Economy

How the Nigerian Economy is Reacting to the Global Crisis

The COVID-19 pandemic is still in full swing. Since the early months of 2020, it has been affecting countries on all continents.

Nigeria is no exception, despite the relatively low death toll. Here is how the global crisis has influenced the national economy so far.

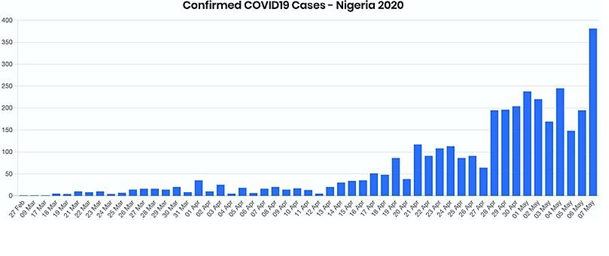

Current Statistics on COVID-19

As of this writing, Nigeria has 4,399 confirmed cases and 143 deaths. This is incomparable to the six-digit figures observed in the US, but the numbers are still growing. Developing countries, in general, have seen relatively few cases, although the danger is still very real.

Declaring of the pandemic sent shock waves across financial markets in early March. However, it is not the only cause of downtrends. In fact, negative dynamics began even before the outbreak. Forecasts of global GDP in 2020 were quite dismal, with only 2.5% growth. The outlook for the emerging markets was especially gloomy.

The Preceding Troubles

Even before the crisis, the local government had a lot to grapple with. The country was still recovering from the oil shock of 2014, and GDP growth was limited — just 2.3% in 2019. The figure was later changed to just 2% by the International Monetary Fund, as a result of oil price collapse and fiscal restrictions.

The debt profile was yet another reason for alarm. According to recent estimates, the debt service-to-revenue ratio stands at 60%. The dismal situation with oil prices is likely to send the figures further down. All these factors should be considered when evaluating the nation’s response to the pandemic.

Key Policy Changes

The Central Bank of Nigeria (CBN) has implemented a fiscal stimulus package. The support scheme provides a credit of 50 billion naira for small and medium-sized businesses, as well as households affected by the crisis. The healthcare industry has been provided with a loan of 100 billion naira. The manufacturing segment has received 1 trillion naira.

Secondly, the institution revised its interest in interventions. The rate has been almost halved, now fixed at 5%. Since March 1, all intervention facilities are put on hold by a one-year moratorium.

Another major issue is the collapse of global demand for crude. Oil is one of the country’s key sources of revenue and foreign exchange. The sharp decline has caused significant damage. Officially, the rate was adjusted from 306 to 360 naira.

Household Consumption: Looming Decrease

Experts predict households to reduce consumption due to several reasons. Spending will be mostly limited to the most essential goods and services. This is inevitable because:

- The population are restricted in movement, either partially or fully;

- Predictions of future income are discouraging, especially for workers in the gig and informal economy;

- The gradual erosion of wealth, but actual and expected, is observed due to downtrends on the stock market and in home equity.

In such desperate times, the population will be looking for alternative sources of income. Online trading, which has recently been embraced by the nation, may see significant growth. For many consumers, it may offer the only source of profit.

FXTM, an international MetaTrader 5 broker, expects more accounts to be opened by residents of Nigeria. The range of instruments includes currency pairs, stocks, CFDs, and other derivatives. Through a licensed broker, these may be traded in Nigeria legally.

Investments by Firms

These are expected to shrink due to the pandemic. It is not yet clear how long it will last, what effect the policies will have, and how economic players will react. The overall turmoil in the finance markets reflects unfavourable market sentiments.

In the realm of stocks, the country has seen a dramatic collapse. The Nigerian Stock Exchange has recorded the deepest fall since 2008. Investors have been hit hard. Given the general uncertainty surrounding the pandemic, and the joyless profit outlook, firms are unlikely to pursue any long-term investment schemes.

Government Expenditure: Projections of Growth

Government spending is predicted to expand as more stimulus packages are released. The measures should compensate for the drop in consumer spending. At the same time, fiscal deficits may soar. This will be exacerbated by the oil prices.

Nigeria is heavily dependent on oil. The commodity accounts for 90% of the country’s exports. The national budget for 2020 was built around predictions of $57 per barrel. However, the price of Brent has been fluctuating around $29 since early April. Since March, the government has already cut its planned expenditure.

A Wake-Up Call?

Overall, Nigeria is bound to experience the dramatic effects of the pandemic and lockdown measures. Despite the government’s efforts to help key industries, its resources are limited. The crash of oil prices is detrimental to the health of the national economy. It remains to be seen whether policymakers can learn from their mistakes and diversify the country’s revenue in the future.

Economy

NGX Market Cap Surpasses N110trn as FY 2025 Earnings Impress Investors

By Dipo Olowookere

Investors at the Nigerian Exchange (NGX) Limited have continued to show excitement for the full-year earnings of companies on the exchange so far.

On Friday, Customs Street further appreciated by 1.01 per cent as more organization released their financial statements for the 2025 fiscal year.

During the session, traders continued their selective trading strategy, with the energy sector going up by 2.47 per cent at the close of business despite profit-taking in the banking counter, which saw its index down by 0.11 per cent.

Yesterday, the insurance space grew by 2.16 per cent, the industrial goods segment expanded by 1.70 per cent, and the consumer goods industry jumped by 0.42 per cent.

Consequently, the All-Share Index (ASI) increased by 1,722.13 points to 171,727.49 points from 170,005.36 points, and the market capitalisation soared by N1.106 trillion to N110.235 trillion from the N109.129 trillion it ended on Thursday.

Business Post reports that there were 59 appreciating stocks and 19 depreciating stocks on Friday, representing a positive market breadth index and strong investor sentiment.

The trio of Omatek, Deap Capital, and NAHCO gained 10.00 per cent each to sell for N2.64, N6.82, and N136.40 apiece, as Zichis and Austin Laz appreciated by 9.98 per cent each to close at N6.72 and N5.40, respectively.

Conversely, The Initiates depreciated by 9.74 per cent to N19.45, DAAR Communications slumped by 7.32 per cent to N1.90, United Capital crashed by 6.55 per cent to N18.55, Coronation Insurance lost 5.71 per cent to quote at N3.30, and First Holdco shrank by 5.53 per cent to N47.00.

The activity chart showed an improvement in the activity level, with the trading volume, value, and number of deals up by 33.77 per cent, 93.27 per cent, and 10.63 per cent, respectively.

This was because traders transacted 953.8 million shares worth N43.1 billion in 51,005 deals compared with the 713.0 million shares valued at N22.3 billion traded in 46,104 deals a day earlier.

Fidelity Bank was the most active with 92.4 million units sold for N1.8 billion, Chams transacted 69.2 million units valued at N310.9 million, Deap Capital exchanged 59.1 million units worth N382.7 million, Access Holdings traded 57.2 million units valued at N1.3 billion, and Tantalizers transacted 48.6 million units worth N228.2 million.

Economy

Naira Retreats to N1,366.19/$1 After 13 Kobo Loss at Official Market

By Adedapo Adesanya

The value of the Naira contracted against the United States Dollar on Friday by 13 Kobo or 0.01 per cent to N1,366.19/$1 in the Nigerian Autonomous Foreign Exchange Market (NAFEX) from the previous day’s value of N1,366.06/$1.

According to data from the Central Bank of Nigeria (CBN), the Nigerian currency also depreciated against the Pound Sterling in the same market window yesterday by N2.37 to N1,857.75/£1 from the N1,855.38/£1 it was traded on Thursday, and further depleted against the Euro by 57 Kobo to close at N1,612.52/€1 versus the preceding session’s N1,611.95/€1.

In the same vein, the exchange rate for international transactions on the GTBank Naira card showed that the Naira lost N8 on the greenback yesterday to N1,383/$1 from the previous day’s N1,375/$1 and at the black market, the Nigerian currency maintained stability against the Dollar at N1,450/$1.

FX analysts anticipate this trend to persist, primarily influenced by increasing external reserves, renewed inflows of foreign portfolio investments, and a reduction in speculative demand.

In the short term, stability in the FX market is expected to continue, supported by policy interventions and improving market confidence.

Nigeria’s foreign reserves experienced an upward trajectory, increasing by $632.38 million within the week to $46.91 billion from $46.27 billion in the previous week.

The Dollar appreciation this week appears to be largely technical, serving as a correction to the substantial losses experienced from mid- to late January.

Meanwhile, the cryptocurrency market slightly appreciated, with Bitcoin (BTC) climbing near $68,000, up nearly 5 per cent since hitting $60,000 late on Thursday after investor confidence in crypto’s utility as a store of value, inflation hedge, and digital currency faltered.

The sell-off extended beyond crypto, with silver plunging 15 per cent and gold sliding more than 2 per cent. US stocks also fell.

The latest recoup saw the price of BTC up by 4.7 per cent to $67,978.96, as Ethereum (ETH) appreciated by 6.3 per cent to $2,021.10, and Ripple (XRP) surged by 9.5 per cent to $1.42.

In addition, Solana (SOL) grew by 7.3 per cent to $85.22, Cardano (ADA) added 6.1 per cent to trade at $0.2683, Dogecoin (DOGE) expanded by 5.4 per cent to $0.0958, Litecoin (LTC) rose by 5.2 per cent to $53.50, and Binance Coin (BNB) jumped by 2.3 per cent to $637.79, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) traded flat at $1.00 each.

Economy

Oil Prices Climb on Worries of Possible Iran-US Conflict

By Adedapo Adesanya

Oil prices settled higher on Friday as traders worried that this week’s talks between the US and Iran had failed to reduce the risk of a military conflict between the two countries.

Brent crude futures traded at $68.05 a barrel after going up by 50 cents or 0.74 per cent, and the US West Texas Intermediate (WTI) crude futures finished at $63.55 a barrel due to the addition of 26 cents or 0.41 per cent.

Iran and the US held negotiations in Muscat, the capital of Oman, on Friday to overcome sharp differences over Iran’s nuclear programme.

It was reported that the talks had ended with Iran’s foreign minister saying negotiators will return to their capitals for consultations and the talks will continue.

Regardless, the meeting kept investors anxious about geopolitical risk, as Iran wanted to stick to nuclear issues while the US wanted to discuss Iran’s ballistic missiles and support for armed groups in the region.

Any escalation of tension between the two nations could disrupt oil flows, since about a fifth of the world’s total consumption passes through the Strait of Hormuz between Oman and Iran.

Saudi Arabia, the United Arab Emirates, Kuwait and Iraq export most of their crude via the strait, as does Iran, which is a member of the Organisation of the Petroleum Exporting Countries (OPEC).

According to Reuters, Iran objected to the presence of any US Central Command (CENTCOM) or other regional military officials, saying that would jeopardise the process.

The current confrontation was sparked by more than two weeks of unrest in Iran that saw authorities launch a deadly crackdown that killed thousands of civilians and shocked the world. As reports of the deaths trickled out of Iran, US President Donald Trump threatened to strike Iran if any of the tens of thousands of protesters arrested were executed.

Meanwhile, Kazakhstan’s planned oil exports could fall by as much as 35 per cent this month via its main route through Russia, as the country’s top oil company, Tengiz oilfield, slowly recovers from fires at power facilities in January.

ING analysts have pointed out Iran’s neighbour, Iraq, and a disagreement with the US as another bullish factor for oil prices. It seems Iraqi politicians favour Mr Nouri al-Maliki as the country’s next Prime Minister, but the US thinks Mr al-Maliki is too close to Iran. President Trump has already threatened the oil producer with consequences if he emerges as PM.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn