Economy

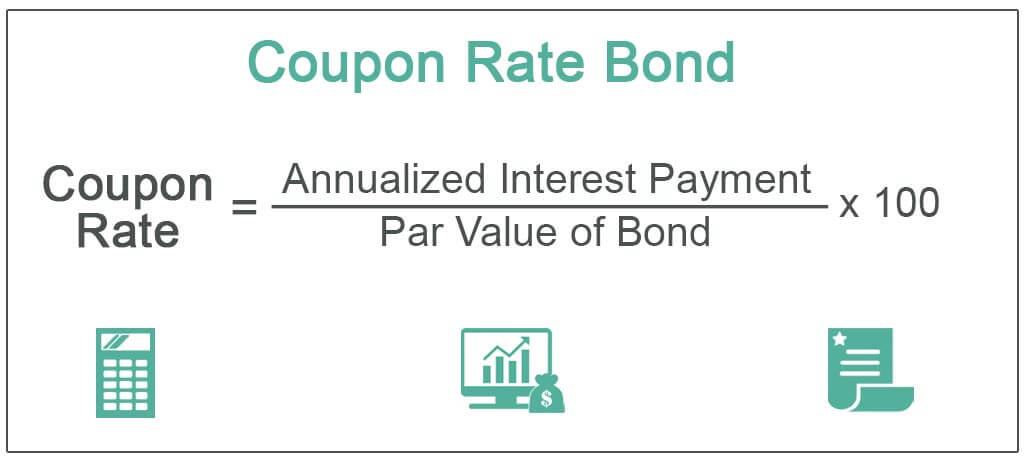

DMO Increases Coupon Rates of 10-year, 20-year, 30-year Bonds

By Ashemiriogwa Emmanuel

The coupon rates of the three bonds offered for sale by the Debt Management Office (DMO) at the last primary market auction (PMA), Wednesday, October 20, 2021, was raised, Business Post reports.

High net-worth individuals (HNIs) and institutional investors who participated in the exercise got more than they might have bargained for as the debt office hopes to keep the demand for the investment tool high.

Before the bond sale, the DMO had said it planned to auction N150 billion worth of the papers in three maturities of 10 years, 20 years and 30 years, all re-opening, at N50 billion each.

However, investors showed significant interest in two of the notes, staking N49.05 billion on the 10-year paper, N80.92 billion on the 20-year note and N120.74 billion on the 30-year bond.

From the analysis of the bond sales, investors offered N250.71 billion on the N150 billion brought to the market, representing 67.14 per cent of over-subscription.

A further breakdown showed that the 12.98% FGN MAR 2050 note was oversubscribed by 141.5 per cent, the 16.2499% FGN APR 2037 paper was oversubscribed by 61.8 per cent and the 12.50% FGN JAN 2026 was under-subscribed by 1.9 per cent.

It was gathered that the debt office allotted N44.80 billion worth of the 10-year note to 36 successful bids at 11.65 per cent, higher than 11.60 per cent at the last exercise, which was a month ago. A total of 44 bids were received for this tenor with the range of bids between 10.50 per cent and 13.00 per cent.

As for the 20-year bond, it allotted N52.72 billion to 61 investors from the 96 offers it received and the coupon rate cleared at 12.95 per cent, higher than the 12.75 per cent of the preceding sale. The range of bids for this maturity was between 12.00 per cent and 14.00 per cent.

A look at the allotment for the 30-year paper showed that the DMO sold N95.24 billion to 54 investors from the 79 bids it received and this cleared at 13.20 per cent compared with the previous 13.00 per cent and the range of bids was from 12.70 per cent to 13.99 per cent.

It can be deduced that during the exercise, the debt office sold a total of N197.76 billion of the FGN bonds to investors, higher than the N150.00 billion it initially wanted to sell.

Economy

Nigeria Adds 150,000 b/d Crude Production in November 2024

By Adedapo Adesanya

Nigeria added 150,000 barrels per day to its crude production in November 2024 as it continues to pursue an ambitious 2 million barrels per day target.

According to the Organisation of the Petroleum Exporting Countries (OPEC), Nigeria’s oil production rose to 1.48 million barrels per day in November, up from 1.33 million barrels per day the previous month.

In its Monthly Oil Market Report (MOMR), OPEC revealed that at 1.48 million barrels per day, it is the continent’s leading oil producer, surpassing Algeria’s 908,000 barrels per day and Congo’s 268,000 barrels per day.

Business Post reports that OPEC doesn’t account for condensates, which Nigeria’s accounts for in its broader 2 million barrels per day target.

Despite the surge in production levels, Nigeria is still under producing its 1.5 million barrels per day output quota under a deal involving OPEC and 10 other producers known as OPEC+.

OPEC said it relied on primary data gotten through direct communication, noting that secondary sources reported 1.417 million barrels per day as Nigeria’s crude production in November — up from 1.4 million barrels per day in October.

The data also shows that OPEC’s total oil production among its 12 members rose by 104,000 barrels per day in the month under review.

According to secondary sources, the total of the 12 OPEC countries’ crude oil production averaged 26.66 million barrels per day in November 2024.

“Crude oil output increased mainly in Libya, Iran, and Nigeria, while production in Iraq, Venezuela, and Kuwait decreased”, OPEC said.

“At the same time, total non-OPEC DoC crude oil production averaged 14.01 mb/d in November 2024, which is 219 tb/d higher, m-o-m. Crude oil output increased mainly in Kazakhstan and Malaysia,” the organisation added.

In a related development, OPEC trimmed its 2024 and 2025 oil demand growth forecasts for the fifth time this year.

Now, the cartel expects the world’s oil demand growth at 1.61 million barrels per day from the previously 1.82 million barrels per day.

For 2025, OPEC says the world oil demand growth forecast is now at 1.45 million barrels per day, a 900,000 barrels per day cut from the previously expected 1.54 million barrels per day.

On the changes, OPEC says that the downgrade for this year owes to more bearish data received in the third quarter of 2024 while the projections for next year relate to the potential impact that will arise from US tariffs.

Economy

Afriland Properties, Geo-Fluids Shrink OTC Securities Exchange by 0.06%

By Adedapo Adesanya

The duo of Afriland Properties Plc and Geo-Fluids Plc crashed the NASD Over-the-Counter (OTC) Securities Exchange by a marginal 0.06 per cent on Wednesday, December 11 due to profit-taking activities.

The OTC securities exchange experienced a downfall at midweek despite UBN Property Plc posting a price appreciation of 17 Kobo to close at N1.96 per share, in contrast to Tuesday’s closing price of N1.79.

Business Post reports that Afriland Properties Plc slid by N1.14 to finish at N15.80 per unit versus the preceding day’s N16.94 per unit, and Geo-Fluids Plc declined by 1 Kobo to trade at N3.92 per share compared with the N3.93 it ended a day earlier.

At the close of transactions, the market capitalisation of the bourse, which measures the total value of securities on the platform, shrank by N650 million to finish at N1.055 trillion compared with the previous day’s N1.056 trillion and the NASD Unlisted Security Index (NSI) went down by 1.86 points to wrap the session at 3,012.50 points compared with 3,014.36 points recorded in the previous session.

The alternative stock market was busy yesterday as the volume of securities traded by investors soared by 146.9 per cent to 5.9 million units from 2.4 million units, as the value of shares transacted by the market participants jumped by 360.9 per cent to N22.5 million from N4.9 million, and the number of deals increased by 50 per cent to 21 deals from 14 deals.

When the bourse closed for the day, Geo-Fluids Plc remained the most active stock by volume (year-to-date) with 1.7 billion units valued at N3.9 billion, followed by Okitipupa Plc with 752.2 million units worth N7.8 billion, and Afriland Properties Plc 297.5 million units sold for N5.3 million.

Also, Aradel Holdings Plc, which is now listed on the Nigerian Exchange (NGX) Limited after its exit from NASD, remained the most active stock by value (year-to-date) with 108.7 million units sold for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.5 million units worth N5.3 billion.

Economy

Naira Weakens to N1,547/$1 at Official Market, N1,670/$1 at Black Market

By Adedapo Adesanya

The euphoria around the recent appreciation of the Naira eased on Wednesday, December 11 after its value shrank against the US Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N5.23 or 0.3 per cent to N1,547.50/$1 from the N1,542.27/$1 it was valued on Tuesday.

It was observed that spectators’ activities may have triggered the weakening of the local currency in the official market at midweek as they tried to fight back and ensure the value of funds in foreign currencies strengthened.

The domestic currency was regaining its footing after the Central Bank of Nigeria (CBN) launched an Electronic Foreign Exchange Matching System (EFEMS) platform to tackle speculation and improve transparency in Nigeria’s FX market.

At midweek, the Nigerian currency depreciated against the Pound Sterling by N3.56 to close at N1,958.68/£1 compared with the preceding day’s N1,955.12/£1 and against the Euro, it slumped by 34 Kobo to trade at N1,612.66/€1, in contrast to the previous session’s N1,613.00/€1.

As for the black market segment, the Naira lost N45 against the American currency during the session to quote at N1,670/$1 compared with the N1,625/$1 it was traded a day earlier.

A look at the cryptocurrency market showed a recovery following profit-taking as the US Consumer Price Index report matched economist forecasts.

The news was enough to convince traders that the Federal Reserve is certain to trim its benchmark fed funds rate another 25 basis points at its meeting next week.

The move also saw Bitcoin (BTC), the most valued coin, return to the $100,000 mark as it added a 2.9 per cent gain and sold for $100,566.12.

The biggest gainer was Cardano (ADA), which jumped by 15.00 per cent to trade at $1.16, as Litecoin (LTC) appreciated by 10.4 per cent to sell for $121.76, and Ethereum (ETH) surged by 7.0 per cent to $3,929.30, while Dogecoin (DOGE) recorded a 6.7 per cent growth to finish at $0.4181.

Further, Binance Coin (BNB) went up by 5.2 per cent to $716.72, Solana (SOL) expanded by 4.6 per cent to $229.77, and Ripple (XRP) increased by 4.2 per cent to $2.43, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closed flat at $1.00 apiece.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN