Feature/OPED

SMEs: Practice to Help You Thrive in Difficult Times

By Timi Olubiyi, PhD

All small businesses and organizations need to figure out how to stay afloat and add value to their customers and audience during these challenging times. For businesses, be they micro, small or large, it has been a difficult time with the cost of running businesses in Nigeria like the rest of African countries. Recall that the review in the pump price of Premium Motor Spirits (PMS), gasoline, otherwise known as fuel, was about 300%, and the inflation number as of June 2023 was 22.76%.

These staggering numbers have caused disruptions to living costs and daily business operating costs. Businesses cannot continue to operate as usual; there is a need to consider strategies to help cushion the effect of the many consequences of the hikes.

Effective business communication is one of the simple strategies to adopt at this time for many reasons. It entails sharing information between employees within the business and also outside, which particularly would involve the customers and other stakeholders. Communication can entail announcing or sharing alterations to the business, new pricing, adjustments to delivery or operating time, a launch of a new product or service, targeting different market segments and so on.

Effective communication is the key to a resilient business and can help greatly at this difficult time for businesses and even households.

Most of the time, effective communication may just take the form of stakeholder engagements, talking to vendors or customers about current realities and mitigating measures, or even talking to colleagues in face-to-face meetings or through the use of computers, or smartphones, about key changes in the environment and the surviving strategies with clarity.

More importantly, regardless of the communication channels communicating accurately is essential. Whether the purpose is to update customers on new products or price differentials or to listen to the yearnings of employees or vendors, good communication is an integral part of effective business management at this time of high uncertainties.

In today’s competitive market and current realities, no matter the size of the business, proper business communication is critical to success and sustainability. It can also enhance organizational survival at this time of high business uncertainties.

Undoubtedly, effective communication can establish good interpersonal and strong working relationships and facilitate cooperation within the staff of an organization, which can help to overcome difficulties and difficult times.

Therefore, to be effective in the current business environment with high inflation rate an effective communication process should be adopted, which should be two-way. That is, good communication should be complemented with active listening.

That said, when communication is open and continuous amongst business stakeholders, customers, and employees, it can help make and maintain business objectives and keep away potential workplace conflicts from getting out of hand.

More so, when organization expectations and issues are regularly discussed and solutions proffered in both formal and informal settings, all members of business stakeholders, including customers, will better understand the status of the business and the new objectives. Therefore, do not make assumptions about customer experience or expectations, simply talk to them.

Ensure making honest conversations at all times to get meaningful feedback from all stakeholders. It would be wrong to assume clients/customers already know the economic realities and not communicate changes that are likely to happen within the business settings and also in services rendered. Take the time to communicate and let clients/customers know about the changes the current realities can cause and the expectations during this new era.

It is important to state that having effective communication can help businesses in so many ways at this time. Surveyed businesses within Nigeria indicated that effective communication could boost customer loyalty, employee morale, and business resilience, promote efficiency, sustain revenue growth, and increase customer engagement.

In response to the recent survey, business operators also indicated that effective communication could also help to lessen the chances of misunderstandings and potentially reduce grievances and even complaints or litigations in the business. Conversely, a lack of it or ineffective communication is seen to lead to disgruntledness of customers leading to poor sales or no low patronage, employee frustration, lower business productivity, and increased employee turnover rate.

It may also increase the chances for misinterpretations, tarnish business goodwill, damage relationships, break trust, and increase anger and hostility. Unlike everyday communications, business communication is vital and must be taken seriously by business operators and entrepreneurs at this time.

Essentially, the customer is king and key to business survival. Consequently, establishing a feedback mechanism can help business operators monitor customer service and product progress, which can help with strategic adjustments to any anticipated change in the market, even with current realities.

Accordingly, developing and encouraging effective communication internally and externally among staff, vendors, and customers/clients is an important skill that all business operators must leverage. In business, therefore, communication can make the difference between success and failure. So, no method of communication in the form of feedback, engagement, interaction, listening or business conversation should

In conclusion, communication is a crucial and significant element in any business setup. Therefore, business organizations should have comprehensive policies and strategies for communicating with customers, employees, and stakeholders, as well as with the community at large.

A business should leverage technology for integrated communication, and every channel of communication should be considered effectively- social media, websites, the internet, phone calls, adverts, letter writings, and so on. Software like Zoom, Skype, GoToMeeting, and other video/audio conferencing technologies have made it easier for businesses to communicate with customers, employees, vendors, and clients.

Business operators and entrepreneurs should equally adopt a link between communication and the organisation’s strategic plan, which can include the organization’s mission, vision, and values to develop a communication strategy for the business. If you are concerned about enhancing or on how to build an effective communication strategy in your business, you may need to reach out to a professional for essential advice urgently. Good luck!

How may you obtain advice or further information on the article?

Dr Timi Olubiyi is an entrepreneurship and business management expert with a PhD in Business Administration from Babcock University, Nigeria. He is a prolific investment coach, columnist, author, adviser, seasoned scholar, Chartered Member of the Chartered Institute for Securities & Investment (CISI), Member of the Institute of Directors, and Securities and Exchange Commission (SEC) registered capital market operator. He can be reached on the Twitter handle @drtimiolubiyi and via email: [email protected], for any questions, reactions, and comments. The opinions expressed in this article are those of the author, Dr Timi Olubiyi, and do not necessarily reflect the opinions of others.

Feature/OPED

On the Gazetted Tax Laws: What if Dasuki Was Indifferent?

By Isah Kamisu Madachi

For over a week now, flipping through the pages of Nigerian newspapers, social media, and other media platforms, the dominant issue trending nationwide has been the discovery of significant discrepancies between the gazetted version of the tax laws made available to the public and what was actually passed by the Nigerian legislature.

Since this shocking discovery by a member of the House of Representatives, opinions from tax experts, public affairs analysts, activists, civil society organisations, opposition politicians, and professional bodies have been pouring in.

Many interesting events capable of burying the tempo of the debate have recently surfaced in the media, yet the tax law discussion persists due to how deeply entrenched public interest is in the contested laws.

However, while many view the issue from angles such as a breach of public trust, a violation of legislative privilege by the executive council, the passage of an ill-prepared law and so on, I see it from a different, narrower, and governance-centred perspective.

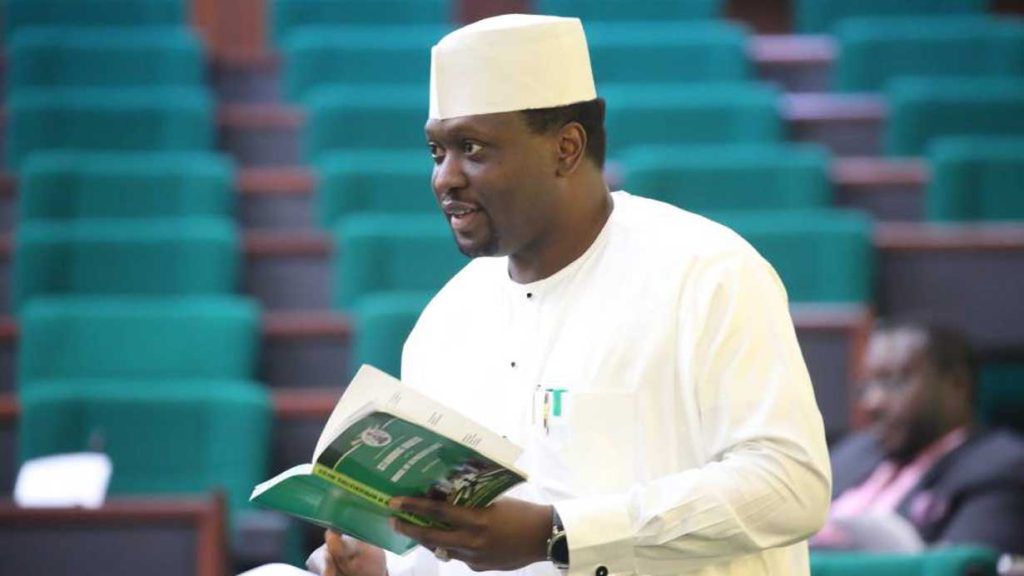

What brought this issue to public attention was an alarm raised by Abdulsammad Dasuki, a member of the House of Representatives from Sokoto State, during a plenary on December 17, 2025. He called the attention of the House to what he identified as discrepancies between the gazetted version of the tax laws he obtained from the Federal Ministry of Information and what was actually debated, agreed upon, and passed on the floors of both the House and the Senate.

He requested that the Speaker ensure all relevant documents, including the harmonised versions, the votes and proceedings of both chambers, and the gazetted copies, are brought before the Committee of the Whole for careful scrutiny. The lawmaker expressed concern over what he described as a serious breach of his legislative privilege.

Beyond that, however, my concern is about how safe and protected Nigerians’ interests are in the hands of our lawmakers at the National Assembly. This ongoing discussion raises a critical question about representation in Nigeria. Does this mean that if Dasuki had also been indifferent and had not bothered to utilise the Freedom of Information Act 2011 to obtain the gazetted version of the laws from the Federal Ministry of Information, take time to study it, and make comparisons, there would have been no cause for alarm from any of Nigeria’s 360 House of Representatives members and 109 senators? Do lawmakers discard the confidence we reposed in them immediately after election results are declared?

This debate should indeed serve a latent function of waking us up to the reality of the glaring disconnect between public interest and the interests of our representatives. The legislature in a democratic setting is a critical institution that goes beyond routine plenaries that are often uninteresting and sparsely attended by the lawmakers. It is meant to be a space for scrutiny, deliberation, and the protection of public interest, especially when complex laws with wide social consequences are involved.

We saw Ali Ndume in a short video clip that recently swept the media, furiously saying during a verbal altercation with Adams Oshiomhole over ambassadorial screening that “the Senate is not a joke.” The Senate is, of course, not a joke, and either should the entire National Assembly be.

Ideally, it should not be a joke to us or to the legislators themselves. Therefore, we should not shy away from discussing how disinterested those entrusted with the task of representing us, and primarily protecting our interests, appear to be in our collective affairs.

It is not a coincidence that even before the current debate around the tax reform law, it had continued to generate controversy since its inception. It also does not take quantum mechanics to understand that something is fundamentally wrong when almost nobody truly understands the law. Thanks to social media, I have come across numerous skits, write-ups, and commentaries attempting to explain it, but often followed by opposing responses saying that the authors either did not understand the law themselves or did not take sufficient time to study it.

The controversy around the gazetted Tax Reform Laws should not end with public outrage or media debates alone. It should force a deeper reflection on how laws are made, checked, and defended in Nigeria’s democracy. A system that relies on the alertness of one lawmaker to prevent serious legislative discrepancies is not a resilient or reliable system. Representation cannot be occasional and vigilance cannot be optional.

Nigerians deserve a legislature that safeguards their interests, not one that notices breaches only when a few individuals choose to be different and look closely. If this ongoing debate does not lead to formidable internal checks and a renewed sense of responsibility among lawmakers, then the problem is far bigger than a flawed gazette. When legislative processes fail, it is ordinary Nigerians who bear the cost through policies they did not scrutinize and consequences they did not consent to.

Isah Kamisu Madachi is a public policy enthusiast and development practitioner. He writes from Abuja and can be reached via: [email protected]

Feature/OPED

After the Capital Rush: Who Really Wins Nigeria’s Bank Recapitalisation?

By Blaise Udunze

By any standard, Nigeria’s ongoing bank recapitalisation exercise is one of the most consequential financial sector reforms since the 2004-2005 consolidation that shrank the number of banks from 89 to 25. Then, as now, the stated objective was stability to have stronger balance sheets, better shock absorption, and banks capable of financing long-term economic growth.

The Central Bank of Nigeria (CBN), in 2024, mandated a sweeping recapitalisation exercise compelling banks to raise substantially higher capital bases depending on their license categories. The categorisation mandated that every Tier-1 deposit money bank with international authorization is to warehouse N500 billion minimum capital base, and a national bank must have N200 billion, while a regional bank must have N50 billion by the deadline of 31st March 2026. According to the apex bank, the objectives were to strengthen resilience, create a more robust buffer against shocks, and position Nigerian banks as global competitors capable of funding a $1 trillion economy.

But in the thick of the race to comply and as the dust gradually settles, a far bigger conversation has emerged, one that cuts to the heart of how our banking system works. What will the aftermath of recapitalisation mean for Nigeria’s banking landscape, financial inclusion agenda, and real-sector development?

Beyond the headlines of rights issues, private placements, and billionaire founders boosting stakes, every Nigerians deserve a sober assessment of what has changed, and what still must change, if recapitalisation is to translate into a genuinely improved banking system.

The points are who benefits most from its evolution, and whether ordinary Nigerians will feel the promised transformation in their everyday financial lives, because history has taught us that recapitalisation is never a neutral policy. The fact remains that recapitalization creates winners and losers, restructures incentives, and often leads to unintended outcomes that outlive the reform itself.

Concentration Risk: When the Big Get Bigger

Recapitalisation is meant to make banks stronger, and at the same time, it risks making them fewer and bigger, concentrating power and risks in an ever-narrowing circle. Nigeria’s Tier-1 banks, those already controlling roughly 70 percent of banking assets, are poised to expand further in both balance sheet size and market influence. This deepens the divide between the “haves” and “have-nots” within the sector.

A critical fallout of this exercise has been the acceleration of consolidation. Stronger banks with ready access to capital markets, like Access Holdings and Zenith Bank, have managed to meet or exceed the new thresholds early by raising funds through rights issues and public offerings. Access Bank boosted its capital to nearly N595 billion, and Zenith Bank to about N615 billion.

In contrast, banks that lack deep pockets or the ability to quickly mobilise investors are lagging. The results always show that the biggest banks raise capital faster and cheaper, while smaller banks struggle to keep pace.

As of mid-2025, fewer than 14 of Nigeria’s 24 commercial banks met the required capital base, meaning a significant number were still scrambling, turning to rights issues, private placements, mergers, and even licensing downgrades to survive.

The danger here is not merely numerical. It is systemic: as capital becomes more concentrated, the banking system could inadvertently mimic oligopolistic tendencies, reducing competition, narrowing choices for customers, and potentially heightening systemic risk should one of these “too-big-to-fail” institutions falter.

Capital Flight or Strategic Expansion? The Foreign Subsidiary Question

One of the most contentious aspects of the recapitalisation aftermath has been the deployment of newly raised capital, especially its use outside Nigeria. Several banks, flush with liquidity from rights issues and injections, have signalled or executed investments in foreign subsidiaries and expansions abroad, like what we are experiencing with Nigerian banks spreading their tentacles to the Ivory Coast, Ghana, Kenya, and beyond. Zenith Bank’s planned expansion into the Ivory Coast exemplifies this outward push.

While international diversification can be a sound strategic move for multinational banks, there is an uncomfortable optics and developmental question here: why is Nigerian money being deployed abroad when millions of Nigerians remain unbanked or underbanked at home?

According to the World Bank, a large number of Nigeria’s adult population still lack access to formal financial services, while millions of SMEs, micro-entrepreneurs, and rural households remain on the edge, underserved by traditional banks that now chase profitability and scale.

Of a truth, redirecting Nigerian capital to foreign markets may deliver shareholder returns, but it does little in the short term to advance domestic financial inclusion, poverty reduction, or grassroots economic participation. The optics of capital flight, even when legal and strategic, demand scrutiny, especially in a nation still struggling with deep regional and demographic disparities.

Impact on Credit and the Real Economy

For the ordinary Nigerian, the most important question is simple: will recapitalisation make credit cheaper and more accessible?

History suggests the answer is not automatic. The tradition in Nigeria’s bank system is mainly to protect returns, and for this reason, many banks respond to higher capital requirements by tightening lending standards, raising interest rates, or focusing on low-risk government securities rather than private-sector loans, because raising capital is expensive, and banks are profit-driven institutions. Small and medium-sized enterprises (SMEs), often described as the engine of growth, are usually the first casualties of such risk aversion.

If recapitalisation results in stronger balance sheets but weaker lending to the real economy, then its benefits remain largely cosmetic. The economy does not grow on capital adequacy ratios alone; it grows when banks take measured risks to finance production, innovation, and consumption.

Retail Banking Retreat: Handing the Mass Market to Fintechs?

In recent years, we have witnessed one of the most striking shifts, or a gradual retreat of traditional banks from mass retail banking, particularly low-income and informal customers.

The question running through the hearts of many is whether Nigerian banks are retreating from retail banking, leaving space for fintech disruptors to fill the void.

In recent years, players like OPAY, Moniepoint, Palmpay, and a host of digital financial services arms have become de facto retail banking platforms for millions of Nigerians. They provide everyday payment services, wallet functionalities, micro-loans, and QR-enabled commerce, areas traditional banks once dominated. This trend has accelerated as banks chase corporate clients where margins are higher and risk profiles perceived as more manageable. The true picture of the financial landscape today is that the fintechs own the retail space, and banks dominate corporate and institutional finance. But it is unclear or uncertain if this model can continue to work effectively in the long term.

Despite the areas in which the Fintechs excel, whether in agility, product innovation, and customer experience, they still rely heavily on underlying banking infrastructure for liquidity, settlement, and regulatory compliance. Should the retail banking ecosystem become split between digital wallets and corporate corridors, rather than being vertically integrated within banks, systemic liquidity dynamics and financial stability could be affected.

Nigerians deserve a banking system where the comforts and conveniences of digital finance are backed by the stability, regulatory oversight, and capital strength of licensed banks, not a system where traditional banks withdraw from retail, leaving unregulated or lightly regulated players to carry that mantle.

Corporate Governance: When Founders Tighten Their Grip

The recapitalisation exercise has not been merely a technical capital-raising exercise; it has become a theatre of power plays at the top. In several banks, founders and major investors have used the exercise to increase their stakes, concentrating ownership even as they extol the virtues of financial resilience.

Prominent founders, from Tony Elumelu at UBA to Femi Otedola at First Holdco and Jim Ovia at Zenith Bank, have all been actively increasing their shareholdings. These moves raise legitimate questions about corporate governance when founders increase control during a regulatory exercise. Are they driven by confidence in their institutions, or are they fortifying personal and strategic influence amid industry restructuring?

Though there might be nothing inherently wrong with founders or shareholders demonstrating faith in their institutions, one fact remains that the governance challenge lies not simply in who holds the shares, but how decisions are made and whose interests are prioritised. Will banks maintain robust internal checks and balances, ensuring that capital deployment aligns with national development goals? The question is whether the CBN is equipped with adequate supervisory bandwidth and tools to check potential excesses if emerging shareholder concentrations translate into undue influence or risks to financial stability. These are questions that transcend annual reports; they strike at the heart of trust in the system.

Regional Disparity in Lending: Lagos Is Not Nigeria

One of the persistent criticisms of Nigerian banking is regional lending inequality. It has been said that most bank loans are still overwhelmingly concentrated in Lagos and the Southwest, despite decades of financial deepening in this region; large swathes of the North, Southeast, and other underserved regions receive disproportionately smaller shares of credit. This imbalance not only undermines inclusive growth but also fuels perceptions of economic exclusion.

Recapitalisation, in theory, should have enhanced banks’ capacity to support broader economic activity. Yet, the reality remains that loans and advances are overwhelmingly concentrated in economic hubs like Lagos.

The CBN must deploy clear incentives and penalties to encourage geographic diversification of lending. This could include differentiated capital requirements, credit guarantees, or tax incentives tied to regional loan portfolios. A recapitalised banking system that does not finance national development is a missed opportunity.

Cybersecurity, Staff Welfare, and the Technology Deficit

Beyond balance sheets and brand expansion, there is a human and technological dimension to the banking sector’s challenge. Fraud remains rampant, and one of the leading frustrations voiced by Nigerians involves failed transactions, delayed reversals, and poor digital experience. Banks can raise capital, but if they fail to invest heavily in cybersecurity, fraud detection, staff training, and welfare, the everyday customer will continue to view the banking system as unreliable.

Nigeria’s fintech revolution has thrived precisely because it has pushed incumbents to become more customer-centric, agile, and tech-savvy. If banks now flush with capital don’t channel a portion of those funds into robust IT systems, workforce development, fraud mitigation, and seamless customer service, then the recapitalisation will have achieved little beyond stronger balance sheets. In short, Nigerians should feel the difference, not merely in stock prices and market capitalisation, but in smooth banking apps, instant reversals, responsive customer care, and secure platforms.

The Banks Left Behind: Mergers, Failures, or Forced Restructuring?

With fewer than half the banks having fully complied with the recapitalisation requirements deep into 2025, a pressing question is: what awaits those that lag? Many banks are still closing capital gaps that run into hundreds of billions of naira. According to industry estimates, the total recapitalisation gap across the sector could reach as much as N4.7 trillion if all requirements are strictly enforced.

Banks that fail to meet the March 2026 deadline face a few options:

– Forced M&A. Regulators could effectively compel weaker banks to merge with stronger ones, echoing the consolidation wave of 2005 that reduced the sector from 89 to 25 banks.

– License downgrades or conversions. Some banks may choose to operate at a lower license category that demands a smaller capital base.

– Exits or closures. In extreme cases, banks that can neither raise capital nor find a merger partner might be forced out of the market.

This regulatory pressure should not be construed merely as punitive. It is part of the CBN’s broader architecture of ensuring that only solvent, well-capitalised, and risk-prepared institutions operate. However, the transition must be managed carefully to prevent contagion, protect depositors, and preserve confidence.

Why Are Tier-1 Banks Still Chasing Capital?

Perhaps the most intriguing puzzle is why some Tier-1 banks, long regarded as strong and profitable, are aggressively raising capital. Even banks thought to be among the strongest, such as UBA, First Holdco, Fidelity, GTCO, and FCMB, have struggled to close their capital gaps. UBA, for instance, succeeded in raising around N355 billion toward its N500 billion target at one point and planned additional rights issues to bridge the remainder.

This reveals another reality that capital is not just numbers on paper; it is investor confidence, market appetite, and macroeconomic stability.

One can also say that the answer lies partly in ambition to expand into new markets, infrastructure financing, and compliance with stricter global standards.

However, it also reflects deeper structural pressures, including currency depreciation eroding capital, rising non-performing loans, and the substantial funding required to support Nigeria’s development needs. Even giants are discovering that yesterday’s capital is no longer sufficient for tomorrow’s challenges.

Reform Without Deception

As the Nigerian banking sector recapitalization exercise comes to a close by March 31, 2026, the ultimate test will be whether the reforms deliver on their transformational promise.

Some of the concerns in the minds of Nigerians today will be to see a system that supports inclusive growth, equitable credit distribution, world-class customer service, and resilient financial intermediation. Or will we see a sector that, despite larger capital bases, still reflects old hierarchies, geographic biases, and operational friction? The cynic might say that recapitalisation simply made big banks bigger and empowered dominant shareholders.

But a more hopeful perspective invites stakeholders, including regulators, customers, civil society, and bankers themselves, to co-design the next chapter of Nigerian banking; one that balances scale with inclusion, profitability with impact, and stability with innovation. The difference will be made not by press releases or shareholder announcements, but by deliberate regulatory action and measurable improvements in how banks serve the economy.

For now, the capital has been raised, but the true capital that counts is the confidence Nigerians place in their banks every time they log into an app, make a transfer, or deposit their life’s savings. Only when that trust is visible in everyday experience can we say that recapitalisation has truly succeeded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

Feature/OPED

Ledig at One: The Year We Turned Stablecoins Into Real Liquidity for the Real World

Ledig, one of Africa’s leading fintech infrastructure companies, marked its first anniversary this year. The company used the anniversary to reflect on how it has approached one of the most persistent problems in cross-border finance: moving large sums of money into and out of emerging markets without the uncertainty, delays, or volatility present in emerging markets.

According to the company, many businesses operating across Africa and similar markets had long dealt with unreliable settlement timelines, opaque processes, and a lack of credible hedging options. Transactions often depended on manual coordination and informal assurances, leaving companies exposed to both operational risk and volatile exchange rates.

Ledig said this reality shaped its decision to enter the market with a focus on scale, speed, and predictability rather than small retail transfers.

The company explained that its infrastructure was designed from the outset to handle high-value flows, ranging from hundreds of thousands of dollars to several million, with settlement measured in seconds rather than days. It built an instant liquidity engine, demonstrating a two-way system that allows businesses to convert stablecoins to local currencies and local currencies back to stablecoins with equal efficiency, demonstrating that corporate cash flows frequently move in both directions, sometimes within the same week.

Ledig noted that early users typically began with smaller test transactions before increasing volumes once they saw payments settle quickly and reliably. That pattern, it said, contributed to the platform crossing $100 million in processed volume within its first year, driven largely by international companies operating across Africa and other emerging markets.

Much of the underlying complexity associated with stablecoin payments, the company added, remains intentionally hidden from users. Wallet management, local settlement rails, and an adaptive foreign exchange engine operate in the background, while clients interact through a simple dashboard or API. Ledig emphasised that users do not need to engage directly with crypto mechanics, as stablecoins function as an internal settlement layer rather than a product they must actively manage.

Beyond settlement speed, Ledig identified currency volatility as a major challenge facing businesses in emerging markets. To address this, the firm introduced a derivatives hedging protocol designed to help businesses lock in value earlier and reduce exposure to adverse exchange rate movements.

The company reported that this hedging product initially operated off-chain and still facilitated over $55 million in activity. It is now transitioning the protocol fully on-chain, with Base selected as the deployment network due to its compatibility with the stablecoins used in Ledig’s settlement flows. Ledig said the move is intended to provide greater transparency and a cleaner execution environment tailored to commercial hedging needs rather than speculative trading.

Ledig also pointed out that its relatively small team has been an advantage rather than a limitation. By avoiding excessive expansion early on, the company said it was able to focus on building modular components that work independently but integrate into a broader treasury and risk management system. These components cover stablecoin-to-fiat conversion, fiat-to-stablecoin flows, foreign exchange management, treasury support, and hedging, allowing businesses to assemble a unified setup for money movement and risk control.

While the company does not publicly disclose detailed revenue figures, it stated that its strongest indicator of growth has been repeat, high-volume usage. Ledig said clients continue to route core operational payments through its platform, including payroll, supplier settlements, and expansion-related transfers, particularly in markets where delays can disrupt entire business operations.

Looking ahead to 2026, Ledig said its priorities include scaling the on-chain deployment of its derivatives hedging protocol, expanding liquidity capacity to support even larger transactions, and strengthening its licensing and regulatory framework to accommodate more institutional partners. The company added that it remains focused on reducing friction for businesses entering or operating in emerging markets.

In closing, Ledig described its first year as an early step rather than a milestone. It reiterated that its objective remains centered on enabling fast, large-value money movement and protecting businesses from currency volatility through a proven hedging framework, while keeping the underlying technology largely invisible to users.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn