Economy

The Challenges Facing Nigeria’s Economy

The Challenges Facing Nigeria’s Economy

The ongoing COVID-19 crisis is threatening to push Nigeria’s economy backwards, just a few years after the country successfully emerged from a damaging recession. The warning signs are flashing again as increased borrowing, a weakening currency and rising unemployment loom ominously.

As government and financial institutions struggle to remedy the situation, there is a growing demand for foreign exchange, forcing banks to ration outflow, while the hoped-for rally in oil prices has not materialised. Over-dependence on oil, policy inconsistency, insecurity and a persistent level of corruption have all had a dampening effect on the nation’s finances.

But Nigeria remains a nation with tremendous resources and potential, and there are reasons to be optimistic about the future, with a number of avenues to explore that could offer increasing prosperity and a way to guide the country to a firmer financial footing.

Promise of Agriculture

Agriculture remains a strength for Nigeria and it has the potential to help revive the economy. There are a number of plans in place, such as the Kano Agro Pastoral Project, that can help to galvanise this important part of the Nigerian economy. Nigeria is blessed with huge reserves of arable land and a significant farming population, offering a potential solution not just to economic downturn but also to the equally important issues of food poverty and food security.

There are promising signs that cooperation between agricultural specialists, state and national governments is starting to take effect, and by focusing on developing targeted crop value chains while improving the rural infrastructure, Nigeria’s farmers can be empowered to boost the economy.

Importance of Diversification

Nigeria has enormous human potential and economic ingenuity. The inventiveness of the Nigerian entrepreneur is on display across many sectors.

Take the thriving and growing mobile technology sector. Evidence suggests that mobile penetration increased from 36% to 50% between 2014 and 2017. That trend has continued with one estimate by Business Monitor International putting the likely number of mobile subscribers at 182 million by 2021, up from 153 million in 2017. Demand for mobile services has been driven both by technological advances and the dynamic marketing practices of Nigerian mobile companies.

This proliferation of mobile usage is also helping to drive the success of some of the top online casinos in Nigeria. The online casino sector, boosted by the ever-widening availability of mobile technology, is expanding rapidly, particularly among the increasingly affluent young Nigerian middle class.

Innovative local gaming companies are striking deals with major online casino content providers, as well as with international payment providers and digital support companies, enabling them to offer an ever more cutting-edge casino gaming experience.

The rise of the online casino and mobile sectors demonstrates Nigeria’s entrepreneurial potential. But fully unleashing that potential may first require tackling the country’s over-reliance on oil revenue. This has become a problem, but Nigeria has the opportunity to lead the way in designing the new green economy of the 2020s.

The government has already launched Africa’s first sovereign green bonds and has taken steps to extricate the country from oil dependency, starting with a cut in oil subsidies.

Money diverted from the oil industry can be directed into the renewables sector, while the Nigerian Ecological Fund has the potential to tackle some of the serious ecological problems facing the nation – a clean-up that can also boost the economy. The Ministry of Works, in conjunction with the wider government, can help to lead the way by bringing about green reforms in the Nigerian construction industry, while tackling the serious housing shortage in the country.

Rise of technology

Technology is another way in which Nigeria can help to steer its economic ship to safer waters. Although it can be difficult to focus on the future in times of economic difficulty, there is enormous untapped potential in Nigeria when it comes to technological change, not least among the country’s business sector. A strong push to adopt new methods, such as remote work, e-commerce and artificial intelligence, much of which has been given a boost by the pandemic, could reap dividends.

There is a huge potential demand for improved IT infrastructure, from collaboration tools that enable workers to operate effectively as a team while working at home, to teaching solutions that can enable teachers to deliver lessons remotely. And beyond that, the promises of cloud computing and smart homes offer Nigeria the opportunity to be bold and take the lead in African technology.

Retooled finance

Technology can also have a role to play in helping the Nigerian finance sector to contribute to the national economy. The pandemic has shown that more can be done in terms of automation and technical solutions to financing problems, while at the same time, the sector can do more to reach out to all sectors of society. The Nigerian finance industry is full of talent and the desire for innovation, and if unleashed, can play a major role in the nation’s recovery.

Like many other nations around the world, Nigeria has taken a hit due to COVID-19 and there are specific long-term problems that the country still needs to face. But the nation remains one of the most significant countries in the world and a powerhouse in Africa, and with sufficient guidance and investment, the potential of Nigerian farmers, business people, administrators, bankers and scientists can be harnessed to help build a more prosperous future.

Economy

Nigeria’s Non-Oil Exports Grow 24.75% to $1.791bn in Q1 2025

By Adedapo Adesanya

The Nigerian Export Promotion Council (NEPC) has announced a 24.75 per cent increase in the value of the country’s non-oil exports, reaching a total of $1.791 billion in the first quarter of 2025.

It stated that the amount surpassed the $1.436 billion generated in the first quarter of 2024.

The Executive Director of the council, Mrs Nonye Ayeni, disclosed the figures while addressing the journalists in Abuja on Monday.

She said the significant growth reflects the resilience and diversification of Nigeria’s export sector beyond crude oil, a shift aimed at reducing the country’s reliance on oil revenue.

According to her, the surge in non-oil exports was driven by increased economic activity in the Agriculture, Manufacturing, and Solid Minerals sectors.

On the US 14 per cent trade tariff, the council says it was positive for the country, adding that it was an opportunity to focus on value addition and increased competitiveness in the global market.

Recall that Nigeria has reiterated plans to boost its non-oil revenues with the Minister of Industry, Trade and Investment, Mrs Jumoke Oduwole, saying the country was stepping up its diversification efforts.

Earlier this month, the Trade Minister said the nation would tackle this challenge with pragmatism, aiming to boost non-oil exports and strengthen economic resilience under President Bola Tinubu’s Renewed Hope Agenda.

Mrs Oduwole had said the US remains a key partner, with bilateral trade reaching N31.1 trillion from 2015 to 2024.

The measures taken by the US presents destabilising challenges to price competitiveness and market access, especially in emerging and value-added sectors vital to our diversification agenda,” the minister explained.

“Government is implementing a range of interventions in policy, financing, infrastructure, and diplomacy to help Nigerian businesses remain competitive amidst regional and global tariff hikes,” Mrs Oduwole said as she outlined Nigeria’s response.

Economy

Nigeria Missing in Top 10 Safest Countries for Foreign Investment List

By Dipo Olowookere

A new report which listed the Top 10 Safest Countries for Foreign Investment has excluded Nigeria despite the efforts of the administration of President Bola Tinubu to make the country the preferred place to do business.

Since assuming office on May 29, 2023, Mr Tinubu has carried out some economic reforms aimed to attract investors to Nigeria, including the liberalisation of the foreign exchange (FX) market, removal of petrol subsidy, and streamlining the tax regime, among others.

In a recent study by Atmos, top 30 countries were identified based on economic stability, investment attractiveness, and political and economic stability.

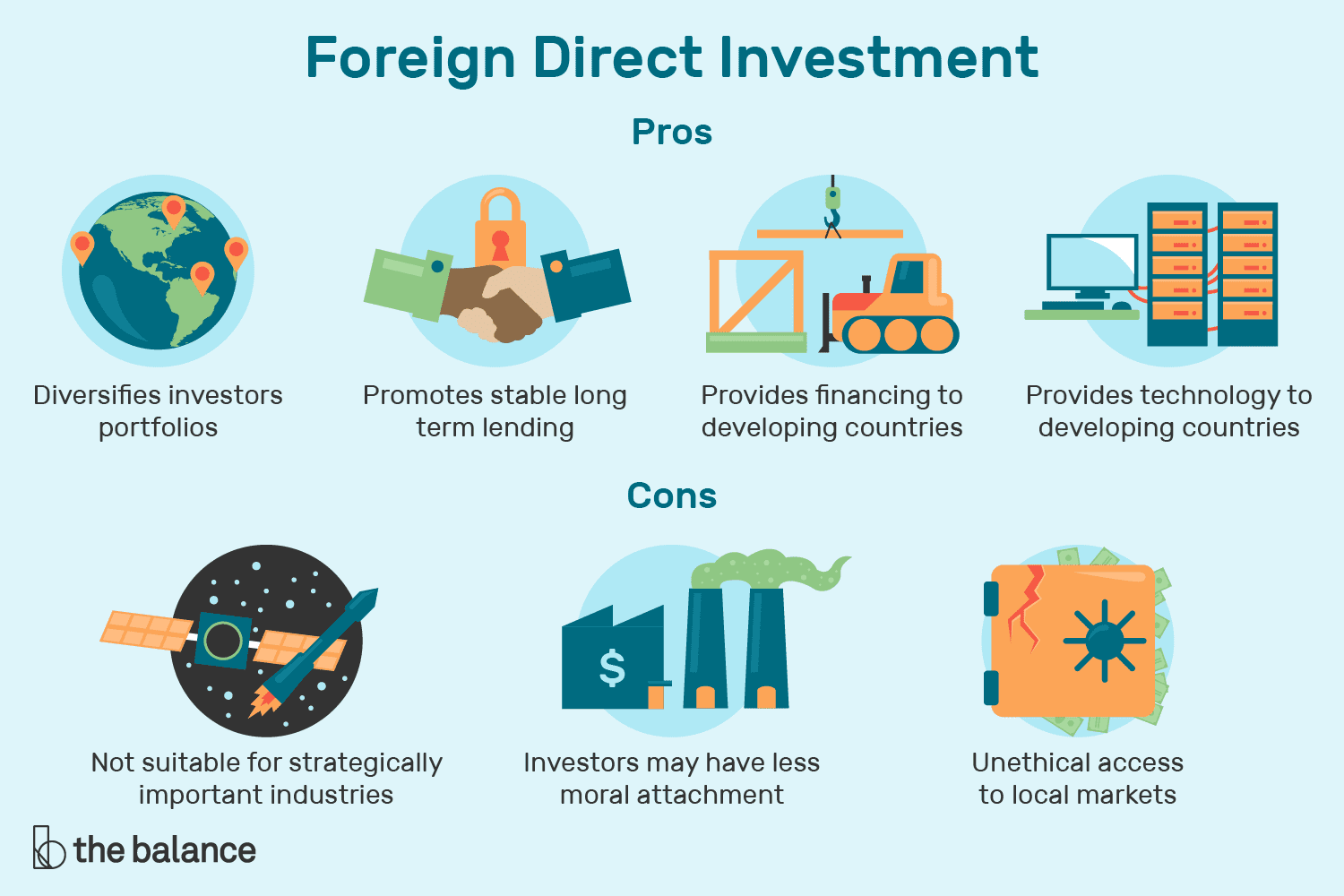

In the outcome of the research made available to Business Post on Monday, it was stated that countries were evaluated using six metrics: economic stability rank, political stability score, global peace index, investment attractiveness, foreign direct investments (FDI), and GDP per capita. These metrics were ranked, with the top country receiving a score of 100.

“When evaluating investment potential, it’s clear that economic strength alone doesn’t paint the full picture.

“Political stability and a peaceful environment are equally essential in fostering a climate that attracts long-term investment. Investors are drawn to countries where risks are minimized and confidence in future growth is high, making these factors just as critical to a nation’s financial appeal,” the chief executive of Atmos, Mr Nick Cooke, stated.

Switzerland led the ranking as the lowest risk country to invest in, with a score of 100. It featured exceptional economic fundamentals and the highest GDP per capita among the top-ranked countries at nearly $100,000. Switzerland demonstrates balance across all metrics, ranking 2nd in economic stability while maintaining excellent political stability (1.07) and peace index scores (1.33).

Singapore followed in 2nd with a score of 90.21, standing out with the highest investment attractiveness (82.4) among the top three nations and exceptional foreign direct investment inflows of over $175 million, outperforming Switzerland in this metric. The city-state’s strategic position in Southeast Asia, combined with its second-place economic stability ranking, creates a powerful investment hub. Singapore’s global peace index of 1.3 is the best among all ranked countries, reflecting its excellent security environment.

The third of the list was Canada with a score of 89.53, demonstrating exceptional investment attractiveness (86.6) and solid political stability (0.82). Canada’s balanced approach to foreign investment has resulted in substantial foreign direct investment (FDI) inflows exceeding $47 million, positioning it as a reliable North American investment alternative. The country maintains strong economic fundamentals, offering a reasonable GDP per capita of $53,431.

Japan ranked 4th with a score of 88.77, featuring the highest investment attractiveness score (86.8) among all countries in the index. The Asian country has an excellent political stability (0.951) and a strong peace index rating (1.33), creating a secure environment for foreign capital. Despite having a lower GDP per capita than other top-five nations at $33,766, Japan’s economic resilience and technological innovation continue to attract nearly $20 million in foreign investments.

The 5th place was occupied by Germany with a score of 86.32. As Europe’s largest economy, Germany maintains excellent economic stability (ranked 3rd), following Switzerland and Singapore, and a strong investment attractiveness (84.6). With GDP per capita exceeding $54K and foreign direct investments approaching $20 million, Germany represents the centerpiece of European investment security.

Denmark is the 6th-lowest risk country to invest in, with a score of 84.38, featuring an impressive GDP per capita of $68,453 and excellent political stability (0.85). Denmark’s peace index of 1.3 places it among the safest nations globally, though its relatively modest FDI figures of $4.5 million reflect its smaller market size. The Nordic nations’ consistent economic policies and transparent business environment remain key strengths for investors seeking stability.

In the 7th, Australia scored 84.08, balancing strong political stability (0.921) with excellent investment attractiveness (81.9). Australia has attracted substantial foreign direct investments exceeding $32.5 million, second only to Singapore among the top ten countries. Australia has attracted $32.5 million in foreign investments, substantially higher than Denmark and second only to Singapore. It also offers a GDP per capita of $64,820 with a relatively stronger peace index (1.525) compared to several preceding countries.

Norway was in 8th with a score of 82.44. With the second-highest GDP per capita at $87,925, Norway only trails Switzerland in this metric. It maintains solid political stability (0.89) and investment attractiveness (78.8), though its economic stability rank (11th) is the lowest among the top ten countries. The Nordic nation has attracted over $10.7 million in foreign investments despite its relatively small market size.

The United Arab Emirates took the 9th position with a score of 80.71, claiming the top position in economic stability among all countries in the index. The UAE combines this economic strength with moderate political stability (0.681) and substantial foreign investments exceeding $22.3 million. At the same time, its relatively weaker peace index score (1.979) and lower investment attractiveness (59.6) compared to other top nations prevent a higher overall ranking.

The 10th spot was grabbed by New Zealand with a score of 76.96, featuring excellent peace index ratings (1.31) but faces challenges with its economic stability ranking (18th) and modest foreign investment inflows of $3.59 million. The country’s investment attractiveness score of 63.0 is significantly lower than that of other top-ranked nations, reflecting its geographical isolation and smaller market size.

Economy

NASD Exchange Drops 0.53% in Week 17 of 2025 Amid High Trading Volume

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange decreased by 0.53 per cent on a week-on-week basis in Week 17 of the 2025 trading year.

This depleted the market capitalisation of the bourse by N10.14 billion in the four-day trading week to N1.914 trillion from the N1.924 trillion recorded in the previous week and the NASD Unlisted Securities Index (NSI) slid by 17.32 points to 3,269.06 points from the 3,286.38 points posted in Week 16.

There were only four trading days last week due to the Easter break stretching into the new week, though the market witnessed a higher turnover.

The volume of securities bought and sold by the market participants soared by 293,055.9 per cent to 3.9 billion units from the 1.33 million units recorded a week earlier, and the value of shares skyrocketed by 33,661.6 per cent to N9.9 billion from the N29.35 million achieved in the preceding week.

The most traded security by value for the week was Infrastructure Credit Guarantee (InfraCredit) Plc with N9.5 billion, Geo-Fluids Plc recorded N355.4 million, FrieslandCampina Wamco Nigeria Plc traded N7.2 million, Central Securities Clearing System (CSCS) Plc transacted N3.8 million, and Afriland Properties Plc posted N2.5 million.

Also, InfraCredit Plc was the most traded instrument by volume with 3.7 billion units, Geo-Fluids Plc transacted 207.7 million units, UBN Property Plc recorded 1.04 million units, FrieslandCampina Wamco Nigeria Plc traded 0.201 million units, and CSCS Plc exchanged 0.178 million units.

Five securities ended on the losers’ table, with FrieslandCampina Wamco Nigeria Plc leading after shedding 6.0 per cent to end at N35.37 per share compared with the previous week’s N37.64 per share.

Further, 11 Plc fell by 3.8 per cent to close at N236.25 per unit versus N245.50 per unit, UBN Property Plc lost 3.2 per cent to trade at N2.10 per share versus N2.17 per share, CSCS Plc declined by 1.8 per cent to N21.71 per unit from N22.10 per unit, and Afriland Properties Plc slumped by 0.1 per cent to N17.78 per share from N17.80 per share.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN