Banking

Access Bank Carpets ICPC Over Arraignment Story

By Dipo Olowookere

The management of Access Bank Plc has rubbished reports in some sections of the media that the bank and its official were recently charged to court by the Independent Corruption Practices and Other Related Offences Commission (ICPC).

The lender and its officials were reported to have been dragged to court over their alleged refusal to lift a Post-No-Debit (PND) order on the accounts belonging to Blaid Properties Limited and Blaid Construction Limited.

Reacting to the issue via a statement, Access Bank said the report, which it claimed contained misleading information, was mainly “calculated to embarrass the bank, its executives and stakeholders.”

The financial institution said it was not aware of “any criminal charge filed against it or any of its officers” neither has any of its officers been served with any criminal summons.

“The publications were calculated to harass and intimidate the bank and its officers for no just cause,” the statement noted.

It said, “As a responsible financial institution which conducts its business transparently within the confines of the law, we consider it imperative to state the following facts relating to the matter.

“Contrary to the publication, neither the bank nor any of its officers mentioned in the publication were arraigned by the ICPC as reported.”

Access Bank explained that, “The ICPC had on the January 18, 2017 instructed the bank not to allow any withdrawal from the Accounts which it was investigating at the time. The bank complied with the instruction by restricting the accounts.

“By another letter dated November 6, 2017, the ICPC instructed the bank to lift the PND on the accounts. In compliance with this second directive, the bank took steps to engage the customers to re-activate the accounts which had since gone dormant due to the restrictions earlier placed on them.

“However, by another letter dated November 9, 2017, the Special Presidential Investigation Panel on Recovery of Public Property directed the bank to place PND on the accounts. The Presidential Panel by its letter of November 14, 2017 subsequently, reiterated its earlier directive amongst others and invited officers of the bank to an interview with its instruction on the accounts.

“Again, by a letter dated November 28, 2017, the ICPC ordered the bank to lift the PND on the accounts stating that the order supersedes any order or orders placing PND on the accounts.

“The bank by its letter dated November 29, 2017 notified the ICPC that the PND was at the instance and request of the Presidential Panel and that there was a pending suit and application filed by the Federal Government of Nigeria, Attorney General of Federation and the Presidential Panel seeking to restrain the bank from releasing any funds from the accounts.

“The bank also notified the ICPC of court to transfer the funds in the accounts to the Registrar of the Federal High Court pending the determination of the suit filed by the Federal Government of Nigeria.

“The bank subsequently received an invitation from the ICPC addressed to its branches and not the Group Managing Director or any of the officers mentioned in the media publications. The bank honoured the invitation and there again reiterated the foregoing facts.

“Notwithstanding the clear facts presented by the bank, the ICPC demanded that the bank provide evidence that the PND had been lifted by Thursday December 7, 2017 failing which its officers would be detained.

“Being a responsible organisation, officers of the bank returned to the ICPC with an advice from the bank’s Solicitors again stating why the bank cannot lift the PND in disregard of the directive of Presidential Panel and the case in court in which the Federal Government and the Attorney General of the Federation in suit No FHC/ABJ/CS1114/2017 were seeking to restrain the bank from releasing funds in the accounts.

“Given what had transpired we were therefore rudely shocked to read the newspaper publications given fact that the bank and its officers have not done anything to warrant being charged for any offence.”

Access Bank said it was “at a loss as to how a government agency setup to fight graft would attempt to criminalize the bank and its officers for complying with the directive of the Presidential Panel to place PND on the accounts which are subject of pending suits.”

“We have stated the above facts to clear any misgivings or mischief calculated to embarrass or intimidate the bank. As a responsible corporate citizen, we remain committed to the ideals of good corporate governance, due process and rule of law,” the lender assured.

Banking

CIBN to Back ACAMB on Professional Development, Industry Advocacy

By Modupe Gbadeyanka

The Chartered Institute of Bankers of Nigeria (CIBN) has promised to support the ambitious plans of the Association of Corporate and Marketing Professionals in Banks (ACAMB).

At a meeting between the leaderships of the two organisations on Tuesday, the president of CIBN, Professor Pius Deji Olanrewaju, said it was impressed with the capability development and the undergraduate mentorship schemes of ACAMB under its leader, Mr Jide Sipe.

The CIBN chief commended the forward-thinking vision of the group, saying it had raised standards across Nigeria’s banking sector.

“ACAMB’s support has given CIBN and the banking sector brand equity,” he said, praising the association’s record in reputation management. recalling ACAMB’s role in addressing crises within the sector, describing the partnership as strategic and beneficial.

He further pledged support for ACAMB’s 30th anniversary in September 2026, its AGM, and other programmes, including fundraising initiatives.

“I want to assure you that everything you have presented today has been clearly noted and will be acted upon.

“We are fully committed to working closely with you so as to translate these discussions and vision into measurable progress. Our shared goal is to strengthen the sector, protect its reputation, and enhance its public image in a meaningful and lasting way.

“This meeting discussed various initiatives and reforms crucial for the future of our industry, including the need for continuous training and adaptation to new programs,” Mr Olanrewaju stated.

Speaking at the meeting, the president of ACAMB described the visit as a crucial first step in his tenure, aimed at contributing significantly to giving flight to his vision and that of ACAMB.

“When we assumed office, one of the first things we agreed on was the need to visit key stakeholders.

“However, before reaching out more broadly, we felt it was important to begin with our primary constituency and core stakeholders. We want them to understand the direction we are taking and to support the work we are doing, so that ACAMB can achieve greater success than it has in the past.

“We couldn’t have properly started our tenure without this very important meeting with the CIBN,” Mr Sipe stated

He introduced the newly constituted ACAMB Exco, which includes the 2nd Vice President, Morolake Phillip-Ladipo; General Secretary, Olugbenga Owootomo; Assistant General Secretary, Ademola Adeshola; Publicity Secretary, Abiodun Coker; and Executive Secretary, Fadekemi Ajakaiye.

Banking

All Set for Second HerFidelity Apprenticeship Programme

By Modupe Gbadeyanka

Registration for the second HerFidelity Apprenticeship Programme (HAP 2.0) organised by Fidelity Bank Plc has commenced.

The Divisional Head of Product Development at Fidelity Bank, Mr Osita Ede, informed newsmen that the initiative was designed to empower women with sustainable entrepreneurship skills.

The lender created the flagship women-empowerment initiative to equip women with practical, income‑generating skills and structured pathways to entrepreneurship.

“HerFidelity Apprenticeship Programme 2.0 reflects our commitment to continuous improvement. Having evaluated feedback from the first edition, we have returned with stronger partnerships and deeper mentorship programmes to ensure that women acquire not just skills, but sustainable economic opportunities,” he said.

“At the heart of the programme is guided, real‑world learning. Participants will undergo intensive apprenticeship training under reputable institutions and industry experts across select fields such as hair styling, shoe making, auto mechatronics, and interior decoration,” Mr Ede added.

He noted that HerFidelity Apprenticeship Programme 2.0 goes beyond skills acquisition by offering participants a wide range of business advisory services. These include business and financial literacy training, mentorship support throughout the apprenticeship journey, access to Fidelity Bank’s women‑focused and SME financial solutions, as well as guidance on business formalisation and growth strategies.

Further emphasising the bank’s vision, Mr Ede said, “By integrating structured mentorship with entrepreneurial development, Fidelity Bank is positioning women not just as trainees, but as future employers, innovators, and economic contributors within their communities. This aligns with our mandate to help individuals grow, businesses thrive, and economies prosper.”

Banking

The Alternative Bank Opens New Branch in Ondo

By Modupe Gbadeyanka

A new branch of The Alternative Bank (AltBank) has been opened in Ondo State as part of the expansion drive of the financial institution.

A statement from the company disclosed that the new branch would support export-oriented agribusinesses through Letters of Credit and commodity-backed trade finance, ensuring that local producers can scale beyond state borders.

For SMEs, the bank is introducing robust payment rails, asset financing for equipment and inventory, and supply chain-backed facilities that strengthen working capital without trapping businesses in interest-based debt cycles.

The Governor of Ondo State, Mr Lucky Aiyedatiwa, represented by his Chief of

Staff, Mr Olusegun Omojuwa, at the commissioning of the branch, underscored the importance of financial institutions in economic development.

“The pivotal role of financial institutions to economic growth and development of any economy cannot be overemphasised. It provides access to capital, supporting small and medium-scale enterprises and encouraging savings.

“Therefore, I have no doubt in my mind that the presence of The Alternative Bank in Ondo State will deepen financial services, create employment opportunities and stimulate economic activities across various sectors,” he said.

In her remarks, the Executive Director for Commercial and Institutional Banking (Lagos and South West) at The Alternative Bank, Mrs Korede Demola-Adeniyi, commended the state government’s leadership and outlined the lender’s long-term vision for Ondo State.

“As Ondo State steps into its next fifty years, and into the future anchored on the sustainable development championed during the recent anniversary celebrations, The Alternative Bank is here to be the financial engine for that vision. We didn’t come to Akure to hang banners. We came to fund work, farms, shops, and factories.”

With Ondo State’s economy anchored largely on agriculture, particularly cocoa production, poultry farming, and other cash crops, alongside a growing SME and trade ecosystem, AltBank is deploying sector-specific financing solutions tailored to these strengths.

For cocoa aggregators, processors and poultry operators, the bank will provide production financing, facility expansion support, machinery lease structures, and structured trade facilities under its joint venture and cost-plus financing models, with transaction cycles of up to 180 days for commodity trades and longer-term structured asset financing for equipment and infrastructure.

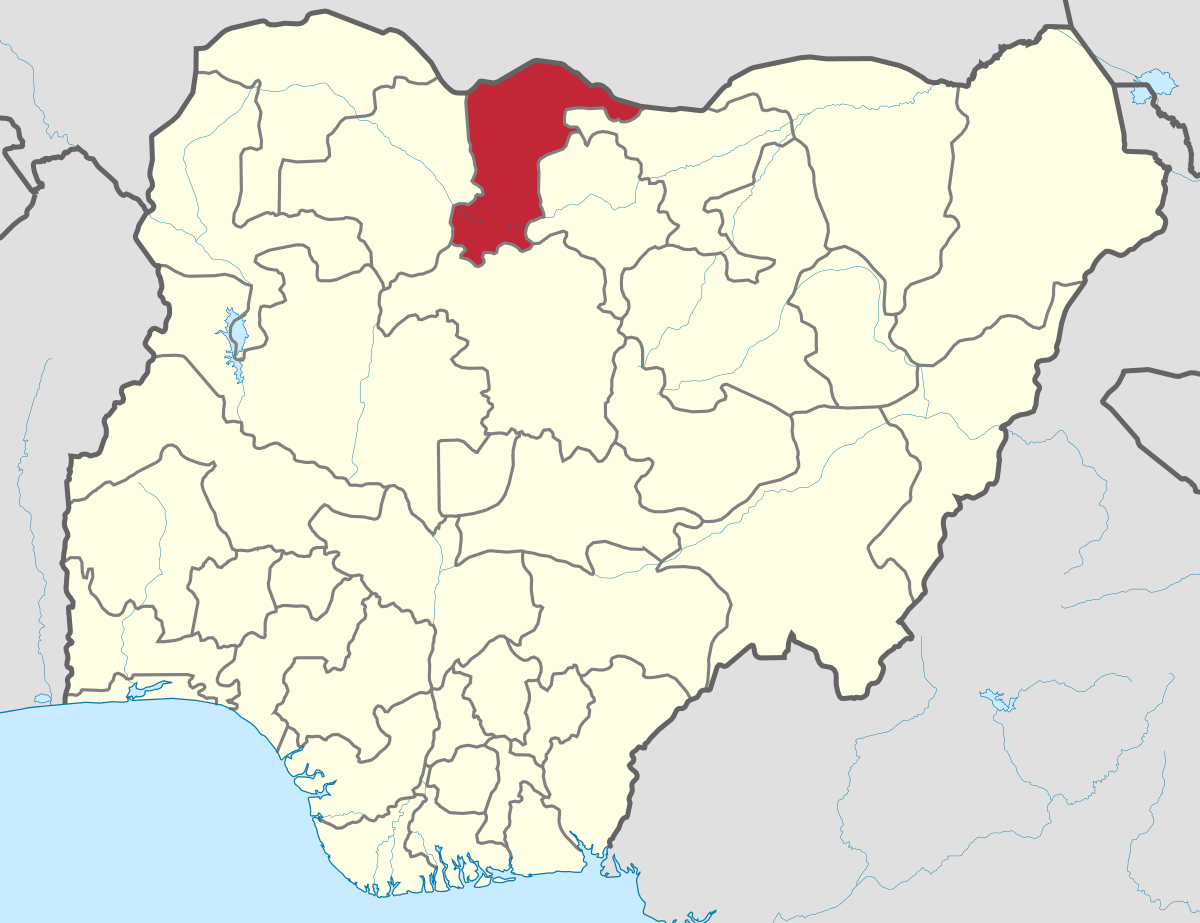

The organisation is a notable national non-interest bank with a physical network now surpassing 170 locations, deploying capital to solve real-world challenges through initiatives such as the Mata Zalla project, which saw to the training of hundreds of women as electric tricycle drivers and mechanics.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn