Economy

Lafarge Africa, Product of Painful Restructuring

By Cordros Research

In June 2014, Lafarge Group announced the combination of its businesses in Nigeria and South Africa to create a leading Sub-Saharan Africa building materials platform.

LafargeHolcim was formed a year after –and became the majority shareholder in LAFARGE – as a result of the successful merger between two global cement giants.

Overall, we saw a transformation of the cement industry at the global level, that could potentially change the dynamics of the Nigerian cement market from one dominated by Dangote Industries Limited (DIL) through Dangote Cement Plc (DANGCEM) – as is currently happening in the brewery industry.

Looking back, WAPCO was actually better-off alone. The 2013 proforma financials show that WAPCO’s standalone EBITDA margin of 37% was a lot bigger than the combined entity’s 27% EBITDA margin. And more instructively, WAPCO’s PBT margin was 28% in 2013 while ASHAKACEM’s and UNICEM’s were 13% and 5% respectively.

Shareholders have been on the losing end since the restructuring. We estimate that the M&A resulted in the dilution of the share of minority shareholders’ stake in the old WAPCO to 22% currently (our estimate), from 40% pre-merger level.

From an earnings perspective, it is instructive noting that since the NGN9.4/s last reported by WAPCO in 2013FY, EPS has been on a consistent slide under LAFARGE to negative NGN6.4 in 2017FY, eroded by high restructuring and financing costs.

The experience has been worse for shareholders when viewed with respect to share price performance.

The causes of LAFARGE’s dwindling earnings are diverse and largely result from the business combination. Operating costs have increased significantly following the M&A at a four-year CAGR of 20%, faster than revenue CAGR of c.10%. From NGN21.5 billion in 2013FY, the total debt reported by LAFARGE increased to NGN287.6 billion in 2017FY, with finance costs increasing accordingly. Besides, earnings have also been beset of efficiency issues in recent years, and revenues have not been supportive.

Desperate measures have been taken under the desperate situation. This includes (1) the diversion of priority from ASHAKACEM’s capacity expansion plan, (2) back and forth moves with the USD shareholder loans, and (3) capital raises resulting in further dilution of minority shareholding.

The Nigerian cement market outlook is not too fantastic in the short to medium term. At -3% average annual rate, the cement market has grown less between 2014-2017 compared to the years preceding, and economic growth is forecast to be much slower. Worse for LAFARGE, DANGCEM has raised the barrier of survival for competitors in the market with the group’s investments of the last decade, and BUA Group is also positioning strategically.

Ultimately, LAFARGE needs to stabilize production across its plants and restore market share back to competitive levels.

We update on LAFARGE following H1-18 result, with HOLD recommendation. The recently announced rights issue is incorporated into our valuation, as we believe it is already being factored in by investors. We also roll forward our estimates and valuation by one year, as we believe investors are already trading on 2019E multiples.

On our DCF-derived TP of NGN27.22, the stock offers 18% potential upside – and expected total return of 25% after incorporating 2018E dividend yield of 6.5%. The stock has lost 21% since the H1-18 result release and rights issue (RI) announcement, not surprisingly faster than the (1) broader market (-11%) and (2) fellow cement companies (DANGCEM: -11%, CCNN: +8%) have dipped.

View the detailed analysis below

Economy

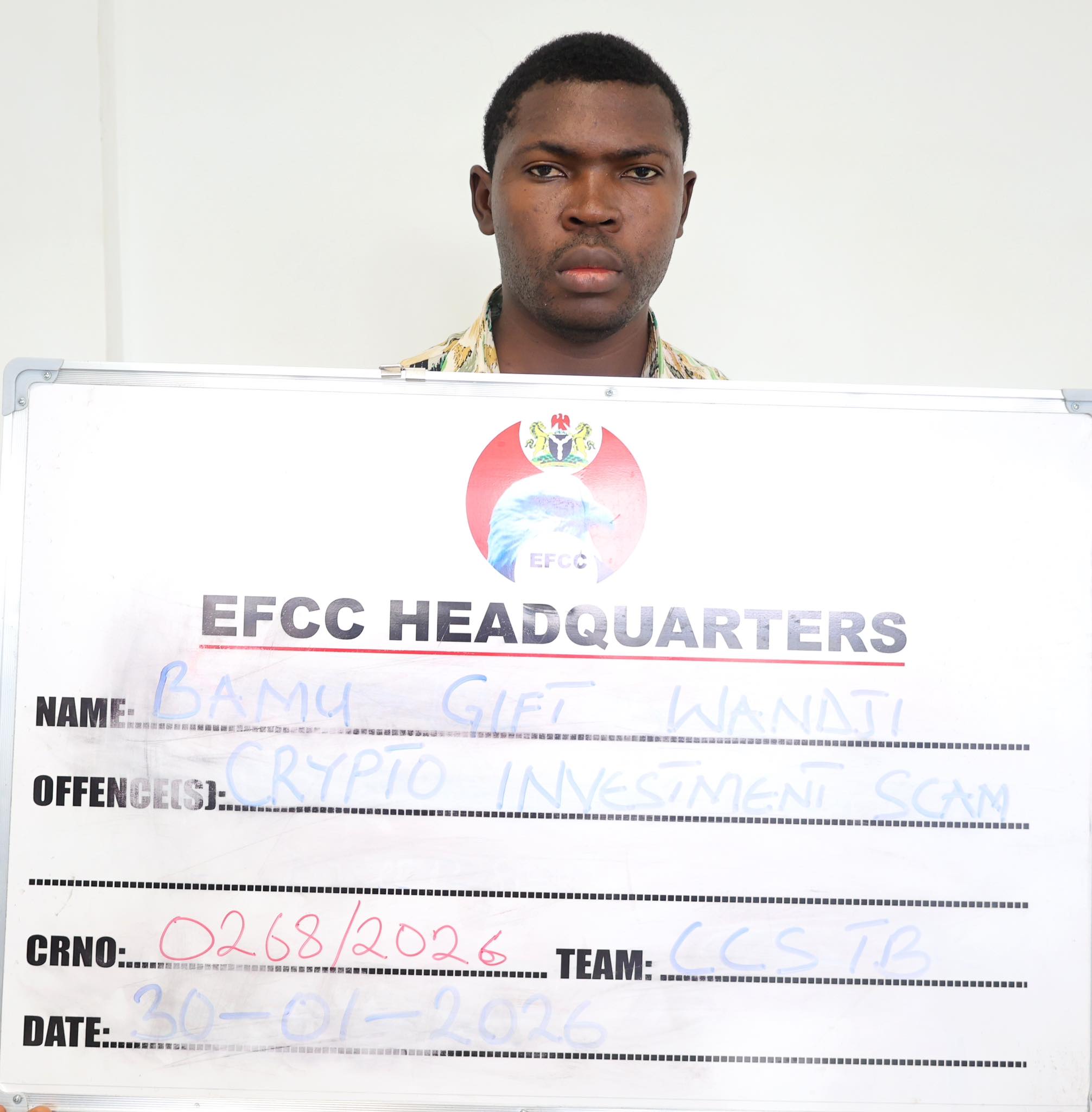

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

Economy

Nigerian Stocks Shed 0.09% on Mild Profit-Taking

By Dipo Olowookere

Profit-takers pounced on the Nigerian Exchange (NGX) Limited on Friday, weakening it by 0.09 per cent at the close of transactions.

Investors toned down on their hunger for Nigerian stocks during the last trading session of the week, with selling pressure mainly on the banking space, which shed 0.78 per cent.

The bourse crumbled despite the other sectors closing green, with the consumer goods up by 0.10 per cent, and the energy index up by 0.02 per cent, while the industrial index closed flat.

Livestock Feeds depreciated by 10.00 per cent to sell for N6.30, Learn Africa declined by 10.00 per cent to N8.10, Living Trust Mortgage Bank also slipped by 10.00 per cent to N4.05, Deap Capital gave up 9.97 per cent to trade at N9.39, and Industrial and Medical Gases lost 9.61 per cent to finish at N31.50.

On the flip side, Zichis appreciated by 9.97 per cent to N4.19, Abbey Mortgage Bank gained 9.94 per cent to quote at N9.40, RT Briscoe jumped by 9.93 per cent to N7.86, Haldane McCall grew by 9.90 per cent to N4.33, and Omatek increased by 9.87 per cent to N3.00.

Business Post reports that the market breadth index was positive despite the poor outcome, recording 33 price gainers and 31 price losers, representing strong investor sentiment.

The All-Share Index was down by 156.91 points during the session to 165,370.40 points from the 165,527.31 points achieved a day earlier, and the market capitalisation depleted by N184 billion to N106.153 trillion from N105.969 trillion.

Trading data showed that 687.4 million equities valued at N15.0 billion exchanged hands in 41,553 deals yesterday compared with the 691.4 million equities worth N15.4 billion traded in 38,665 deals on Thursday, implying a jump in the number of deals by 7.47 per cent, and a slip in the trading volume and value by 2.60 per cent, respectively.

The busiest stock on Friday was Veritas Kapital with 80.5 million units worth N197.0 million, Secure Electronic Technology transacted 79.3 million units valued at N87.5 million, Deap capital transacted 33.3 million units for N340.5 million, Access Holdings sold 31.0 million units valued at N703.0 million, and Zenith Bank exchanged 30.6 million units worth N2.2 billion.

Economy

NASD Exchange Rises 0.20%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange appreciated by 0.20 per cent on Friday, January 30, supported by the gains achieved by two securities on the platform.

During the session, Okitipupa Plc went up by N15.70 to finish at N234.60 per share versus the previous day’s N218.90 per share and Paintcomm Investment Plc expanded by 5 Kobo to close at N11.05 per unit compared with the previous day’s N11.00 per unit.

It was observed that yesterday, there were three price losers led by Geo-Fluids Plc, which dropped 60 Kobo to sell at N5.75 per share versus N6.35 per share, Afriland Properties Plc declined by 35 Kobo to close at N13.65 per unit compared with Thursday’s closing price of N14.00 per unit, and Industrial and General Insurance (IGI) Plc depreciated by 3 Kobo to 66 Kobo per share from 69 Kobo per share.

At the close of business, the NASD Unlisted Security Index (NSI) rose by 7.34 points to 3,630.11 points from 3,622.77 points and the market capitalisation grew by N4.39 billion to N2.171 trillion from N2.167 trillion.

A total of 287,618 units of securities exchanged hands on Friday compared with the previous day’s 1.9 million units of securities, indicating a decline in the volume of trades by 85.6 per cent.

The value of transactions, according to data, was down by 77.2 per cent to N3.1 million from N13.4 million, but the number of deals increased by 31.3 per cent to 21 deals from 16 deals.

Central Securities Clearing System (CSCS) Plc remained the most traded stock by value (year-to-date) with 15.4 million units exchanged for N623.0 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.6 million units traded for N108.5 million, and Geo-Fluids Plc with 9.1 million units valued at N61.1 million.

CSCS Plc also ended the session as the most active stock by volume (year-to-date) with 15.4 million units sold for N623.0 million, followed by Mass Telecom Innovation Plc with 10.1 million units worth N4.1 million, and Geo-Fluids Plc with 9.1 million units valued at N61.1 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn