Economy

Prop Trading Success

In the fast-paced and competitive world of finance, the path to success in proprietary trading can often be elusive. However, by implementing a few key strategies, traders can greatly increase their chances of achieving profitability and staying ahead of the curve.

First and foremost, it is crucial to develop a deep understanding of market dynamics and trends. By staying informed about global economic factors, geopolitical events, and industry-specific news, traders can position themselves to make informed decisions and take advantage of lucrative opportunities.

Furthermore, risk management is paramount in the world of prop trading. The ability to assess and mitigate risks is what sets successful traders apart from the rest. By employing sound risk management techniques such as diversification, stop-loss orders, and proper position sizing, traders can protect their capital and minimize losses during volatile market conditions.

Effective analysis and sound decision-making are also essential components of prop trading success. By combining technical analysis with fundamental analysis, traders can identify potential market trends, evaluate the strength of those trends, and make strategic trading decisions based on this information. Additionally, the ability to remain disciplined and stick to a well-defined trading plan is crucial to avoid emotional decision-making and impulsive trades.

FXCI – Where Traders Thrive with the Best Trading Firms, offers a comprehensive support system and cutting-edge resources, enabling traders to stay informed, manage risk effectively, and make informed trading decisions, ultimately increasing their chances of profitability and carving a niche for themselves in the competitive world of proprietary trading.

Tips for Mastering Prop Trading

Becoming a successful prop trader requires a deep understanding of the intricacies of the market, impeccable execution skills, and the ability to adapt to changing market conditions. This section provides valuable insights and tips for aspiring prop traders to master their craft.

1. Develop a Solid Trading Strategy

A crucial aspect of prop trading mastery is the development of a well-defined and tested trading strategy. This strategy should encompass entry and exit points, risk management techniques, and a clear understanding of the market factors that influence your trading decisions. Regularly monitor and evaluate the effectiveness of your strategy and be open to making adjustments as needed.

2. Embrace Risk Management

Successful prop traders understand the importance of risk management and incorporate it into every trade they make. Set strict stop-loss limits and adhere to them to ensure that losses are kept under control. Implement position sizing techniques to manage risk exposure and diversify your portfolio to reduce overall risk. By effectively managing risk, you can protect your capital and increase your chances of long-term profitability.

3. Continuously Educate Yourself

The world of trading is constantly evolving, and as a prop trader, it is crucial to stay ahead of the curve. Invest time in continuous learning and stay updated on market trends, economic indicators, and changes in regulations. Attend webinars, read books and articles, and follow reputable traders and industry experts on social media to expand your knowledge and gain valuable insights.

4. Develop Mental Resilience

Prop trading can be mentally challenging, especially during periods of market volatility or when faced with losses. It is essential to develop mental resilience and emotional control to avoid making impulsive or emotionally driven trading decisions. Practice mindfulness techniques, maintain a healthy work-life balance, and surround yourself with a supportive network of fellow traders to help you stay focused and maintain a healthy mindset.

5. Utilize Technology and Tools

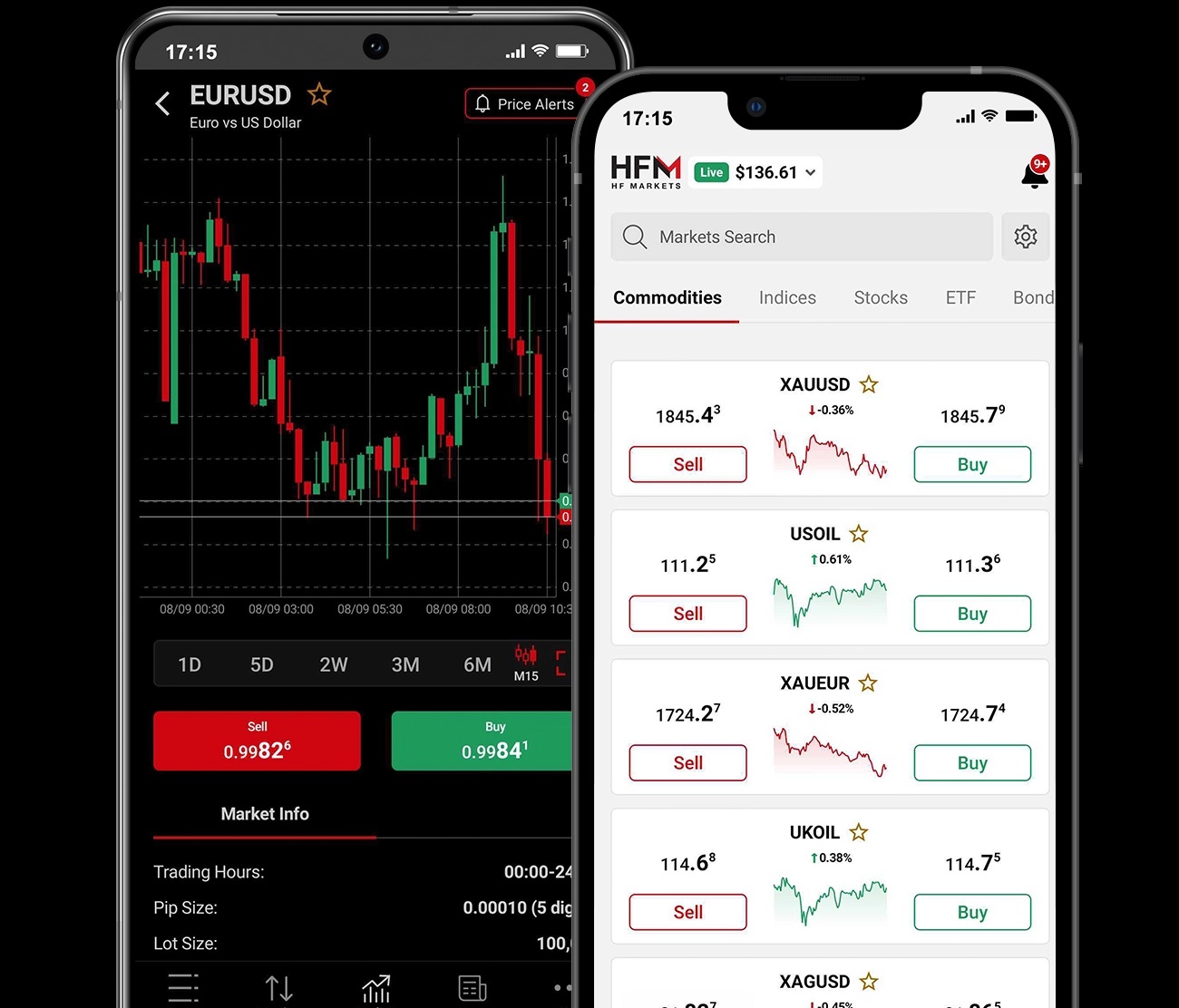

In today’s digital age, prop traders have access to a wide range of tools and technologies that can enhance their trading performance. Use cutting-edge trading platforms, charting software, and data analytics tools to gain a competitive edge. Leverage automation and algorithmic trading strategies to streamline your trading process and increase efficiency. Stay informed about the latest technological advancements in the industry and explore how they can benefit your trading approach.

Conclusion

Mastering prop trading requires a combination of technical expertise, disciplined execution, and a continuous commitment to learning and improvement. By following these tips and incorporating them into your trading routine, you can enhance your chances of achieving success as a prop trader.

Developing a Solid Trading Strategy

Creating a robust and effective trading strategy is essential for success in the world of proprietary trading. This section will explore the key principles and techniques required to develop a solid plan that aligns with your goals and risk tolerance.

Understanding Market Analysis

To develop a reliable trading strategy, it is crucial to have a deep understanding of market analysis. This involves studying various factors that impact price movements, such as fundamental analysis, technical indicators, and market sentiment. By gaining insights into these factors, traders can identify potential entry and exit points, as well as anticipate market trends.

Defining Risk Management Principles

In addition to market analysis, incorporating robust risk management principles is vital when crafting a trading strategy. Successful prop traders acknowledge the importance of setting risk parameters, such as maximum loss limits and position sizing. By implementing risk management techniques, traders can minimize losses during adverse market conditions and ensure long-term sustainability.

Developing a data-driven approach

Developing a trading strategy based on data-driven analysis can significantly increase the likelihood of success. By utilizing historical market data and backtesting techniques, traders can validate their strategies and identify potential weaknesses. This data-driven approach allows traders to fine-tune their strategies, ensuring they remain adaptive to changing market conditions.

Emphasizing Discipline and Psychology

While technical and fundamental analysis are essential components of a solid trading strategy, cultivating discipline and maintaining psychological composure is equally crucial. Emotion-driven decision-making can lead to impulsive trades and undue risks. By mastering self-control and adhering to predefined rules, traders can minimize emotional biases and make rational decisions that align with their strategy.

In conclusion, developing a solid trading strategy requires a combination of market analysis, risk management principles, a data-driven approach, and a disciplined mindset. By understanding these fundamental elements, traders can enhance their chances of achieving success in the world of proprietary trading.

Risk Management Techniques for Prop Traders

In the pursuit of successful proprietary trading, it is essential for traders to be equipped with effective risk management techniques. These techniques aim to mitigate the potential losses that may arise from market volatility and uncertainty. Proper risk management not only safeguards the trader’s capital but also enhances their ability to generate consistent profits.

1. Position Sizing

One crucial risk management technique for prop traders is position sizing. This involves determining the appropriate amount of capital to allocate to each trade based on the trader’s risk tolerance and expected return. By using this technique, traders can limit their exposure to individual positions and maintain a balanced portfolio.

2. Stop Loss Orders

Implementing stop loss orders is another effective risk management technique for prop traders. A stop loss order is a predetermined price level at which the trader automatically exits a position to limit potential losses. By placing stop loss orders, traders can establish a maximum acceptable loss for each trade, minimizing the impact of adverse market movements.

Moreover, it is crucial for prop traders to regularly reevaluate their risk management techniques and adjust them accordingly. Being adaptive and flexible in risk management allows traders to stay ahead of the ever-changing market conditions and adjust their strategies as needed.

In summary, successful prop traders employ various risk management techniques to protect their capital and maximize their trading performance. While position sizing and stop loss orders are essential components, continuously refining and adapting risk management strategies is crucial for long-term success in the volatile world of proprietary trading.

Psychological Skills for Trading Success

Mastering the mental aspect of trading is essential for achieving success in the high-stakes world of prop trading. Developing strong psychological skills can be the key differentiator between profitability and failure in the market. This section will explore the crucial mindset required for successful trading, emphasizing the importance of discipline, emotional control, and resilience.

One of the fundamental psychological skills necessary for trading success is discipline. Trading requires strict adherence to predefined trading plans and strategies, resisting the temptations of impulsive decisions and emotional reactions. Disciplined traders have the ability to stick to their predetermined risk management rules, executing trades without deviating from their strategies based on short-term market fluctuations or external noise.

Emotional control is another critical skill that traders must develop. The financial markets can be highly volatile and unpredictable, often triggering intense emotions such as fear, greed, and anxiety. Successful traders are able to keep their emotions in check, making rational decisions based on analysis and logic rather than being driven by emotional impulses. They understand the importance of maintaining objectivity and not allowing emotions to cloud their judgment.

In addition to discipline and emotional control, resilience is a crucial psychological skill for trading success. The ability to bounce back from losses, setbacks, and mistakes is essential for staying in the game and recovering from downturns. Resilient traders are not easily discouraged by temporary failures and view them as valuable learning experiences. They have the mental toughness to stay focused and motivated, even when faced with adversity.

Developing these psychological skills takes time and practice. Traders should constantly work on self-awareness, identifying their strengths and weaknesses in order to improve their mental game. They can utilize techniques such as journaling, mindfulness, and visualization to enhance their discipline, emotional control, and resilience. Ultimately, traders who prioritize these psychological skills increase their chances of achieving long-term success in the competitive world of prop trading.

Economy

Naira Down Again at NAFEX, Trades N1,359/$1

By Adedapo Adesanya

The Naira further weakened against the Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) for the fourth straight session this week on Thursday, February 26.

At the official market yesterday, the Nigerian Naira lost N3.71 or 0.27 per cent to trade at N1,359.82/$1 compared with the previous session’s N1,356.11/$1.

In the same vein, the local currency depreciated against the Pound Sterling in the same market window on Thursday by N8.27 to close at N1,843.23/£1 versus Wednesday’s closing price of N1,834.96/£1, and against the Euro, it crashed by N8.30 to quote at N1,606.89/€1, in contrast to the midweek’s closing price of N1,598.59/€1.

But at the GTBank forex desk, the exchange rate of the Naira to the Dollar remained unchanged at N1,367/$1, and also at the parallel market, it maintained stability at N1,365/$1.

The continuation of the decline of the Nigerian currency is attributed to a surge in foreign payments that have outpaced the available Dollars in the FX market.

In a move to address the ongoing shortfall at the official window, the Central Bank of Nigeria (CBN) intervened by selling $100 million to banks and dealers on Tuesday.

However, the FX support failed to reverse the trend, though analysts see no cause for alarm, given that the authority recently mopped up foreign currency to achieve balance and it is still within the expected trading range of N1,350 and N1,450/$1.

As for the cryptocurrency market, major tokens posted losses over the last 24 hours as traders continued to de-risk alongside equities following Nvidia’s earnings-driven pullback, with Ripple (XRP) down by 2.7 per cent to $1.40, and Dogecoin (DOGE) down by 1.6 per cent to $0.0098.

Further, Litecoin (LTC) declined by 1.3 per cent to $55.87, Ethereum (ETH) slipped by 0.9 per cent to $2,036.89, Bitcoin (BTC) tumbled by 0.7 per cent to $67,708.21, Cardano (ADA) slumped by 0.6 per cent to $0.2924, and Solana (SOL) depreciated by 0.4 per cent to $87.22, while Binance Coin (BNB) gained 0.4 per cent to sell for $629.95, with the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closing flat at $1.00 each.

Economy

Crude Oil Falls as Geopolitical Risk Around Iran Clouds Supply Outlook

By Adedapo Adesanya

Crude oil settled lower on Thursday as investors tracked developments in talks between the United States and Iran over the latter’s nuclear programme, weighing potential supply concerns if hostilities escalate.

Brent crude futures lost 10 cents or 0.14 per cent to close at $70.75 a barrel, while the US West Texas Intermediate (WTI) crude futures depreciated by 21 cents or 0.32 per cent to $65.21 a barrel.

The US and Iran held indirect talks in Geneva on Thursday over their long-running nuclear dispute to avert a conflict after US President Donald Trump ordered a military build-up in the region.

Prices had gained earlier in the session after media reports indicated the talks had stalled over US insistence on zero enrichment of uranium by Iran, as well as a demand for the delivery of all 60 per cent-enriched uranium to the US.

However, prices then retreated after the two countries extended talks into next week, reducing the immediate strike potential.

Iran’s Foreign Minister, who confirmed talks will continue next week, said Thursday’s talks were the most serious exchanges with the US yet, saying Iran clearly laid out its demand for lifting sanctions and the process for relief.

His counterpart from Oman, who is handling the talks, said significant progress was made in Thursday’s talks. The Omani minister’s upbeat assessment followed indirect talks between Iranian Foreign Minister and US envoys Steve Witkoff and Jared Kushner in Geneva, with one session in the morning and the second in the afternoon.

He will also hold talks with US Vice President JD Vance and other US officials in Washington on Friday.

The Trump administration has insisted that Iran’s ballistic missile program and its support for armed groups in the region must be part of the negotiations.

The American President said on February 19 that Iran must make a deal in 10 to 15 days, warning that “really bad things” would otherwise happen.

On Tuesday, he briefly laid out his case for a possible attack on Iran in his State of the Union speech, underlining that while he preferred a diplomatic solution, he would not allow Iran to obtain a nuclear weapon.

Meanwhile, the US continues to amass forces in the Middle Eastern region, with the military saying it is prepared to execute orders given by the US President.

Economy

Why Transparency Matters in Your Choice of a Financial Broker

Choosing a Forex broker is essentially picking a partner to hold the wallet. In 2026, the market is flooded with flashy ads promising massive leverage and “zero fees,” but most of that is just noise. Real transparency is becoming a rare commodity. It isn’t just a corporate buzzword; it’s the only way a trader can be sure they aren’t playing against a stacked deck. If a broker’s operations are a black box, the trader is flying blind, which is a guaranteed way to blow an account.

The Scam of “Zero Commissions”

The first place transparency falls apart is in the pricing. Many brokers scream about “zero commissions” to get people through the door, but they aren’t running a charity. If they aren’t charging a flat fee, they are almost certainly hiding their profit in bloated spreads or “slippage.” A trader might hit buy at one price and get filled at a significantly worse one without any explanation. This acts as a silent tax on every trade. A transparent broker doesn’t hide the bill; they provide a live, auditable breakdown of costs so the trader can actually calculate their edge.

The Conflict of Market Making

It is vital to know who is on the other side of the screen. Many brokers act as “Market Makers,” which is a polite way of saying they win when the trader loses. This creates a massive conflict of interest. There is little incentive for a broker to provide fast execution if a client’s profit hurts their own bottom line. A broker with nothing to hide is open about using an ECN or STP model, simply passing orders to the big banks and taking a small, visible fee. If a broker refuses to disclose their execution model, they are likely betting against their own clients.

Regulation as a Safety Net

Transparency is worthless without an actual watchdog. A broker that values its reputation leads with its licenses from heavy-hitters like the FCA or ASIC. They don’t bury their regulatory status in the fine print or hide behind “offshore” jurisdictions with zero oversight. More importantly, they provide proof that client funds are kept in segregated accounts. This ensures that if the broker goes bust, the money doesn’t go to their creditors—it stays with the trader. Without this level of openness, capital is essentially unprotected.

The Withdrawal Litmus Test

The ultimate test of a broker’s transparency is how they handle the exit. There are countless horror stories of traders growing an account only to find that “technical errors” or vague “bonus terms” prevent them from withdrawing their money. A legitimate broker has clear, public rules for getting funds out and doesn’t hide behind a wall of unreturned emails. If a platform makes it difficult to see the exit strategy, it’s a sign that the front door should have stayed closed.

Conclusion

In 2026, honesty is the most valuable feature a broker can offer. It is the foundation that allows a trader to focus on the charts instead of worrying if their stops are being hunted. Finding a partner with clear pricing, honest execution, and real regulation is the first trade that has to be won. Flashy marketing is easy to find, but transparency is what actually keeps a trader in the game for the long haul.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn