Brands/Products

Stanbic IBTC Bank, MTN, Leadway Assurance Score High in Positive Reputation

By Dipo Olowookere

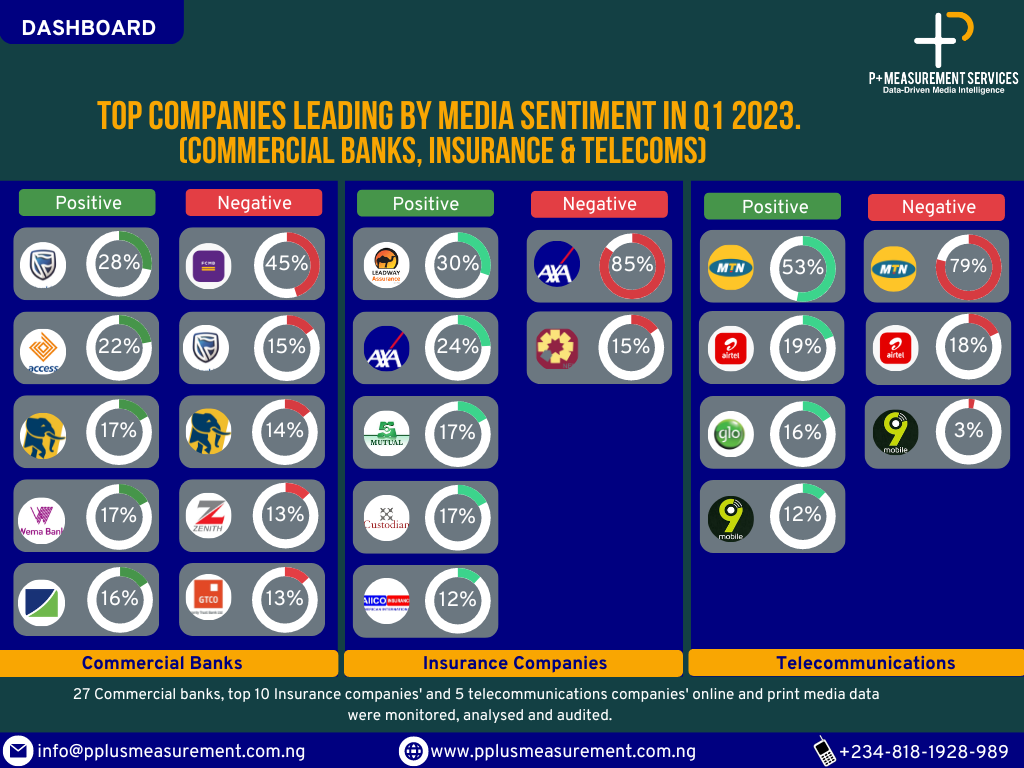

A leading media intelligence consultancy in Nigeria, P+ Measurement Services, has revealed that the trio of Stanbic IBTC Bank, MTN Nigeria, and Leadway Assurance have emerged on the top in their respective sectors for positive reputation in the first quarter of 2023.

The firm disclosed that it arrived at the ranking after tracking more than 1.3 million online publications from blogs, news sites, broadcasts, forums, and digital media in the local and global media space, as well as about 5,115 print publications (including daily, weekly, and monthly publications).

P+ Measurement said it extracted different metadata from various online and print publications, spokesperson analysis, CEOs performances, and other topics to gauge the sentiments of reporters, editors, publishers, and opinion writers on organisations in Nigeria’s commercial banking, insurance and telecommunications sectors.

A thorough review of the commercial banks’ media reputation showed that two tier-1 banks and three tier-2 banks made the top five with the highest positive feelings in Q1 2023, while three tier-1 banks and two tier-2 banks made the list with the highest negative attitudes.

It listed the top five banks by positive reputation as Stanbic IBTC Bank with 28 per cent, Access Bank with 22 per cent, First Bank and Wema Bank with 17 per cent each and Fidelity Bank with 16 per cent.

However, the top five banks with negative media reputations were First City Monument Bank (FCMB) with 45 per cent, Stanbic IBTC Bank with 15 per cent, First Bank with 14 per cent, and Zenith Bank and GTCO with 13 per cent each.

In the insurance industry, Leadway Assurance led the positive reputation survey with 30 per cent, AXA Mansard Insurance had 24 per cent, Mutual Benefits Assurance had 17 per cent, Custodian Investment Plc also had 17 per cent, and AIICO Insurance had 12 per cent.

Conversely, AXA Mansard Insurance topped the negative reputation chart with 85 per cent, while NEM Insurance had 15 per cent.

As for the telecommunication sector, MTN Nigeria received the highest positive reputation score of 53 per cent, Airtel recorded 19 per cent, Globacom had 16 per cent, and 9mobile posted 12 per cent.

On the flip side, MTN topped the table with 79 per cent, followed by Airtel with 18 per cent, while 9mobile recorded 3 per cent in the first three months of this year.

Positive Reputation Drivers

The analysis below outlines the most important factors contributing to the positive reputation of the leading commercial banks, insurance providers, and telecommunication providers in Nigeria in Q1 2023.

In the banking industry, Stanbic IBTC Bank strengthened its position as a leader by promoting cashless transactions and announcing new board appointments across the group. Organizers for the Access Bank Lagos City Marathon were revealed by Access Bank, and First Bank has reaffirmed its commitment to fostering economic growth.

The insurance industry saw Leadway assurance support AI and data-driven initiatives in the sector. AXA Mansard equipped 100 female entrepreneurs with digital marketing expertise in 2023, and Mutual Benefits offered media professionals N99 million in group accident insurance

Leading the Telecommunication sector is MTN, with its partnership with PAU to train journalists in technology, Airtel reiterated its commitment to giving African children access to high-quality education, and Globacom and Samsung introduced the Galaxy S23 smartphone.

Negative Reputation Drivers

Analysis of the negative reputational drivers in the banking sector revealed that ICPC arrested FCMB Manager for loading wrapped cash in ATM, followed by Stanbic IBTC Bank officials detained by the ICPC on suspicion of hoarding CBN’s new naira notes, and also FG Charged First Bank of Nigeria Managing Director, 2 Lawyers Over Forgery.

Despite higher income, AXA Mansard’s annual profit declined by 40%, and also concerning the non-payment of a claim by NEM Insurance Plc, a group considered petitioning NAICOM and others.

In the telecommunication sector, a crash in MTN’s network put over 80 million subscribers offline, and this had an impact on its reputation, while a decline in the shares of Airtel in the stock market impacted its prestige in the period under review.

Brands/Products

Airtel Nigeria Wins Most Preferred Telecom Brand Award

By Modupe Gbadeyanka

Another award has been added to the shelves of Airtel Nigeria for the quality service it offers its numerous subscribers.

At the 14th Nigerian NewsDirect Awards held at the Lagos Oriental Hotel on Friday, December 6, 2024, the company went home with the Most Preferred and Admired Telecommunications Brand award.

The chief executive of Airtel Nigeria, Mr Dinesh Balsingh, thanked the news platform for the recognition, reiterating the dedication of the organisation towards the growth of Nigeria.

“At Airtel, we remain steadfast in our mission to enrich lives and contribute to the sustainable growth of our nation, and we are proud to receive this award as the Most Preferred and Admired Telecommunications Brand.

“This recognition reaffirms our commitment to connecting Nigerians, driving digital inclusion, and empowering communities through innovative solutions,” he said.

The ceremony, themed Achieving Economic Prosperity: The Role of Human Capacity Development, Fiscal Prudence, and Revenue Generation, celebrated outstanding contributions made by individuals and corporate organisations to national development across sectors and industries.

The chairman of Odu’a Investment Limited, Mr Bimbo Ashiru, thanked all participating entities for their “continuous contributions and support to the nation’s growth.”

“You have demonstrated excellence and have significantly contributed to Nigeria’s progress and we believe this platform will continue to highlight and encourage best practices across industries,” he stated.

The event attracted several persons, including the chairman of the Lagos State Internal Revenue Service (LIRS), Mr Ayodele Subair; and the Registrar-General of the Corporate Affairs Commission (CAC), Mr Hussaini Ishaq Magaji; among others.

Brands/Products

Rite Foods Backs 2024 Ibadan Chops, Chills Festival

By Modupe Gbadeyanka

The second edition of the Ibadan Chops and Chills Festival held on December 1, 2024, received the backing of Rite Foods Limited.

It was a platform for young entrepreneurs, food vendors, and entertainers to showcase their talents and promote the rich cultural heritage of Oyo State in particular, and Nigeria in general.

Rite Foods used the event to foster growth and innovation among enterprising youths in society in demonstration of its commitment to youth empowerment and community engagement.

The Corporate Communications Manager at Rite Foods, Mr Innocent Adulugba, said, “As a manufacturing company driven by innovation, Rite Foods Limited believes in the power of young people and the importance of providing platforms that enable them to showcase their skills and talents.”

“The Ibadan Chops and Chills Festival aligns with our mission to inspire, support, and add value to talents and entrepreneurs across Nigeria,” he added.

“Rite Foods Limited recognizes the Ibadan Chops and Chills Festival as a platform for growth and that is why the company is here today to leverage support so the participating food exhibitors can benefit via joint marketing efforts, co-promotions, and expanded distribution channels under one roof,” Mr Adulugba stated.

“We are partnering with food vendors to offer consumers a more comprehensive and enjoyable experience, such as pairing beverages like Bigi, Sosa or Fearless with complementary food options of their choice,” he noted.

Also speaking, the convener of the programme, Ms Chinwendu Festus of Wendy’s Kitchen, said, “The first edition of Ibadan Chops and Chills was a success, which inspired us to aim higher this year.

“Our goal is to provide young people with the space to showcase their culinary talents, grow their businesses, and connect with a broader audience.”

The Commissioner for Youth and Sports, Ms Wasilat Adefemi Adegoke, stated, “This initiative is one of the best I have seen. It aligns perfectly with our administration’s goals of empowering the youth, promoting cultural heritage, and fostering talent.”

It was gathered that the festival featured cooking competitions, entertainment shows, guest tours and vendor exhibitions, which highlighted the diversity and ingenuity of participants and the diversity of food options on display.

Brands/Products

Why Waste Your Subscription? Here’s How to Get the Best of it!

In this economy, you can’t be paying for things and not getting the full value. Unfortunately, that’s how most cable TV subscribers feel. It’s like there’s a lot on TV, but nothing for you. Here’s a solution to that problem. We’ve taken the time to sieve through everything, so you don’t have to. Here are a few tips to help you make the most of your GOtv subscription during the holidays.

Take Advantage of the Golden Window Offer: The best entertainment sits on GOtv Supa Plus – and there’s an easy step to get there. To celebrate, GOtv is extending the Golden Window deal for Supa+ subscribers. Instead of paying the regular ₦15,700, you can now enjoy the Supa+ package for just ₦13,900. That’s where all the Premier League games sit. There’s a game almost every day this period. You also get Africa Magic Showcase for a little family drama – relive the easy-to-watch TV series, suitable for the family. Don’t miss out on this premium offer; take advantage of the savings while you can.

Check Out New Channels: Why not try something new and explore different channels this Christmas? It’s a great chance to step outside your usual picks and discover some festive gems and fresh content you might not expect. From comedy specials to music concerts. For example, the Holiday Pop-Up Channel will have the most recent stand-up comedy show from Nigeria’s best stand-up Comedian – Bovi — Christmas with Bovi (December 24th–26th). It’s also better to watch the Calabar Rocks Music Concert, Naija Most Wanted, and the Akwa Ibom Christmas Carols Festival 2024 on TV than under the sun.

Set Reminders for Special Movies and Shows: With all the festive activities going on, it’s easy to forget and get lost in pointless scrolling online. A simple reminder can remind you to take a break from triggering social media posts and enjoy wholesome entertainment on TV. From new Africa Magic originals like ‘The Jump’ and ‘10th Anniversary’ to classic favourites like Bad Moms and Problem Child – a classic, there’s so much to enjoy. Set those reminders so you can enjoy all the festive cheer without the fear of missing out.

Host Watch Parties: The holidays are all about spending time with loved ones, and what better way to do that than by hosting a watch party? With your GOtv subscription, you’ve got everything you need for a fun-filled day. Picture this: Christmas Day, surrounded by family and friends, all gathered together to enjoy the Bovi Comedy Special—Christmas with Bovi. Whether it’s a comedy special, a classic holiday movie, or the latest Africa Magic original, there’s something to bring everyone together. So, make it a date, prepare the Christmas rice and chicken, and enjoy.

Stream Online via the GOtv App: During the festive season, homes are often buzzing with family members coming together to celebrate. If your household is anything like this, the battle for control of the remote and deciding what to watch can get intense. To avoid the remote wars, you can make use of the GOtv Stream app. The real owners of the remote can watch what they want while you stream yours – everyone wins.

So, go ahead and subscribe now or upgrade to unlock the cheer and excitement of the season with GOtv. Take advantage of the GOtv Supa Plus Golden Window and pay just N13,900 instead of the usual N15,700.

To upgrade, subscribe, or reconnect, simply download the MyGOtv app or dial *288#. To catch up and for on-the-go viewing, don’t forget to download the GOtv Stream App and enjoy your favourite shows anytime, anywhere.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN