Economy

Best Time to Trade Forex in Nigeria

If you wonder when it’s best to trade Forex to get the best results and what the best hours to maximize your returns are, this article is for you. Read on to get the answers to these questions and find out the best trading hours.

While it can be a matter of personal preferences when to trade, and you can allocate your time depending on your daily schedule, let’s see when it’s best to enter the market to make higher profits and when it’s best to keep off trading.

Best days to trade Forex

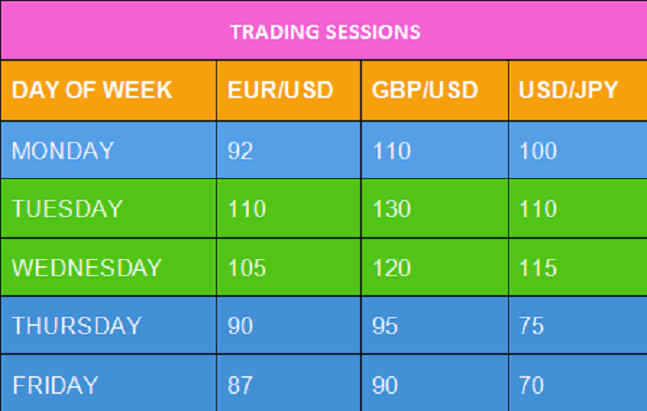

You may have noticed that on some particular days, markets move more actively than on others. Take a look at the table below and check out the average volatility in pips for three major currency pairs (EUR/USD, GBP/USD, USD/JPY) depending on the business day:

As we can see, all three pairs register the highest volatility on Tuesday and Wednesday. With that in mind, we recommend entering the market during periods of high market volatility. This way, you’ll be able to take advantage of more trading opportunities and maximize your profit even if you are using a trading bot.

Trading sessions

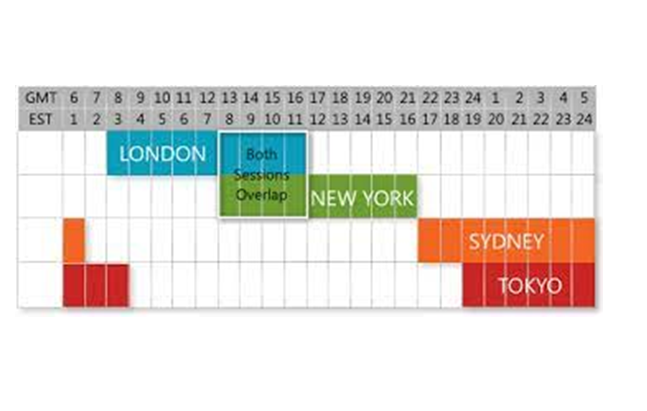

Now that we’ve figured out the best trading days, let’s talk about the most favourable trading time. Trading in the foreign exchange market takes place 24 hours a day five days a week. However, currency pairs can move at a different pace at different times. Although Forex is a decentralized market, a significant amount of money comes from banks, and they stick to a certain schedule.

Forex trading sessions can be divided into four major groups:

- North American (New York)

- Asian (Tokyo)

- European (London)

- Pacific (Sydney)

At the beginning of every session, the currencies are gaining momentum:

During the European session, all pairs containing the euro and the pound sterling demonstrate high volatility, with EUR/USD, EUR/GBP and EUR/CHF showing the largest trading volumes. Very often, the trend can commence in the European trading session and continue into the American session.

In the American session, the pairs containing the US dollar are on the rise: EUR/USD, USD/CHF and USD/JPY. During this time, the Canadian dollar, the USD/CAD pair, comes to life. During the American session, the trend may reverse. Besides, important economic reports are generally released in the evening. Those can trigger volatility spikes in currency pairs that include the US dollar.

In the Asian and Pacific session, the pairs containing the Japanese yen and NZD/USD are especially active. Throughout the night session, the market is tranquil since US and European banks are closed. The volatility is low, so the price often fails to gain momentum and break any key levels. So, the market is usually flat with the price trading within the range. For this reason, most traders prefer not to trade at night.

Best intervals for day trading

9.20 – 9.50 – The beginning of the European session. Trading volume is significant. While this trading interval offers a lot of trading opportunities, it’s highly risky as well. If you are a novice trader, we suggest that you don’t rush into the market at this point. Wait till the volatility settles a bit.

9.40 – 10.10 – Trading volumes are still significant, the quotes are moving fast, liquidity is sufficient. Now that the situation has already stabilized, it’s the perfect time to enter the market and place your orders.

10.25 – 11.10 – Volatility decreases, market participants lock in their profits and close their trades. This time interval is the best to start scheduling your next trades.

11.15 – 14.15 – Most breakouts occurring during this period are very inaccurate. Prices start moving sideways. Feel free to take a break. It’s best that you refrain from trading at this time.

14.10 – 15.25 – Most trends have already formed. There’s no sense in opening your trades now. But if you do, trade with the trend and be vigilant. Around 15:30, the trend may pause or even reverse.

15.20 -16.00 – The last 30 minutes of the day session, major market participants start adjusting their portfolios. It may seem that high volatility can bring you some good profits, we’d recommend staying on the safe side as the trading environment is too unpredictable now. Avoiding and managing risks is part of smart trading, remember?

All in all: The usual best trading time is 8 a.m. to 12 a.m. – it’s when trading hours of the New York and London exchanges overlap. These two trading hubs account for more than 50% of all Forex transactions.

When you SHOULD NOT trade

It’s funny how everyone is looking for the best time to trade. And few people think when it gets too risky to trade and when it’s better to avoid the market. It’s highly undesirable that you enter the market on:

- By the end of the week, we all get tired and tend to make illogical decisions. It can be hard to predict market behaviour at the end of the week. Friday is one of those days when the majority of traders suffer losses. Some traders lock in their profits to safely leave for the weekend. Others, on the contrary, jump into the market to make quick money. Prices start going up and down, especially in the afternoon, which can result in substantial losses.

- Banks are usually closed on holidays, market activity is low. On holidays, the risk of losing your deposit increases. You might be hoping for a spike in prices after the holidays, but the market likes to make adjustments. And they are usually not in your favour.

- News releases. We are going to offer you some obvious advice that no one takes anyway: do not trade the news. You can’t predict with 100% accuracy where the price will move after the release of significant news, a statement or a report. At this point, the price movement is often chaotic. So, we recommend exiting the market 1.5 hours before the publication. Refrain from trading for about the same amount of time after the news is released.

Summing up

While Forex is open around the clock, all traders are human beings who need their rest. That’s why it’s essential to know the trading sessions schedule and market hours that determine volatility peaks. Enter the market when it demonstrates a strong momentum. This way, you’ll be able to monitor price developments better and identify trading instruments with the highest profit potential.

Economy

Police, Capital Market Regulators Partner for Nigeria’s Economic Growth

By Aduragbemi Omiyale

The Nigeria Police Force (NPF) has promised to work with the Securities and Exchange Commission (SEC) and the Nigerian Exchange (NGX) Group Plc for the prevention of financial crime, and the reinforcement of trust and confidence in Nigeria’s capital market.

The Inspector General of Police, Mr Kayode Egbetokun, gave this assurance on Wednesday at the closing gong ceremony in his honour at the NGX in Lagos.

The police chief said, “A transparent and well-regulated capital market is vital to Nigeria’s economic growth. The Nigeria Police Force remains committed to working with regulators and market operators to prevent financial crime, protect investors, and uphold the integrity of our financial system.”

Earlier in his welcome address, the chairman of NGX Group, Mr Umaru Kwairanga, commended the leadership of the police in supporting market integrity.

“Market integrity is a shared responsibility. By honouring the Inspector-General of Police, we are reinforcing the importance of institutional alignment in protecting investors and preserving trust in our financial system.

“Strong collaboration between regulators, enforcement agencies, and market infrastructure institutions is essential to building a resilient and credible market that supports economic growth,” he stated.

The Director-General of SEC, Mr Emomotimi Agama, while speaking, emphasized the importance of coordinated enforcement, noting: “Investor protection is at the core of market regulation, and today’s engagement highlights how critical collaboration with law enforcement is to achieving that mandate. This partnership strengthens our enforcement capacity, enhances deterrence against illegal investment activities, and reinforces confidence in the Nigerian capital market.”

As for the chairman of NGX Limited, Mr Ahonsi Unuigbe, “A transparent and orderly market can only thrive where rules are respected and misconduct is addressed decisively. The presence of the Nigeria Police Force in this collective effort sends a strong signal that safeguarding the market is a national priority.”

Similarly, the chief executive of NGX Group, Mr Temi Popoola, stressed the importance of aligning innovation with oversight, pointing out that, “Technology and market growth must be supported by strong enforcement and investor protection frameworks. Our collaboration with the SEC and the Nigeria Police Force reflects a unified approach to preserving the credibility of Nigeria’s capital market.”

Economy

NASD OTC Exchange Closes Green by 0.09%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange rallied by 0.09 per cent on Wednesday, February 4, amid renewed appetite for unlisted stocks.

This lifted the NASD Unlisted Security Index (NSI) by 3.18 points to 3,641.30 points from the previous session’s 3,641.30 points and raised the market capitalisation by N1.9 billion to N2.180 trillion from the N2.178 trillion quoted on Tuesday.

The bourse recorded three price gainers and four price losers at the midweek session.

The advancers were led by Air Liquide Plc, which went up by N2.04 rise to end at N22.53 per share versus the previous session’s N20.49 per share, Central Securities Clearing System (CSCS) added 97 Kobo to sell at N44.97 per unit versus N44.00 per unit, and Acorn Petroleum Plc appreciated by 2 Kobo to N1.37 per share from N1.35 per share.

On the flip side, Geo-Fluids Plc lost 55 Kobo to sell at N6.26 per unit versus N6.81 per unit, Nipco Plc depreciated by 48 Kobo to trade at N259.00 per share versus N259.48 per share, FrieslandCampina Wamco Nigeria Plc declined by 40 Kobo to N63.10 per unit from N63.50 per unit, and Industrial and General Insurance (IGI) depleted by 1 Kobo to 65 Kobo per share from 66 Kobo per share.

Yesterday, the volume of trades slid by 64.5 per cent to 2.5 million units from 7.0 million units, the value of transaction decreased by 53.2 per cent to N17.7 million from N37.9 million, and the number of deals went down by 47.1 per cent to 18 deals from 34 deals.

CSCS Plc remained the most traded stock by value on a year-to-date basis with 16.0 million units valued at N652.6 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.7 million units exchanged for N111.2 million, and Geo-Fluids Plc with 11.7 million units traded for N76.1 million.

CSCS Plc was also the most active stock by volume on a year-to-date basis with 16.0 million units sold for N652.6 million, trailed by Mass Telecom Innovation Plc with 13.3 million units worth N5.3 million, and Geo-Fluids Plc with 11.7 million units valued at N76.1 million.

Economy

Naira Rallies to N1,358/$1 at Official Market, N1,450/$1 at Parallel Market

By Adedapo Adesanya

The Naira rallied at the different segments of the foreign exchange (FX) market on Wednesday as supply continues to outweigh demand, giving it an edge against the United States Dollar.

In the parallel market, the Nigerian Naira improved its value on the greenback yesterday by N5 to quote at N1,450/$1 compared with the previous day’s N1,455/$1, and at the GTBank FX desk, it gained N3 to trade at N1,383/$1, in contrast to Tuesday’s exchange rate of N1,386/$1.

In the the Nigerian Autonomous Foreign Exchange Market (NAFEX), which is also the official market, the Naira firmed up against the Dollar at midweek by N14.63 or 1.1 per cent to settle at N1,358.28/$1 versus the preceding session’s N1,372.91/$1.

Against the Pound Sterling, the domestic currency appreciated on Wednesday by N14.16 to N1,863.43/£1 from the previous day’s N1,877.59/£1, and gained N13.73 on the Euro to end at N1,606.03/€1 versus the N1,619.76/€1 it was exchanged a day earlier.

The strengthening of the Naira value has been driven by the injection of forex into the financial markets by foreign investors seeking attractive investments in the emerging markets, helping to boost Nigeria’s external reserves, which provide the Central Bank of Nigeria (CBN) with the capacity to support the local currency.

As of February 4, 2026, the reserves reached $46.59 billion.

The local currency has been able to find a solid path despite no indications of any intervention from the apex bank in recent week, strengthening the case of price discovery.

Policy moves by the CBN is also offering a backbone for the FX market as it considers some strategic reforms through a policy known as the Single Regulatory Window.

In its 2025 Fintech Report, the central bank said this scheme will significantly reduce time-to-market for new digital financial products by streamlining licensing and supervisory processes across multiple agencies.

Meanwhile, the cryptocurrency market was in red amid a broad sell-off in global technology stocks, with reports showing that liquidity was notably thin, amplifying price moves and contributing to forced liquidations. The decline followed a sharp sell-off in global technology stocks overnight, where concerns over the pace of artificial intelligence adoption and rising capital spending by major firms weighed heavily on valuations.

Bitcoin (BTC) lost 7.9 per cent to sell at $70,534.94, Ripple (XRP) declined by 11.2 per cent to $1.42, Binance Coin (BNB) slumped by 9.4 per cent to $689.70, Ethereum (ETH) crashed by 8.9 per cent to $2,072.46, and Solana (SOL) dipped by 8.7 per cent to $89.86.

In addition, Dogecoin (DOGE) depreciated by 6.9 per cent to $0.1008, Cardano (ADA) slipped by 6.8 per cent to $0.2792, Litecoin (LTC) dropped 5.1 per cent to trade at $57.56, and US Dollar Tether (USDT) went down by 0.1 per cent to $0.9980, while the US Dollar Coin (USDC) closed flat at $1.00.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn