Economy

SEC Seeks Innovative Financial Products for Pension Industry

By Aduragbemi Omiyale

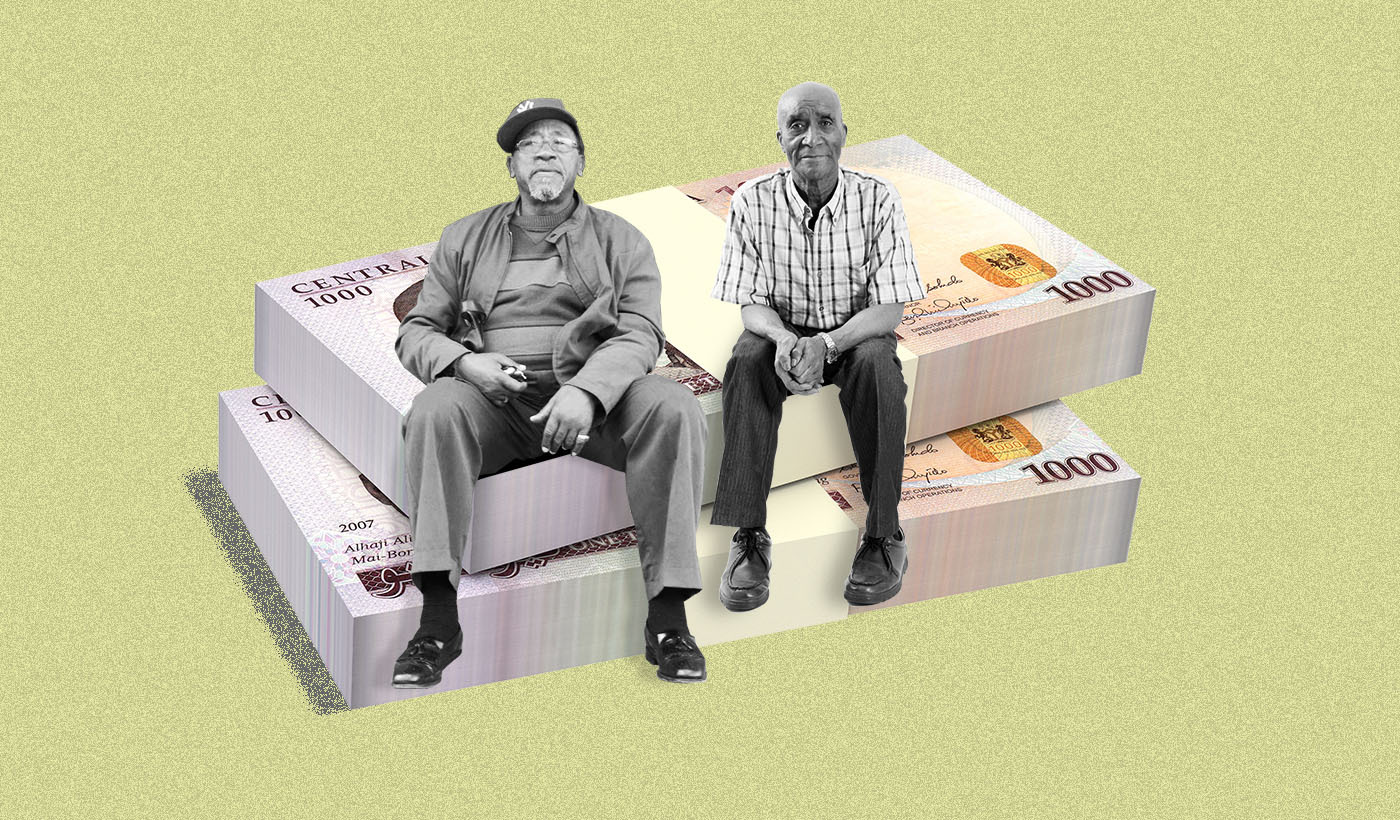

The Director-General of the Securities and Exchange Commission (SEC), Mr Lamido Yuguda, has called for more innovative financial products to meet the needs of the pension industry in Nigeria so as to deepen the capital market and sustain the growth in the sector, especially in the non-interest segment.

Mr Yuguda made this call at a one-day seminar organised by the agency themed The Imperative of Non-Interest Capital Market for Pension Industry.

According to him, the non-interest finance segment holds great potentials in furthering the development of the capital market and the growth of the nation’s economy as it is one of the most appropriate for the funding of long-term infrastructure.

He described the pension industry as one of the fastest-growing in the nation’s economy with assets under management of N13 trillion as at the end of September 2021 adding that of this impressive amount, less than N80 billion is invested in Sukuk, representing a little less than one per cent of total pension assets under management.

“This calls for more innovative financial products to deepen our market and sustain the growth in the industry, especially in the non-interest segment.

“We strongly believe that the capital market has a leading role to play in this regard by providing a variety of long-term investable products to service the needs of the pension industry as well as other investors with a similar focus.

“It is encouraging that the national pension commission has taken concrete steps to improve the regulatory framework for the investment of pension funds in the non-interest capital market by the introduction of an operational framework for the non-interest fund.

“This will no doubt provide an additional opportunity for retirement savings account holders and retirees to invest their savings in financial instruments that are aligned with their lite goals and objectives.

“Indeed, the operationalization of the funds definitely accelerates the national financial inclusion agenda while increasing the quantum of investible funds by unlocking the untapped capital,” he said.

Mr Yuguda stated that as of September 2021, the total assets stood at N7.79 billion constituting about 0.059 per cent of total pension assets under management expressing the hope that the fund assets will grow with robust public awareness, education programs and capacity building of stakeholders through seminars, workshops and programs such as this.

“The SEC in the realisation of the potential of the noninterest segment of the capital market has a veritable avenue for providing long-term capital launched its 10-year capital market masterplan with a very strong focus on the development of the non-interest capital market segment through awareness creation, capacity building, review of regulatory framework and development of non-interest projects and services.

“I am happy to report that a significant number of its strategic initiatives have been achieved as several sharia/ethical funds have been registered by the SEC.

“In addition, the SEC collaborated with the MO towards providing a framework for the issuance of the first FGN Sukuk in 2017 and two other issuances of Sukuk have followed.

“However, we believe that more work still needs to be directed towards achieving other critical initiatives of non-interest in our capital market plan.

‘At SEC, we have been approached by a number of potential corporate issuers of scope and we have registered the first issuer of scope, we are aware that a number of corporate issuers are interested in issuing Sukuk, but some of them have noted that they will like clarity on the neutrality of the Sukuk vis-a-vis corporate bonds.

“The increased supply of scope will hasten the development of the non-interest capital market because I am confident that the non-interest finance experts gathered here today will invoke the interest and attention of participants and enhance their knowledge of the subject to eventually lead to the birth of promoters and on takers of non-interest products of the capital market,” he added.

In a goodwill message, the Director-General of the National Pensions Commission (PenCom) Ms Aisha Dabir Umar, commended the SEC for organising this webinar.

The PenCom chief, represented by the Commissioner Administration, Mr Umar Farouk Aminu, acknowledged the collaborative efforts of the two agencies which have over the years laid acceptable values and good governance standards in their investments of pension funds in the Nigerian capital market.

“As you may be aware, PenCom recently released a list of operational guidelines for non-interest funds. It is our belief that this singular act will promote financial inclusion in Nigeria, and particularly drive enrolment in the macro pension fund. It is my call that industry practitioners gathered here will come up with practical measures to facilitate the issuance of non-interest instruments in the market.”

She stated that PenCom remains resolute in ensuring that all instruments meet this requirement before pension investment and commended the collaboration between PenCom and SEC towards deepening the capital market to sustainably introduce non-interest products.

In his remarks, the Secretary-General of the Islamic Financial Services Board, Dr Bello Danbatta, said Islamic finance is a complementary system adding that no system would be able to develop without integrating it into its financial system.

“Sustainable finance is not complete without integrative finance and integrative finance is only possible when you have non-interest and interest-based finance,” he stated.

Economy

Afriland Properties Lifts NASD OTC Securities Exchange by 0.04%

By Adedapo Adesanya

Afriland Properties Plc helped the NASD Over-the-Counter (OTC) Securities Exchange record a 0.04 per cent gain on Tuesday, December 10 as the share price of the property investment rose by 34 Kobo to N16.94 per unit from the preceding day’s N16.60 per unit.

As a result of this, the market capitalisation of the bourse went up by N380 million to remain relatively unchanged at N1.056 trillion like the previous trading day.

But the NASD Unlisted Security Index (NSI) closed higher at 3,014.36 points after it recorded an addition of 1.09 points to Monday’s closing value of 3,013.27 points.

The NASD OTC securities exchange recorded a price loser and it was Geo-Fluids Plc, which went down by 2 Kobo to close at N3.93 per share, in contrast to the preceding day’s N3.95 per share.

During the trading session, the volume of securities bought and sold by investors increased by 95.8 per cent to 2.4 million units from the 1.2 million securities traded in the preceding session.

However, the value of shares traded yesterday slumped by 3.7 per cent to N4.9 million from the N5.07 million recorded a day earlier, as the number of deals surged by 27.3 per cent to 14 deals from 11 deals.

Geo-Fluids Plc remained the most active stock by volume (year-to-date) with 1.7 billion units sold for N3.9 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.5 million units worth N5.3 million.

Also, Aradel Holdings Plc remained the most active stock by value (year-to-date) with 108.7 million units worth N89.2 billion, followed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.5 million units sold for N5.3 billion.

Economy

Naira Trades N1,542/$1 as FX Speculators Dump Dollars in Panic

By Adedapo Adesanya

The Naira continued to appreciate on the US Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM), gaining 0.7 per cent or N10.23 on Tuesday, December 10 to trade at N1,542.27/$1 compared with the preceding day’s N1,552.50/$1.

The Central Bank of Nigeria (CBN)-backed Electronic Foreign Exchange Matching System (EFEMS) platform introduced to tackle speculation and improve transparency in Nigeria’s FX market has been attributed as the source of the Naira’s appreciation.

Speculators holding foreign currencies, particularly the US Dollar, have seen the value of their money drastically drop due to the appreciation of the local currency. This is forcing them to dump greenback into the system and take the domestic currency alternative- a move that has seen available FX increase.

Equally, the domestic currency improved its value against the Pound Sterling in the official market during the trading day by N6.81 to sell for N1,955.12/£1 compared with Monday’s closing price of N1,961.93/£1 and against the Euro, it gained N10.84 to close at N1,613.00/€1, in contrast to the previous day’s rate of N1,623.84/€1.

Data from the FMDQ Securities Exchange showed that the value of forex transactions significantly increased yesterday by $228.85 million or 257.2 per cent to $401.17 million from the preceding session’s $112.32 million.

However, in the parallel market, the Nigerian currency weakened against the US Dollar on Tuesday by N5 to settle at N1,625/$1 compared with the previous day’s value of N1,620/$1.

In the cryptocurrency market, Dogecoin (DOGE) lost 4.8 per cent to sell at $0.39116, Litecoin (LTC) depreciated by 3.3 per cent to trade at $110.25, Binance Coin (BNB) went south by 2.3 per cent to $681.44, Ethereum (ETH) dropped 1.6 per cent to finish at $3,671.08, and Cardano (ADA) slid by 0.5 per cent to $0.8837

Conversely, Ripple (XRP) jumped by 5.4 per cent to $2.23 amid a continued shift for the coin with its parent company seeing the benefits of a crypto-friendly regulatory environment for US-based companies.

XRP is closely related to Ripple Labs, a high-profile payments company targeted by the SEC in 2020 on allegations of selling the token as a security to U.S. investors. Ripple fully cleared a long-drawn court case in 2024.

Further, Solana (SOL) expanded by 0.8 per cent to $219.75, Bitcoin (BTC) grew by 0.4 per cent to $97,446.95, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

Economy

Chinese Demand, Europe, Syria Development Buoy Oil Prices

By Adedapo Adesanya

Oil prices rose on Tuesday, influenced by increasing demand in China, the world’s largest buyer, as well as developments in Europe and Syria, with Brent crude futures closing at $72.19 per barrel after chalking up 5 cents or 0.07 per cent while the US West Texas Intermediate finished at $68.59 a barrel after it gained 22 cents or 0.32 per cent.

China will adopt an “appropriately loose” monetary policy in 2025 as the world’s largest oil importer tries to spur economic growth. This would be the first easing of its stance in 14 years.

Chinese crude imports also grew annually for the first time in seven months, jumping in November on a year-on-year basis.

Speculation about winter demand in Europe also contributed to the rise in prices as the period has been known for high demand.

In Syria, rebels were working to form a government and restore order after the ousting of President Bashar al-Assad, with the country’s banks and oil sector set to resume work on Tuesday.

Although Syria itself is not a major oil producer, it is strategically located and has strong ties with Russia and Iran – two of the world’s largest oil producers.

Market analysts noted that the tensions in the Middle East seem contained, which led market participants to price for potentially low risks of a wider regional spillover leading to significant oil supply disruption.

The market is also looking forward to the US Federal Reserve, which is expected to make a 25 basis point cut to interest rates at the end of its December 17-18 meeting.

This move could improve oil demand in the world’s biggest economy, though traders are waiting to see if this week’s inflation data derails the cut.

Crude oil inventories in the US rose by 499,000 barrels for the week ending November 29, according to The American Petroleum Institute (API). Analysts had expected a draw of 1.30 million barrels.

For the week prior, the API reported a 1.232-million barrel build in crude inventories.

So far this year, crude oil inventories have fallen by roughly 3.4 million barrels since the beginning of the year, according to API data.

Official data from the US Energy Information Administration (EIA) will be released later on Wednesday.

Also, the market is getting relief from the recent decision of selected members of the Organisation of the Petroleum Exporting Countries and its allies, OPEC+ to delay the rollback of 2.2 million barrels per day of oil production cuts to April from January. Another 3.6 million barrels per day in output reductions across the OPEC+ group has been extended to the end of 2026 from the end of 2025.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN