Economy

S/Sudan President To Speak At Africa Oil & Power 2017

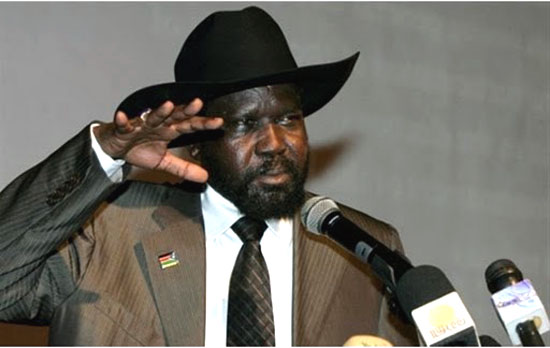

president salva kiir

By Dipo Olowookere

South Sudan President, Mr Salva Kiir Mayardit, will present opening speech on June 5, 2017 in Cape Town, organisers of the event have said.

This followed decision of the crisis-ridden country and Africa Oil & Power to work in partnership on a slew of initiatives to promote foreign direct investment in the East African country.

Mr Mayardit is expected to present a keynote address at the conference, which will also host a special Market Spotlight session on South Sudan to feature Minister of Petroleum, Mr Ezekiel Lol Gatkuoth alongside key industry leadership to discuss developments in the industry.

South Sudan has adopted a strongly pro-business attitude with the hope that expansions in the petroleum sector and heightened exploration activity will stimulate its economy.

Once one of sub-Saharan Africa’s mightiest hydrocarbon economies, South Sudan has seen oil production decline since the country has grappled with civil conflicts with a rebel faction.

South Sudan currently produces 130,000 barrels per day but is capable of daily output of 500,000 barrels.

The Ministry of Petroleum has been undergoing some important negotiations with oil companies to enter the market and has previously considered launching its first licensing round.

The Market Spotlight session on South Sudan will gather the industry’s key participants to discuss developments in the sector, including exploration activity, production outlooks, energy security, corporate finance, downstream and export infrastructure. Africa Oil & Power will produce a range of resources for the South Sudanese government to promote its activities.

“We are truly honored that the Government of South Sudan has agreed to participate in Africa Oil & Power,” said Guillaume Doane, CEO of Africa Oil & Power. “South Sudan has a proud legacy in the petroleum sector and has shown a huge willingness to attract companies to the country and develop its abundance of hydrocarbons. The country recognizes that unlocking those natural resources is vital to fostering economic growth, restoring peace and stability and we hope to be useful in those efforts.”

“South Sudan is truly honored to participate in Africa’s premier energy industry event,” said Ezekiel Lol Gatkuoth, Minister of Petroleum for South Sudan. “Our country strives to restore its rightful place in Africa’s hydrocarbons sector and we see this an opportunity for our head of state H.E. General Salva Kiir Mayardit to outline our vision for the industry and attract investors to South Sudan.”

The participation of the South Sudan government follows the commitment of several high-level government to Africa Oil & Power 2017, including: Patrice Trovoada, Prime Minister of São Tomé and Principe; and Francisco Pascual Obama Asue, Prime Minister of Equatorial Guinea; Gabriel Mbaga Obiang Lima, Minister of Mines and Hydrocarbons of Equatorial Guinea; and Tina Joemat-Pettersson, Minister of Energy for South Africa.

Economy

Nigeria Adds 150,000 b/d Crude Production in November 2024

By Adedapo Adesanya

Nigeria added 150,000 barrels per day to its crude production in November 2024 as it continues to pursue an ambitious 2 million barrels per day target.

According to the Organisation of the Petroleum Exporting Countries (OPEC), Nigeria’s oil production rose to 1.48 million barrels per day in November, up from 1.33 million barrels per day the previous month.

In its Monthly Oil Market Report (MOMR), OPEC revealed that at 1.48 million barrels per day, it is the continent’s leading oil producer, surpassing Algeria’s 908,000 barrels per day and Congo’s 268,000 barrels per day.

Business Post reports that OPEC doesn’t account for condensates, which Nigeria’s accounts for in its broader 2 million barrels per day target.

Despite the surge in production levels, Nigeria is still under producing its 1.5 million barrels per day output quota under a deal involving OPEC and 10 other producers known as OPEC+.

OPEC said it relied on primary data gotten through direct communication, noting that secondary sources reported 1.417 million barrels per day as Nigeria’s crude production in November — up from 1.4 million barrels per day in October.

The data also shows that OPEC’s total oil production among its 12 members rose by 104,000 barrels per day in the month under review.

According to secondary sources, the total of the 12 OPEC countries’ crude oil production averaged 26.66 million barrels per day in November 2024.

“Crude oil output increased mainly in Libya, Iran, and Nigeria, while production in Iraq, Venezuela, and Kuwait decreased”, OPEC said.

“At the same time, total non-OPEC DoC crude oil production averaged 14.01 mb/d in November 2024, which is 219 tb/d higher, m-o-m. Crude oil output increased mainly in Kazakhstan and Malaysia,” the organisation added.

In a related development, OPEC trimmed its 2024 and 2025 oil demand growth forecasts for the fifth time this year.

Now, the cartel expects the world’s oil demand growth at 1.61 million barrels per day from the previously 1.82 million barrels per day.

For 2025, OPEC says the world oil demand growth forecast is now at 1.45 million barrels per day, a 900,000 barrels per day cut from the previously expected 1.54 million barrels per day.

On the changes, OPEC says that the downgrade for this year owes to more bearish data received in the third quarter of 2024 while the projections for next year relate to the potential impact that will arise from US tariffs.

Economy

Afriland Properties, Geo-Fluids Shrink OTC Securities Exchange by 0.06%

By Adedapo Adesanya

The duo of Afriland Properties Plc and Geo-Fluids Plc crashed the NASD Over-the-Counter (OTC) Securities Exchange by a marginal 0.06 per cent on Wednesday, December 11 due to profit-taking activities.

The OTC securities exchange experienced a downfall at midweek despite UBN Property Plc posting a price appreciation of 17 Kobo to close at N1.96 per share, in contrast to Tuesday’s closing price of N1.79.

Business Post reports that Afriland Properties Plc slid by N1.14 to finish at N15.80 per unit versus the preceding day’s N16.94 per unit, and Geo-Fluids Plc declined by 1 Kobo to trade at N3.92 per share compared with the N3.93 it ended a day earlier.

At the close of transactions, the market capitalisation of the bourse, which measures the total value of securities on the platform, shrank by N650 million to finish at N1.055 trillion compared with the previous day’s N1.056 trillion and the NASD Unlisted Security Index (NSI) went down by 1.86 points to wrap the session at 3,012.50 points compared with 3,014.36 points recorded in the previous session.

The alternative stock market was busy yesterday as the volume of securities traded by investors soared by 146.9 per cent to 5.9 million units from 2.4 million units, as the value of shares transacted by the market participants jumped by 360.9 per cent to N22.5 million from N4.9 million, and the number of deals increased by 50 per cent to 21 deals from 14 deals.

When the bourse closed for the day, Geo-Fluids Plc remained the most active stock by volume (year-to-date) with 1.7 billion units valued at N3.9 billion, followed by Okitipupa Plc with 752.2 million units worth N7.8 billion, and Afriland Properties Plc 297.5 million units sold for N5.3 million.

Also, Aradel Holdings Plc, which is now listed on the Nigerian Exchange (NGX) Limited after its exit from NASD, remained the most active stock by value (year-to-date) with 108.7 million units sold for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.5 million units worth N5.3 billion.

Economy

Naira Weakens to N1,547/$1 at Official Market, N1,670/$1 at Black Market

By Adedapo Adesanya

The euphoria around the recent appreciation of the Naira eased on Wednesday, December 11 after its value shrank against the US Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N5.23 or 0.3 per cent to N1,547.50/$1 from the N1,542.27/$1 it was valued on Tuesday.

It was observed that spectators’ activities may have triggered the weakening of the local currency in the official market at midweek as they tried to fight back and ensure the value of funds in foreign currencies strengthened.

The domestic currency was regaining its footing after the Central Bank of Nigeria (CBN) launched an Electronic Foreign Exchange Matching System (EFEMS) platform to tackle speculation and improve transparency in Nigeria’s FX market.

At midweek, the Nigerian currency depreciated against the Pound Sterling by N3.56 to close at N1,958.68/£1 compared with the preceding day’s N1,955.12/£1 and against the Euro, it slumped by 34 Kobo to trade at N1,612.66/€1, in contrast to the previous session’s N1,613.00/€1.

As for the black market segment, the Naira lost N45 against the American currency during the session to quote at N1,670/$1 compared with the N1,625/$1 it was traded a day earlier.

A look at the cryptocurrency market showed a recovery following profit-taking as the US Consumer Price Index report matched economist forecasts.

The news was enough to convince traders that the Federal Reserve is certain to trim its benchmark fed funds rate another 25 basis points at its meeting next week.

The move also saw Bitcoin (BTC), the most valued coin, return to the $100,000 mark as it added a 2.9 per cent gain and sold for $100,566.12.

The biggest gainer was Cardano (ADA), which jumped by 15.00 per cent to trade at $1.16, as Litecoin (LTC) appreciated by 10.4 per cent to sell for $121.76, and Ethereum (ETH) surged by 7.0 per cent to $3,929.30, while Dogecoin (DOGE) recorded a 6.7 per cent growth to finish at $0.4181.

Further, Binance Coin (BNB) went up by 5.2 per cent to $716.72, Solana (SOL) expanded by 4.6 per cent to $229.77, and Ripple (XRP) increased by 4.2 per cent to $2.43, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closed flat at $1.00 apiece.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN