Feature/OPED

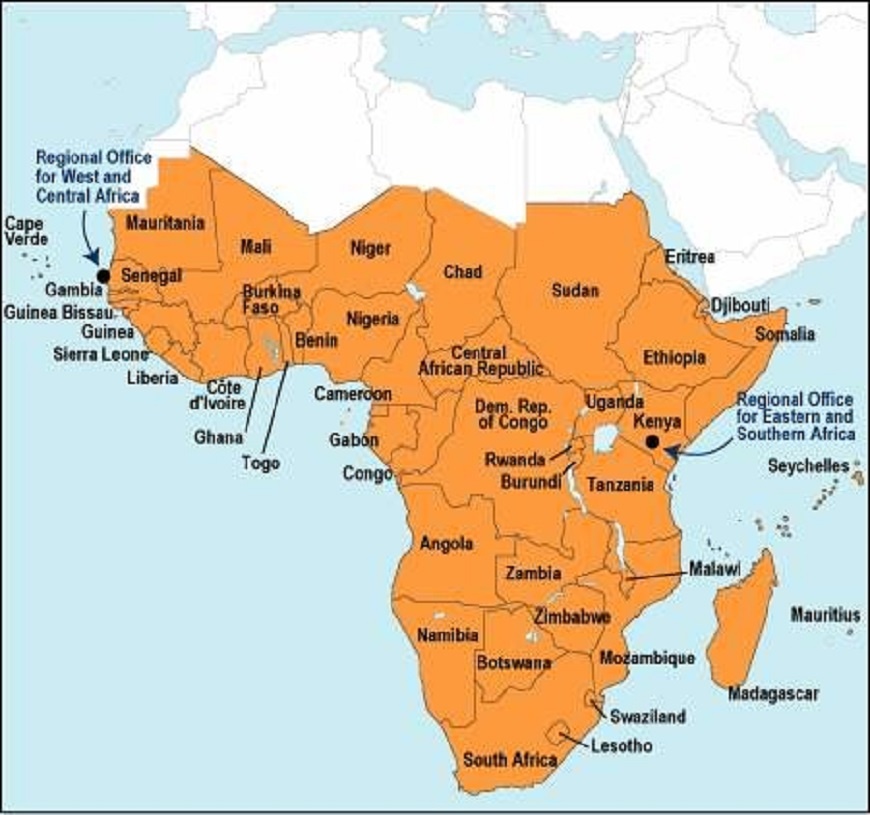

Why Development in Sub-Saharan Africa is Lagging

By Tolu Oyekan

I was born in Nigeria in the early 1980s. Based on forecasts at the time, I should be starting the final decade of my life now.

But my odds have improved quite a bit. Indeed, it is a testament to the advances over these past 40 years in healthcare and standards of living – in the overall quality of life for at least some people – that the average life expectancy for a person born today in sub-Saharan Africa (SSA) has increased by 10 years.

In some countries, like Rwanda, which was beset by a devastating civil war in the 1990s, the life expectancy gains are even more dramatic.

Part of the reasons for the rise in average life expectancy is the fall in early childhood mortality. Death rates among SSA children under five have declined to fewer than 80 per 1000 live births in 2018 from more than double that figure in 1990. This progress is laudable.

But despite these gains, there is much further to go. Even with the advances in life expectancy, sub-Saharan Africa lags behind most of the rest of the world in this regard.

In fact, the life expectancy in Africa’s most populous country, Nigeria, is only 55 years. And perhaps more disconcerting is the region’s alarming poverty rate.

About 40% of sub-Saharan Africa, or over 400 million people, live on less than $1.90 a day, defined as the extreme poverty line. That is more than double the poverty rate in South Asia, another region struggling with widespread destitution.

Moreover, the COVID-19 disease may set the region back even more. Recent separate reports from the World Health Organisation (WHO) and the World Bank estimate that globally, the number of preventable child deaths and poverty rates will regress to previous high levels before the pandemic is over, particularly in countries already struggling the most. We already had a long journey ahead of us and now the distance has been stretched.

Clearly, the emergence of sub-Saharan Africa as an economic success offering a decent quality of life and a better future for its population is at best in its very infantile stages.

In virtually every category of the 17 United Nations Sustainable Development Goals (SDGs) – covering healthcare, hunger, education, jobs, fair wages, economic growth and the environment, among other critical dimensions – sub-Saharan Africa trails well behind the rest of the world.

Perhaps the most problematic issue is that while we have a long distance to travel, we have to get there at a record pace. The UN has set a target of 2030 to reach the SDG’s goals and in effect, eliminate the developmental obstacles to growth and minimum livelihoods that hold back SSA and other countries around the world. For SSA, that is an ambitious deadline.

To just take one example, the ratio of people living in extreme poverty in sub-Saharan Africa dropped from around 50% a decade ago to today’s 40%.

Going from 40 per cent to zero in the next nine years would require a development campaign far exceeding anything tried before in these countries.

Yet, as difficult as that sounds, we can at least make significant progress if we avoid wasted efforts and inefficiencies. We must optimize our development efforts for faster impact. We must optimize for speed.

Over a series of articles, I will explore the critical facets of development activities in the region that must be emphasized and improved upon to achieve quicker and more permanent progress.

Initially, I will focus on three areas that can be addressed immediately and produce results in a relatively short time: We must gather more and better data and utilize it more effectively; we must increasingly adjust the developmental techniques we employ to ensure they sufficiently address local concerns and issues while taking advantage of existing best practices, even from other disciplines; and we must enlarge the tent to bring a wider and more diverse group of people into the design and implementation process.

Looking at these three areas more closely, there are significant gaps between how we view them today and how we should both enhance our understanding of them and improve how we use them to make real developmental gains:

Data: Good data about the SSA region is essential. It would allow us to fully understand current conditions and livelihood challenges, compare ourselves against other regions that are attempting to be innovative in solving the same problems, and measure our progress in granular intervals against goals – including the UN SDGs – so that we can take corrective action quickly was needed to keep ourselves on track. Unfortunately, sub-Saharan Africa is data challenged and has been so for a while. But if we try to build our data aggregation capabilities slowly, following the path that regions with inherently more data have taken, we will not be able to move as fast as we must. Therefore, we must identify and implement pragmatic approaches to dramatically improve our data gathering procedures and methods.

Techniques: In attempting to solve specific development challenges, we often make the mistake of adopting tried and tested technical approaches that perhaps have worked in other places but are insufficiently tailored to the specific needs of the sub-Saharan region. As a result, we forfeit the opportunity to consider methods and strategies that are aligned with unique regional needs. For instance, behavioural techniques can encourage desirable actions by sub-Saharan individuals and groups, which in turn can help in local development. Or digital solutions can leverage software to make a development programme more cost-effective. For instance, advancing the use of telemedicine so physicians from outside SSA can efficiently and inexpensively supplement local medical services. These are just two possibilities and the more we think about innovative techniques well suited to the region, the better we will get at designing and implementing them.

People: Although there appears to be a push to increasingly widen the participation of African people in the campaigns to solve Africa’s problems, I believe that we are still ignoring many potential beneficiaries. In other words, even in our attempts to enlarge the tent, we still fail to address the needs of key stakeholders that are pivotal for the success of SSA development efforts; among them, women, young people, the bottom of the economic pyramid, the private sector and small businesses. Perhaps a more provocative perspective on this is that we must expand the tent of people taking part in designing developmental solutions and overcome our challenges with the help of beneficiaries – rather than trying to provide answers to or for the beneficiaries.

So, how should we approach development in sub-Saharan Africa during this decade? Africans favour the expression, ‘If you want to go quickly, go alone. If you want to go far, go together.’ I would add that we must actually go further than we had thought pre-COVID, and we must also go fast.

Over the coming weeks, I will share my thoughts about some of the things we can do to address the three areas I mentioned that must be immediately analysed, improved upon and tailored for a sub-Saharan solution. I hope we can debate these issues and that collectively, we can produce an exhaustive and workable series of steps to begin a viable developmental journey for SSA.

So, what do you think? Do you agree that we have a long way to go despite the progress? Is there a case for maintaining the status quo and continuing to attempt development across the region as we have before? In addition to Data, Techniques, and People, are there other aspects of development designs that we should be considering and fixing?

In my view, the gap between where we are today and where we must get to by 2030 is far. I look forward to exploring together how we achieve these bold goals quickly.

Tolu Oyekan is a Partner at Boston Consulting Group (BCG)

Feature/OPED

Why the Future of PR Depends on Healthier Client–Agency Partnerships

By Moliehi Molekoa

The start of a new year often brings optimism, new strategies, and renewed ambition. However, for the public relations and reputation management industry, the past year ended not only with optimism but also with hard-earned clarity.

2025 was more than a challenging year. It was a reckoning and a stress test for operating models, procurement practices, and, most importantly, the foundation of client–agency partnerships. For the C-suite, this is not solely an agency issue.

The year revealed a more fundamental challenge: a partnership problem that, if left unaddressed, can easily erode the very reputations, trust, and resilience agencies are hired to protect. What has emerged is not disillusionment, but the need for a clearer understanding of where established ways of working no longer reflect the reality they are meant to support.

The uncomfortable truth we keep avoiding

Public relations agencies are businesses, not cost centres or expandable resources. They are not informal extensions of internal teams, lacking the protection, stability, or benefits those teams receive. They are businesses.

Yet, across markets, agencies are often expected to operate under conditions that would raise immediate concerns in any boardroom:

-

Unclear and constantly shifting scope

-

Short-term contracts paired with long-term expectations

-

Sixty-, ninety-, even 120-day payment terms

-

Procurement-led pricing pressure divorced from delivery realities

-

Pitch processes that consume months of senior talent time, often with no feedback, timelines, or accountability

If these conditions would concern you within your own organisation, they should also concern you regarding the partner responsible for your reputation.

Growth on paper, pressure in practice

On the surface, the industry appears healthy. Global market valuations continue to rise. Demand for reputation management, stakeholder engagement, crisis preparedness, and strategic counsel has never been higher.

However, beneath this top-line growth lies the uncomfortable reality: fewer than half of agencies expect meaningful profit growth, even as workloads increase and expectations rise.

This disconnect is significant. It indicates an industry being asked to deliver more across additional platforms, at greater speed, with deeper insight, and with higher risk exposure, all while absorbing increased commercial uncertainty.

For African agencies in particular, this pressure is intensified by factors such as volatile currencies, rising talent costs, fragile data infrastructure, and procurement models adopted from economies with fundamentally different conditions. This is not a complaint. It is reality.

This pressure is not one-sided. Many clients face constraints ranging from procurement mandates and short-term cost controls to internal capacity gaps, which increasingly shift responsibility outward. But pressure transfer is not the same as partnership, and left unmanaged, it creates long-term risk for both parties.

The pitching problem no one wants to own

Agencies are not anti-competition. Pitches sharpen thinking and drive excellence. What agencies increasingly challenge is how pitching is done.

Across markets, agencies participate in dozens of pitches each year, with success rates well below 20%. Senior leaders frequently invest unpaid hours, often with limited information, tight timelines, and evaluation criteria that prioritise cost over value.

And then, too often, dead silence, no feedback, no communication about delays, and a lack of decency in providing detailed feedback on the decision drivers.

In any other supplier relationship, this would not meet basic governance standards. In a profession built on intellectual capital, it suggests that expertise is undervalued.

This is also where independent pitch consultants become increasingly important and valuable if clients choose this route to help facilitate their pitch process. Their role in the process is not to advocate for agencies but to act as neutral custodians of fairness, realism, and governance. When used well, they help clients align ambition with timelines, scope, and budget, and ensure transparency and feedback that ultimately lead to better decision-making.

“More for less” is not a strategy

A particularly damaging expectation is the belief that agencies can sustainably deliver enterprise-level outcomes on limited budgets, often while dedicating nearly full-time senior resources. This is not efficiency. It is misalignment.

No executive would expect a business unit to thrive while under-resourced, overexposed, and cash-constrained. Yet agencies are often required to operate under these conditions while remaining accountable for outcomes that affect market confidence, stakeholder trust, and brand equity.

Here is a friendly reminder: reputation management is not a commodity. It is risk management.

It is value creation. It also requires investment that matches its significance.

A necessary reset

As leadership teams plan for growth, resilience, and relevance, there is both an opportunity and a responsibility to reset how agency partnerships are structured.

That reset looks like:

-

Contracts that balance flexibility and sustainability

-

Payment terms that reflect mutual dependency

-

Pitch processes that respect time, talent, and transparency for all parties

-

Scopes that align ambition with available budgets

-

Relationships based on professional parity rather than power imbalance

This reset also requires discipline on the agency side – clearer articulation of value, sharper scoping, and greater transparency about how senior expertise is deployed. Partnership is not protectionism; it is mutual accountability.

The Leadership Question That Matters

The question for the C-suite is quite simple:

If your agency mirrored your internal standards of governance, fairness, and accountability, would you still be comfortable with how the relationship is structured?

If the answer is no, then change is not only necessary but also strategic. Because strong brands are built on strong partnerships. Strong partnerships endure only when both sides are recognised, respected, and resourced as businesses in their own right.

The agencies that succeed and the brands that truly thrive will be those that recognise this early and act deliberately.

Moliehi Molekoa is the Managing Director of Magna Carta Reputation Management Consultants and PRISA Board Member

Feature/OPED

Directing the Dual Workforce in the Age of AI Agents

By Linda Saunders

We will be the last generation to work with all-human workforces. This is not a provocative soundbite but a statement of fact, one that signals a fundamental shift in how organisations operate and what leadership now demands. The challenge facing today’s leaders is not simply adopting new technology but architecting an entirely new operating model where humans and autonomous AI agents work in concert.

According to Salesforce 2025 CEO research, 99% of CEOs say they are prepared to integrate digital labor into their business, yet only 51% feel fully prepared to do so. This gap between awareness and readiness reveals the central tension of this moment: we recognise the transformation ahead but lack established frameworks for navigating it. The question is no longer whether AI agents will reshape work, but whether leaders can develop the new capabilities required to direct this dual workforce effectively.

The scale of change is already visible in the data. According to the latest CIO trends, AI implementation has surged 282% year over year, jumping from 11% to 42% of organisations deploying AI at scale. Meanwhile, the IDC estimates that digital labour will generate a global economic impact of $13 trillion by 2030, with their research suggesting that agentic AI tools could enhance productivity by taking on the equivalent of almost 23% of a full-time employee’s weekly workload.

With the majority of CEOs acknowledging that digital labor will transform their company structure entirely, and that implementing agents is critical for competing in today’s economic climate, the reality is that transformation is not coming, it’s already here, and it requires a fundamental change to the way we approach leadership.

The Director of the Dual Workforce

Traditional management models, built on hierarchies of human workers executing tasks under supervision, were designed for a different era. What is needed now might be called the Director of the dual workforce, a leader whose mandate is not to execute every task but to architect and oversee effective collaboration between human teams and autonomous digital labor. This role is governed by five core principles that define how AI agents should be structured, deployed and optimised within organisations.

Structure forms the foundation. Just as organisational charts define human roles and reporting lines, leaders must design clear frameworks for AI agents, defining their scope, establishing mandates and setting boundaries for their operation. This is particularly challenging given that the average enterprise uses 897 applications, only 29% of which are connected. Leaders must create coherent structures within fragmented technology landscapes as a strong data foundation is the most critical factor for successful AI implementation. Without proper structure, agents risk operating in silos or creating new inefficiencies rather than resolving existing ones.

Oversight translates structure into accountability. Leaders must establish clear performance metrics and conduct regular reviews of their digital workforce, applying the same rigour they bring to managing human teams. This becomes essential as organisations scale beyond pilot projects and we’ve seen a significant increase in companies moving from pilot to production, indicating that the shift from experimentation to operational deployment is accelerating. It’s also clear that structured approaches to agent deployment can deliver return on investment substantially faster than do-it-yourself methods whilst reducing costs, but only when proper oversight mechanisms are in place.

To ensure agents learn from trusted data and behave as intended before deployment, training and testing is required. Leaders bear responsibility for curating the knowledge base agents access and rigorously testing their behaviour before release. This addresses a critical challenge: leaders believe their most valuable insights are trapped in roughly 19% of company data that remains siloed. The quality of training directly impacts performance and properly trained agents can achieve 75% higher accuracy than those deployed without rigorous preparation.

Additionally, strategy determines where and how to deploy agent resources for competitive advantage. This requires identifying high-value, repetitive or complex processes where AI augmentation drives meaningful impact. Early adoption patterns reveal clear trends: according to the Salesforce Agentic Enterprise Index tracking the first half of 2025, organisations saw a 119% increase in agents created, with top use cases spanning sales, service and internal business operations. The same research shows employees are engaging with AI agents 65% more frequently, and conversations are running 35% longer, suggesting that strategic deployment is finding genuine utility rather than novelty value.

The critical role of observability

The fifth principle, to observe and track, has emerged as perhaps the most critical enabler for scaling AI deployments safely. This requires real-time visibility into agent behaviour and performance, creating transparency that builds trust and enables rapid optimisation.

Given the surge in AI implementation, leaders need unified views of their AI operations to scale securely. Success hinges on seamless integration into core systems rather than isolated projects, and agentic AI demands new skills, with the top three in demand being leadership, storytelling and change management. The ability to observe and track agent performance is what makes this integration possible, allowing leaders to identify issues quickly, demonstrate accountability and make informed decisions about scaling.

The shift towards dual workforce management is already reshaping executive priorities and relationships. CIOs now partner more closely with CEOs than any other C-suite peer, reflecting their changing and central role in technology-driven strategy. Meanwhile, recent CHRO research found that 80% of Chief Human Resources Officers believe that within five years, most workforces will combine humans and AI agents, with expected productivity gains of 30% and labour cost reductions of 19%. The financial perspective has also clearly shifted dramatically, with CFOs moving away from cautious experimentation toward actively integrating AI agents into how they assess value, measure return on investment, and define broader business outcomes.

Leading the transition

The current generation of leaders are the crucial architects who must design and lead this transition. The role of director of the dual workforce is not aspirational but necessary, grounded in principles that govern effective agent deployment. Success requires moving beyond viewing AI as a technical initiative to understanding it as an organisational transformation that touches every aspect of operations, from workflow design to performance management to strategic planning.

This transformation also demands new capabilities from leaders themselves. The skills that defined effective management in all-human workforces remain important but are no longer sufficient. Leaders must develop fluency in understanding agent capabilities and limitations, learn to design workflows that optimally divide labor between humans and machines, and cultivate the ability to measure and optimise performance across both types of workers. They must also navigate the human dimensions of this transition, helping employees understand how their roles evolve, ensuring that the benefits of productivity gains are distributed fairly, and maintaining organisational cultures that value human judgement and creativity even as routine tasks migrate to digital labor.

The responsibility to direct what comes next, to architect systems where human creativity, judgement and relationship-building combine with the scalability, consistency and analytical power of AI agents, rests with today’s leaders. The organisations that thrive will be those whose directors embrace this mandate, developing the structures, oversight mechanisms, training protocols, strategic frameworks and observability systems that allow dual workforces to deliver on their considerable promise.

Feature/OPED

Energy Transition: Will Nigeria Go Green Only To Go Broke?

By Isah Kamisu Madachi

Nigeria has been preparing for a sustainable future beyond oil for years. At COP26 in the UK, the country announced its commitment to carbon neutrality by 2060. Shortly after the event, the Energy Transition Plan (ETP) was unveiled, the Climate Change Act 2021 was passed and signed into law, and an Energy Transition Office was created for the implementations. These were impressive efforts, and they truly speak highly of the seriousness of the federal government. However, beyond climate change stress, there’s an angle to look at this issue, because in practice, an important question in this conversation that needs to be answered is: how exactly will Nigeria’s economy be when oil finally stops paying the bills?

For decades, oil has been the backbone of public finance in Nigeria. It funds budgets, stabilises foreign exchange, supports states through monthly FAAC allocations, and quietly props up the naira. Even when production falls or prices fluctuate, the optimism has always been that oil will somehow carry Nigeria through the storms. It is even boldly acknowledged in the available policy document of the energy transition plan that global fossil fuel demand will decline. But it does not fully confront what that decline means for a country of roughly 230 million people whose economy is still largely structured around oil dollars.

Energy transition is often discussed from the angle of the emissions issue alone. However, for Nigeria, it is first an economic survival issue. Evidence already confirms that oil now contributes less to GDP than it used to, but it remains central to government revenue and foreign exchange earnings. When oil revenues drop, the effects are felt in budget shortfalls, rising debt, currency pressure, and inflation. Nigerians experienced this reality during periods of oil price crashes, from 2014 to the pandemic shock.

The Energy Transition Plan promises to lift 100 million Nigerians out of poverty, expand energy access, preserve jobs, and lead a fair transition in Africa. These are necessary goals for a future beyond fossil fuels. But this bold ambition alone does not replace revenue. If oil earnings shrink faster than alternative sources grow, the transition risks deepening fiscal stress rather than easing it. Without a clear post-oil revenue strategy tied directly to the transition, Nigeria may end up cleaner with the net-zero goals achieved, but poorer.

Jobs need to be considered, too. The plan recognises that employment in the oil sector will decline over time. What should be taken into consideration is where large-scale employment will come from. Renewable energy, of course, creates jobs, but not automatically, and not at the scale oil-related value chains once supported, unless deliberately designed to do so. Solar panels assembled abroad and imported into Nigeria will hardly replace lost oil jobs. Local manufacturing, large-scale skills development, and industrial policy are what make the difference, yet these remain weak links in Nigeria’s transition conversation.

The same problem is glaringly present in public finance. States that depend heavily on oil-derived allocations are already struggling to pay salaries, though with improvement after fuel subsidy removal. A future with less oil revenue will only worsen this unless states are supported to proactively build formidably productive local economies. Energy transition, if disconnected from economic diversification, could unintentionally widen inequality between regions and states and also exacerbate dependence on internal and external borrowing.

There is also the foreign exchange question. Oil export is still Nigeria’s main source of dollars. As global demand shifts and revenues decline, pressure on the naira will likely intensify unless non-oil exports rise in a dramatically meaningful way. However, Nigeria’s non-oil export base remains very narrow. Agriculture, solid minerals, manufacturing, and services are often mentioned, but rarely aligned with the Energy Transition Plan in a concrete and measurable way.

The core issue here is not about Nigeria wanting to transition, but that it wants to transition without rethinking how the economy earns, spends, and survives. Clean energy will not automatically fix public finance, stabilise the currency, or replace lost oil income and jobs. Those outcomes require deliberate and strategic economic choices that go beyond power generation and meeting emissions targets. Otherwise, the country will be walking into a future where oil is no longer dependable, yet nothing else has been built strongly enough to pay the bills as oil did.

Isah Kamisu Madachi is a policy analyst and development practitioner. He writes from Abuja and can be reached via [email protected]

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn