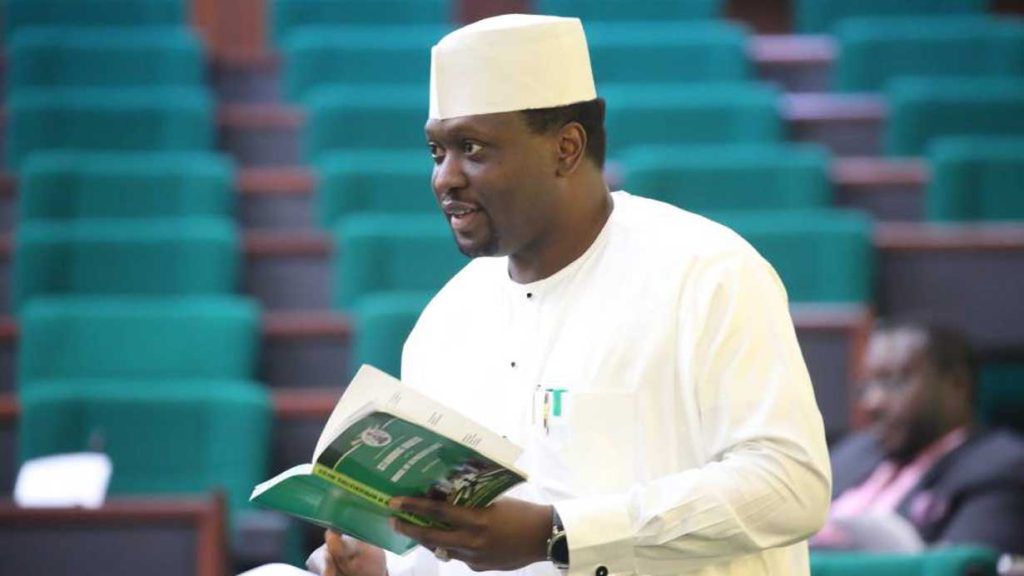

What brought this issue to public attention was an alarm raised by Abdulsammad Dasuki, a member of the House of Representatives from Sokoto State, during a plenary on December 17, 2025. He called the attention of the House to what he identified as discrepancies between the gazetted version of the tax laws he obtained from the Federal Ministry of Information and what was actually debated, agreed upon, and passed on the floors of both the House and the Senate.

He requested that the Speaker ensure all relevant documents, including the harmonised versions, the votes and proceedings of both chambers, and the gazetted copies, are brought before the Committee of the Whole for careful scrutiny. The lawmaker expressed concern over what he described as a serious breach of his legislative privilege.

Beyond that, however, my concern is about how safe and protected Nigerians’ interests are in the hands of our lawmakers at the National Assembly. This ongoing discussion raises a critical question about representation in Nigeria. Does this mean that if Dasuki had also been indifferent and had not bothered to utilise the Freedom of Information Act 2011 to obtain the gazetted version of the laws from the Federal Ministry of Information, take time to study it, and make comparisons, there would have been no cause for alarm from any of Nigeria’s 360 House of Representatives members and 109 senators? Do lawmakers discard the confidence we reposed in them immediately after election results are declared?

This debate should indeed serve a latent function of waking us up to the reality of the glaring disconnect between public interest and the interests of our representatives. The legislature in a democratic setting is a critical institution that goes beyond routine plenaries that are often uninteresting and sparsely attended by the lawmakers. It is meant to be a space for scrutiny, deliberation, and the protection of public interest, especially when complex laws with wide social consequences are involved.

We saw Ali Ndume in a short video clip that recently swept the media, furiously saying during a verbal altercation with Adams Oshiomhole over ambassadorial screening that “the Senate is not a joke.” The Senate is, of course, not a joke, and either should the entire National Assembly be.

Ideally, it should not be a joke to us or to the legislators themselves. Therefore, we should not shy away from discussing how disinterested those entrusted with the task of representing us, and primarily protecting our interests, appear to be in our collective affairs.

It is not a coincidence that even before the current debate around the tax reform law, it had continued to generate controversy since its inception. It also does not take quantum mechanics to understand that something is fundamentally wrong when almost nobody truly understands the law. Thanks to social media, I have come across numerous skits, write-ups, and commentaries attempting to explain it, but often followed by opposing responses saying that the authors either did not understand the law themselves or did not take sufficient time to study it.

The controversy around the gazetted Tax Reform Laws should not end with public outrage or media debates alone. It should force a deeper reflection on how laws are made, checked, and defended in Nigeria’s democracy. A system that relies on the alertness of one lawmaker to prevent serious legislative discrepancies is not a resilient or reliable system. Representation cannot be occasional and vigilance cannot be optional.

Nigerians deserve a legislature that safeguards their interests, not one that notices breaches only when a few individuals choose to be different and look closely. If this ongoing debate does not lead to formidable internal checks and a renewed sense of responsibility among lawmakers, then the problem is far bigger than a flawed gazette. When legislative processes fail, it is ordinary Nigerians who bear the cost through policies they did not scrutinize and consequences they did not consent to.

Isah Kamisu Madachi is a public policy enthusiast and development practitioner. He writes from Abuja and can be reached via: [email protected]

Feature/OPED

After the Capital Rush: Who Really Wins Nigeria’s Bank Recapitalisation?

By Blaise Udunze

By any standard, Nigeria’s ongoing bank recapitalisation exercise is one of the most consequential financial sector reforms since the 2004-2005 consolidation that shrank the number of banks from 89 to 25. Then, as now, the stated objective was stability to have stronger balance sheets, better shock absorption, and banks capable of financing long-term economic growth.

The Central Bank of Nigeria (CBN), in 2024, mandated a sweeping recapitalisation exercise compelling banks to raise substantially higher capital bases depending on their license categories. The categorisation mandated that every Tier-1 deposit money bank with international authorization is to warehouse N500 billion minimum capital base, and a national bank must have N200 billion, while a regional bank must have N50 billion by the deadline of 31st March 2026. According to the apex bank, the objectives were to strengthen resilience, create a more robust buffer against shocks, and position Nigerian banks as global competitors capable of funding a $1 trillion economy.

But in the thick of the race to comply and as the dust gradually settles, a far bigger conversation has emerged, one that cuts to the heart of how our banking system works. What will the aftermath of recapitalisation mean for Nigeria’s banking landscape, financial inclusion agenda, and real-sector development?

Beyond the headlines of rights issues, private placements, and billionaire founders boosting stakes, every Nigerians deserve a sober assessment of what has changed, and what still must change, if recapitalisation is to translate into a genuinely improved banking system.

The points are who benefits most from its evolution, and whether ordinary Nigerians will feel the promised transformation in their everyday financial lives, because history has taught us that recapitalisation is never a neutral policy. The fact remains that recapitalization creates winners and losers, restructures incentives, and often leads to unintended outcomes that outlive the reform itself.

Concentration Risk: When the Big Get Bigger

Recapitalisation is meant to make banks stronger, and at the same time, it risks making them fewer and bigger, concentrating power and risks in an ever-narrowing circle. Nigeria’s Tier-1 banks, those already controlling roughly 70 percent of banking assets, are poised to expand further in both balance sheet size and market influence. This deepens the divide between the “haves” and “have-nots” within the sector.

A critical fallout of this exercise has been the acceleration of consolidation. Stronger banks with ready access to capital markets, like Access Holdings and Zenith Bank, have managed to meet or exceed the new thresholds early by raising funds through rights issues and public offerings. Access Bank boosted its capital to nearly N595 billion, and Zenith Bank to about N615 billion.

In contrast, banks that lack deep pockets or the ability to quickly mobilise investors are lagging. The results always show that the biggest banks raise capital faster and cheaper, while smaller banks struggle to keep pace.

As of mid-2025, fewer than 14 of Nigeria’s 24 commercial banks met the required capital base, meaning a significant number were still scrambling, turning to rights issues, private placements, mergers, and even licensing downgrades to survive.

The danger here is not merely numerical. It is systemic: as capital becomes more concentrated, the banking system could inadvertently mimic oligopolistic tendencies, reducing competition, narrowing choices for customers, and potentially heightening systemic risk should one of these “too-big-to-fail” institutions falter.

Capital Flight or Strategic Expansion? The Foreign Subsidiary Question

One of the most contentious aspects of the recapitalisation aftermath has been the deployment of newly raised capital, especially its use outside Nigeria. Several banks, flush with liquidity from rights issues and injections, have signalled or executed investments in foreign subsidiaries and expansions abroad, like what we are experiencing with Nigerian banks spreading their tentacles to the Ivory Coast, Ghana, Kenya, and beyond. Zenith Bank’s planned expansion into the Ivory Coast exemplifies this outward push.

While international diversification can be a sound strategic move for multinational banks, there is an uncomfortable optics and developmental question here: why is Nigerian money being deployed abroad when millions of Nigerians remain unbanked or underbanked at home?

According to the World Bank, a large number of Nigeria’s adult population still lack access to formal financial services, while millions of SMEs, micro-entrepreneurs, and rural households remain on the edge, underserved by traditional banks that now chase profitability and scale.

Of a truth, redirecting Nigerian capital to foreign markets may deliver shareholder returns, but it does little in the short term to advance domestic financial inclusion, poverty reduction, or grassroots economic participation. The optics of capital flight, even when legal and strategic, demand scrutiny, especially in a nation still struggling with deep regional and demographic disparities.

Impact on Credit and the Real Economy

For the ordinary Nigerian, the most important question is simple: will recapitalisation make credit cheaper and more accessible?

History suggests the answer is not automatic. The tradition in Nigeria’s bank system is mainly to protect returns, and for this reason, many banks respond to higher capital requirements by tightening lending standards, raising interest rates, or focusing on low-risk government securities rather than private-sector loans, because raising capital is expensive, and banks are profit-driven institutions. Small and medium-sized enterprises (SMEs), often described as the engine of growth, are usually the first casualties of such risk aversion.

If recapitalisation results in stronger balance sheets but weaker lending to the real economy, then its benefits remain largely cosmetic. The economy does not grow on capital adequacy ratios alone; it grows when banks take measured risks to finance production, innovation, and consumption.

Retail Banking Retreat: Handing the Mass Market to Fintechs?

In recent years, we have witnessed one of the most striking shifts, or a gradual retreat of traditional banks from mass retail banking, particularly low-income and informal customers.

The question running through the hearts of many is whether Nigerian banks are retreating from retail banking, leaving space for fintech disruptors to fill the void.

In recent years, players like OPAY, Moniepoint, Palmpay, and a host of digital financial services arms have become de facto retail banking platforms for millions of Nigerians. They provide everyday payment services, wallet functionalities, micro-loans, and QR-enabled commerce, areas traditional banks once dominated. This trend has accelerated as banks chase corporate clients where margins are higher and risk profiles perceived as more manageable. The true picture of the financial landscape today is that the fintechs own the retail space, and banks dominate corporate and institutional finance. But it is unclear or uncertain if this model can continue to work effectively in the long term.

Despite the areas in which the Fintechs excel, whether in agility, product innovation, and customer experience, they still rely heavily on underlying banking infrastructure for liquidity, settlement, and regulatory compliance. Should the retail banking ecosystem become split between digital wallets and corporate corridors, rather than being vertically integrated within banks, systemic liquidity dynamics and financial stability could be affected.

Nigerians deserve a banking system where the comforts and conveniences of digital finance are backed by the stability, regulatory oversight, and capital strength of licensed banks, not a system where traditional banks withdraw from retail, leaving unregulated or lightly regulated players to carry that mantle.

Corporate Governance: When Founders Tighten Their Grip

The recapitalisation exercise has not been merely a technical capital-raising exercise; it has become a theatre of power plays at the top. In several banks, founders and major investors have used the exercise to increase their stakes, concentrating ownership even as they extol the virtues of financial resilience.

Prominent founders, from Tony Elumelu at UBA to Femi Otedola at First Holdco and Jim Ovia at Zenith Bank, have all been actively increasing their shareholdings. These moves raise legitimate questions about corporate governance when founders increase control during a regulatory exercise. Are they driven by confidence in their institutions, or are they fortifying personal and strategic influence amid industry restructuring?

Though there might be nothing inherently wrong with founders or shareholders demonstrating faith in their institutions, one fact remains that the governance challenge lies not simply in who holds the shares, but how decisions are made and whose interests are prioritised. Will banks maintain robust internal checks and balances, ensuring that capital deployment aligns with national development goals? The question is whether the CBN is equipped with adequate supervisory bandwidth and tools to check potential excesses if emerging shareholder concentrations translate into undue influence or risks to financial stability. These are questions that transcend annual reports; they strike at the heart of trust in the system.

Regional Disparity in Lending: Lagos Is Not Nigeria

One of the persistent criticisms of Nigerian banking is regional lending inequality. It has been said that most bank loans are still overwhelmingly concentrated in Lagos and the Southwest, despite decades of financial deepening in this region; large swathes of the North, Southeast, and other underserved regions receive disproportionately smaller shares of credit. This imbalance not only undermines inclusive growth but also fuels perceptions of economic exclusion.

Recapitalisation, in theory, should have enhanced banks’ capacity to support broader economic activity. Yet, the reality remains that loans and advances are overwhelmingly concentrated in economic hubs like Lagos.

The CBN must deploy clear incentives and penalties to encourage geographic diversification of lending. This could include differentiated capital requirements, credit guarantees, or tax incentives tied to regional loan portfolios. A recapitalised banking system that does not finance national development is a missed opportunity.

Cybersecurity, Staff Welfare, and the Technology Deficit

Beyond balance sheets and brand expansion, there is a human and technological dimension to the banking sector’s challenge. Fraud remains rampant, and one of the leading frustrations voiced by Nigerians involves failed transactions, delayed reversals, and poor digital experience. Banks can raise capital, but if they fail to invest heavily in cybersecurity, fraud detection, staff training, and welfare, the everyday customer will continue to view the banking system as unreliable.

Nigeria’s fintech revolution has thrived precisely because it has pushed incumbents to become more customer-centric, agile, and tech-savvy. If banks now flush with capital don’t channel a portion of those funds into robust IT systems, workforce development, fraud mitigation, and seamless customer service, then the recapitalisation will have achieved little beyond stronger balance sheets. In short, Nigerians should feel the difference, not merely in stock prices and market capitalisation, but in smooth banking apps, instant reversals, responsive customer care, and secure platforms.

The Banks Left Behind: Mergers, Failures, or Forced Restructuring?

With fewer than half the banks having fully complied with the recapitalisation requirements deep into 2025, a pressing question is: what awaits those that lag? Many banks are still closing capital gaps that run into hundreds of billions of naira. According to industry estimates, the total recapitalisation gap across the sector could reach as much as N4.7 trillion if all requirements are strictly enforced.

Banks that fail to meet the March 2026 deadline face a few options:

– Forced M&A. Regulators could effectively compel weaker banks to merge with stronger ones, echoing the consolidation wave of 2005 that reduced the sector from 89 to 25 banks.

– License downgrades or conversions. Some banks may choose to operate at a lower license category that demands a smaller capital base.

– Exits or closures. In extreme cases, banks that can neither raise capital nor find a merger partner might be forced out of the market.

This regulatory pressure should not be construed merely as punitive. It is part of the CBN’s broader architecture of ensuring that only solvent, well-capitalised, and risk-prepared institutions operate. However, the transition must be managed carefully to prevent contagion, protect depositors, and preserve confidence.

Why Are Tier-1 Banks Still Chasing Capital?

Perhaps the most intriguing puzzle is why some Tier-1 banks, long regarded as strong and profitable, are aggressively raising capital. Even banks thought to be among the strongest, such as UBA, First Holdco, Fidelity, GTCO, and FCMB, have struggled to close their capital gaps. UBA, for instance, succeeded in raising around N355 billion toward its N500 billion target at one point and planned additional rights issues to bridge the remainder.

This reveals another reality that capital is not just numbers on paper; it is investor confidence, market appetite, and macroeconomic stability.

One can also say that the answer lies partly in ambition to expand into new markets, infrastructure financing, and compliance with stricter global standards.

However, it also reflects deeper structural pressures, including currency depreciation eroding capital, rising non-performing loans, and the substantial funding required to support Nigeria’s development needs. Even giants are discovering that yesterday’s capital is no longer sufficient for tomorrow’s challenges.

Reform Without Deception

As the Nigerian banking sector recapitalization exercise comes to a close by March 31, 2026, the ultimate test will be whether the reforms deliver on their transformational promise.

Some of the concerns in the minds of Nigerians today will be to see a system that supports inclusive growth, equitable credit distribution, world-class customer service, and resilient financial intermediation. Or will we see a sector that, despite larger capital bases, still reflects old hierarchies, geographic biases, and operational friction? The cynic might say that recapitalisation simply made big banks bigger and empowered dominant shareholders.

But a more hopeful perspective invites stakeholders, including regulators, customers, civil society, and bankers themselves, to co-design the next chapter of Nigerian banking; one that balances scale with inclusion, profitability with impact, and stability with innovation. The difference will be made not by press releases or shareholder announcements, but by deliberate regulatory action and measurable improvements in how banks serve the economy.

For now, the capital has been raised, but the true capital that counts is the confidence Nigerians place in their banks every time they log into an app, make a transfer, or deposit their life’s savings. Only when that trust is visible in everyday experience can we say that recapitalisation has truly succeeded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn