Banking

Access Bank Obtains Regulatory Approval for N75b Rights Issue

By Dipo Olowookere

A regulatory approval has been obtained by Access Bank for its proposed raising of N75 billion ($207 million) through rights issue.

Access Bank, during its investor conference call on Wednesday, disclosed that the rights issue would be launched in the first half of 2019, mostly likely after the completion of its acquisition of Diamond Bank.

“Access Bank has historically maintained strong capital levels comfortably in excess of minimum regulatory requirements and is concluding a $250 million Tier II capital raise.

“Access Bank has also obtained regulatory approval to raise up to N75 billion (~$207 million) in a rights issue to be launched during H1 2019.

“This accelerates the capital management plan to support retail growth, set out in the Bank’s five year strategy,” the financial institution said during the call.

On Monday, Access Bank and Diamond Bank announce a merger that results in an enlarged Tier-1 Nigerian banking franchise and the largest bank in Africa by retail clients.

This followed the entry into a Memorandum of Agreement, approved by the Boards of both banks as announced on December 17, 2018, with both lenders receiving no objection from the Central Bank of Nigeria (CBN), the sector’s regulator.

According to details of the deal, Diamond Bank shareholders will receive N1.00 in cash for each share held in Diamond Bank and two Access Bank shares for every 7 shares held in Diamond Bank, implying pro-forma ownership structure in the combined entity of 81 percent for Access Bank shareholders and 19 percent for Diamond Bank shareholders.

The transaction combines Access Bank’s strong management team and risk management culture with Diamond Bank’s growing retail franchise, with potential for strong value creation for shareholders via extraction of financial synergies

The deal is expected to create a strong, safer financial institution with a diversified product offering and expanded distribution capabilities to provide clear benefits for customers, staff, and key stakeholders

In the pre-transaction completion, Diamond Bank is expected to undertake an impairment on its loan book pursuant to the implementation of IFRS 9, which is currently being evaluated and will be reflected in 2018YE numbers, while a Joint Implementation and Integration Committee was established to prepare and manage post-completion integration and strategic efforts.

In the dateline seen by Business Post, both parties will file for CBN approval of the merger in principle this month, while a clearance of scheme of merger from the Securities and Exchange Commission (SEC) is expected next month.

In March 2019, Access Bank and Diamond Bank look forward to having Court Ordered Meetings to seek shareholders’ approval, while the court sanction is projected for same month.

Both lenders hope to have the final approval of SEC and CBN between April and May 2019, while the transaction should be finalised before the end of June 2019.

Banking

All Set for Second HerFidelity Apprenticeship Programme

By Modupe Gbadeyanka

Registration for the second HerFidelity Apprenticeship Programme (HAP 2.0) organised by Fidelity Bank Plc has commenced.

The Divisional Head of Product Development at Fidelity Bank, Mr Osita Ede, informed newsmen that the initiative was designed to empower women with sustainable entrepreneurship skills.

The lender created the flagship women-empowerment initiative to equip women with practical, income‑generating skills and structured pathways to entrepreneurship.

“HerFidelity Apprenticeship Programme 2.0 reflects our commitment to continuous improvement. Having evaluated feedback from the first edition, we have returned with stronger partnerships and deeper mentorship programmes to ensure that women acquire not just skills, but sustainable economic opportunities,” he said.

“At the heart of the programme is guided, real‑world learning. Participants will undergo intensive apprenticeship training under reputable institutions and industry experts across select fields such as hair styling, shoe making, auto mechatronics, and interior decoration,” Mr Ede added.

He noted that HerFidelity Apprenticeship Programme 2.0 goes beyond skills acquisition by offering participants a wide range of business advisory services. These include business and financial literacy training, mentorship support throughout the apprenticeship journey, access to Fidelity Bank’s women‑focused and SME financial solutions, as well as guidance on business formalisation and growth strategies.

Further emphasising the bank’s vision, Mr Ede said, “By integrating structured mentorship with entrepreneurial development, Fidelity Bank is positioning women not just as trainees, but as future employers, innovators, and economic contributors within their communities. This aligns with our mandate to help individuals grow, businesses thrive, and economies prosper.”

Banking

The Alternative Bank Opens New Branch in Ondo

By Modupe Gbadeyanka

A new branch of The Alternative Bank (AltBank) has been opened in Ondo State as part of the expansion drive of the financial institution.

A statement from the company disclosed that the new branch would support export-oriented agribusinesses through Letters of Credit and commodity-backed trade finance, ensuring that local producers can scale beyond state borders.

For SMEs, the bank is introducing robust payment rails, asset financing for equipment and inventory, and supply chain-backed facilities that strengthen working capital without trapping businesses in interest-based debt cycles.

The Governor of Ondo State, Mr Lucky Aiyedatiwa, represented by his Chief of

Staff, Mr Olusegun Omojuwa, at the commissioning of the branch, underscored the importance of financial institutions in economic development.

“The pivotal role of financial institutions to economic growth and development of any economy cannot be overemphasised. It provides access to capital, supporting small and medium-scale enterprises and encouraging savings.

“Therefore, I have no doubt in my mind that the presence of The Alternative Bank in Ondo State will deepen financial services, create employment opportunities and stimulate economic activities across various sectors,” he said.

In her remarks, the Executive Director for Commercial and Institutional Banking (Lagos and South West) at The Alternative Bank, Mrs Korede Demola-Adeniyi, commended the state government’s leadership and outlined the lender’s long-term vision for Ondo State.

“As Ondo State steps into its next fifty years, and into the future anchored on the sustainable development championed during the recent anniversary celebrations, The Alternative Bank is here to be the financial engine for that vision. We didn’t come to Akure to hang banners. We came to fund work, farms, shops, and factories.”

With Ondo State’s economy anchored largely on agriculture, particularly cocoa production, poultry farming, and other cash crops, alongside a growing SME and trade ecosystem, AltBank is deploying sector-specific financing solutions tailored to these strengths.

For cocoa aggregators, processors and poultry operators, the bank will provide production financing, facility expansion support, machinery lease structures, and structured trade facilities under its joint venture and cost-plus financing models, with transaction cycles of up to 180 days for commodity trades and longer-term structured asset financing for equipment and infrastructure.

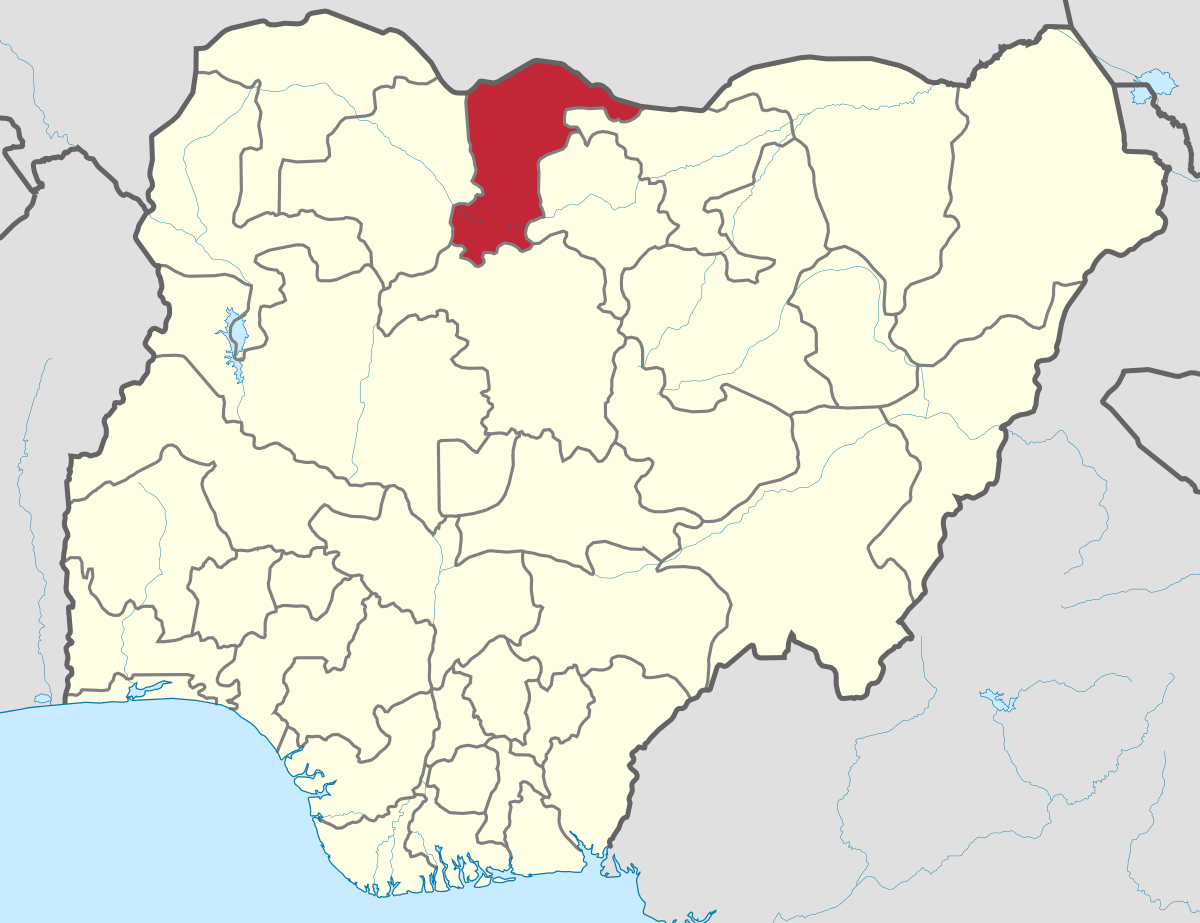

The organisation is a notable national non-interest bank with a physical network now surpassing 170 locations, deploying capital to solve real-world challenges through initiatives such as the Mata Zalla project, which saw to the training of hundreds of women as electric tricycle drivers and mechanics.

Banking

Recapitalisation: 20 Nigerian Banks Now Fully Compliant—Cardoso

By Adedapo Adesanya

The Governor of the Central Bank of Nigeria (CBN), Mr Yemi Cardoso, announced on Tuesday that the country’s banking sector is making strong progress in the recapitalisation drive, with 20 banks now fully compliant.

Mr Cardoso disclosed this during a press conference at the first Monetary Policy Committee (MPC) meeting of 2026, where he also highlighted positive developments in the nation’s foreign reserves.

On March 28, 2024, the apex bank announced an increase in the minimum capital requirements for commercial banks with international licences to N500 billion.

National and regional financial institutions’ capital bases were pegged at N200 billion and N50 billion, respectively.

Also, CBN raised the merchant bank minimum capital requirement to N50 billion for national licence holders.

The banking regulator said the new capital base for national and regional non-interest banks is N20 billion and N10 billion, respectively.

To meet the minimum capital requirements, CBN advised banks to consider the injection of “fresh equity capital through private placements, rights issue and/or offer for subscription”.

Following the development, several banks announced plans to raise funds through share and bond issuances.

In January, Zenith Bank said it had raised N350.46 billion through rights issue and public offer to meet the CBN minimum capital requirement.

Guaranty Trust Holding Company Plc (GTCO), on July 4, said it had successfully priced its fully marketed offering on the London Stock Exchange (LSE).

In September, the CBN governor said 14 banks fully met their recapitalisation requirements — up from eight banks in July.

With one month to the central bank’s March 31, 2026, recapitalisation deadline, 13 Nigerian lenders are yet to cross the finish line.

Additionally, the governor noted that 33 banks have raised funds as part of the ongoing recapitalisation exercise, signalling robust capital mobilisation across the sector.

He stated that gross foreign reserves have climbed to a 13-year high of $50.4 billion as of mid-February 2026.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn