General

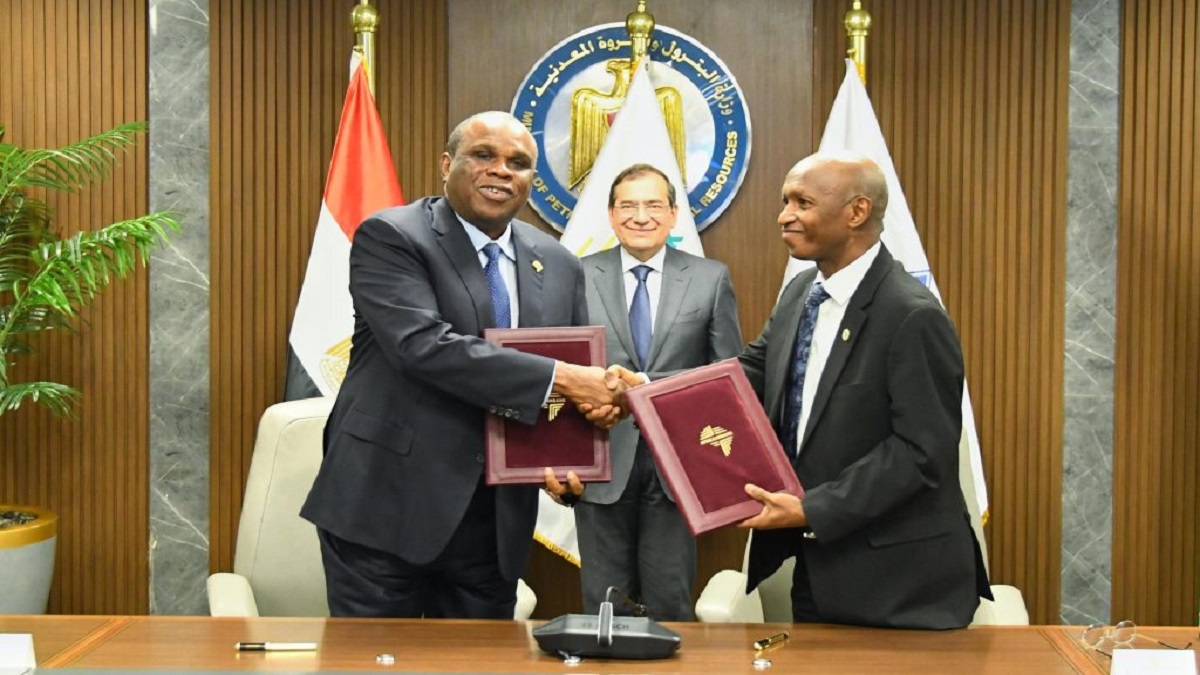

Nigeria, Angola, Ghana Fulfil Capital Commitments to Africa Energy Bank

By Modupe Gbadeyanka

The trio of Nigeria, Angola, and Ghana has fulfilled their capital commitments toward establishing the Africa Energy Bank (AEB) in what is seen as a significant development for Africa’s energy sector.

The AEB aims to finance oil and gas projects across the continent, addressing funding challenges posed by traditional Western financial institutions’ reluctance to support fossil fuel initiatives due to environmental concerns.

Recall that the African Petroleum Producers Organization (APPO) requires that to operate the financial institution, members must get 44 per cent of the capital base of $5 billion.

Each of the 18 members of the group is required to provide at least $83 million and beyond Nigeria, Angola and Ghana, five additional member states – Algeria, Benin, the Republic of Congo, Equatorial Guinea and Ivory Coast – have pledged to make their payments, aligning with the bank’s goal to commence operations in the first half of 2025.

The AEB aims to finance oil and gas projects across the continent, addressing funding challenges posed by traditional Western financial institutions’ reluctance to support fossil fuel initiatives due to environmental concerns.

At the Congo Energy and Investment Forum last week, the Secretary General of APPO, Mr Omar Farouk Ibrahim, said the move to kick-off the bank, which is headquartered in Abuja, Nigeria, is progressing.

AEB is a strategic response to Africa’s need for dedicated financial institutions that understand the continent’s unique energy landscape.

By providing tailored financing solutions, the bank is poised to accelerate energy project development, enhance energy security and drive economic growth.

As more countries contribute their capital shares, the bank is expected to play a pivotal role in unlocking investment, bridging financing gaps and ensuring sustainable energy expansion across Africa.

Nigeria remains sub-Saharan Africa’s largest oil producer, offering significant opportunities in the oil and gas sector, including a 2025 bid round.

The implementation of the Petroleum Industry Act has introduced regulatory reforms to enhance transparency and attract investment, driving major projects forward.

Recent final investment decisions (FIDs) include TotalEnergies’ $550 million Ubeta Gas Field Development and Shell’s $5 billion Bonga North Project, yet additional financing is crucial to advancing Nigeria’s gas agenda and unlocking its full potential in the energy transition.

Angola, on its part, is actively diversifying its energy portfolio while advancing major deepwater developments, including TotalEnergies’ $6 billion Kaminho Deepwater Project, Eni’s Agogo Integrated West Hub and a limited public tender, with a long-term goal of increasing production to 2 million barrels per day.

Ghana is strengthening its position as a leading oil and gas player with new commitments from Eni and Tullow Oil. In March, Eni and the Ghana National Petroleum Corporation signed an agreement to enhance offshore exploration, optimize existing assets and advance untapped reserves.

General

NIMASA Mulls Expansion of Nigeria’s Deep Blue Project

By Adedapo Adesanya

The Nigerian Maritime Administration and Safety Agency (NIMASA) is considering expanding the country’s Deep Blue Project due to its perceived success, with impact felt across the Gulf of Guinea, where it has helped to reduce piracy massively and gained global recognition, to ensure sustainability and greater impact.

The Director General of NIMASA, Mr Dayo Mobereola, made this known during his strategic visit to the Chief of Naval Staff, Vice Admiral Idi Abass, at the Naval Headquarters, Abuja.

Mr Mobereola, while commending the Navy for the harmonious collaboration with NIMASA and congratulating the CNS who had previously served as Maritime Guard Commander under the agency, called for continued partnership with the security outfit under his watch.

“It is important that we continue our partnership and strengthen our relationship. Our purpose here is to congratulate you and to discuss the benefits of the Deep Blue Project, how to sustain it, expand it, and increase its impact on the Gulf of Guinea.

“We are confident that we have the backing of the President, the Minister of Marine and Blue Economy, and the Nigerian Navy, hence, we are working towards presenting our proposal on the necessary improvements to be undertaken,” he stated.

The DG acknowledged the importance of the Deep Blue Project, noting that its impact resonates globally, with the International Maritime Organisation (IMO) commending it.

“The Deep Blue Project is vital, and countries around Africa and some other parts of the world are coming to copy our model. The IMO is asking how a civilian organisation was able to achieve this feat. It is therefore important that we continue to collaborate and do even better for greater sustainability,” he said.

Mr Mobereola also congratulated the Chief of Operations, Nigerian Navy, Rear Admiral Musa Katagum, who is joining the NIMASA governing board as the Navy’s representative.

On his part, the Chief of Naval Staff, Vice Admiral Idi Abass, while welcoming the NIMASA DG and his delegation, commended the Agency for the good work it is doing in the maritime sector and its continued support to the Nigerian Navy.

“Part of my command’s objective is to work in synergy with other agencies to achieve our goal as a country. We complement each other. We have no option but to collaborate and synergise.”

The Naval chief noted some concerns, which include the MoU between NIMASA and the Nigerian Navy, which has been in place since 2007 and should be revisited.

He also solicited for the Navy to be called upon for such needs as vessel repair, hydrographic surveys and chartings, stating the Navy’s capacity in handling such tasks.

The CNS also canvassed NIMASA’s assistance for wreck removal, particularly as the Navy gears towards its 70th Anniversary, where it looks forward to welcoming foreign ships.

He further commended NIMASA for its recent launch of the Cabotage Vessel Financing Fund (CVFF) Application Portal, noting that the organisation has come a long way in its planned disbursement of the fund.

General

Ikeja Electric Fumes Over Impropriety Allegations Against CEO, Chairman

By Adedapo Adesanya

Ikeja Electricity Distribution Company has described as malicious and misleading a widespread publication currently circulating online alleging impropriety about its chief executive, Ms Folake Soetan, and its board chairman, Mr Kola Adesina.

The management of the DisCo noted that a publication attributed to ‘Nigerian Global Business Forum’ defamed its CEO and the chairman of the IKEDC board.

The company said, “The publication, attributed to yet to be verified individuals and organisation, is clearly intended to misinform the public and bring the company and its leadership into disrepute through fabricated claims, the DisCo observed.”

Ikeja Electric noted that its investigation so far revealed that the ‘Nigerian Global Business Forum’ is an unregistered organisation with no recognised legal or corporate existence locally or abroad.

According to the energy firm, the signatories, “Dr Alaba Kalejaiye” and “Musa Ahmed,” have no verifiable professional credentials or established public profiles, and the publication contains false and misleading statements regarding Ikeja Electric’s operations, safety record, and financial practices.

The organisation said it had instructed its legal advisers to conduct a thorough forensic investigation and to initiate defamation proceedings against the authors, publishers, and any persons or entities found responsible for sponsoring or disseminating this malicious publication.

Ikeja Electric said it operates within a strict framework of accountability and remains committed to transparency and service improvement, warning it will not tolerate coordinated disinformation campaigns aimed at undermining public confidence and tarnishing its corporate integrity.

“Ikeja Electric remains steadfast in its mandate to deliver reliable power while upholding the highest standards of corporate governance and customer excellence.

Members of the public are advised to disregard the false publication in its entirety,” it said in a statement.

General

PMS May Sell N1,000 Per Litre if Marketers Adopt Costly Coastal Loading

By Aduragbemi Omiyale

Nigerians may be forced to purchase premium motor spirit (PMS), commonly known as petrol, for almost N1,000 per litre if marketers choose to go for the costly coastal evacuation and not the cheaper gantry loading, the Dangote Petroleum Refinery has cautioned.

Though the company clarified that marketers were free to choose their preferred mode of evacuation, it emphasised that the implication of adopting the coastal loading was that consumers would pay more for the product because of the extra costs.

According to Dangote Refinery, “Coastal logistics can add approximately N75 per litre to the cost of petrol, which, if passed on to consumers, would push the pump price of PMS close to N1,000 per litre.”

The firm noted that its “world-class gantry facility” has 91 loading bays capable of loading up to 2,900 tankers daily.

Operating on a 24-hour basis, the facility can evacuate over 50 million litres of Premium Motor Spirit PMS, 14 million litres of Automotive Gas Oil (diesel) and other refined products each day, it added, urging marketers and policymakers to prioritise logistics choices that support price stability and consumer welfare.

It stressed that direct gantry evacuation eliminates port charges, maritime levies and vessel-related costs that do not add value to end users, helping to optimise costs, improve distribution efficiency and support price stability.

“Reliance on coastal delivery, particularly within Lagos, may introduce avoidable costs with material implications for fuel pricing, consumer welfare and overall economic wellbeing,” the company stated in a statement.

Based on Nigeria’s average daily consumption of about 50 million litres of PMS and 14 million litres of diesel, the refinery estimated that sustained dependence on coastal logistics could impose an additional annual cost of roughly N1.752 trillion. This cost, it said, would ultimately be borne either by producers or Nigerian consumers.

The refinery also renewed calls for coordinated investment in pipeline infrastructure nationwide, arguing that functional pipelines linking refineries to depots would significantly cut distribution costs, improve supply reliability and strengthen national energy security.

It said domestic refining has already delivered measurable benefits to the Nigerian economy. Since the commencement of operations, the price of diesel has fallen from about N1,700 per litre to N1,100 and currently trades between N980 and N990. Similarly, PMS prices have declined from about N1,250 per litre to between N839 and N900.

It added that increased local supply has sharply reduced fuel importation, eased foreign exchange pressures and improved market stability, contributing to a stronger naira, which recently traded at about N1,385 to the dollar.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn